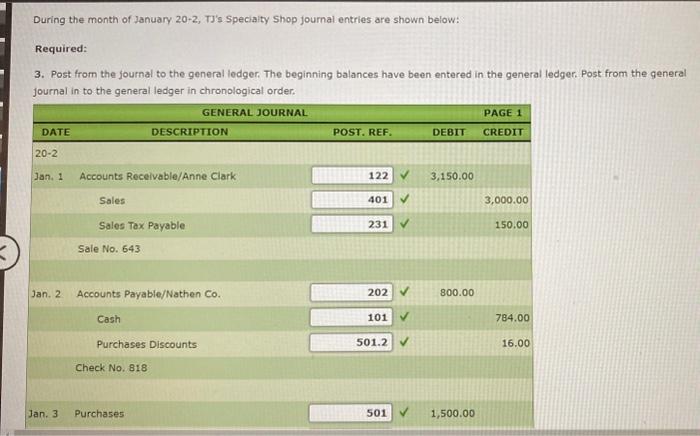

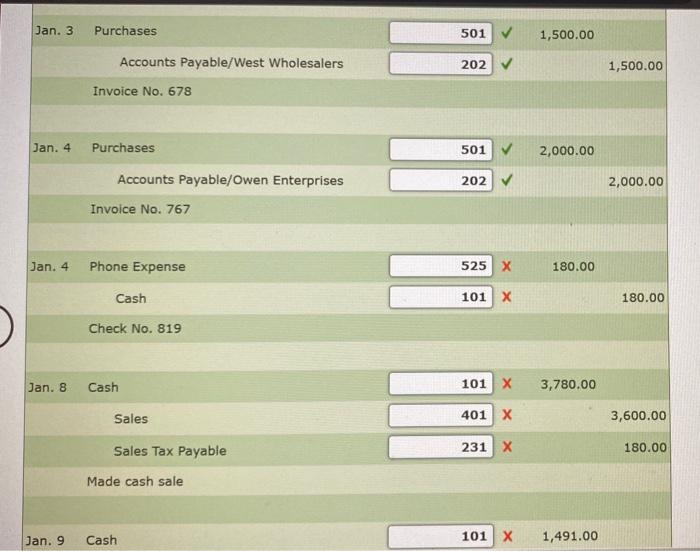

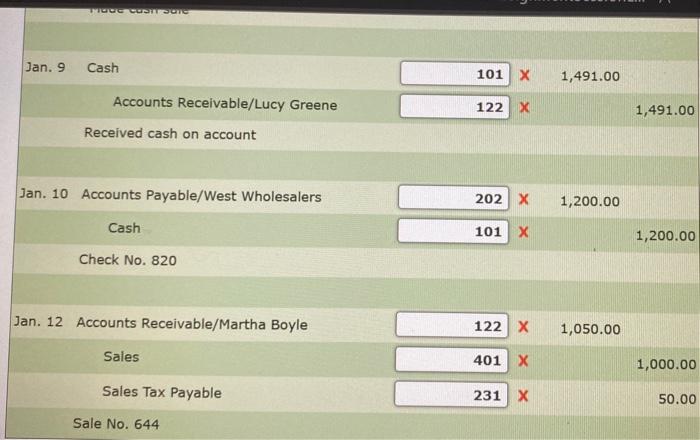

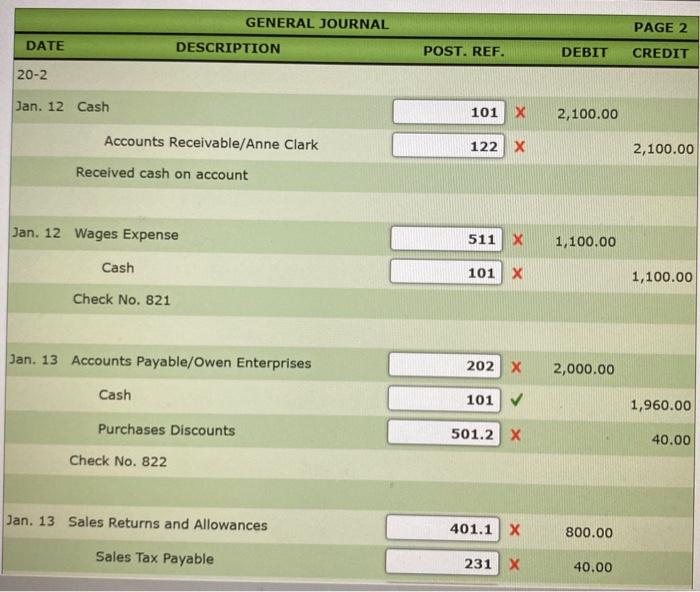

hello... I'm not sure what I'm doing wrong on the post references. please help. thank you...

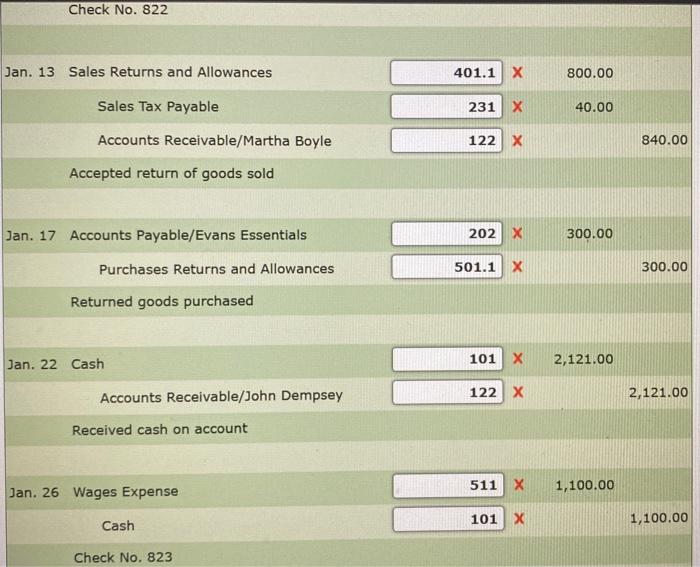

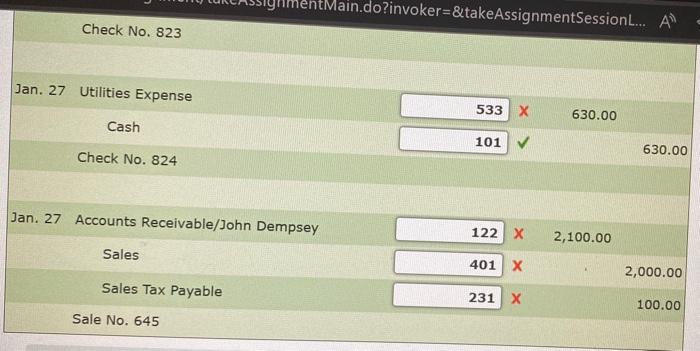

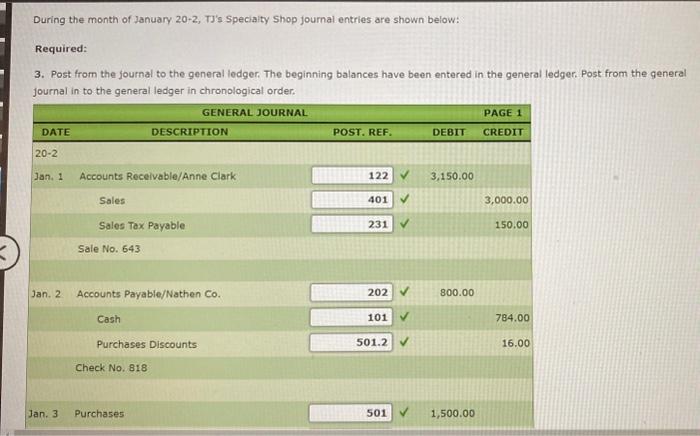

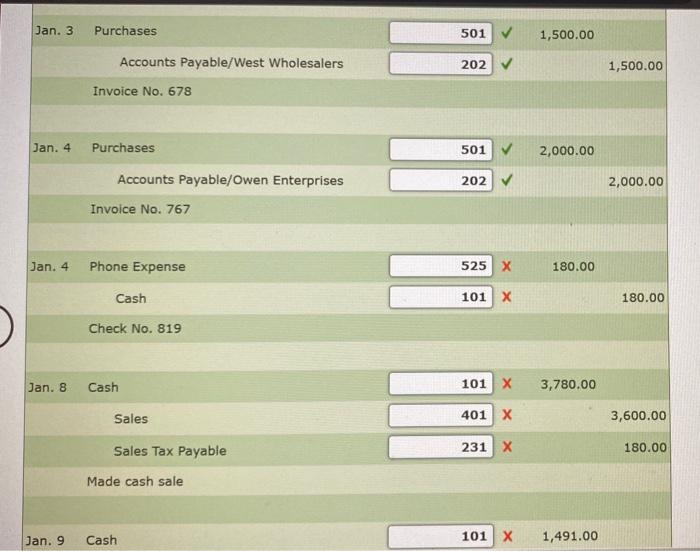

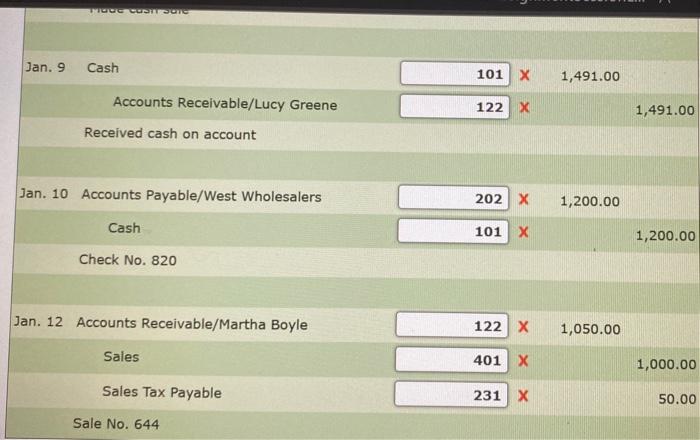

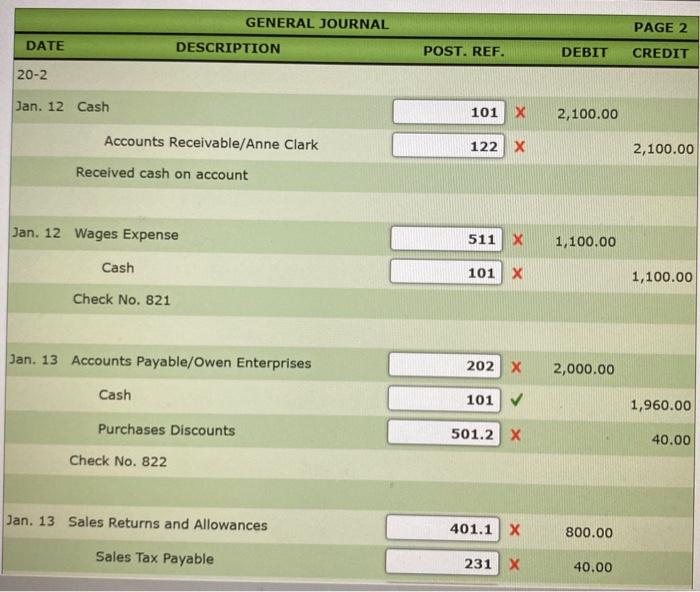

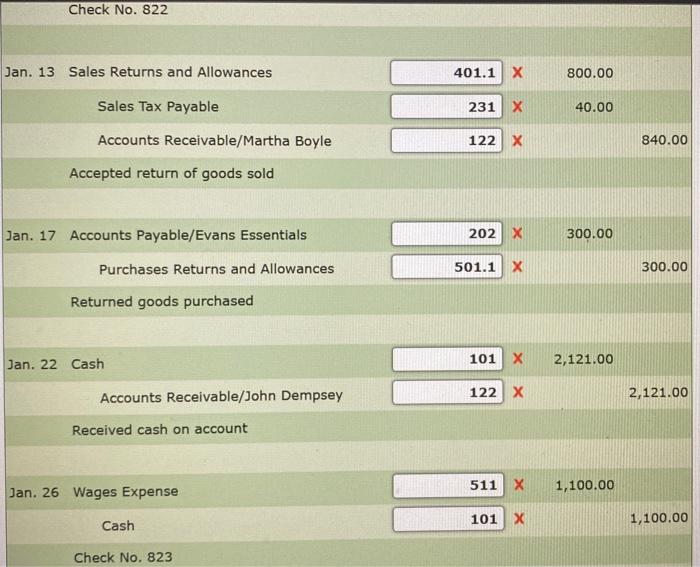

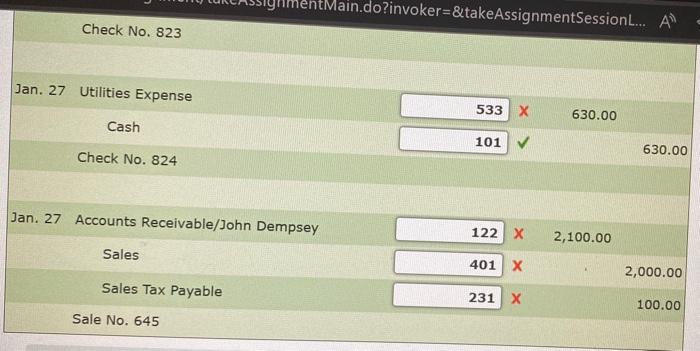

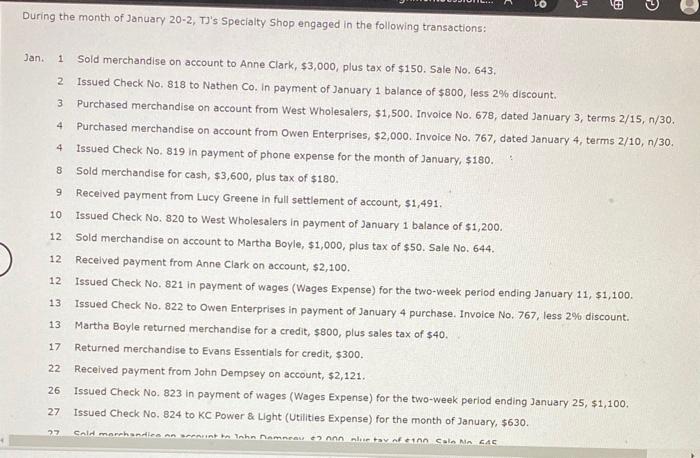

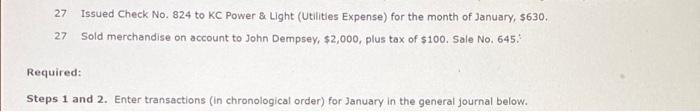

During the month of January 20-2, TJ's Speciaity Shop journal entries are shown below: Required: 3. Post from the journal to the general ledger. The beginning balances have been entered in the general ledger. Post from the general journal in to the general ledger in chronological order. Invoice No. 767 Jan. 4 Phone Expense Check No. 819 Jan. 8 Cash 1013,780.00 Sales 401 3,600.00 Sales Tax Payable 231 180.00 Made cash sale Jan. 9 Cash 1011,491.00 Jan. 9 Cash Received cash on account Jan. 10 Accounts Payable/West Wholesalers 2021,200.00 Cash 1011,200.00 Check No. 820 Jan. 12 Accounts Receivable/Martha Boyle 1221,050.00 Sales 4011,000.00 Sales Tax Payable 231 50.00 Sale No. 644 Check No. 822 Jan. 13 Sales Returns and Allowances Sales Tax Payable Accounts Receivable/Martha Boyle Accepted return of goods sold Jan. 17 Accounts Payable/Evans Essentials 202300.00 Purchases Returns and Allowances Returned goods purchased Jan.22CashAccountsReceivable/JohnDempsey10112,121.001222,121.00 Received cash on account Jan. 26 Wages Expense 5111,100.00 Cash 101 x 1,100.00 Check No. 823 Check No. 823 Jan. 27 Utilities Expense CashCheckNo.824 Jan. 27 Accounts Receivable/John Dempsey Sale No. 645 Jan. 1 Sold merchandise on account to Anne Clark, $3,000, plus tax of $150. Sale No. 643, 2 Issued Check No. 818 to Nathen Co. In payment of January 1 balance of $800, less 2% discount. 3 Purchased merchandise on account from West Wholesalers, $1,500. Invoice No. 678 , dated January 3 , terms 2/15,n/30. 4 Purchased merchandise on account from Owen Enterprises, $2,000. Invoice No. 767, dated January 4 , terms 2/10,n/30. 4 Issued Check No. 819 in payment of phone expense for the month of January, $180. : 8 Sold merchandise for cash, $3,600, plus tax of $180. 9 Recelved payment from Lucy Greene in full settlement of account, $1,491. 10 Issued Check No, 820 to West Wholesalers in payment of January 1 balance of $1,200. 12 Sold merchandise on account to Martha Boyle, $1,000, plus tax of $50. Sale No. 644. 12 Received payment from Anne Clark on account, $2,100. 12 Issued Check No. 821 in payment of wages (Wages Expense) for the two-week period ending January 11,$1,100. 13 Issued Check No. 822 to Owen Enterprises in payment of January 4 purchase. Invoice No. 767 , less 2% discount. 13 Martha Boyle returned merchandise for a credit, $800, plus sales tax of $40. 17 Returned merchandise to Evans Essentials for credit, $300. 22 Received payment from John Dempsey on account, $2,121. 26 Issued Check No. 823 in payment of wages (Wages Expense) for the two-week period ending January 25,$1,100. 27 Issued Check No, 824 to KC Power \& Light (Utilities Expense) for the month of January, $630. 27. Issued Check No. 824 to KC Power \& Light (Utilities Expense) for the month of January, $630. 27 Sold merchandise on account to John Dempsey, $2,000, plus tax of $100. Sale No. 645: Required: Steps 1 and 2. Enter transactions (in chronological order) for January in the general journal below. During the month of January 20-2, TJ's Speciaity Shop journal entries are shown below: Required: 3. Post from the journal to the general ledger. The beginning balances have been entered in the general ledger. Post from the general journal in to the general ledger in chronological order. Invoice No. 767 Jan. 4 Phone Expense Check No. 819 Jan. 8 Cash 1013,780.00 Sales 401 3,600.00 Sales Tax Payable 231 180.00 Made cash sale Jan. 9 Cash 1011,491.00 Jan. 9 Cash Received cash on account Jan. 10 Accounts Payable/West Wholesalers 2021,200.00 Cash 1011,200.00 Check No. 820 Jan. 12 Accounts Receivable/Martha Boyle 1221,050.00 Sales 4011,000.00 Sales Tax Payable 231 50.00 Sale No. 644 Check No. 822 Jan. 13 Sales Returns and Allowances Sales Tax Payable Accounts Receivable/Martha Boyle Accepted return of goods sold Jan. 17 Accounts Payable/Evans Essentials 202300.00 Purchases Returns and Allowances Returned goods purchased Jan.22CashAccountsReceivable/JohnDempsey10112,121.001222,121.00 Received cash on account Jan. 26 Wages Expense 5111,100.00 Cash 101 x 1,100.00 Check No. 823 Check No. 823 Jan. 27 Utilities Expense CashCheckNo.824 Jan. 27 Accounts Receivable/John Dempsey Sale No. 645 Jan. 1 Sold merchandise on account to Anne Clark, $3,000, plus tax of $150. Sale No. 643, 2 Issued Check No. 818 to Nathen Co. In payment of January 1 balance of $800, less 2% discount. 3 Purchased merchandise on account from West Wholesalers, $1,500. Invoice No. 678 , dated January 3 , terms 2/15,n/30. 4 Purchased merchandise on account from Owen Enterprises, $2,000. Invoice No. 767, dated January 4 , terms 2/10,n/30. 4 Issued Check No. 819 in payment of phone expense for the month of January, $180. : 8 Sold merchandise for cash, $3,600, plus tax of $180. 9 Recelved payment from Lucy Greene in full settlement of account, $1,491. 10 Issued Check No, 820 to West Wholesalers in payment of January 1 balance of $1,200. 12 Sold merchandise on account to Martha Boyle, $1,000, plus tax of $50. Sale No. 644. 12 Received payment from Anne Clark on account, $2,100. 12 Issued Check No. 821 in payment of wages (Wages Expense) for the two-week period ending January 11,$1,100. 13 Issued Check No. 822 to Owen Enterprises in payment of January 4 purchase. Invoice No. 767 , less 2% discount. 13 Martha Boyle returned merchandise for a credit, $800, plus sales tax of $40. 17 Returned merchandise to Evans Essentials for credit, $300. 22 Received payment from John Dempsey on account, $2,121. 26 Issued Check No. 823 in payment of wages (Wages Expense) for the two-week period ending January 25,$1,100. 27 Issued Check No, 824 to KC Power \& Light (Utilities Expense) for the month of January, $630. 27. Issued Check No. 824 to KC Power \& Light (Utilities Expense) for the month of January, $630. 27 Sold merchandise on account to John Dempsey, $2,000, plus tax of $100. Sale No. 645: Required: Steps 1 and 2. Enter transactions (in chronological order) for January in the general journal below