Hello,

I'm struggling in my final project in this part. Could you please help me with this solution?

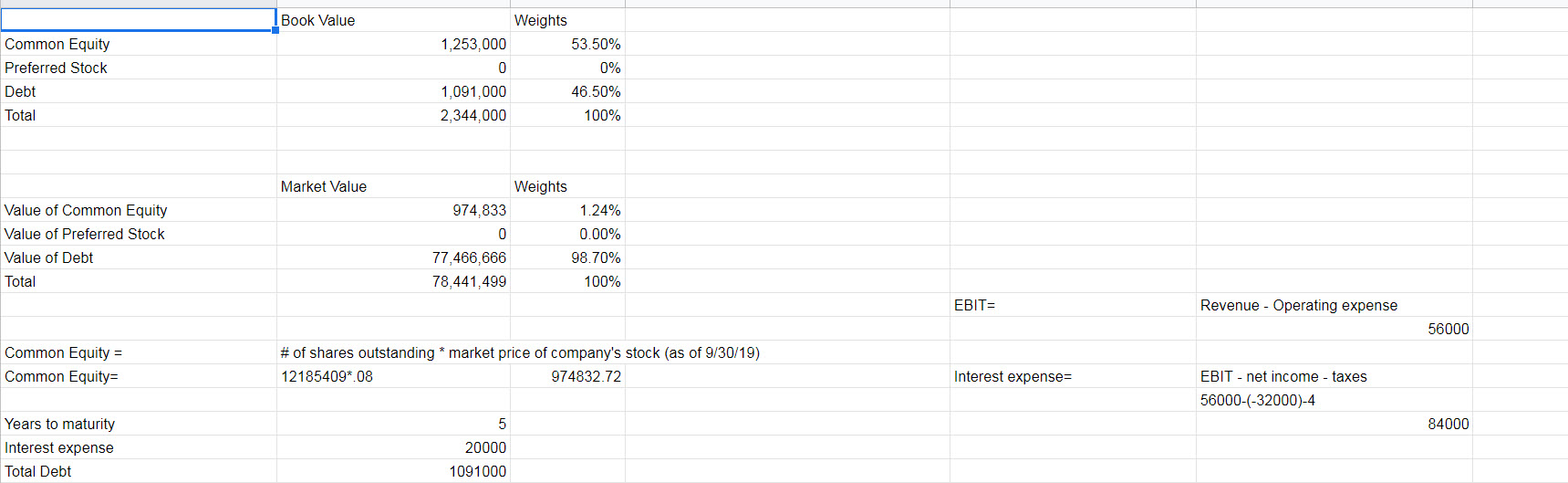

4) Compute Weighted Average Cost of Capital (WACC)

- Estimate the firms before-tax and after-tax component cost of debt; (Note: If the information about the current corporate tax rate is not available, you need to estimate the tax rate based on the historical tax payments).

- Estimate the firms component cost of preferred stock;

- Use three approaches (CAPM, DCF, bond-yield-plus-risk-premium) to estimate the component cost of common equity for the firm.

- Calculate the firms weighted average cost of capital (WACC) using the market-based capital weights.

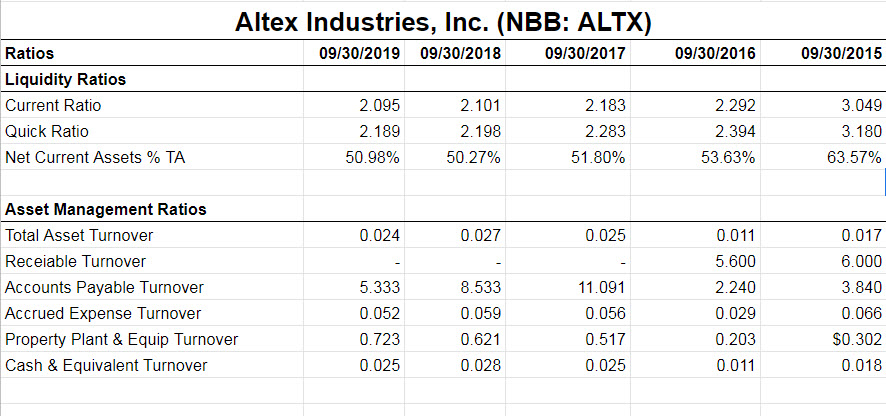

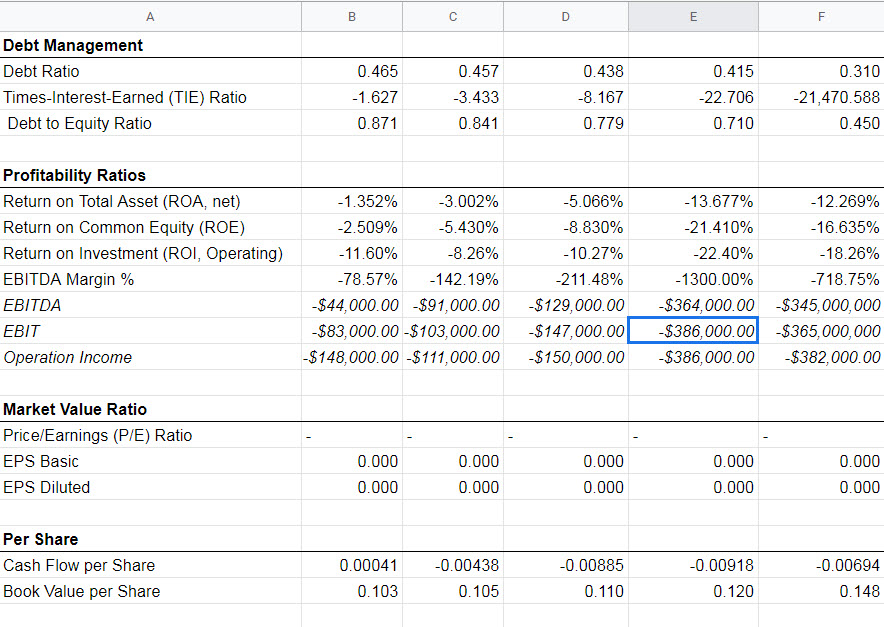

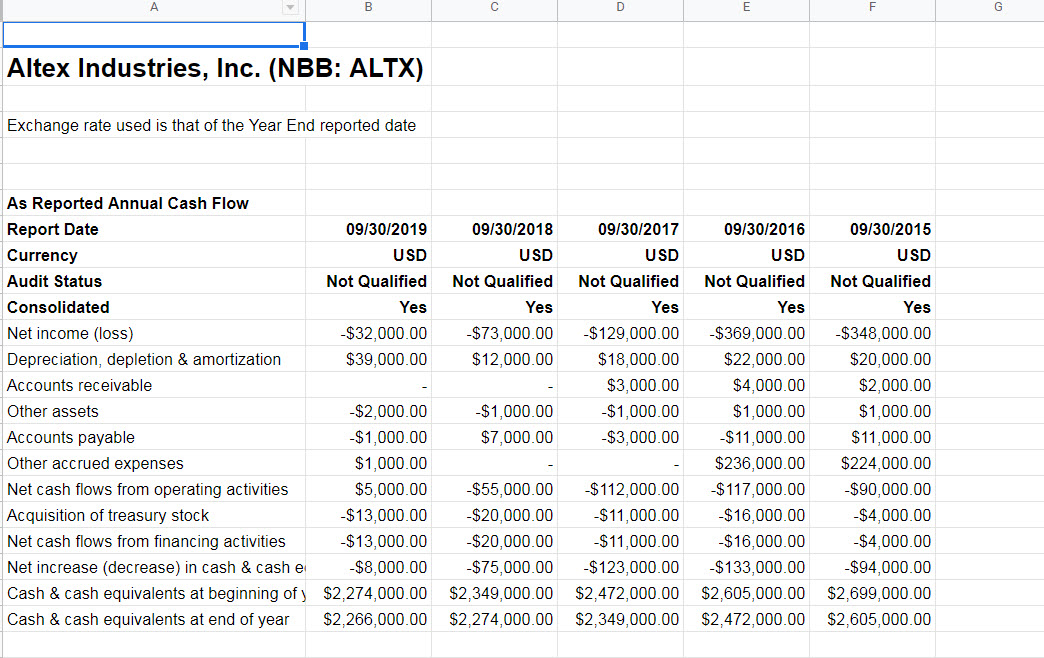

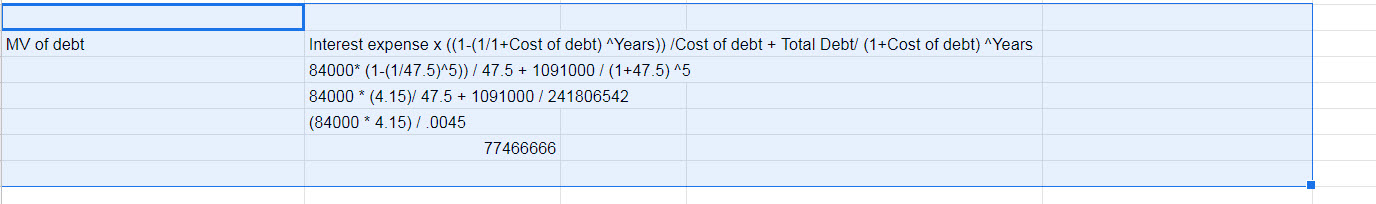

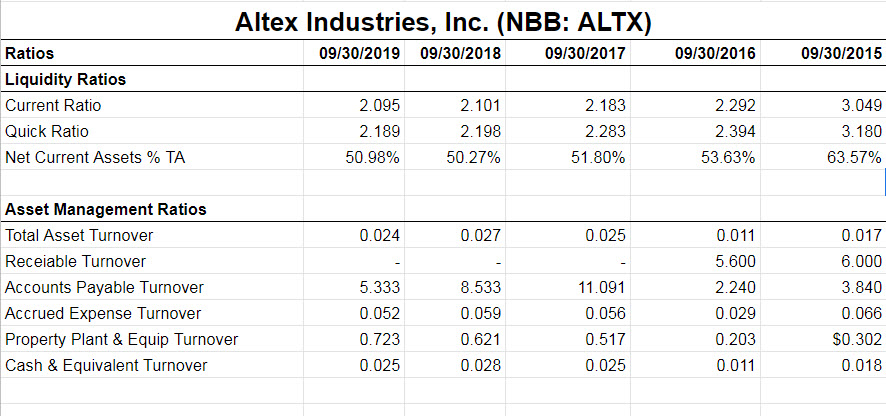

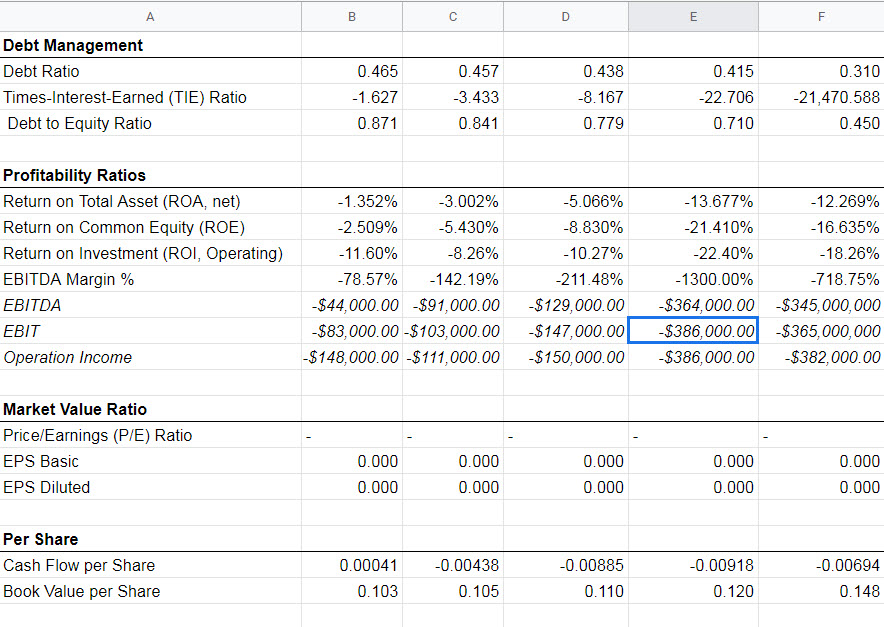

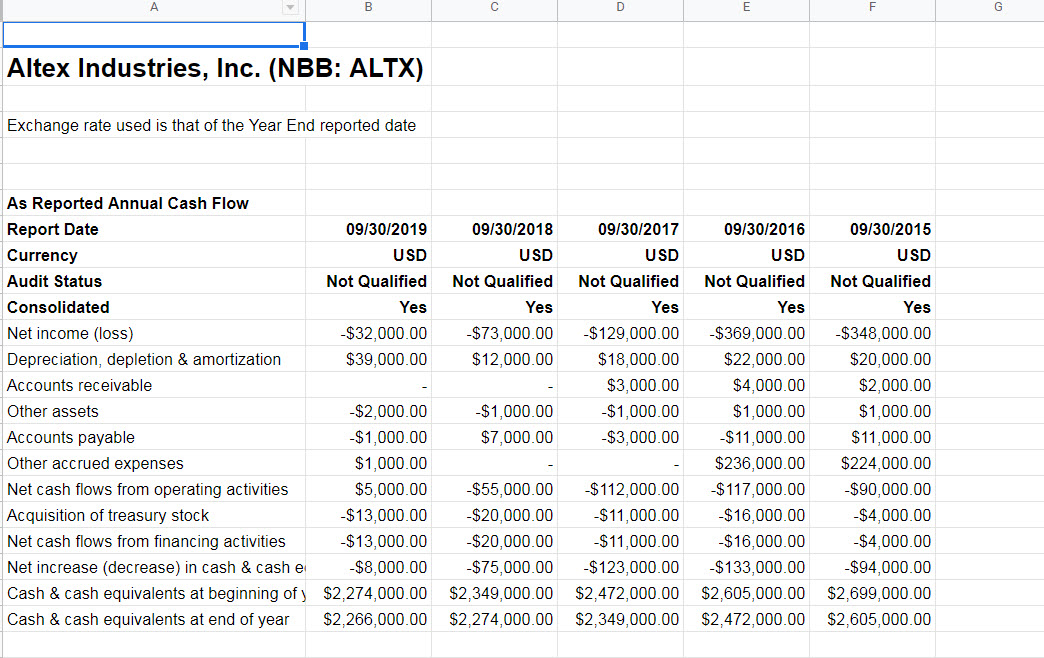

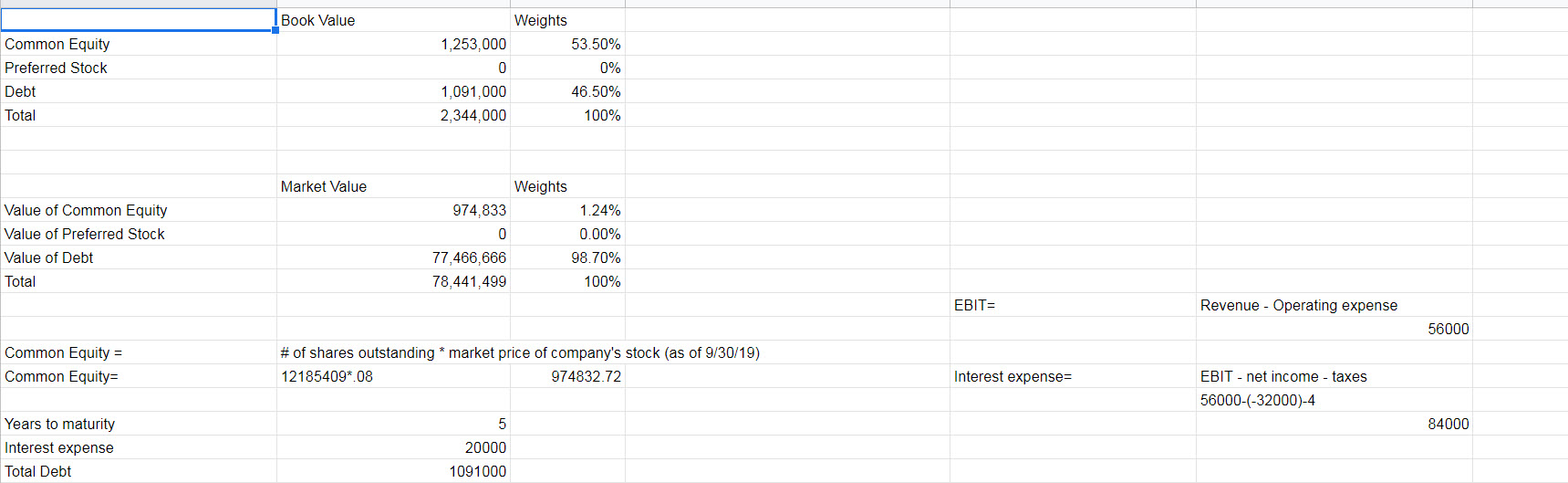

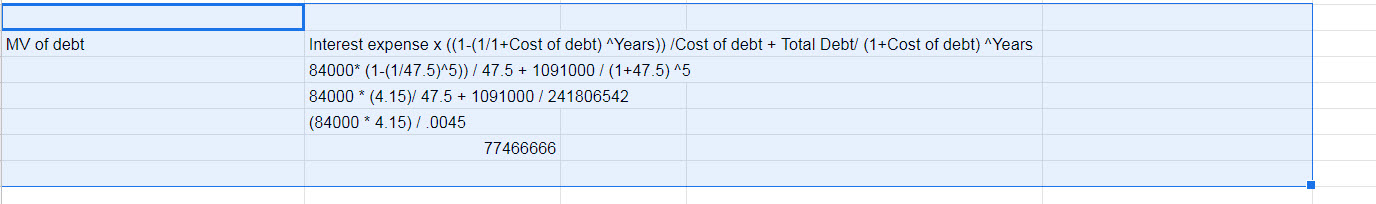

Altex Industries, Inc. (NBB: ALTX) 09/30/2019 09/30/2018 09/30/2017 09/30/2016 09/30/2015 Ratios Liquidity Ratios Current Ratio Quick Ratio Net Current Assets % TA 2.095 2.101 2.1892 .198 50.98% 50.27% 2.183 2.283 51.80% 2.292 2.394 53.63% 3.049 3.180 63.57% 0.024 0.027 0.025 0.017 Asset Management Ratios Total Asset Turnover Receiable Turnover Accounts Payable Turnover Accrued Expense Turnover Property Plant & Equip Turnover Cash & Equivalent Turnover 5.333 0.052 0.723 0.025 8.533 0.059 0.621 0.028 11.091 0.056 0.517 0.025 0.011 5.600 2.240 0.029 0.203 0.011 6.000 3.840 0.066 $0.302 0.018 Debt Management Debt Ratio Times-Interest-Earned (TIE) Ratio Debt to Equity Ratio 0.465 -1.627 0.871 0.457 -3.433 0.841 0.438 -8.167 0.779 0.415 -22.706 0.710 0.310 -21,470.588 0.450 Profitability Ratios Return on Total Asset (ROA, net) Return on Common Equity (ROE) Return on Investment (ROI, Operating) EBITDA Margin % EBITDA EBIT Operation Income -1.352% -3.002% -2.509% -5.430% -11.60% -8.26% -78.57% -142. 19% -$44,000.00 $91,000.00 -$83,000.00 - $103,000.00 -$148,000.00 -$111,000.00 -5.066% -8.830% -10.27% -211.48% $129,000.00 - $147,000.00 $150,000.00 -13.677% -21.410% -22.40% -1300.00% $364,000.00 -$386,000.00 - $386,000.00 -12.269% -16.635% -18.26% -718.75% $345,000,000 $365,000,000 $382,000.00 Market Value Ratio Price/Earnings (P/E) Ratio EPS Basic EPS Diluted 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 Per Share Cash Flow per Share Book Value per Share 0.00041 0.103 -0.00438 0.105 -0.00885 0.110 -0.00918 0.120 -0.00694 0.148 Altex Industries, Inc. (NBB: ALTX) Exchange rate used is that of the Year End reported date 09/30/2016 USD Not Qualified 09/30/2018 USD Not Qualified Yes $73,000.00 $12,000.00 Yes As Reported Annual Cash Flow Report Date 09/30/2019 Currency USD Audit Status Not Qualified Consolidated Yes Net income (loss) -$32,000.00 Depreciation, depletion & amortization $39,000.00 Accounts receivable Other assets -$2,000.00 Accounts payable -$1,000.00 Other accrued expenses $1,000.00 Net cash flows from operating activities $5,000.00 Acquisition of treasury stock -$13,000.00 Net cash flows from financing activities $13,000.00 Net increase (decrease) in cash & cash e -$8,000.00 Cash & cash equivalents at beginning ofy $2,274,000.00 Cash & cash equivalents at end of year $2,266,000.00 09/30/2017 USD Not Qualified Yes $129,000.00 $18,000.00 $3,000.00 -$1,000.00 -$3,000.00 -$1,000.00 $7,000.00 -$369,000.00 $22,000.00 $4,000.00 $1,000.00 $11,000.00 $236,000.00 $ 117,000.00 $16,000.00 $16,000.00 - $133,000.00 $2,605,000.00 $2,472,000.00 09/30/2015 USD Not Qualified Yes $348,000.00 $20,000.00 $2,000.00 $1,000.00 $11,000.00 $224,000.00 $90,000.00 $4,000.00 $4,000.00 $94,000.00 $2,699,000.00 $2,605,000.00 -$55,000.00 $20,000.00 - $20,000.00 $75,000.00 $2,349,000.00 $2,274,000.00 $112,000.00 - $11,000.00 $11,000.00 -$123,000.00 $2,472,000.00 $2,349,000.00 Book Value Weights 1,253,000 53.50% 0% Common Equity Preferred Stock Debt Total 1,091,000 2,344,000 46.50% 100% Market Value Value of Common Equity Value of Preferred Stock Value of Debt Weights 974,833 1.24% 0.00% 77,466,666 98.70% 78,441,499 100% Total EBIT= Revenue - Operating expense 56000 Common Equity = Common Equity= # of shares outstanding * market price of company's stock (as of 9/30/19) 12185409* 08 974832.72 Interest expense- EBIT - net income - taxes 56000-(-32000)-4 84000 Years to maturity Interest expense Total Debt 20000 1091000 MV of debt Interest expense x ((1-(1/1+Cost of debt) "Years)) /Cost of debt + Total Debt/ (1+Cost of debt) Years 84000* (1-(1/47.5)*5)) / 47.5 + 1091000 / (1+47.5) ^5 84000 * (4.15)) 47.5 +1091000/241806542 (84000 * 4.15) /.0045 77466666