Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello Im stuck on these last 3 questions I thought i would ask them together as they all correlate. Chart the cells in sheet #1

Hello Im stuck on these last 3 questions I thought i would ask them together as they all correlate.

Chart

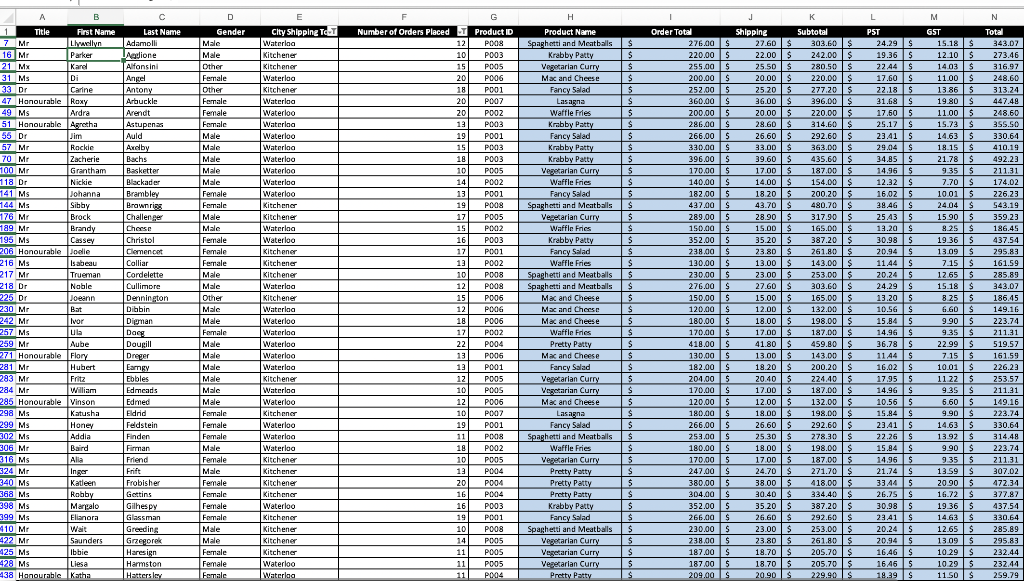

the cells in sheet #1 customer information are filtered to show certain information but they go from 1-10001

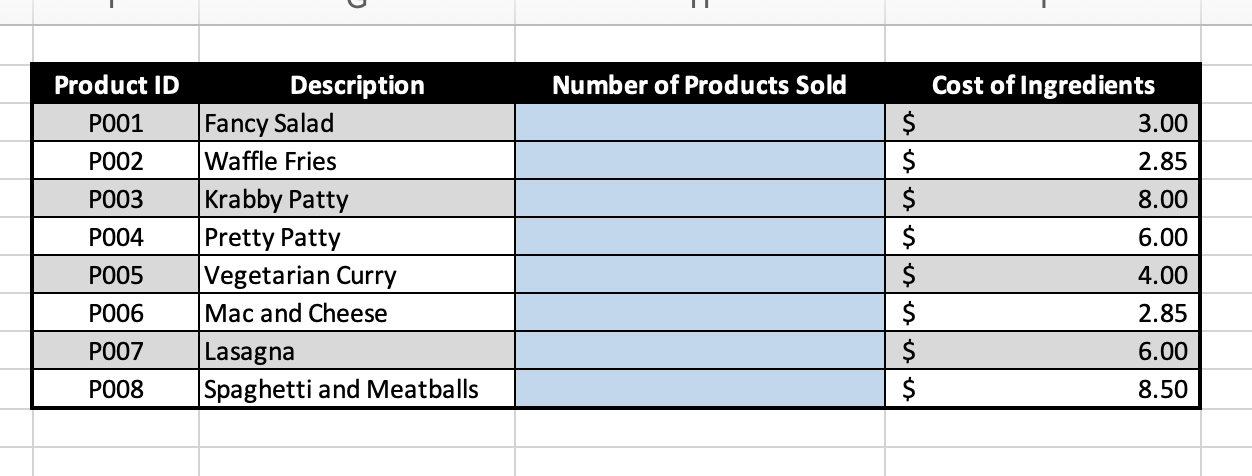

cells in sheet #3 Summary

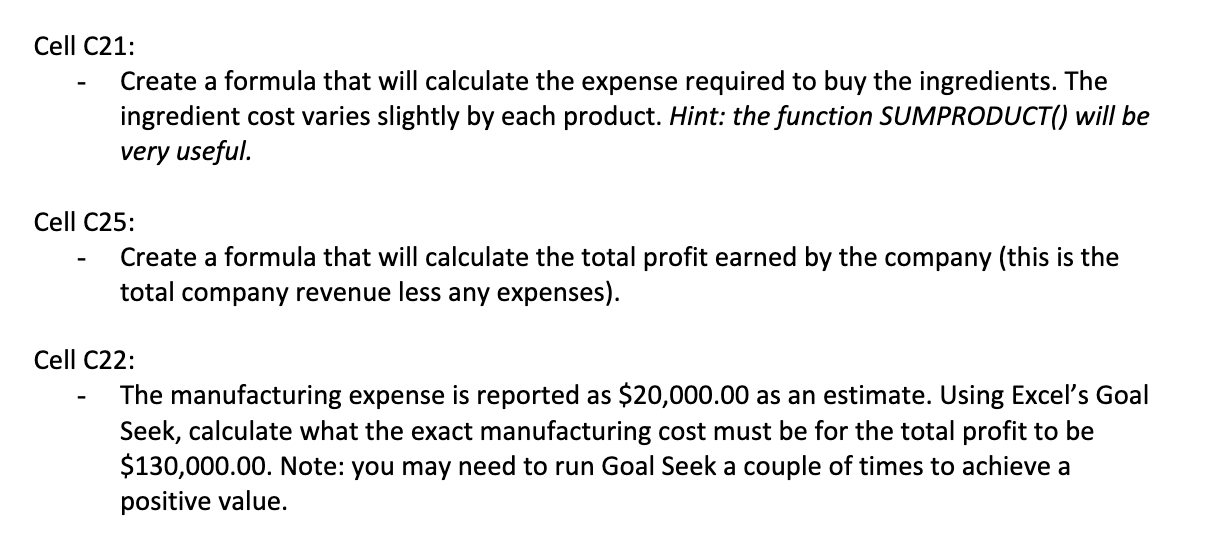

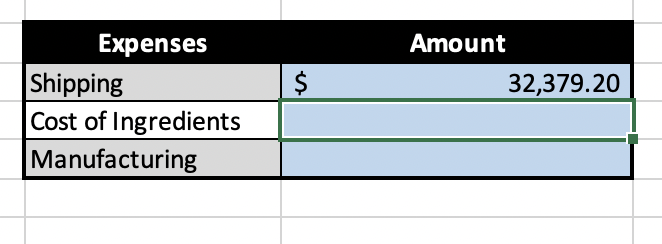

Cell C21: - Create a formula that will calculate the expense required to buy the ingredients. The ingredient cost varies slightly by each product. Hint: the function SUMPRODUCT() will be very useful. Cell C25: - Create a formula that will calculate the total profit earned by the company (this is the total company revenue less any expenses). Cell C22: - The manufacturing expense is reported as $20,000.00 as an estimate. Using Excel's Goal Seek, calculate what the exact manufacturing cost must be for the total profit to be $130,000.00. Note: you may need to run Goal Seek a couple of times to achieve a positive value. \begin{tabular}{|c|l|l|lr|} \hline \multicolumn{1}{|c|}{ Product ID } & \multicolumn{1}{c}{ Nescription } & & $ & \multicolumn{2}{c|}{ Cost of Ingredients } \\ \hline P001 & Fancy Salad & & $ & 2.85 \\ \hline P002 & Waffle Fries & & $ & 8.00 \\ \hline P003 & Krabby Patty & & $ & 6.00 \\ \hline P004 & Pretty Patty & & $ & 4.00 \\ \hline P005 & Vegetarian Curry & & $.85 \\ \hline P006 & Mac and Cheese & & $.00 \\ \hline P007 & Lasagna & & $5 \\ \hline P008 & Spaghetti and Meatballs & & $ & 8.50 \\ \hline \end{tabular} \begin{tabular}{|l|lr|} \hline \multicolumn{2}{c|}{ Expenses } & Amount \\ \hline Shipping & $ & 32,379.20 \\ \hline Cost of Ingredients & & \\ \hline Manufacturing & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started