Hello I'm studying by myself but I really confusing cuz I don't know where my mistake came from.. and could you plz provide explanation?

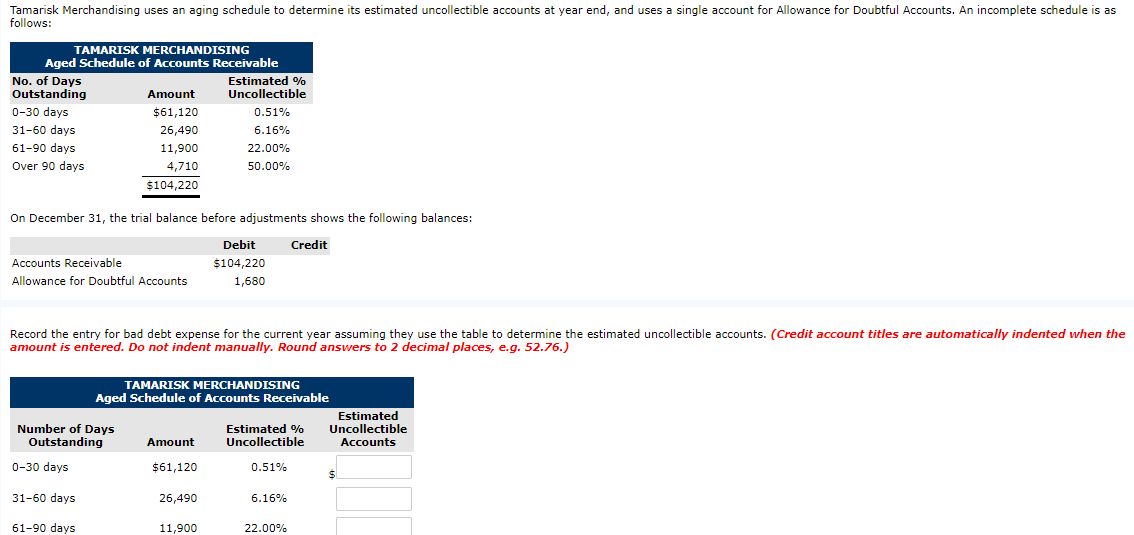

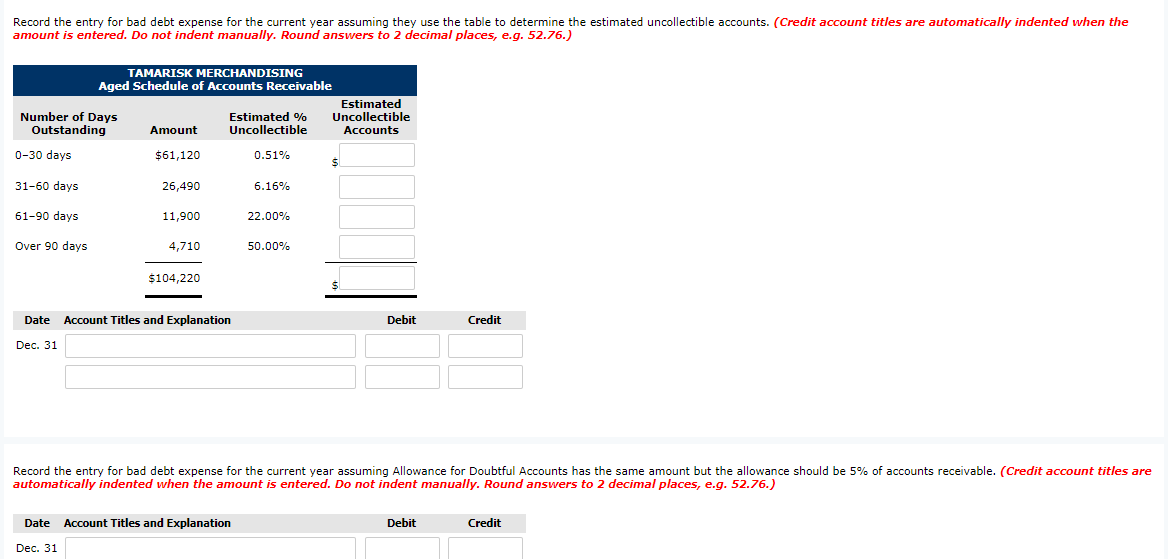

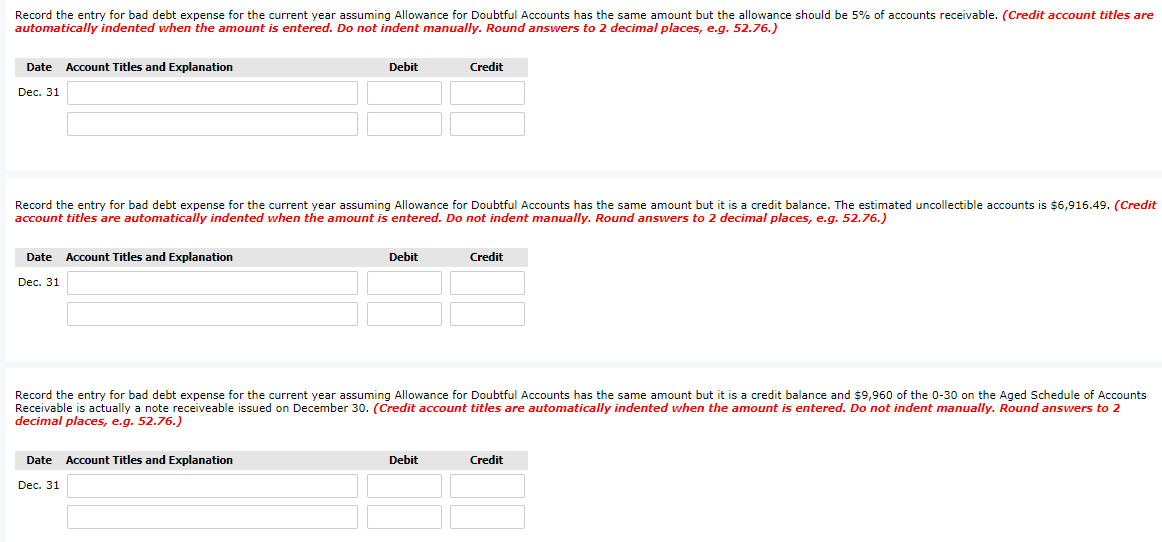

Tamarisk Merchandising uses an aging schedule to determine its estimated uncollectible accounts at year end, and uses a single account for Allowance for Doubtful Accounts. An incomplete schedule is as follows: TAMARISK MERCHANDISING Aged Schedule of Accounts Receivable No. of Days Estimated % Outstanding Amount Uncollectible 0-30 days $61,120 0.51% 31-60 days 26,490 6.16% 61-90 days 11,900 22.00% Over 90 days 4,710 50.00% $104,220 On December 31, the trial balance before adjustments shows the following balances: Debit Credit Accounts Receivable $104,220 Allowance for Doubtful Accounts 1,680 Record the entry for bad debt expense for the current year assuming they use the table to determine the estimated uncollectible accounts. ( Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) TAMARISK MERCHANDISING Aged Schedule of Accounts Receivable Estimated Number of Days Estimated % Uncollectible Outstanding Amount Uncollectible Accounts 0-30 days $61,120 0.51% 31-60 days 26,490 6.16% 61-90 days 11,900 22.00%Record the entry for bad debt expense for the current year assuming they use the table to determine the estimated uncollectible accounts. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) TAMARISK MERCHANDISING Aged Schedule of Accounts Receivable Estimated Number of Days Estimated % Uncollectible Outstanding Amount Uncollectible Accounts 0-30 days $61,120 0.51% 31-60 days 26,490 6.16% 61-90 days 11,900 22.00% Over 90 days 4,710 50.00% $104,220 S Date Account Titles and Explanation Debit Credit Dec. 31 Record the entry for bad debt expense for the current year assuming Allowance for Doubtful Accounts has the same amount but the allowance should be 5% of accounts receivable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) Date Account Titles and Explanation Debit Credit Dec. 31Record the entry for bad debt expense for the current year assuming Allowance for Doubtful Accounts has the same amount but the allowance should be 5% of accounts receivable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) Date Account Titles and Explanation Debit Credit Dec. 31 Record the entry for bad debt expense for the current year assuming Allowance for Doubtful Accounts has the same amount but it is a credit balance. The estimated uncollectible accounts is $6,916.49. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) Date Account Titles and Explanation Debit Credit Dec. 31 Record the entry for bad debt expense for the current year assuming Allowance for Doubtful Accounts has the same amount but it is a credit balance and $9,960 of the 0-30 on the Aged Schedule of Accounts Receivable is actually a note receiveable issued on December 30. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.76.) Date Account Titles and Explanation Debit Credit Dec. 31