Answered step by step

Verified Expert Solution

Question

1 Approved Answer

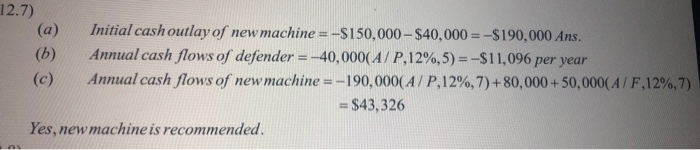

Hello, in the opportunity-cost approach. see pic 2: the solution manual has solved it by considering the lost money (40000) from the defender to be

Hello, in the opportunity-cost approach.

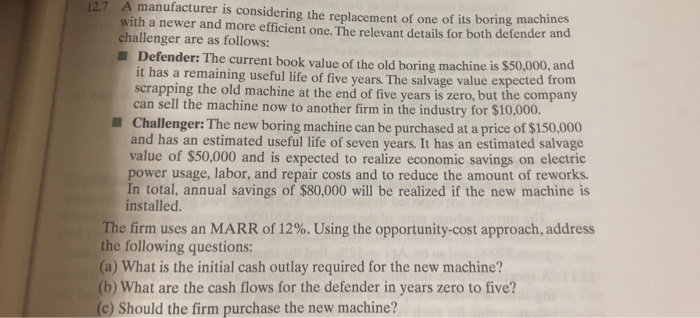

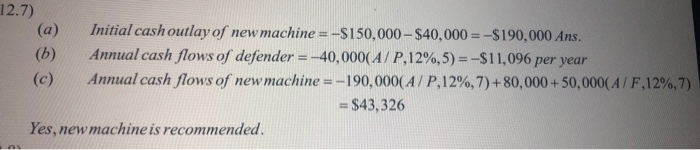

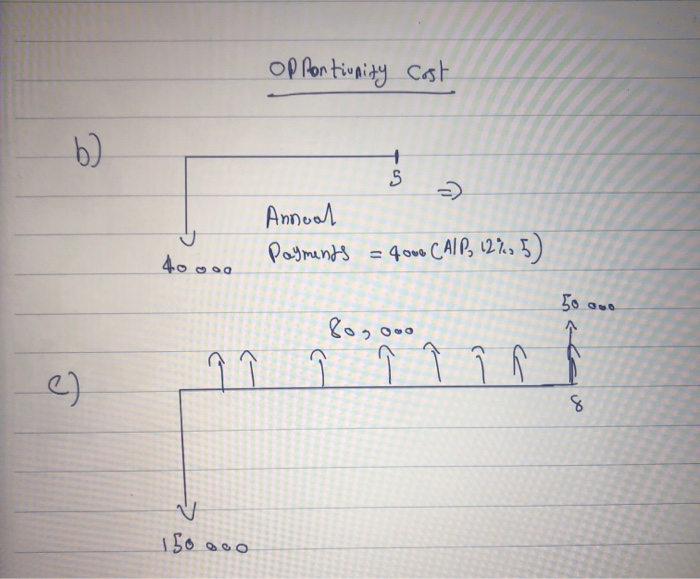

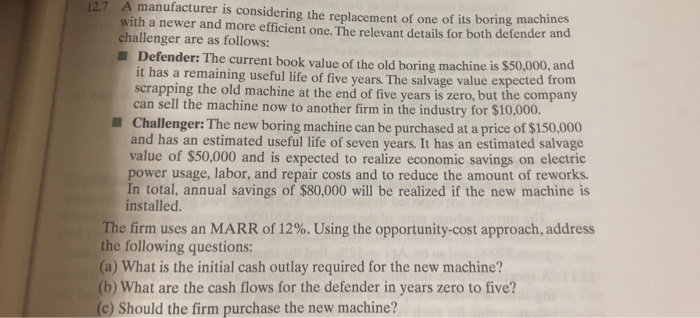

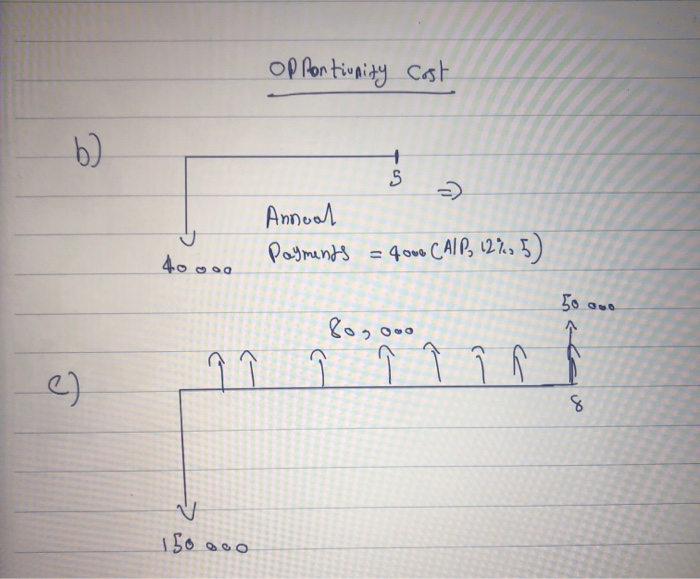

12.7 A manufacturer is considering the replacement of one of its boring machines with a newer and more efficient one. The relevant details for both defender an challenger are as follows: Defender: The current book value of the old boring machine is $50,000, it has a remaining useful life of five years. The scrapping the old machine at the end of five years is zero, bu can sell the machine salvage value expected from t the company now to another firm in the industry for $10,000. Challenger: The new boring machine can be purchased at a price of $150,000 and has an estimated useful life of seven years. It has an estimated salvage value of $50,000 and is expected to realize economic savings on electric power usage, labor, and repair costs and to reduce the amount of reworks. In total, annual savings of $80,000 will be realized if the new machine is installed The firm uses an MARR of 12%. Using the opportunity cost approach, address the following questions: (a) What is the initial cash outlay required for the new machine? (b) What are the cash flows for the defender in years zero to five? Should the firm purchase the new machine? 12.7) (a) (b) (c) Initialcash outlay ornew machine =-S150,000-$40,000--$190,000 Ans. Annual cash flows of defender -40,000( A / P,12%, 5)--S11096 per year Annua/cash flows or new machine -190,000( A / P, 12%,7) +80,000 + 50,000( 4/F,12%,7) $43,326 Yes, new machine is recommended b) 5 ayman see pic 2: the solution manual has solved it by considering the lost money (40000) from the defender to be in the challenger which contradicts the opportunity-cost approach. shouldnt it be like pic3? where we consider the initial investement (-150000) on the challenger at year 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started