Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello is there anyone done this case before,or someone can do it need help (need to answer three question each one 800 words) all three

hello is there anyone done this case before,or someone can do it need help

(need to answer three question each one 800 words)

all three questions at the end of case

thank you so much

its visible

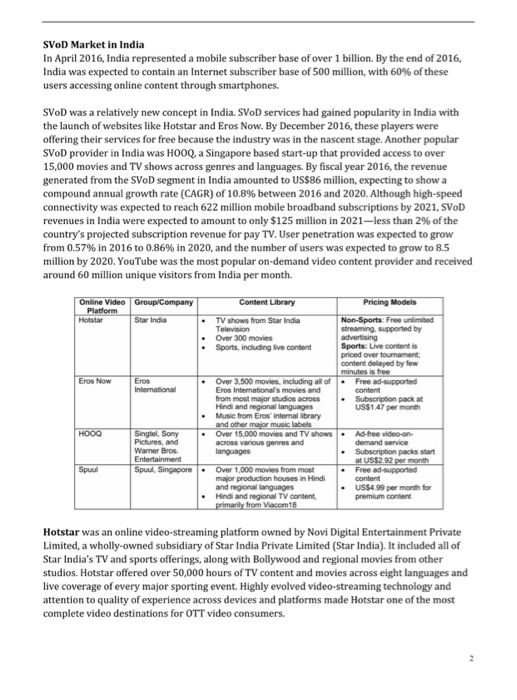

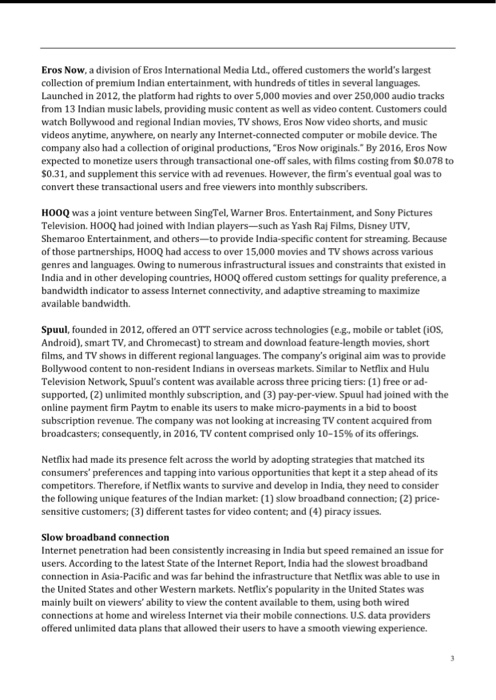

Netflix in India Netflix was the world's leading provider of on-demand video, streaming movies and TV series to over 83 million subscribers in more than 190 countries. The company was founded by Reed Hastings and Marc Randolph on August 29, 1997, in Scotts Valley, California. Initially, the model of Netflix was an online version of the typical pay-per-rent model that was used across the United States by video rental outlets. The company soon evolved into a monthly subscription model, which negated the need for due dates and delay fees. And shortly afterwards, Netflix changed to an online video streaming model. Netflix launched its online video streaming service in 2007. Under the service, members received unlimited movie rentals for a nominal monthly fee. The underlying motive behind launching this service in addition to the DVD rental service) was to make the members switch to the streaming service in the hope of reducing the cost of shipping DVDs. Furthermore, Netflix understood the changing trends of the entertainment industry and how the consumers increasingly wanted to access and consume videos online. The streaming service enabled Netflix customers to access video content from any place, at any time. The introduction of this service also coincided with the period of rapid Internet expansion in the Western world, with broadband speeds greatly improved. In 2007, Netflix began with an offering of 2,000 titles for instant streaming. By 2010, that offering had multiplied 10 times, to over 20,000 titles, and the streaming service was available in the United States, Canada, and 43 other countries. In 2011, Netflix realized that it was paying huge sums in content licensing costs for TV shows, documentaries, and movies. Therefore, the company started investing in creating original content for its subscribers. Series like House of Cards and Orange Is the New Black were massive hits among viewers that paved the way for similar future production. On January 6, 2016, Netflix, Inc. (Netflix) entered India. It was part of the company's vision to be present in approximately 200 countries by the end of 2016. At the launch event, Hastings stated, "Netflix was the first to allow 'binge watching' and give consumers control over entertainment. We have helped consumers discover [the] value of entertainment on demand." In India, Netflix offered only online video streaming services on demand. The case is rewritten based on Tripti Ghosh Sharma, Suraj S., Mitali Srivastava, Tarun Chandoke, and Prachi Prakash (2017), "Netflix in India: The Way Ahead", Richard Ivey School of Business Foundation, 22 Feb. SVOD Market in India In April 2016, India represented a mobile subscriber base of over 1 billion. By the end of 2016, India was expected to contain an Internet subscriber base of 500 million, with 60% of these users accessing online content through smartphones. SVOD was a relatively new concept in India. SVOD services had gained popularity in India with the launch of websites like Hotstar and Eros Now. By December 2016, these players were offering their services for free because the industry was in the nascent stage. Another popular SVOD provider in India was HOOQ a Singapore based start-up that provided access to over 15,000 movies and TV shows across genres and languages. By fiscal year 2016, the revenue generated from the SVOD segment in India amounted to US$86 million, expecting to show a compound annual growth rate (CAGR) of 10.8% between 2016 and 2020. Although high-speed connectivity was expected to reach 622 million mobile broadband subscriptions by 2021, SVOD revenues in India were expected to amount to only $125 million in 2021-less than 2% of the country's projected subscription revenue for pay TV. User penetration was expected to grow from 0.57% in 2016 to 0.86% in 2020, and the number of users was expected to grow to 8.5 million by 2020. YouTube was the most popular on-demand video content provider and received around 60 million unique visitors from India per month. Online Video Group Company Content Library Pricing Models Platform Hotstar Star India TV shows from Star India Non-Sports: Free unlimited Television streaming, supported by Over 300 movies advertising Sports, including live content Sports: Live content is priced over tournament content delayed by few minutes is free Eros Now Eros Over 3.500 movies, including all of Free ad-supported International Eros International's movies and content from most major studios BOSS Subscription packat Hindi and regional languages US$147 per month Music from Eros internalibrary and other major music labels Singtel, Sony Over 15,000 movies and TV shows - Ad-free video on Pictures, and across various genres and demand service Warner Bros. languages Subscription packs start Entertainment at US$2.92 per month Spuul Spuul, Singapore - Over 1,000 movies from most Free ad-supported major production houses in Hindi content and regional languages US$4.99 per month for Hindi and regional TV content premium content primarily from Viacom 18 Hotstar was an online video streaming platform owned by Novi Digital Entertainment Private Limited, a wholly-owned subsidiary of Star India Private Limited (Star India). It included all of Star India's TV and sports offerings, along with Bollywood and regional movies from other studios. Hotstar offered over 50,000 hours of TV content and movies across eight languages and live coverage of every major sporting event. Highly evolved video streaming technology and attention to quality of experience across devices and platforms made Hotstar one of the most complete video destinations for OTT video consumers. Eros Now, a division of Eros International Media Ltd., offered customers the world's largest collection of premium Indian entertainment, with hundreds of titles in several languages. Launched in 2012, the platform had rights to over 5,000 movies and over 250,000 audio tracks from 13 Indian music labels, providing music content as well as video content Customers could watch Bollywood and regional Indian movies, TV shows, Eros Now video shorts, and music videos anytime, anywhere, on nearly any Internet-connected computer or mobile device. The company also had a collection of original productions, "Eros Now originals." By 2016, Eros Now expected to monetize users through transactional one-off sales, with films costing from $0.078 to $0.31, and supplement this service with ad revenues. However, the firm's eventual goal was to convert these transactional users and free viewers into monthly subscribers. HOOQ was a joint venture between Singtel, Warner Bros. Entertainment, and Sony Pictures Television. HOOQ had joined with Indian players-such as Yash Raj Films, Disney UTV, Shemaroo Entertainment, and others-to provide India-specific content for streaming. Because of those partnerships, HOOQ had access to over 15,000 movies and TV shows across various genres and languages. Owing to numerous infrastructural issues and constraints that existed in India and in other developing countries, HOOQ offered custom settings for quality preference, a bandwidth indicator to assess Internet connectivity, and adaptive streaming to maximize available bandwidth. Spuul, founded in 2012, offered an OTT service across technologies (eg., mobile or tablet (ios, Android), smart TV, and Chromecast) to stream and download feature-length movies, short films, and TV shows in different regional languages. The company's original aim was to provide Bollywood content to non-resident Indians in overseas markets. Similar to Netflix and Hulu Television Network, Spuul's content was available across three pricing tiers: (1) free or ad- supported, (2) unlimited monthly subscription, and (3) pay-per-view. Spuul had joined with the online payment firm Paytm to enable its users to make micro-payments in a bid to boost subscription revenue. The company was not looking at increasing TV content acquired from broadcasters; consequently, in 2016, TV content comprised only 10-15% of its offerings. Netflix had made its presence felt across the world by adopting strategies that matched its consumers' preferences and tapping into various opportunities that kept it a step ahead of its competitors. Therefore, if Netflix wants to survive and develop in India, they need to consider the following unique features of the Indian market: (1) slow broadband connection; (2) price- sensitive customers; (3) different tastes for video content; and (4) piracy issues. Slow broadband connection Internet penetration had been consistently increasing in India but speed remained an issue for users. According to the latest State of the Internet Report, India had the slowest broadband connection in Asia-Pacific and was far behind the infrastructure that Netflix was able to use in the United States and other Western markets. Netflix's popularity in the United States was mainly built on viewers' ability to view the content available to them, using both wired connections at home and wireless Internet via their mobile connections. U.S. data providers offered unlimited data plans that allowed their users to have a smooth viewing experience. Contrastingly, there were no viable unlimited Internet offers from any of the data providers in India. These unlimited data plans suffered from fair-usage policy speeds of less than 100 kilobits, which was meagre when compared to the data speeds provided in the United States (between 50 and 500 megabits per second). Studies had found that, globally, there was a linear relationship between Internet speed and video consumption. Meanwhile, the consumption of high-definition (HD) and ultra-high-definition (UHD) video content was expected to increase with a combined share of 21% of online videos in 2018-up from 4.5% in 2013. Fixed broadband speed Average video minutes per Countries following the (kilobit) View pattern 0-5,000 Indonesia, India 5.000-10.000 4,000 Italy, Mexico, Brazil 10.000-15,000 5.000 Chile China, Australia 15.000-20.000 7000 New Zealand, France Spain, United States, Canada, Russia 20.000-25,000 9,000 Germany 25,000-30,000 11,000 Japan, Sweden Source: Cisco. "The Zettabyte En-Trends and Analysis CISCO VNL June 2. 2016. accessed November 26, 2016 www.o.com entus index.perconnectivity wp.html The absence of a robust broadband system in India left much to be desired. Due to low broadband penetration and a lack of robust Internet infrastructure, the younger generation in India was more comfortable watching video content on smartphones than on computers or televisions Price sensitive customers Netflix offered a free trial period of one month for first-time users in India, which started when a user registered on the Netflix India website. After the expiry of the trial period, consumers were required to purchase a subscription package. Subscription prices ranged from $7.50 (standard definition content for a single screen) to $12 per month (premium service, with access to UHD content). Initially, payment for the subscriptions was possible only through credit cards and PayPal, but due to the penetration of debit cards in the Indian market, certain debit cards (Visa, MasterCard, and Maestro) were also eventually accepted. Netflix's pricing strategies in India need to absorb the high costs to operate. Netflix incurred substantial costs in promoting itself in India to increase brand visibility. Such huge spending on promotions had a strong effect on the bottom line of the company. Further, the cost of doing business in a new country like India included that of creating content that would cater to the needs of the local audience, keeping in mind the varied tastes among different age groups and populations. The investment also involved the direct cost of partnerships with domestic content providers (eg. Sony, Star Plus, and Channel V (for youth-oriented shows)). paying for exclusive access to original programming, distribution, hosting the content locally, and various other technology costs associated with rolling out the services. Different tastes Content was one of the biggest hurdles Netflix had to overcome. Just after the company's Indian launch, it disappointed many subscribers when it offered only 7% of its overall library in India. The Indian version of Netflix was different from the one offered in the United States. Much of the company's original content was available to Netflix's Indian users, but the number of Bollywood offerings was limited to only 100 titles. It remained to be seen whether the company would be able to cultivate such a following for its original content among Indian consumers. Adding new content to Netflix's Indian library was a slow, gradual process. After six months, Netflix offered 916 movies and 368 TV shows from across the world on its Indian platform, while in the United States, it offered 4,042 movies and 1,138 TV shows. Furthermore, the amount of Indian content was still low. After operating in the country for six months, Netflix announced the production of its first original series in India, based on the famous novel Sacred Games by Vikram Chandra. The firm partnered with Phantom Films, a reputed Bollywood film studio, for the production of the series. Netflix also planned to expand its portfolio by including content in regional languages like Bengali, Gujarati, Tamil, Punjabi, and Marathi. India had a thriving film and TV industry that enjoyed an overwhelming patronage from its viewers. If Netflix wanted to occupy a bigger share of the market and maintain its initially acquired subscribers, it had to be swift in embracing the varied local content in Indiaboth by producing original content and by acquiring the rights for existing content. In this respect, Netflix was lagging behind its major competitors, many of which had rich and diverse libraries of Indian content. Piracy Apart from competing with fellow SVoD companies, Netflix also had to deal with the threat of illegally obtained (i.e., pirated) video. Despite the international crackdown on piracy, there was still a general acceptance of this activity among Indian viewers, many of whom did not wish to pay for something they could get for free. This same philosophy also drove the problem of password sharing, which involved numerous viewers sharing a single Netflix account in order to bring down the individual cost of subscription. When confronted with this problem in the United States, Netflix had reacted by getting a court ruling that made sharing passwords for money illegal. However, even if such a law were passed in India, the company would face difficulties regarding its implementation. Six months after Netflix's launch in India, important questions loomed: Would the company be able to rise up to the challenge and meet the needs of Indian consumers? Was the Indian market or consumer seasoned enough to adopt a more sophisticated model of SVOD? How could Netflix get a stronghold in a market that was still grappling with basic infrastructure problems and low Internet penetration? Questions to be answered: (1) Netflix is NOT a born global company. Netflix was founded in 1997, and the globalisation of the company did not start until 2010 (13 years later) when Netflix entered Canadian market. However, since 2010, Netflix quickly expanded its business all over the world, and the platform currently supports 26 languages and broadcasts to 183 million audience worldwide. Please offer explanations on (1) why Netflix is not a born global company but (2) why its global expansion can be so rapid after 2010? (800 words max) (2) What were the advantages and disadvantages faced by Netflix when the company entered India? How did Netflix resolve the difficulties to gain market share in India? With Amazon Prime also entering India, how would you evaluate the future performance of Netflix in Indian market? What can Netflix do now to improve the market performance in India? Please provide at least two marketing-related strategic suggestions to Netflix for the next five years (2021-2025) and explain why these two suggestions are proposed. (800 words max) (3) As a company founded in the United States, do you think that Netflix adopted the mindset of Globalisation 3.0 when they entered India? Please use examples to indicate why you think Netflix adopted Globalisation 3.0 or not. Nowadays, many consumers believe that multinationals are responsible for contributing to the sustainable development of the host nations. Do you agree with this opinion and why? Is Netflix contributing to the sustainable development of India? Can you provide at least two suggestions to Netflix as measures or routes for the company to improve their social responsibility performance in India? (800 words max) Netflix in India Netflix was the world's leading provider of on-demand video, streaming movies and TV series to over 83 million subscribers in more than 190 countries. The company was founded by Reed Hastings and Marc Randolph on August 29, 1997, in Scotts Valley, California. Initially, the model of Netflix was an online version of the typical pay-per-rent model that was used across the United States by video rental outlets. The company soon evolved into a monthly subscription model, which negated the need for due dates and delay fees. And shortly afterwards, Netflix changed to an online video streaming model. Netflix launched its online video streaming service in 2007. Under the service, members received unlimited movie rentals for a nominal monthly fee. The underlying motive behind launching this service in addition to the DVD rental service) was to make the members switch to the streaming service in the hope of reducing the cost of shipping DVDs. Furthermore, Netflix understood the changing trends of the entertainment industry and how the consumers increasingly wanted to access and consume videos online. The streaming service enabled Netflix customers to access video content from any place, at any time. The introduction of this service also coincided with the period of rapid Internet expansion in the Western world, with broadband speeds greatly improved. In 2007, Netflix began with an offering of 2,000 titles for instant streaming. By 2010, that offering had multiplied 10 times, to over 20,000 titles, and the streaming service was available in the United States, Canada, and 43 other countries. In 2011, Netflix realized that it was paying huge sums in content licensing costs for TV shows, documentaries, and movies. Therefore, the company started investing in creating original content for its subscribers. Series like House of Cards and Orange Is the New Black were massive hits among viewers that paved the way for similar future production. On January 6, 2016, Netflix, Inc. (Netflix) entered India. It was part of the company's vision to be present in approximately 200 countries by the end of 2016. At the launch event, Hastings stated, "Netflix was the first to allow 'binge watching' and give consumers control over entertainment. We have helped consumers discover [the] value of entertainment on demand." In India, Netflix offered only online video streaming services on demand. The case is rewritten based on Tripti Ghosh Sharma, Suraj S., Mitali Srivastava, Tarun Chandoke, and Prachi Prakash (2017), "Netflix in India: The Way Ahead", Richard Ivey School of Business Foundation, 22 Feb. SVOD Market in India In April 2016, India represented a mobile subscriber base of over 1 billion. By the end of 2016, India was expected to contain an Internet subscriber base of 500 million, with 60% of these users accessing online content through smartphones. SVOD was a relatively new concept in India. SVOD services had gained popularity in India with the launch of websites like Hotstar and Eros Now. By December 2016, these players were offering their services for free because the industry was in the nascent stage. Another popular SVOD provider in India was HOOQ a Singapore based start-up that provided access to over 15,000 movies and TV shows across genres and languages. By fiscal year 2016, the revenue generated from the SVOD segment in India amounted to US$86 million, expecting to show a compound annual growth rate (CAGR) of 10.8% between 2016 and 2020. Although high-speed connectivity was expected to reach 622 million mobile broadband subscriptions by 2021, SVOD revenues in India were expected to amount to only $125 million in 2021-less than 2% of the country's projected subscription revenue for pay TV. User penetration was expected to grow from 0.57% in 2016 to 0.86% in 2020, and the number of users was expected to grow to 8.5 million by 2020. YouTube was the most popular on-demand video content provider and received around 60 million unique visitors from India per month. Online Video Group Company Content Library Pricing Models Platform Hotstar Star India TV shows from Star India Non-Sports: Free unlimited Television streaming, supported by Over 300 movies advertising Sports, including live content Sports: Live content is priced over tournament content delayed by few minutes is free Eros Now Eros Over 3.500 movies, including all of Free ad-supported International Eros International's movies and content from most major studios BOSS Subscription packat Hindi and regional languages US$147 per month Music from Eros internalibrary and other major music labels Singtel, Sony Over 15,000 movies and TV shows - Ad-free video on Pictures, and across various genres and demand service Warner Bros. languages Subscription packs start Entertainment at US$2.92 per month Spuul Spuul, Singapore - Over 1,000 movies from most Free ad-supported major production houses in Hindi content and regional languages US$4.99 per month for Hindi and regional TV content premium content primarily from Viacom 18 Hotstar was an online video streaming platform owned by Novi Digital Entertainment Private Limited, a wholly-owned subsidiary of Star India Private Limited (Star India). It included all of Star India's TV and sports offerings, along with Bollywood and regional movies from other studios. Hotstar offered over 50,000 hours of TV content and movies across eight languages and live coverage of every major sporting event. Highly evolved video streaming technology and attention to quality of experience across devices and platforms made Hotstar one of the most complete video destinations for OTT video consumers. Eros Now, a division of Eros International Media Ltd., offered customers the world's largest collection of premium Indian entertainment, with hundreds of titles in several languages. Launched in 2012, the platform had rights to over 5,000 movies and over 250,000 audio tracks from 13 Indian music labels, providing music content as well as video content Customers could watch Bollywood and regional Indian movies, TV shows, Eros Now video shorts, and music videos anytime, anywhere, on nearly any Internet-connected computer or mobile device. The company also had a collection of original productions, "Eros Now originals." By 2016, Eros Now expected to monetize users through transactional one-off sales, with films costing from $0.078 to $0.31, and supplement this service with ad revenues. However, the firm's eventual goal was to convert these transactional users and free viewers into monthly subscribers. HOOQ was a joint venture between Singtel, Warner Bros. Entertainment, and Sony Pictures Television. HOOQ had joined with Indian players-such as Yash Raj Films, Disney UTV, Shemaroo Entertainment, and others-to provide India-specific content for streaming. Because of those partnerships, HOOQ had access to over 15,000 movies and TV shows across various genres and languages. Owing to numerous infrastructural issues and constraints that existed in India and in other developing countries, HOOQ offered custom settings for quality preference, a bandwidth indicator to assess Internet connectivity, and adaptive streaming to maximize available bandwidth. Spuul, founded in 2012, offered an OTT service across technologies (eg., mobile or tablet (ios, Android), smart TV, and Chromecast) to stream and download feature-length movies, short films, and TV shows in different regional languages. The company's original aim was to provide Bollywood content to non-resident Indians in overseas markets. Similar to Netflix and Hulu Television Network, Spuul's content was available across three pricing tiers: (1) free or ad- supported, (2) unlimited monthly subscription, and (3) pay-per-view. Spuul had joined with the online payment firm Paytm to enable its users to make micro-payments in a bid to boost subscription revenue. The company was not looking at increasing TV content acquired from broadcasters; consequently, in 2016, TV content comprised only 10-15% of its offerings. Netflix had made its presence felt across the world by adopting strategies that matched its consumers' preferences and tapping into various opportunities that kept it a step ahead of its competitors. Therefore, if Netflix wants to survive and develop in India, they need to consider the following unique features of the Indian market: (1) slow broadband connection; (2) price- sensitive customers; (3) different tastes for video content; and (4) piracy issues. Slow broadband connection Internet penetration had been consistently increasing in India but speed remained an issue for users. According to the latest State of the Internet Report, India had the slowest broadband connection in Asia-Pacific and was far behind the infrastructure that Netflix was able to use in the United States and other Western markets. Netflix's popularity in the United States was mainly built on viewers' ability to view the content available to them, using both wired connections at home and wireless Internet via their mobile connections. U.S. data providers offered unlimited data plans that allowed their users to have a smooth viewing experience. Contrastingly, there were no viable unlimited Internet offers from any of the data providers in India. These unlimited data plans suffered from fair-usage policy speeds of less than 100 kilobits, which was meagre when compared to the data speeds provided in the United States (between 50 and 500 megabits per second). Studies had found that, globally, there was a linear relationship between Internet speed and video consumption. Meanwhile, the consumption of high-definition (HD) and ultra-high-definition (UHD) video content was expected to increase with a combined share of 21% of online videos in 2018-up from 4.5% in 2013. Fixed broadband speed Average video minutes per Countries following the (kilobit) View pattern 0-5,000 Indonesia, India 5.000-10.000 4,000 Italy, Mexico, Brazil 10.000-15,000 5.000 Chile China, Australia 15.000-20.000 7000 New Zealand, France Spain, United States, Canada, Russia 20.000-25,000 9,000 Germany 25,000-30,000 11,000 Japan, Sweden Source: Cisco. "The Zettabyte En-Trends and Analysis CISCO VNL June 2. 2016. accessed November 26, 2016 www.o.com entus index.perconnectivity wp.html The absence of a robust broadband system in India left much to be desired. Due to low broadband penetration and a lack of robust Internet infrastructure, the younger generation in India was more comfortable watching video content on smartphones than on computers or televisions Price sensitive customers Netflix offered a free trial period of one month for first-time users in India, which started when a user registered on the Netflix India website. After the expiry of the trial period, consumers were required to purchase a subscription package. Subscription prices ranged from $7.50 (standard definition content for a single screen) to $12 per month (premium service, with access to UHD content). Initially, payment for the subscriptions was possible only through credit cards and PayPal, but due to the penetration of debit cards in the Indian market, certain debit cards (Visa, MasterCard, and Maestro) were also eventually accepted. Netflix's pricing strategies in India need to absorb the high costs to operate. Netflix incurred substantial costs in promoting itself in India to increase brand visibility. Such huge spending on promotions had a strong effect on the bottom line of the company. Further, the cost of doing business in a new country like India included that of creating content that would cater to the needs of the local audience, keeping in mind the varied tastes among different age groups and populations. The investment also involved the direct cost of partnerships with domestic content providers (eg. Sony, Star Plus, and Channel V (for youth-oriented shows)). paying for exclusive access to original programming, distribution, hosting the content locally, and various other technology costs associated with rolling out the services. Different tastes Content was one of the biggest hurdles Netflix had to overcome. Just after the company's Indian launch, it disappointed many subscribers when it offered only 7% of its overall library in India. The Indian version of Netflix was different from the one offered in the United States. Much of the company's original content was available to Netflix's Indian users, but the number of Bollywood offerings was limited to only 100 titles. It remained to be seen whether the company would be able to cultivate such a following for its original content among Indian consumers. Adding new content to Netflix's Indian library was a slow, gradual process. After six months, Netflix offered 916 movies and 368 TV shows from across the world on its Indian platform, while in the United States, it offered 4,042 movies and 1,138 TV shows. Furthermore, the amount of Indian content was still low. After operating in the country for six months, Netflix announced the production of its first original series in India, based on the famous novel Sacred Games by Vikram Chandra. The firm partnered with Phantom Films, a reputed Bollywood film studio, for the production of the series. Netflix also planned to expand its portfolio by including content in regional languages like Bengali, Gujarati, Tamil, Punjabi, and Marathi. India had a thriving film and TV industry that enjoyed an overwhelming patronage from its viewers. If Netflix wanted to occupy a bigger share of the market and maintain its initially acquired subscribers, it had to be swift in embracing the varied local content in Indiaboth by producing original content and by acquiring the rights for existing content. In this respect, Netflix was lagging behind its major competitors, many of which had rich and diverse libraries of Indian content. Piracy Apart from competing with fellow SVoD companies, Netflix also had to deal with the threat of illegally obtained (i.e., pirated) video. Despite the international crackdown on piracy, there was still a general acceptance of this activity among Indian viewers, many of whom did not wish to pay for something they could get for free. This same philosophy also drove the problem of password sharing, which involved numerous viewers sharing a single Netflix account in order to bring down the individual cost of subscription. When confronted with this problem in the United States, Netflix had reacted by getting a court ruling that made sharing passwords for money illegal. However, even if such a law were passed in India, the company would face difficulties regarding its implementation. Six months after Netflix's launch in India, important questions loomed: Would the company be able to rise up to the challenge and meet the needs of Indian consumers? Was the Indian market or consumer seasoned enough to adopt a more sophisticated model of SVOD? How could Netflix get a stronghold in a market that was still grappling with basic infrastructure problems and low Internet penetration? Questions to be answered: (1) Netflix is NOT a born global company. Netflix was founded in 1997, and the globalisation of the company did not start until 2010 (13 years later) when Netflix entered Canadian market. However, since 2010, Netflix quickly expanded its business all over the world, and the platform currently supports 26 languages and broadcasts to 183 million audience worldwide. Please offer explanations on (1) why Netflix is not a born global company but (2) why its global expansion can be so rapid after 2010? (800 words max) (2) What were the advantages and disadvantages faced by Netflix when the company entered India? How did Netflix resolve the difficulties to gain market share in India? With Amazon Prime also entering India, how would you evaluate the future performance of Netflix in Indian market? What can Netflix do now to improve the market performance in India? Please provide at least two marketing-related strategic suggestions to Netflix for the next five years (2021-2025) and explain why these two suggestions are proposed. (800 words max) (3) As a company founded in the United States, do you think that Netflix adopted the mindset of Globalisation 3.0 when they entered India? Please use examples to indicate why you think Netflix adopted Globalisation 3.0 or not. Nowadays, many consumers believe that multinationals are responsible for contributing to the sustainable development of the host nations. Do you agree with this opinion and why? Is Netflix contributing to the sustainable development of India? Can you provide at least two suggestions to Netflix as measures or routes for the company to improve their social responsibility performance in India? (800 words max) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started