Answered step by step

Verified Expert Solution

Question

1 Approved Answer

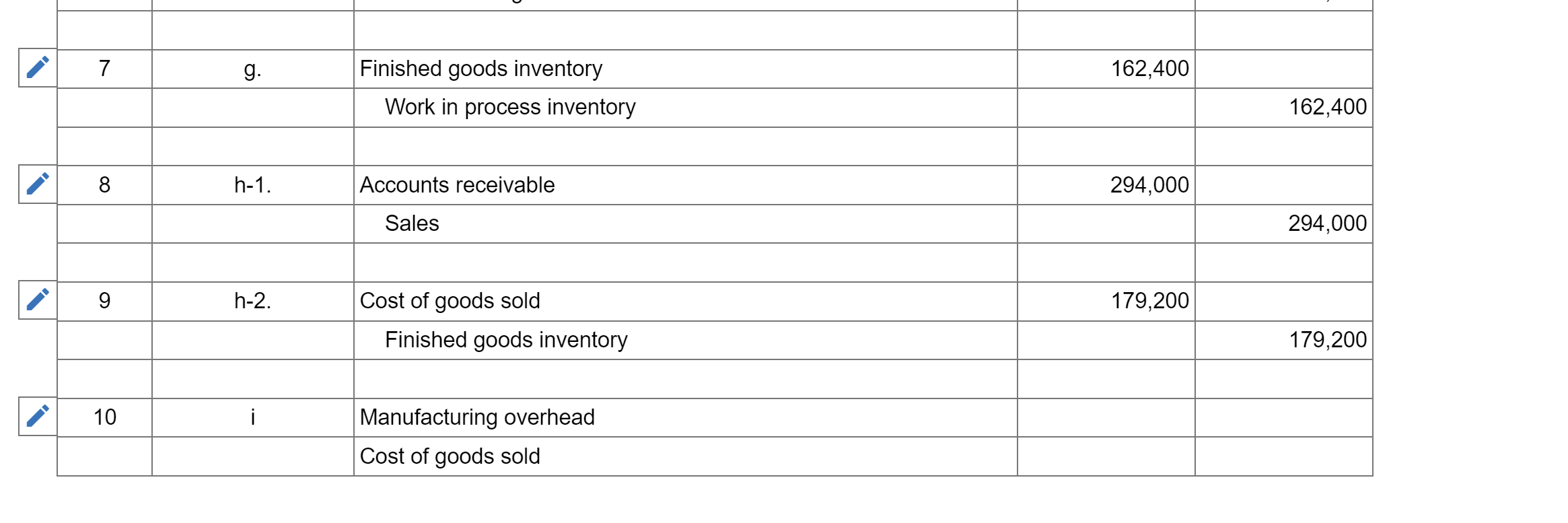

Hello! Just having trouble with answering question I. A demonstration of how to correctly solve this question would be greatly appreciated. Everything answered up to

Hello! Just having trouble with answering question I. A demonstration of how to correctly solve this question would be greatly appreciated. Everything answered up to the empty boxes at I is confirmed correct. Thank you.

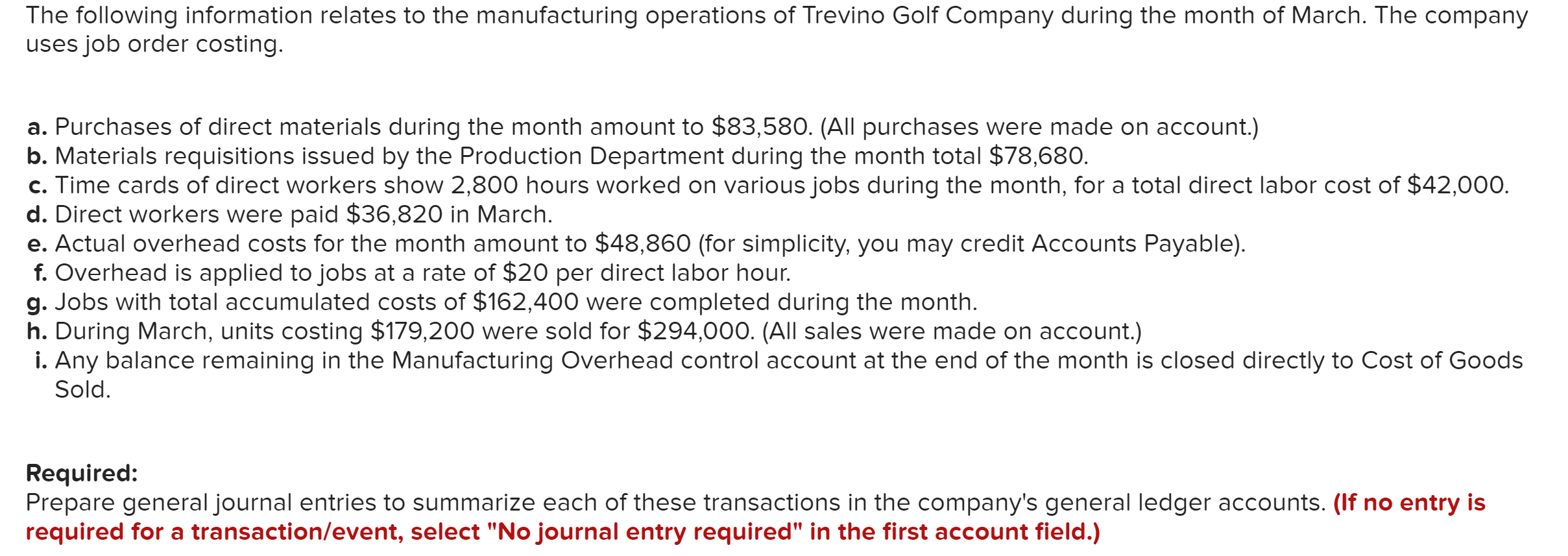

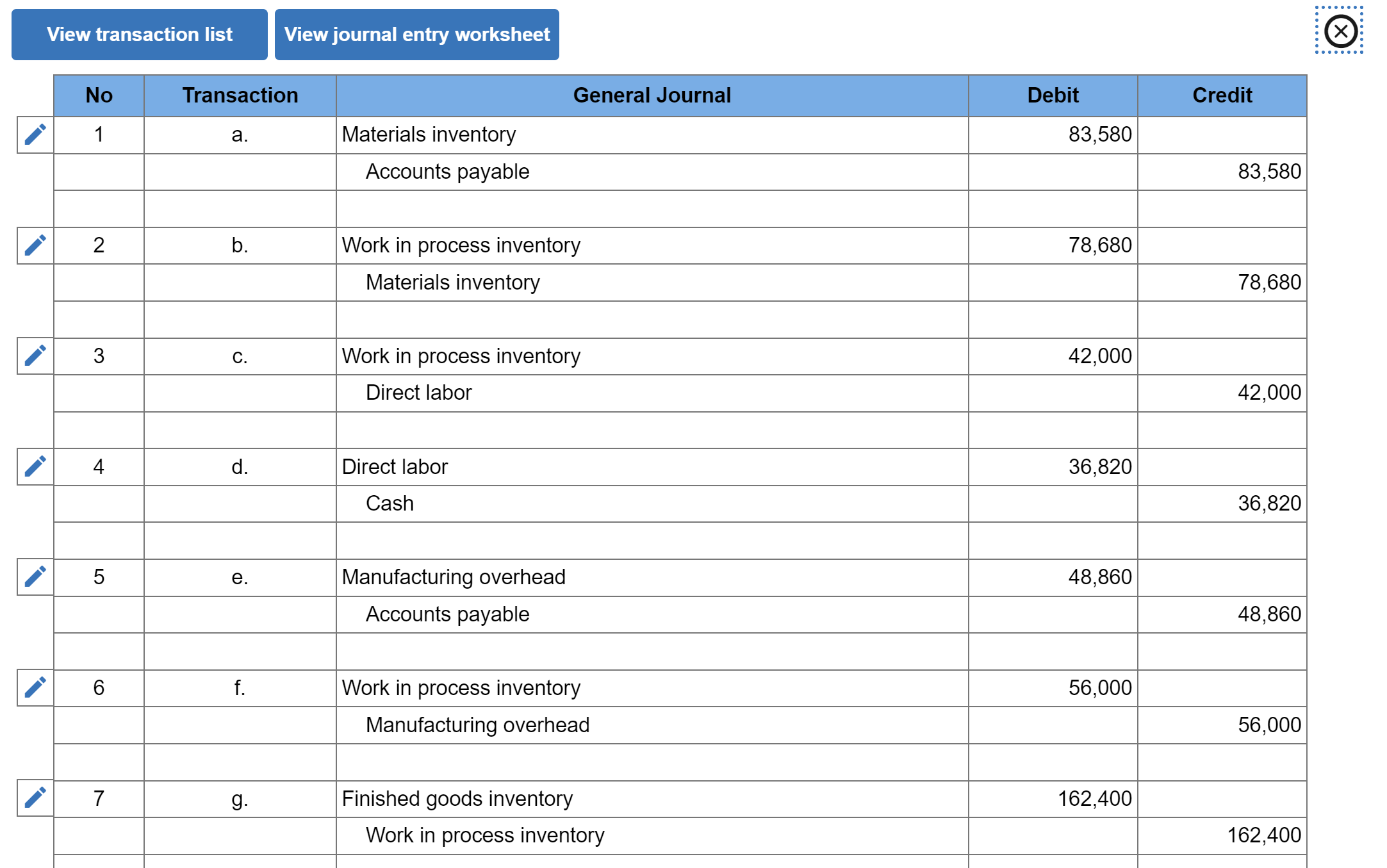

The following information relates to the manufacturing operations of Trevino Golf Company during the month of March. The company uses job order costing. a. Purchases of direct materials during the month amount to $83,580. (All purchases were made on account.) b. Materials requisitions issued by the Production Department during the month total $78,680. c. Time cards of direct workers show 2,800 hours worked on various jobs during the month, for a total direct labor cost of $42,000. d. Direct workers were paid $36,820 in March. e. Actual overhead costs for the month amount to $48,860 (for simplicity, you may credit Accounts Payable). f. Overhead is applied to jobs at a rate of $20 per direct labor hour. g. Jobs with total accumulated costs of $162,400 were completed during the month. h. During March, units costing $179,200 were sold for $294,000. (All sales were made on account.) i. Any balance remaining in the Manufacturing Overhead control account at the end of the month is closed directly to Cost of Goods Sold. Required: Prepare general journal entries to summarize each of these transactions in the company's general ledger accounts. (If no entry is View transaction list View journal entry worksheet \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Transaction & General Journal & Debit & Credit \\ \hline \multirow[t]{2}{*}{} & 1 & a. & Materials inventory & 83,580 & \\ \hline & & & Accounts payable & & 83,580 \\ \hline \multirow[t]{2}{*}{} & 2 & b. & Work in process inventory & 78,680 & \\ \hline & & & Materials inventory & & 78,680 \\ \hline \multirow[t]{2}{*}{} & 3 & c. & Work in process inventory & 42,000 & \\ \hline & & & Direct labor & & 42,000 \\ \hline & 4 & d. & Direct labor & 36,820 & \\ \hline & & & Cash & & 36,820 \\ \hline & 5 & e. & Manufacturing overhead & 48,860 & \\ \hline & & & Accounts payable & & 48,860 \\ \hline \multirow[t]{2}{*}{} & 6 & f. & Work in process inventory & 56,000 & \\ \hline & & & Manufacturing overhead & & 56,000 \\ \hline & 7 & g. & Finished goods inventory & 162,400 & \\ \hline & & & Work in process inventory & & 162,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{%} & 7 & g. & Finished goods inventory & 162,400 & \\ \hline & & & Work in process inventory & & 162,400 \\ \hline & 8 & h-1. & Accounts receivable & 294,000 & \\ \hline & & & Sales & & 294,000 \\ \hline & 9 & h2. & Cost of goods sold & 179,200 & \\ \hline & & & Finished goods inventory & & 179,200 \\ \hline & 10 & i & Manufacturing overhead & & \\ \hline & & & Cost of goods sold & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started