Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, may you please answer all parts of the question:-) I included both the balance sheet and income statement, but they dont need anything done

Hello, may you please answer all parts of the question:-) I included both the balance sheet and income statement, but they dont need anything done to them :) Thank you!

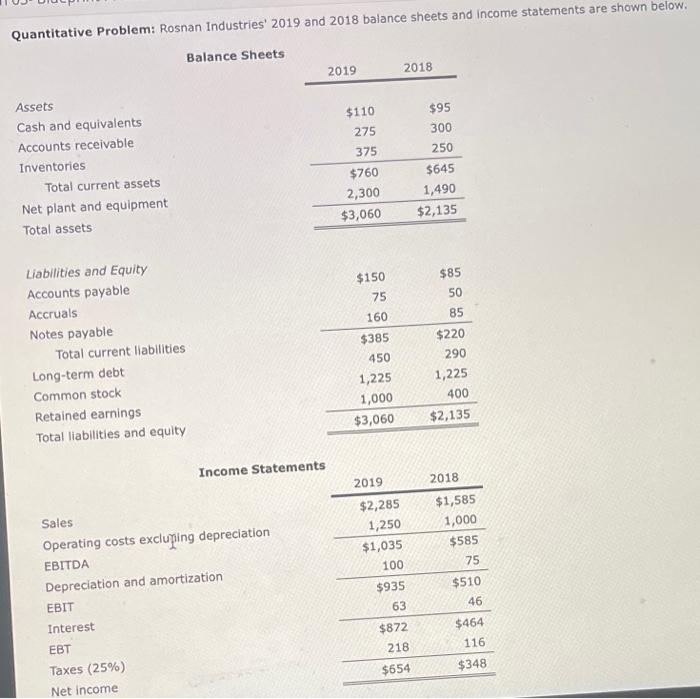

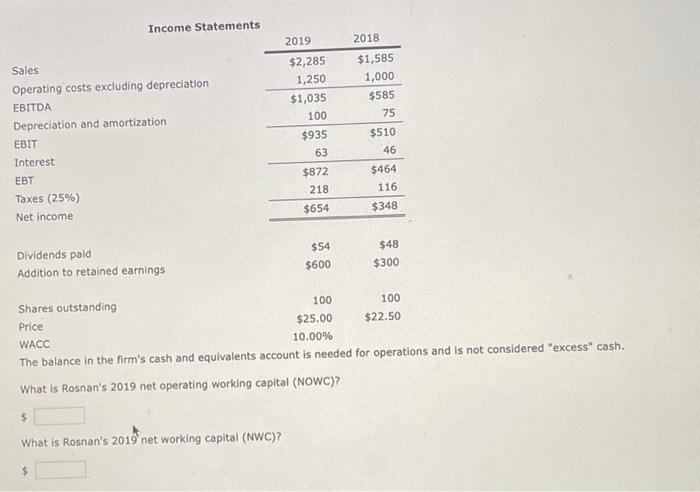

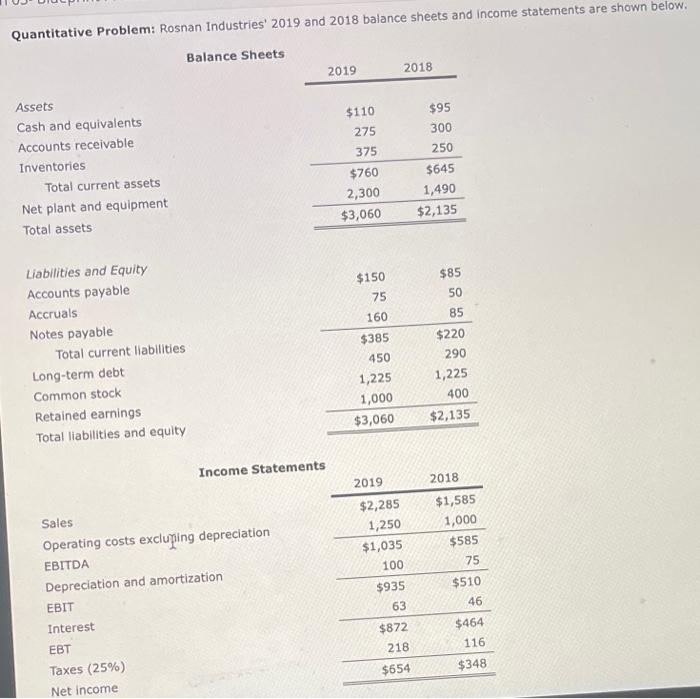

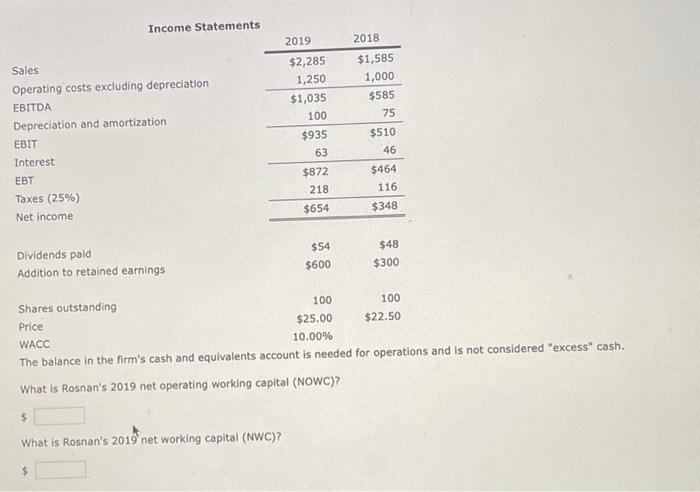

Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below, Balance Sheets 2019 2018 $110 $95 300 275 375 250 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets $760 2,300 $3,060 $645 1,490 $2,135 $150 75 $85 50 160 Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $385 450 1,225 1,000 $3,060 85 $220 290 1,225 400 $2,135 Income Statements 2019 2018 $2,285 1,250 $1,035 100 $935 Sales Operating costs excluping depreciation EBITDA Depreciation and amortization EBIT Interest EBT Taxes (25%) Net Income $1,585 1,000 $585 75 $510 46 63 $464 116 $872 218 $654 $348 Income Statements 2019 2018 Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest Taxes (25%) Net Income $2,285 1,250 $1,035 100 $935 63 $872 218 $654 $1,585 1,000 $585 75 $510 46 $464 116 $348 Dividends pald Addition to retained earnings $54 $600 $48 $300 Shares outstanding 100 100 Price $25.00 $22.50 WACC 10.00% The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess* cash. What is Rosnan's 2019 net operating working capital (NOWC)? $ What is Rosnan's 2019 net working capital (NWC)? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started