Answered step by step

Verified Expert Solution

Question

1 Approved Answer

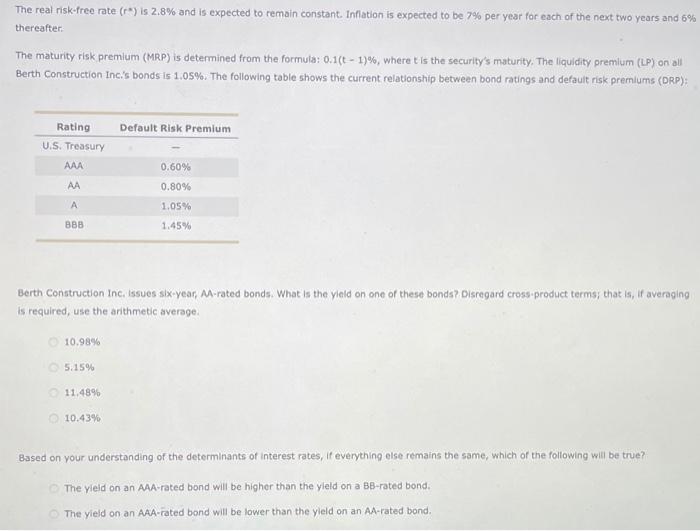

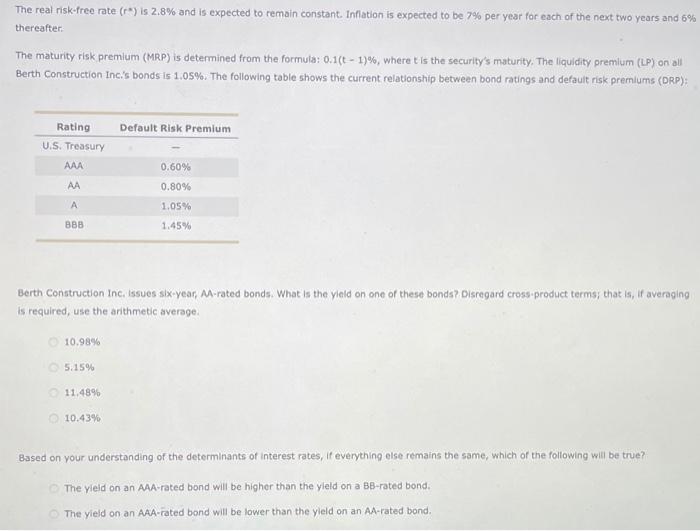

hello! may you please answer! thank you so much! :) The real risk-free rate (*) is 2.8% and is expected to remain constant. Inflation is

hello! may you please answer! thank you so much! :)

The real risk-free rate (*) is 2.8% and is expected to remain constant. Inflation is expected to be 7% per year for each of the next two years and 6% thereafter The maturity risk premium (MRP) is determined from the formula: 0.1(t-1)%, where is the security's maturity. The liquidity premium (LP) on all Berth Construction Inc.'s bonds is 1,05%. The following table shows the current relationship between bond ratings and default risk premiums (ORP); Default Risk Premium Rating U.S. Treasury AAA 0.60% AA 0.80% A 1.05% 1,45% BBB Berth Construction Inc, Issues six-year, M-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 10.98% 5:15% 11.4896 10.43% Based on your understanding of the determinants of interest rates, it everything else remains the same, which of the following will be true? The yield on an AAA-rated bond will be higher than the yield on a BB-rated bond. The yield on an AAA-rated bond will be lower than the yield on an AA-rated bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started