Answered step by step

Verified Expert Solution

Question

1 Approved Answer

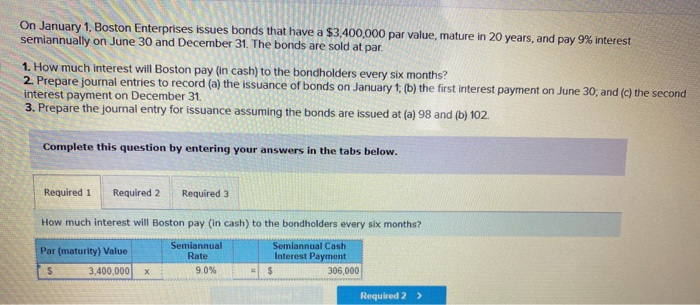

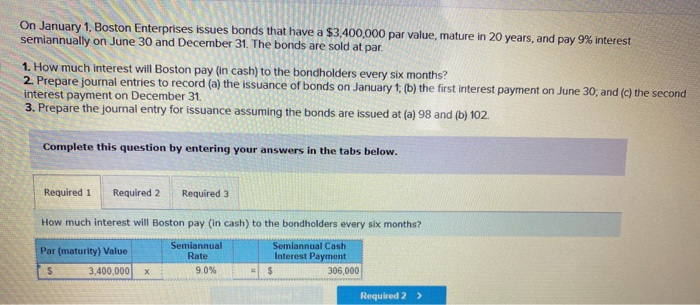

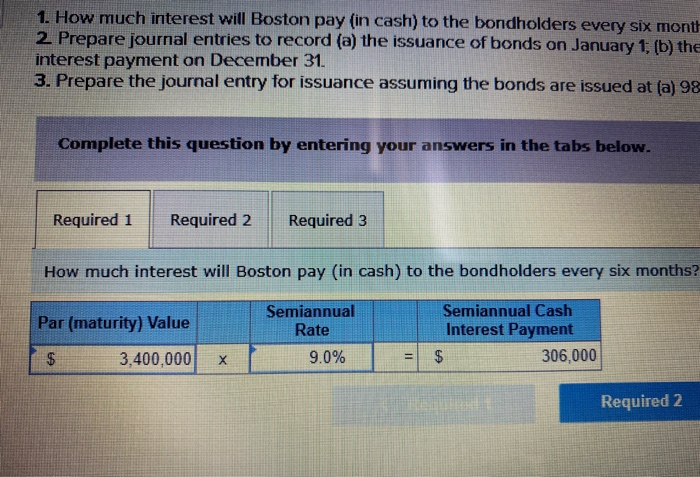

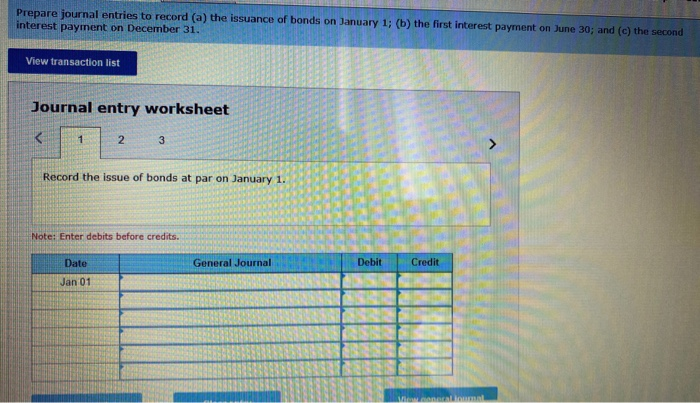

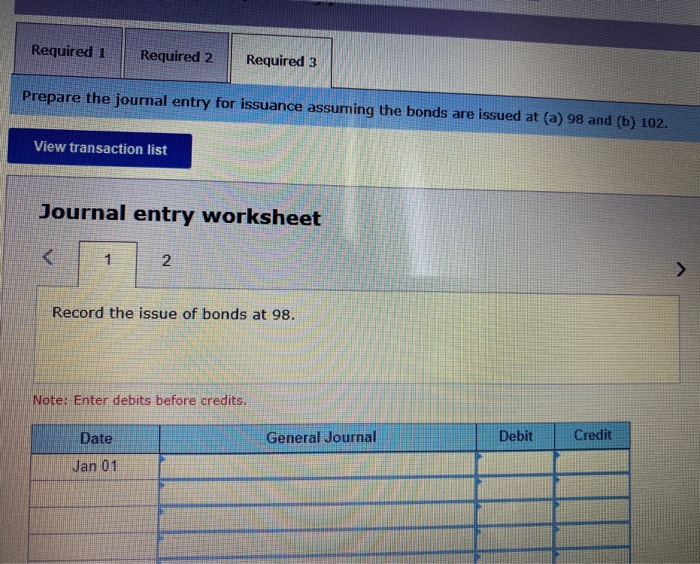

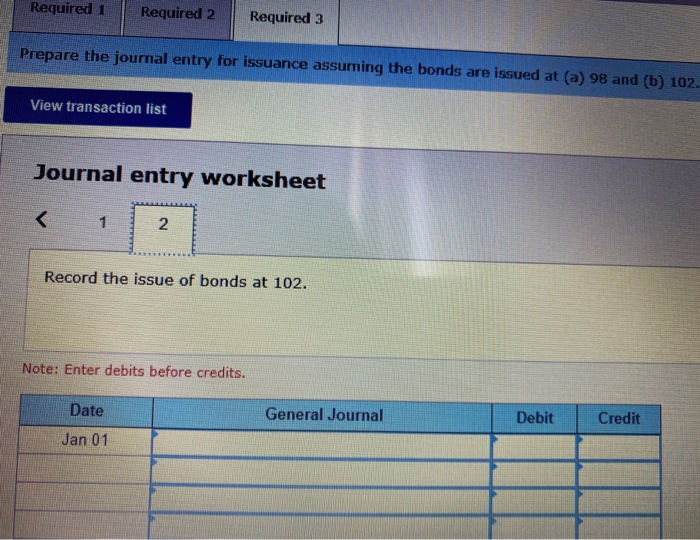

Hello, need help with this question! And can you let me know if Required 1 is correct? Thank you! On January 1, Boston Enterprises issues

Hello, need help with this question! And can you let me know if Required 1 is correct? Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started