Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, need help with this question with explanation too thank u kidnly refer to the last 2 pics hi this is the full question as

hello, need help with this question with explanation too thank u

kidnly refer to the last 2 pics

hi this is the full question as given :(

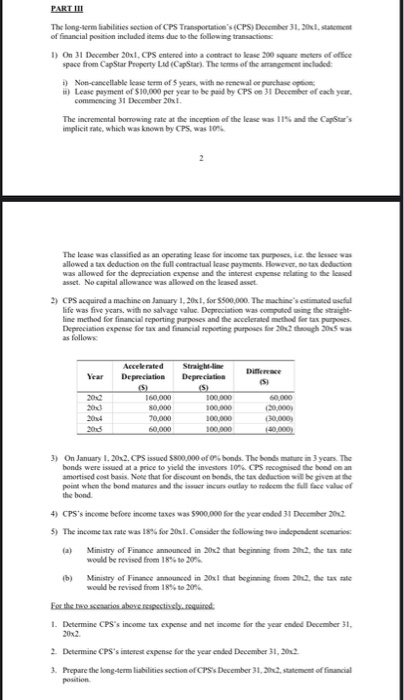

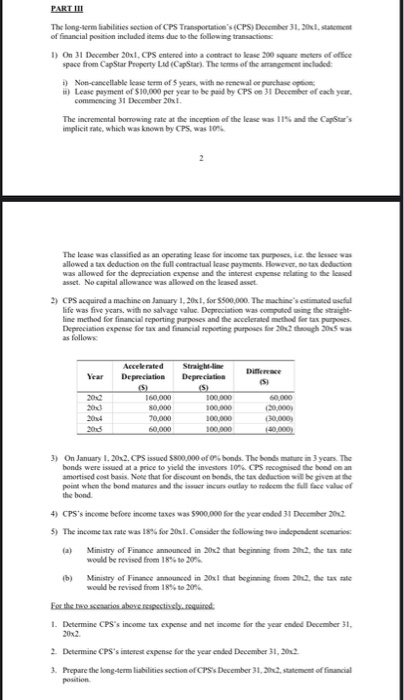

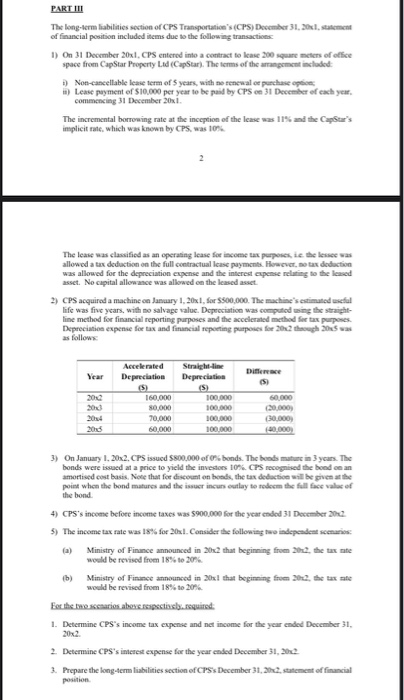

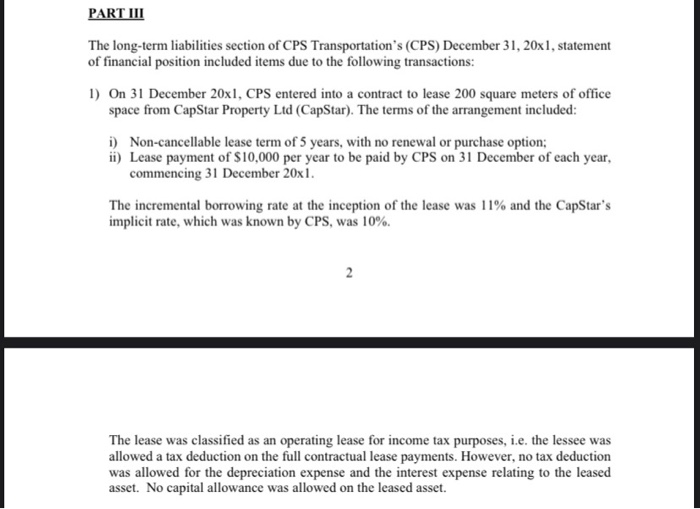

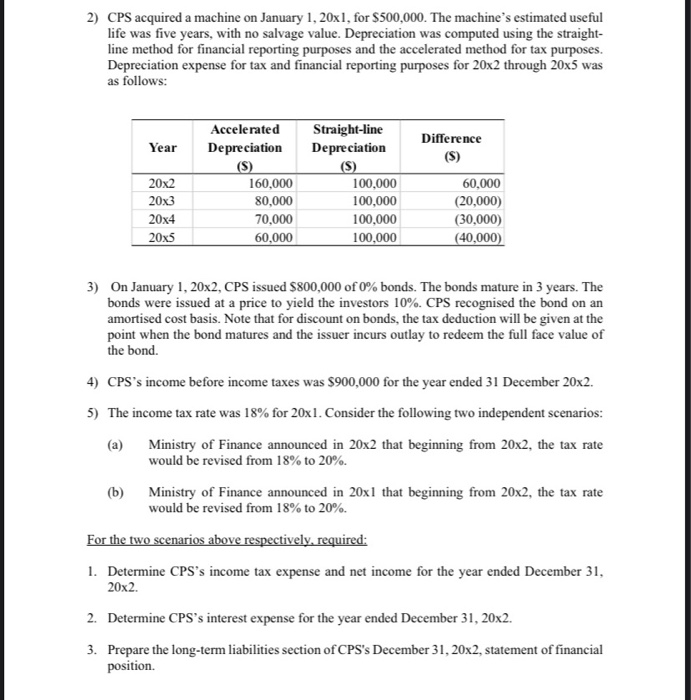

PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 2, statement of financial position included items due to the following transactions 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CupStar). The terms of the arrangement included +) Non-cancellable lease term of 5 years, with no renewal or purchase Option b) Lease payment of 10.000 per year to be paid by CPS 31 December of cach year. commencing 31 December 20xi The incremental borrowing rate at the inception of the lease was 11% and the Caper's by % 2 The case was classified as an operating lease for income tax purposes, ie the lessee was allowed a tax deduction on the full contractual case payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed as the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 2012 though 2013 as follows Year Straight-line Depreciation Difference 2014 2013 Accelerated Depreciation CS 160,000 80.000 70,000 60.000 100,000 100.000 100,000 100.000 2015 3) On January 1, 20x2. CPS issued $800,000 of 0% bonds. The bonds main 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issue incursoutlay to redeem the full face value of the bond 4) CPS's income before income taxes was 5900.000 for the year ended 31 December 2012 5) The income tax rate was 18% for 2-1. Consider the following two independent scenarios Ministry of Finance announced in 2012 that beginning from 2012. the tax ste would be revised from 18% to 20% ib) Ministry of Finance announced in the that beginning from 20:2. the tax rate would be revised from 18% to 20% For the two scenarios above spetsbreuired. 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2 2. Determine CPS's interest expense for the year ended December 31, 2012 3. Prepare the long-term liabilities section of CPS's December 31, 2012. statement of financial PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 2, statement of financial position included items due to the following transactions 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CupStar). The terms of the arrangement included +) Non-cancellable lease term of 5 years, with no renewal or purchase Option b) Lease payment of 10.000 per year to be paid by CPS 31 December of cach year. commencing 31 December 20xi The incremental borrowing rate at the inception of the lease was 11% and the Caper's by % 2 The case was classified as an operating lease for income tax purposes, ie the lessee was allowed a tax deduction on the full contractual case payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed as the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 2012 though 2013 as follows Year Straight-line Depreciation Difference 2014 2013 Accelerated Depreciation CS 160,000 80.000 70,000 60.000 100,000 100.000 100,000 100.000 2015 3) On January 1, 20x2. CPS issued $800,000 of 0% bonds. The bonds main 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issue incursoutlay to redeem the full face value of the bond 4) CPS's income before income taxes was 5900.000 for the year ended 31 December 2012 5) The income tax rate was 18% for 2-1. Consider the following two independent scenarios Ministry of Finance announced in 2012 that beginning from 2012. the tax ste would be revised from 18% to 20% ib) Ministry of Finance announced in the that beginning from 20:2. the tax rate would be revised from 18% to 20% For the two scenarios above spetsbreuired. 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2 2. Determine CPS's interest expense for the year ended December 31, 2012 3. Prepare the long-term liabilities section of CPS's December 31, 2012. statement of financial PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 20x1, statement of financial position included items due to the following transactions: 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CapStar). The terms of the arrangement included: i) Non-cancellable lease term of 5 years, with no renewal or purchase option; ii) Lease payment of $10,000 per year to be paid by CPS on 31 December of each year, commencing 31 December 20x1. The incremental borrowing rate at the inception of the lease was 11% and the CapStar's implicit rate, which was known by CPS, was 10%. 2 The lease was classified as an operating lease for income tax purposes, i.e. the lessee was allowed a tax deduction on the full contractual lease payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset. 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed using the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 20x2 through 20x5 was as follows: Difference Year 20x2 20x3 20x4 20x5 Accelerated Depreciation (S) 160,000 80,000 70,000 60,000 Straight-line Depreciation (S) 100,000 100,000 100,000 100,000 60,000 (20,000) (30,000) (40,000) 3) On January 1, 20x2, CPS issued $800,000 of 0% bonds. The bonds mature in 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issuer incurs outlay to redeem the full face value of the bond. 4) CPS's income before income taxes was $900,000 for the year ended 31 December 20x2. 5) The income tax rate was 18% for 20x1. Consider the following two independent scenarios: (a) Ministry of Finance announced in 20x2 that beginning from 20x2, the tax rate would be revised from 18% to 20%. (b) Ministry of Finance announced in 20xl that beginning from 20x2, the tax rate would be revised from 18% to 20%. For the two scenarios above respectively, required: 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2. 2. Determine CPS's interest expense for the year ended December 31, 20x2. 3. Prepare the long-term liabilities section of CPS's December 31, 20x2, statement of financial position. PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 2, statement of financial position included items due to the following transactions 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CupStar). The terms of the arrangement included +) Non-cancellable lease term of 5 years, with no renewal or purchase Option b) Lease payment of 10.000 per year to be paid by CPS 31 December of cach year. commencing 31 December 20xi The incremental borrowing rate at the inception of the lease was 11% and the Caper's by % 2 The case was classified as an operating lease for income tax purposes, ie the lessee was allowed a tax deduction on the full contractual case payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed as the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 2012 though 2013 as follows Year Straight-line Depreciation Difference 2014 2013 Accelerated Depreciation CS 160,000 80.000 70,000 60.000 100,000 100.000 100,000 100.000 2015 3) On January 1, 20x2. CPS issued $800,000 of 0% bonds. The bonds main 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issue incursoutlay to redeem the full face value of the bond 4) CPS's income before income taxes was 5900.000 for the year ended 31 December 2012 5) The income tax rate was 18% for 2-1. Consider the following two independent scenarios Ministry of Finance announced in 2012 that beginning from 2012. the tax ste would be revised from 18% to 20% ib) Ministry of Finance announced in the that beginning from 20:2. the tax rate would be revised from 18% to 20% For the two scenarios above spetsbreuired. 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2 2. Determine CPS's interest expense for the year ended December 31, 2012 3. Prepare the long-term liabilities section of CPS's December 31, 2012. statement of financial PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 2, statement of financial position included items due to the following transactions 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CupStar). The terms of the arrangement included +) Non-cancellable lease term of 5 years, with no renewal or purchase Option b) Lease payment of 10.000 per year to be paid by CPS 31 December of cach year. commencing 31 December 20xi The incremental borrowing rate at the inception of the lease was 11% and the Caper's by % 2 The case was classified as an operating lease for income tax purposes, ie the lessee was allowed a tax deduction on the full contractual case payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed as the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 2012 though 2013 as follows Year Straight-line Depreciation Difference 2014 2013 Accelerated Depreciation CS 160,000 80.000 70,000 60.000 100,000 100.000 100,000 100.000 2015 3) On January 1, 20x2. CPS issued $800,000 of 0% bonds. The bonds main 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issue incursoutlay to redeem the full face value of the bond 4) CPS's income before income taxes was 5900.000 for the year ended 31 December 2012 5) The income tax rate was 18% for 2-1. Consider the following two independent scenarios Ministry of Finance announced in 2012 that beginning from 2012. the tax ste would be revised from 18% to 20% ib) Ministry of Finance announced in the that beginning from 20:2. the tax rate would be revised from 18% to 20% For the two scenarios above spetsbreuired. 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2 2. Determine CPS's interest expense for the year ended December 31, 2012 3. Prepare the long-term liabilities section of CPS's December 31, 2012. statement of financial PART III The long-term liabilities section of CPS Transportation's (CPS) December 31, 20x1, statement of financial position included items due to the following transactions: 1) On 31 December 20x1, CPS entered into a contract to lease 200 square meters of office space from CapStar Property Ltd (CapStar). The terms of the arrangement included: i) Non-cancellable lease term of 5 years, with no renewal or purchase option; ii) Lease payment of $10,000 per year to be paid by CPS on 31 December of each year, commencing 31 December 20x1. The incremental borrowing rate at the inception of the lease was 11% and the CapStar's implicit rate, which was known by CPS, was 10%. 2 The lease was classified as an operating lease for income tax purposes, i.e. the lessee was allowed a tax deduction on the full contractual lease payments. However, no tax deduction was allowed for the depreciation expense and the interest expense relating to the leased asset. No capital allowance was allowed on the leased asset. 2) CPS acquired a machine on January 1, 20x1, for $500,000. The machine's estimated useful life was five years, with no salvage value. Depreciation was computed using the straight- line method for financial reporting purposes and the accelerated method for tax purposes. Depreciation expense for tax and financial reporting purposes for 20x2 through 20x5 was as follows: Difference Year 20x2 20x3 20x4 20x5 Accelerated Depreciation (S) 160,000 80,000 70,000 60,000 Straight-line Depreciation (S) 100,000 100,000 100,000 100,000 60,000 (20,000) (30,000) (40,000) 3) On January 1, 20x2, CPS issued $800,000 of 0% bonds. The bonds mature in 3 years. The bonds were issued at a price to yield the investors 10%. CPS recognised the bond on an amortised cost basis. Note that for discount on bonds, the tax deduction will be given at the point when the bond matures and the issuer incurs outlay to redeem the full face value of the bond. 4) CPS's income before income taxes was $900,000 for the year ended 31 December 20x2. 5) The income tax rate was 18% for 20x1. Consider the following two independent scenarios: (a) Ministry of Finance announced in 20x2 that beginning from 20x2, the tax rate would be revised from 18% to 20%. (b) Ministry of Finance announced in 20xl that beginning from 20x2, the tax rate would be revised from 18% to 20%. For the two scenarios above respectively, required: 1. Determine CPS's income tax expense and net income for the year ended December 31, 20x2. 2. Determine CPS's interest expense for the year ended December 31, 20x2. 3. Prepare the long-term liabilities section of CPS's December 31, 20x2, statement of financial position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started