Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello please answer the first 4 questions if you are unable to answers all 6 questions. Thank you so much! WEST VIRGINIA Company's Widget division

Hello please answer the first 4 questions if you are unable to answers all 6 questions.

Thank you so much!

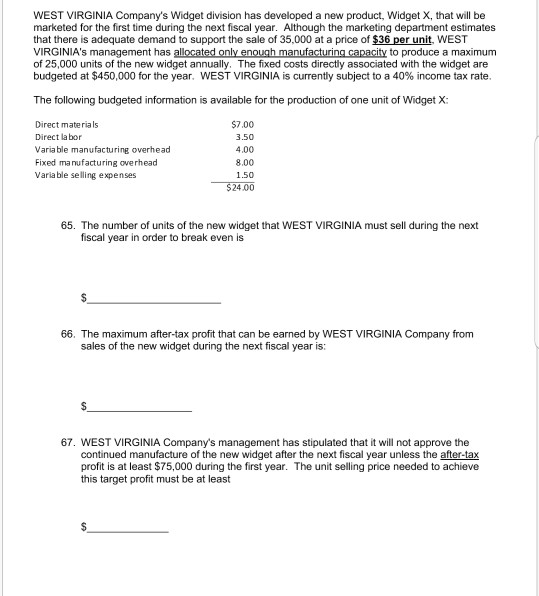

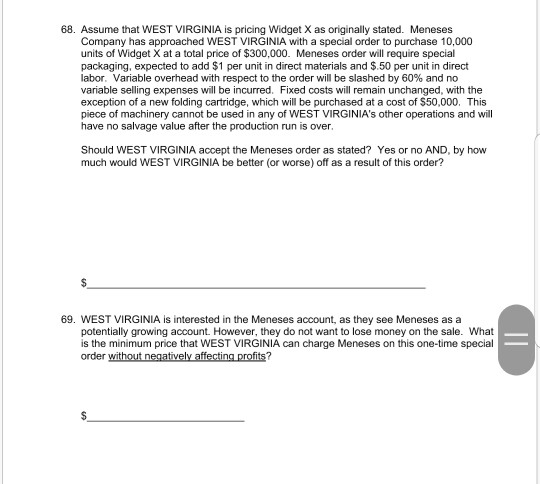

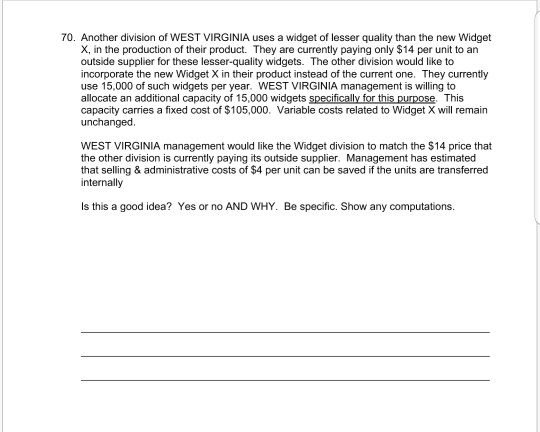

WEST VIRGINIA Company's Widget division has developed a new product, Widget X, that will be marketed for the first time during the next fiscal year. Although the marketing department estimate:s that there is adequate demand to support the sale of 35,000 at a price of $36 per unit, WEST VIRGINIA's management has of 25,000 units of the new widget annually. The fixed costs directly associated with the widget are budgeted at $450,000 for the year. WEST VIRGINIA is currently subject to a 40% income tax rate to produce a maximum The following budgeted information is available for the production of one unit of Widget X: Direct mate rials Direct la bor Varia ble manufacturing overhead Fixed manufacturing overhead Variable selling expenses $7.00 3.50 4.00 8.00 1.50 24 00 65. The number of units of the new widget that WEST VIRGINIA must sell during the next fiscal year in order to break even is 66. The maximum after-tax profit that can be earned by WEST VIRGINIA Company from sales of the new widget during the next fiscal year is: 67. WEST VIRGINIA Company's management has stipulated that it will not approve the continued manufacture of the new widget after the next fiscal year unless the after-tax profit is at least $75,000 during the first year. The unit selling price needed to achieve this target profit must be at least 68. Assume that WEST VIRGINIA is pricing Widget X as originally stated. Meneses Company has approached WEST VIRGINIA with a special order to purchase 10,000 units of Widget X at a total price of $300,000. Meneses order will require special packaging, expected to add $1 per unit in direct materials and $.50 per unit in direct labor Variable overhead with respect to the order will be slashed by 60% and no variable selling expenses will be incurred. Fixed costs will remain unchanged, with the exception of a new folding cartridge, which will be purchased at a cost of $50,000. This piece of machinery cannot be used in any of WEST VIRGINIA's other operations and will have no salvage value after the production run is over, Should WEST VIRGINIA accept the Meneses order as stated? Yes or no AND, by how much would WEST VIRGINIA be better (or worse) off as a result of this order? 69. WEST VIRGINIA is interested in the Meneses account, as they see Meneses as a potentially growing account. However, they do not want to lose money on the sale. What is the minimum price that WEST VIRGINIA can charge Meneses on this one-time special order without negatively affecting profits? 70. Another division of WEST VIRGINIA uses a widget of lesser quality than the new Widget X, in the production of their product. They are currently paying only $14 per unit to an outside supplier for these lesser-quality widgets. The other division would like to incorporate the new Widget X in their product instead of the current one. They currently use 15,000 of such widgets per year. WEST VIRGINIA management is willing to allocate an additional capacity of 15,000 widgets specifically for this purpose This capacity carries a fixed cost of $105,000. Variable costs related to Widget X will remain unchanged WEST VIRGINIA management would like the Widget division to match the $14 price that the other division is currently paying its outside supplier. Management has estimated that selling & administrative costs of $4 per unit can be saved if the units are transferred internally Is this a good idea? Yes or no AND WHY. Be specific. Show any computationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started