Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, please do this For total of all four years, the four methods have the same total depreciation expense and therefore no effect on profit;

Hello, please do this

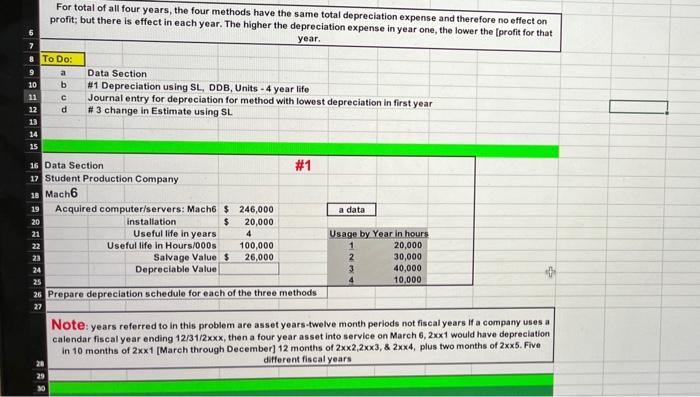

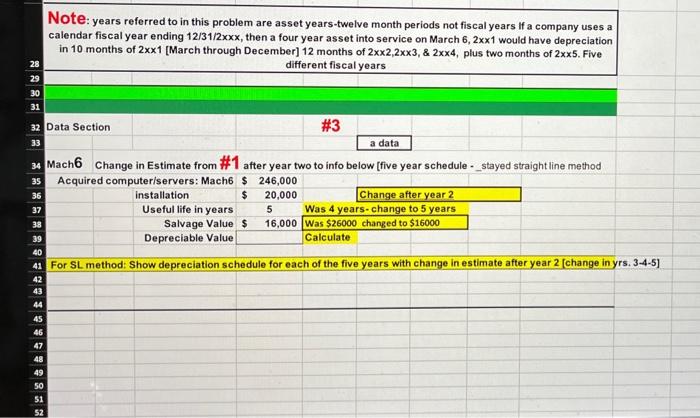

For total of all four years, the four methods have the same total depreciation expense and therefore no effect on profit; but there is effect in each year. The higher the depreciation expense in year one, the lower the [profit for that \begin{tabular}{|c|c|c|} \hline 6 & \\ \hline 7 & \\ \hline 8 & To Do: & \\ \hline 9 & a & Data Section \\ \hline 10 & b & \#1 Depreciation using SL, DDB, Units - 4 year life \end{tabular} year. c Journal entry for depreciation for method with lowest depreciation in first year Prepare depreciation schedule for each of the three methods Note: years referred to in this problem are asset years-twelve month periods not fiscal years if a company uses a calendar fiscal year ending 12/31/2x, then a four year asset into service on March 6,2x1 would have depreciation in 10 months of 21 [March through December] 12 months of 22,203,824, plus two months of 25. Five different fiscal years Note: years referred to in this problem are asset years-twelve month periods not fiscal years if a company uses a calendar fiscal year ending 12/31/2xxx, then a four year asset into service on March 6,2x1 would have depreciation in 10 months of 2x1 [March through December] 12 months of 2x2,2x3,&2x4, plus two months of 2x5. Five different fiscal years Mach6 Change in Estimate from #1 after year two to info below [five year schedule -_stayed straight line method For total of all four years, the four methods have the same total depreciation expense and therefore no effect on profit; but there is effect in each year. The higher the depreciation expense in year one, the lower the [profit for that \begin{tabular}{|c|c|c|} \hline 6 & \\ \hline 7 & \\ \hline 8 & To Do: & \\ \hline 9 & a & Data Section \\ \hline 10 & b & \#1 Depreciation using SL, DDB, Units - 4 year life \end{tabular} year. c Journal entry for depreciation for method with lowest depreciation in first year Prepare depreciation schedule for each of the three methods Note: years referred to in this problem are asset years-twelve month periods not fiscal years if a company uses a calendar fiscal year ending 12/31/2x, then a four year asset into service on March 6,2x1 would have depreciation in 10 months of 21 [March through December] 12 months of 22,203,824, plus two months of 25. Five different fiscal years Note: years referred to in this problem are asset years-twelve month periods not fiscal years if a company uses a calendar fiscal year ending 12/31/2xxx, then a four year asset into service on March 6,2x1 would have depreciation in 10 months of 2x1 [March through December] 12 months of 2x2,2x3,&2x4, plus two months of 2x5. Five different fiscal years Mach6 Change in Estimate from #1 after year two to info below [five year schedule -_stayed straight line method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started