Question

Hello, please help. i have attached documents as well. journalizing and Posting Transactions Annette Creighton opened Creighton Consulting. She rented a small office and paid

Hello,

please help.

i have attached documents as well.

journalizing and Posting Transactions

Annette Creighton opened Creighton Consulting. She rented a small office and paid a part-time worker to answer the Phone and make deliveries. Her chart of accounts is as follows:

| Chart of Accounts | |||||

| Assets | Revenues | ||||

| 101 | Cash | 401 | Consulting Fees | ||

| 142 | Office Supplies | ||||

| 181 | Office Equipment | Expenses | |||

| 511 | Wages Expense | ||||

| Liabilities | 512 | Advertising Expense | |||

| 202 | Accounts Payable | 521 | Rent Expense | ||

| 525 | Phone Expense | ||||

| Owners Equity | 526 | Transportation Expense | |||

| 311 | Annette Creighton, Capital | 533 | Utilities Expense | ||

| 312 | Annette Creighton, Drawing | 549 | Miscellaneous Expense | ||

Creightons transactions for the first month of business are as follows:

| Jan. 1 | Creighton invested cash in the business, $9,500. |

| 2 | Paid rent, $550. |

| 3 | Purchased office supplies on account, $320. |

| 4 | Purchased office equipment on account, $1,460. |

| 6 | Received cash for services rendered, $567. |

| 7 | Paid phone bill, $41. |

| 8 | Paid utilities bill, $34. |

| 10 | Received cash for services rendered, $360. |

| 12 | Made payment on account, $60. |

| 13 | Paid for car rental while visiting an out-of-town client (transportation expense), $140. |

| 15 | Paid part-time worker, $350. |

| 17 | Received cash for services rendered, $405. |

| 18 | Creighton withdrew cash for personal use, $100. |

| 20 | Paid for a newspaper ad, $20. |

| 22 | Reimbursed part-time employee for cab fare incurred delivering materials to clients (transportation expense), $35. |

| 24 | Paid for books on consulting practices (miscellaneous expense), $20. |

| 25 | Received cash for services rendered, $322. |

| 27 | Made payment on account for office equipment purchased, $160. |

| 29 | Paid part-time worker, $350. |

| 30 | Received cash for services rendered, $200. |

Required:

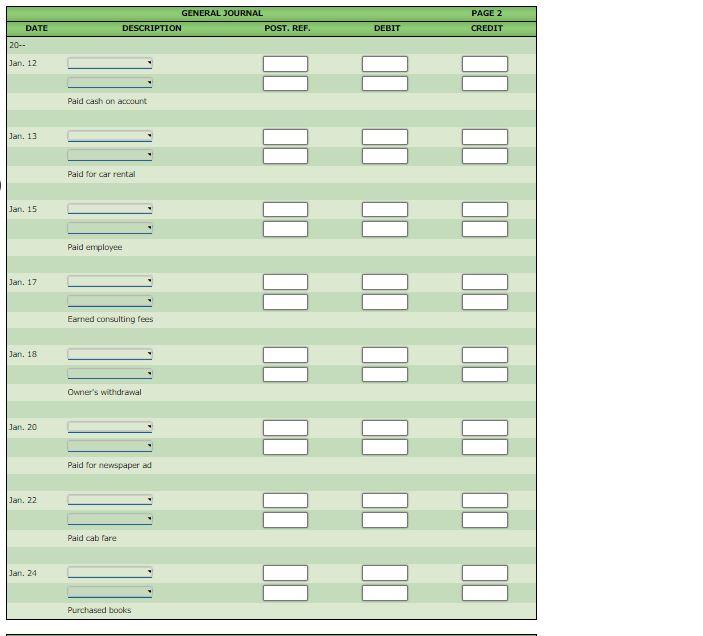

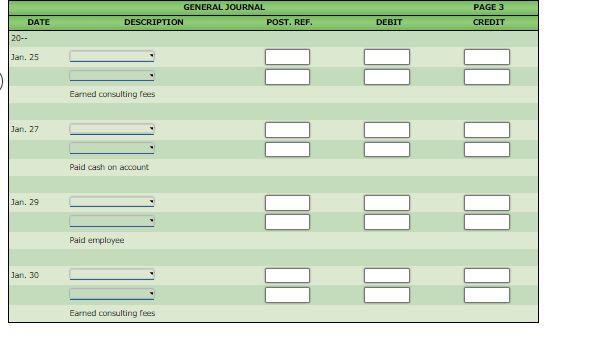

1. Journalize the transactions for January in a two-column general journal. Use the following journal page numbers: January 110, page 1; January 1224, page 2; January 2530, page 3. Enter the posting reference when you complete part 2.

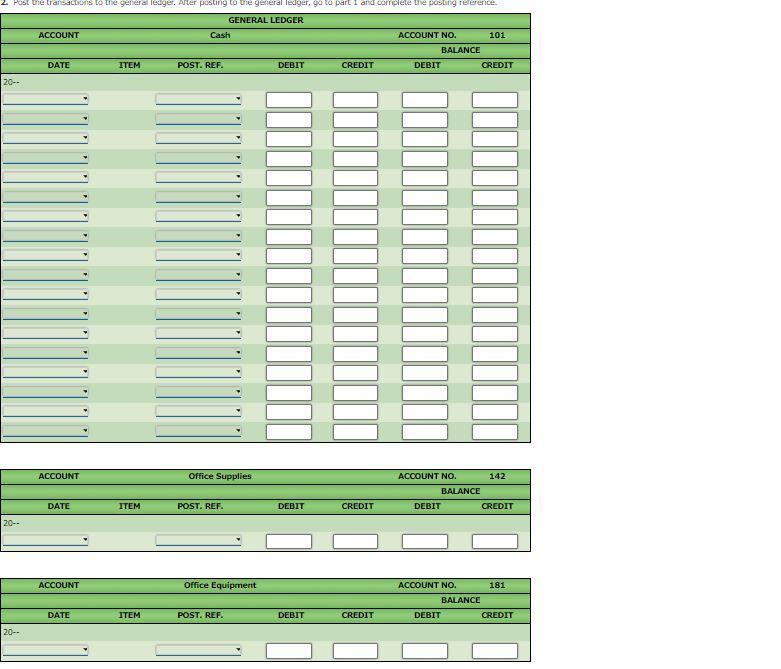

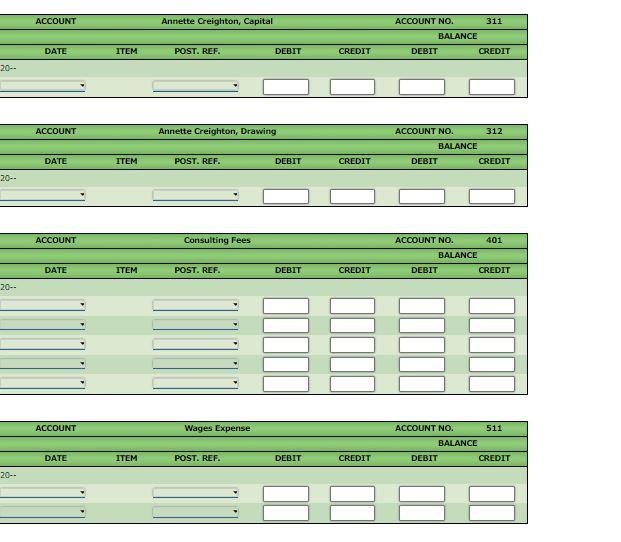

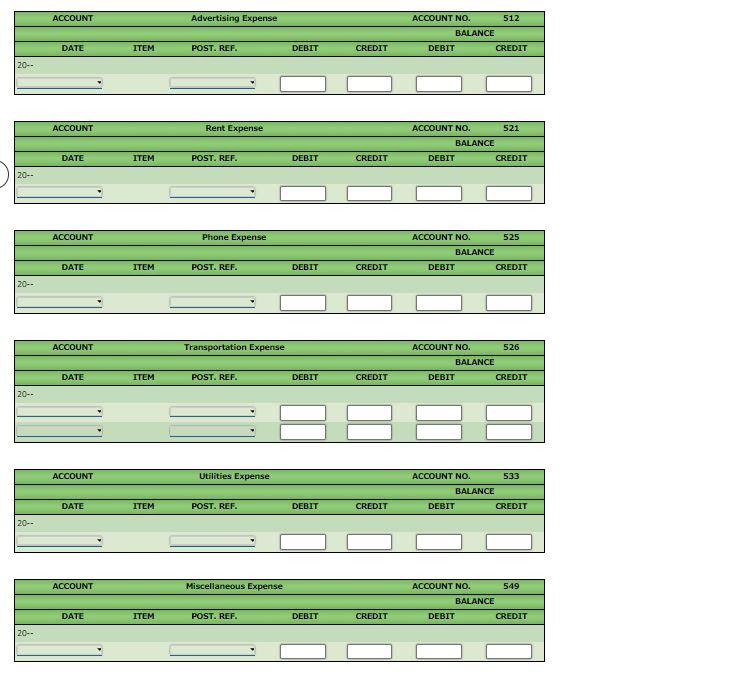

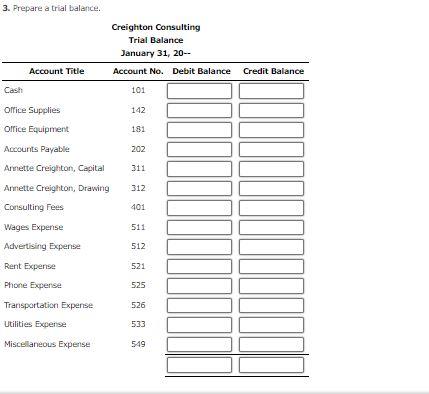

GENERAL JOURNAL PAGE 1 CREDIT DATE DESCRIPTION POST. REF. DEBIT 20-- Jan. 1 Original investment in the business Jan. 2 3 Paid rent Jan. 3 Purchased office supplies on account [Jan, 4 Purchased office equipment on account Jan. 6 Earned consulting fees Jan 7 Paid phone bill Jan. 8 = = Paid utilities will Jan. 10 Earned consulting fees PAGE 2 GENERAL JOURNAL DESCRIPTION POST. REF. DATE DEBIT CREDIT 20- Jan. 12 Paid cash on account Jan. 13 Paid for car rental Jan. 15 Paid employee Jan. 17 Earned consulting fees Jan. 18 Owner's withdrawal Jan. 20 Paid for newspaper ad Jan. 22 Paid cab fare Jan. 24 Purchased books GENERAL JOURNAL DESCRIPTION POST. REF. PAGE 3 CREDIT DEBIT DATE 20- Jan 25 Earned consulting fees Jan. 27 Paid cash on account Jan, 29 Paid employee Jan. 30 Earned consulting fees 2. Post the transactions to the general ledger. After posting to the general ledger, go to part 1 and complete the posting reference GENERAL LEDGER ACCOUNT Cash ACCOUNT NO. 101 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20- ACCOUNT Office Supplies ACCOUNT NO. 142 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20- ACCOUNT Office Equipment ACCOUNT NO. 181 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20-- ACCOUNT Annette Creighton, Capital ACCOUNT NO. 311 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20- ACCOUNT Annette Creighton, Drawing 312 ACCOUNT NO. BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20- ACCOUNT Consulting Fees ACCOUNT NO. 401 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20- ACCOUNT Wages Expense ACCOUNT NO. 511 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20-- ACCOUNT Advertising Expense ACCOUNT NO. 512 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20-- ACCOUNT Rent Expense ACCOUNT NO. 521 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20-- ACCOUNT Phone Expense ACCOUNT NO. 525 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20- ACCOUNT Transportation Expense ACCOUNT NO. 526 BALANCE DATE ITEM POST. REF. DEBIT CREDIT DEBIT CREDIT 20- ACCOUNT Utilities Expense ACCOUNT NO. 533 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20- ACCOUNT Miscellaneous Expense ACCOUNT NO. 549 BALANCE DEBIT CREDIT DATE ITEM POST. REF. DEBIT CREDIT 20-- 3. Prepare a trial balance. Creighton Consulting Trial Balance January 31, 20- Account No. Debit Balance Credit Balance 101 Account Title Cash Orfice Supplies 142 Office Equipment 181 Accounts Payable 202 311 312 Annette Creighton, Capital Annette Creighton, Drawing Consulting Fees Wages Expense Advertising Expense 401 511 512 Rent Expense 521 Phone Expert 525 526 Transportation Expense Utilities Expense 533 Miscellaneous Expense 549Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started