Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello! please help me solve this in excel. it would be greatly appreciated to see the formulas used as well. thank you! 2 EDMM 3200

hello! please help me solve this in excel. it would be greatly appreciated to see the formulas used as well.

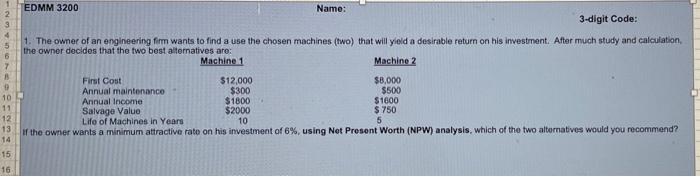

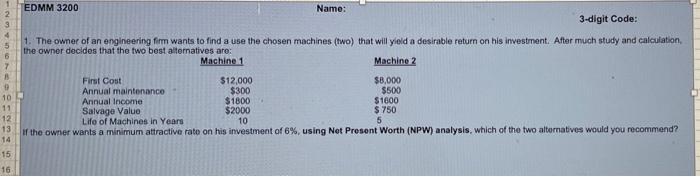

2 EDMM 3200 Name: 3-digit Code: 1. The owner of an engineering firm wants to find a use the chosen machines (two) that will yield a desirable return on his investment. After much study and calculation, the owner decides that the two best alternatives are: Machine 1 Machine 2 First Cost $12,000 $8,000 Annual maintenance $300 $500 Annual Income $1800 $1600 Salvage Value $2000 $ 750 Life of Machines in Years 10 5 If the owner wants a minimum attractive rate on his investment of 6%, using Net Present Worth (NPW) analysis, which of the two alternatives would you recommend? B 9 10 11 12 13 14 15 16 thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started