Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, please help me with this (the drop arrows and blank boxes), I continue to them it incorrect. 12. Inflation-induced tax distortions Edison receives a

Hello, please help me with this (the drop arrows and blank boxes), I continue to them it incorrect.

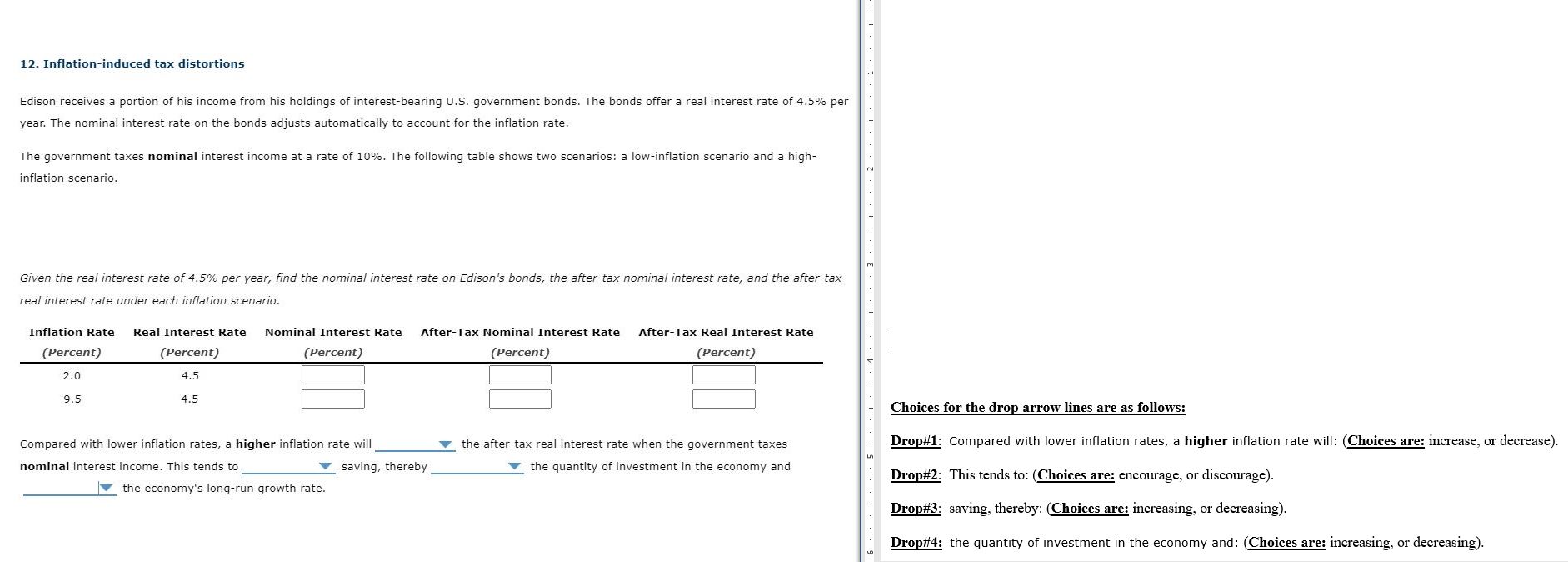

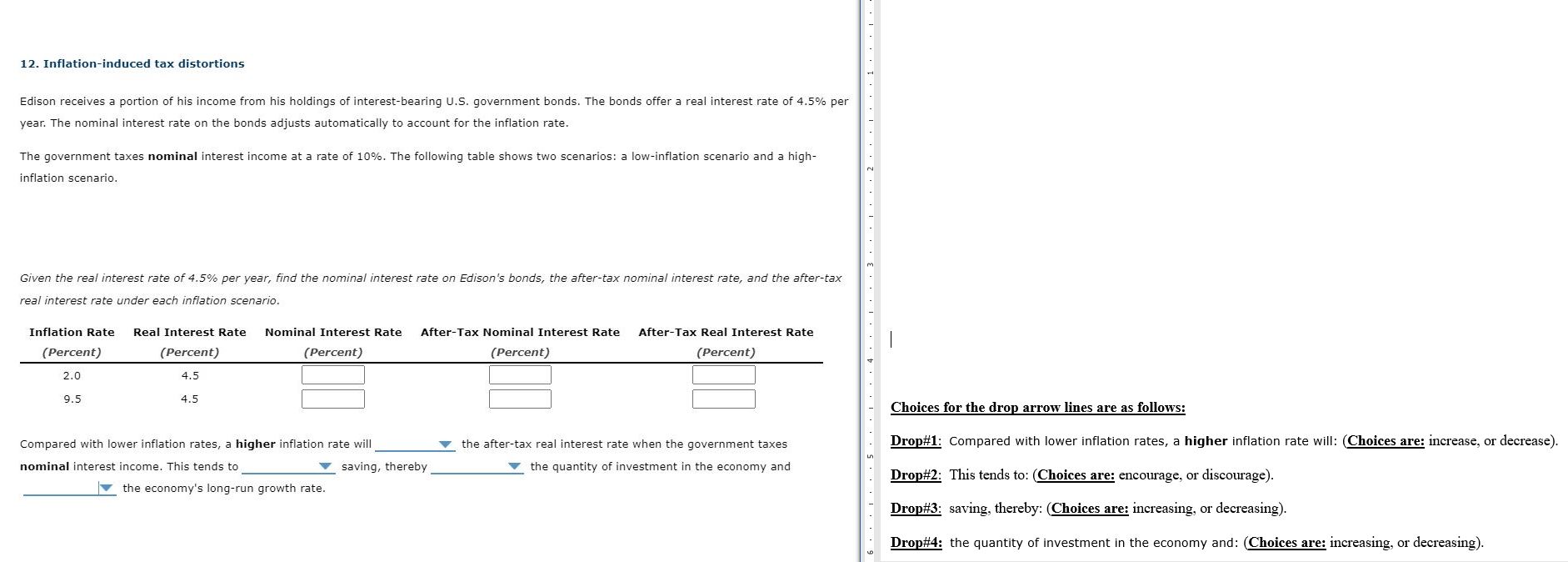

12. Inflation-induced tax distortions Edison receives a portion of his income from his holdings of interest-bearing U.S. government bonds. The bonds offer a real interest rate of 4.5% per year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate. The government taxes nominal interest income at a rate of 10%. The following table shows two scenarios: a low-inflation scenario and a high- inflation scenario. Given the real interest rate of 4.5% per year, find the nominal interest rate on Edison's bonds, the after-tax nominal interest rate, and the after-tax real interest rate under each inflation scenario. Inflation Rate Real Interest Rate Nominal Interest Rate Nominal Interest Rate (Percen t) After-Tax Real Interest Rate (Percen t) (Percen t) 2.0 (Percen t) 4.5 (Percent) Choices for the drop arrow lines are as follows: Compared with lower inflation rates, a higher inflation rate will the after-tax real interest rate when the government taxes v the quantity of investment in the economy and Drop#l : Drop#2 : Drop#3 : Compared with lower inflation rates, a higher inflation rate will: This tends to: (Choices are: encourage, or discourage). saving, thereby: (Choices are: increasing, or decreasing). (Choices are: increase, or decrease). nominal interest income. This tends to the economy's long-run growth rate. saving, thereby Drop#4: the quantity of investment in the economy and: (Choices are: increasing, or decreasing).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started