Question: Refer to the Racquetball Racket case. Review the problem statement and influence chart that were generated for this case in conjunction with the corresponding exercises

Refer to the Racquetball Racket case. Review the problem statement and influence chart that were generated for this case in conjunction with the corresponding exercises in Chapter 2. (If this has not yet been done, develop the problem statement and influence chart as preliminary steps.) Design a spreadsheet to evaluate the Net Present Value of selling the new ball at $0.65, assuming the competitor does not change price.

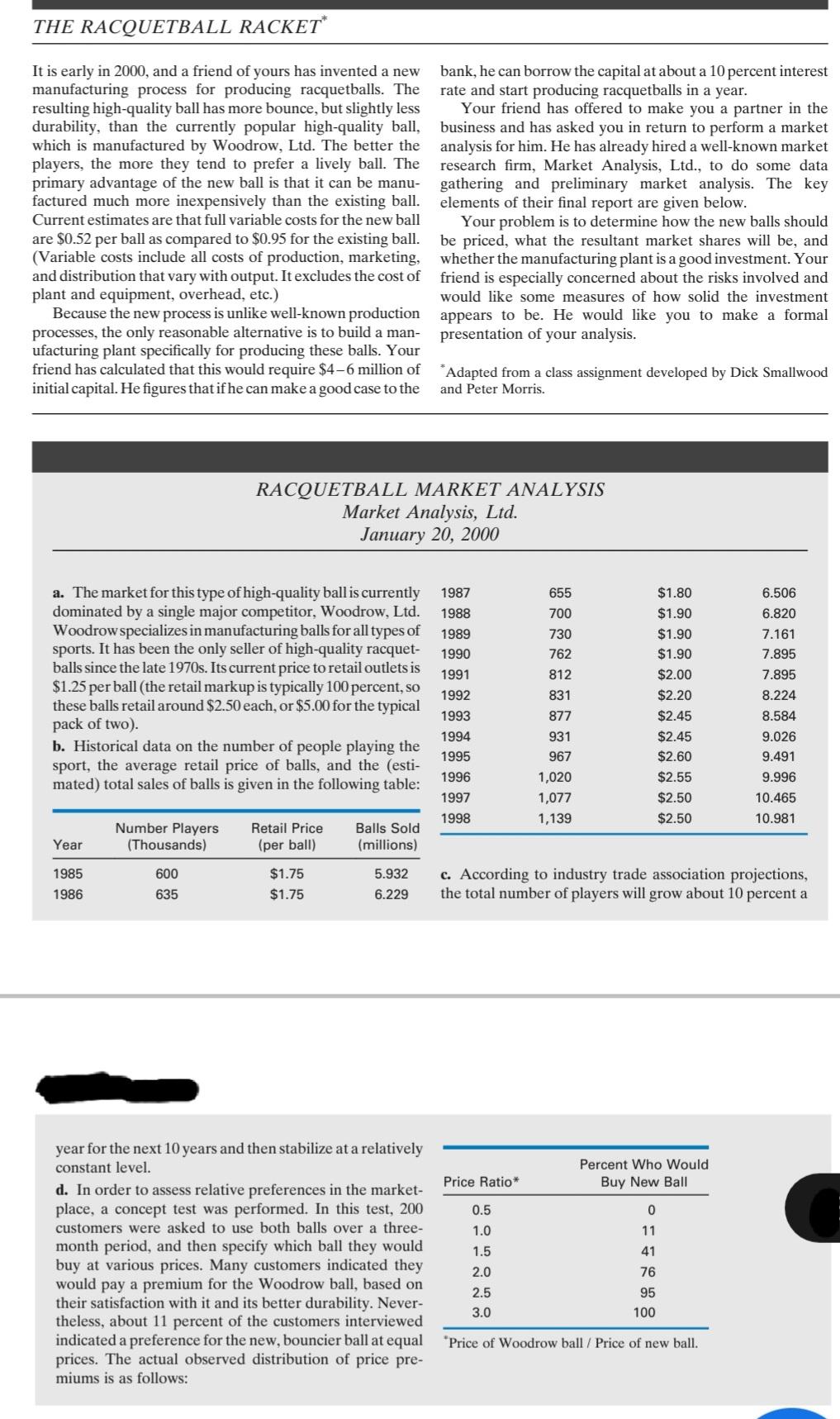

THE RACQUETBALL RACKET It is early in 2000, and a friend of yours has invented a new manufacturing process for producing racquetballs. The resulting high-quality ball has more bounce, but slightly less durability, than the currently popular high-quality ball, which is manufactured by Woodrow, Ltd. The better the analysis for him. He has already hired a well-known market players, the more they tend to prefer a lively ball. The primary advantage of the new ball is that it can be manu- factured much more inexpensively than the existing ball. elements of their final report are given below. bank, he can borrow the capital at about a 10 percent interest rate and start producing racquetballs in a year. Your friend has offered to make you a partner in the business and has asked you in return to perform a market research firm, Market Analysis, Ltd., to do some data gathering and preliminary market analysis. The key Current estimates are that full variable costs for the new ball Your problem is to determine how the new balls should be priced, what the resultant market shares will be, and are $0.52 per ball as compared to $0.95 for the existing ball. (Variable costs include all costs of production, marketing, whether the manufacturing plant is a good investment. Your and distribution that vary with output. It excludes the cost of friend is especially concerned about the risks involved and plant and equipment, overhead, etc.) Because the new process is unlike well-known production appears to be. He would like you to make a formal processes, the only reasonable alternative is to build a man- ufacturing plant specifically for producing these balls. Your friend has calculated that this would require $4-6 million of initial capital. He figures that if he can make a good case to the would like some measures of how solid the investment presentation of your analysis. *Adapted from a class assignment developed by Dick Smallwood and Peter Morris. RACQUETBALL MARKET ANALYSIS Market Analysis, Ltd. January 20, 2000 a. The market for this type of high-quality ball is currently dominated by a single major competitor, Woodrow, Ltd. Woodrowspecializes in manufacturing balls for all types of sports. It has been the only seller of high-quality racquet- balls since the late 1970s. Its current price to retail outlets is $1.25 per ball (the retail markup is typically 100 percent, so these balls retail around $2.50 each, or $5.00 for the typical pack of two). b. Historical data on the number of people playing the sport, the average retail price of balls, and the (esti- mated) total sales of balls is given in the following table: 1987 655 $1.80 6.506 1988 700 $1.90 6.820 1989 730 $1.90 7.161 1990 762 $1.90 7.895 1991 812 $2.00 7.895 1992 831 $2.20 8.224 1993 877 $2.45 8.584 1994 931 $2.45 9.026 1995 967 $2.60 9.491 1996 1,020 $2.55 9.996 1997 1,077 $2.50 10.465 1998 1,139 $2.50 10.981 Number Players (Thousands) Retail Price Balls Sold Year (per ball) (millions) c. According to industry trade association projections, the total number of players will grow about 10 percent a 1985 600 $1.75 5.932 1986 635 $1.75 6.229 year for the next 10 years and then stabilize at a relatively constant level. Percent Who Would Price Ratio* Buy New Ball d. In order to assess relative preferences in the market- place, a concept test was performed. In this test, 200 customers were asked to use both balls over a three- 0.5 1.0 11 month period, and then specify which ball they would buy at various prices. Many customers indicated they would pay a premium for the Woodrow ball, based on their satisfaction with it and its better durability. Never- theless, about 11 percent of the customers interviewed indicated a preference for the new, bouncier ball at equal prices. The actual observed distribution of price pre- miums is as follows: 1.5 41 2.0 76 2.5 95 3.0 100 "Price of Woodrow ball / Price of new ball.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

RACQUETBALL Ltd Full variable cost of manufactuing NEW bal... View full answer

Get step-by-step solutions from verified subject matter experts