Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, please help with parts a and b! Thank you in advance. 23 456919 8 10 11 12 13 14 15 16 17 18 19

hello, please help with parts a and b! Thank you in advance.

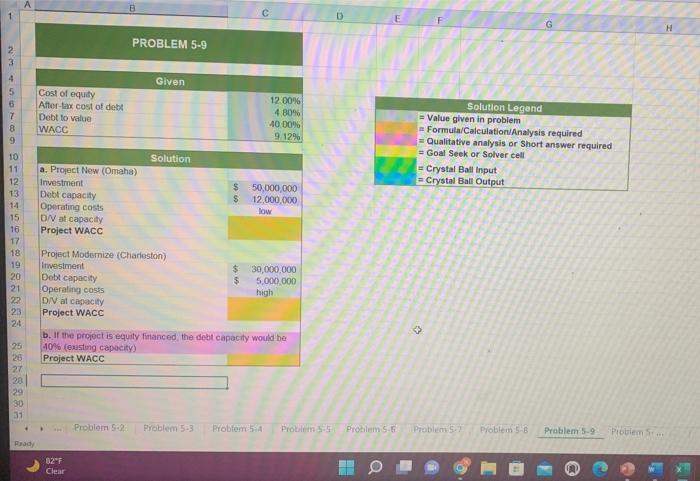

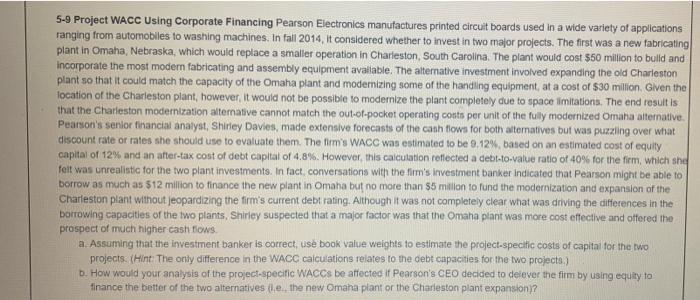

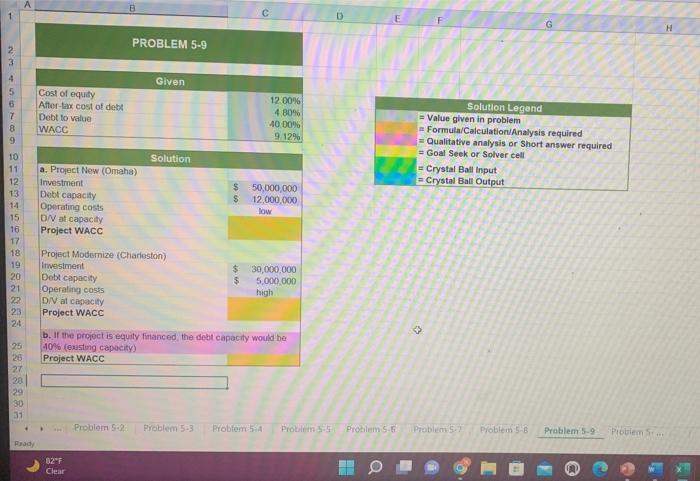

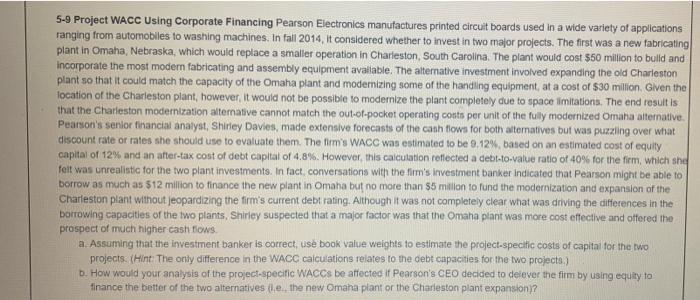

23 456919 8 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Ready Cost of equity After-tax cost of debt Debt to value WACC a. Project New (Omaha) Investment Debt capacity Operating costs D/V at capacity Project WACC PROBLEM 5-9 Debt capacity Operating costs D/V at capacity Project WACC Given Project Modernize (Charleston) Investment 82"F Clear Solution 50,000,000 $ $ 12,000,000 low $ 12.00% 4.80% 40.00% 9.12% $ 30,000,000 5,000,000 high b. If the project is equity financed, the debt capacity would be 40% (existing capacity) Project WACC D E Problem 5-2. Problem 5-3 Problem 5-4 Problem S-5 Problem 5-6 H a = Value given in problem Solution Legend Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell Crystal Ball Input =Crystal Ball Output 43 Problem 5-7 G Problem 5-8 Problem 5-9 Problem S... 5-9 Project WACC Using Corporate Financing Pearson Electronics manufactures printed circuit boards used in a wide variety of applications ranging from automobiles to washing machines. In fall 2014, it considered whether to invest in two major projects. The first was a new fabricating plant in Omaha, Nebraska, which would replace a smaller operation in Charleston, South Carolina. The plant would cost $50 million to build and incorporate the most modern fabricating and assembly equipment available. The alternative investment involved expanding the old Charleston plant so that it could match the capacity of the Omaha plant and modernizing some of the handling equipment, at a cost of $30 million. Given the location of the Charleston plant, however, it would not be possible to modernize the plant completely due to space limitations. The end result is that the Charleston modernization alternative cannot match the out-of-pocket operating costs per unit of the fully modernized Omaha alternative. Pearson's senior financial analyst, Shirley Davies, made extensive forecasts of the cash flows for both alternatives but was puzzling over what discount rate or rates she should use to evaluate them. The firm's WACC was estimated to be 9.12%, based on an estimated cost of equity capital of 12% and an after-tax cost of debt capital of 4.8%. However, this calculation reflected a debt-to-value ratio of 40% for the firm, which she felt was unrealistic for the two plant investments. In fact, conversations with the firm's investment banker indicated that Pearson might be able to borrow as much as $12 million to finance the new plant in Omaha but no more than $5 million to fund the modernization and expansion of the Charleston plant without jeopardizing the firm's current debt rating. Although it was not completely clear what was driving the differences in the borrowing capacities of the two plants, Shirley suspected that a major factor was that the Omaha plant was more cost effective and offered the prospect of much higher cash flows. a. Assuming that the investment banker is correct, use book value weights to estimate the project-specific costs of capital for the two projects. (Hint: The only difference in the WACC calculations relates to the debt capacities for the two projects.) b. How would your analysis of the project-specific WACCS be affected if Pearson's CEO decided to delever the firm by using equity to finance the better of the two alternatives (.e., the new Omaha plant or the Charleston plant expansion)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started