Hello!! please help with parts b-d thank you!

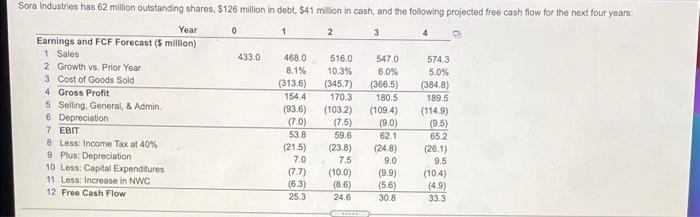

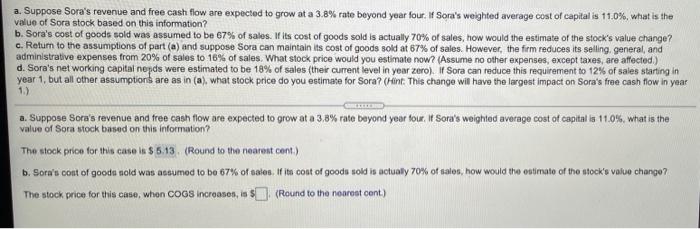

Sora Industries has 62 million outstanding shares, $126 million in debt, 541 million in cash, and the following projected free cash flow for the next four years Year 0 1 2 3 Earnings and FCF Forecast ($ million) 1 Sales 433.0 468.0 516.0 547,0 574.3 2 Growth vs. Prior Year 8.1% 10.3% 6.0% 5.0% 3 Cost of Goods Sold (313.6) (345.7) (366,5) (384.8) 4 Gross Profit 154.4 170.3 180.5 189.5 5 Selling, General, & Admin (936) (1032) (109.4) (1149) 6 Depreciation (7.0) (7.5) 19.0) (9.5) 7 EBIT 538 59.6 621 8 Less Income Tax at 40% (215) (23.8) (248) (26.1) 9 Plus: Depreciation 7.0 7.5 9.0 9.5 10 Less: Capital Expenditures (7.7) (10,0) (9.9) (10.4) 11 Less: Increase in NWC (6.3) (8.6) (5.6) (4.9) 12 Free Cash Flow 253 24.6 30.8 33.3 65.2 a. Suppose Sora's revenue and free cash flow are expected to grow at a 3.8% rate beyond year four. If Sora's weighted average cost of capital is 11.0%, what is the value of Sora stock based on this information? b. Sora's cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would the estimate of the stock's value change? c. Return to the assumptions of part (a) and suppose Sora can maintain its cost of goods sold at 67% of sales. However, the firm reduces its selling general, and administrative expenses from 20% of sales to 16% of sales. What stock price would you estimate now? (Assume no other expenses, except taxes, are affected) d. Sora's networking capital nepds were estimated to be 18% of sales (their current level in year zero). If Sora can reduce this requirement to 12% of sales starting in year 1, but all other assumptions are as in (a), what stock price do you estimate for Sora? (Hint. This change will have the largest impact on Sora's free cash flow in year 1.) a. Suppose Sora's revenue and free cash flow are expected to grow at a 3.8% rate beyond year four. If Sora's weighted average cost of capital is 11.0%, what is the value of Sora stock based on this information? The stock price for this case is $ 5.13. (Round to the nearest cont.) 6. Sora's cost of goodu nold was assumed to be 67% of eates. If its cost of goods sold is actually 70% of sales, how would the estimate of tho stock's value chanpo? The stock price for this case, when cocs increason, is $ (Round to the nearest cont.)