Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, Please help with this and include explanation with steps so I can follow along and know where you are getting the numbers from. Thank

Hello, Please help with this and include explanation with steps so I can follow along and know where you are getting the numbers from. Thank You very much.

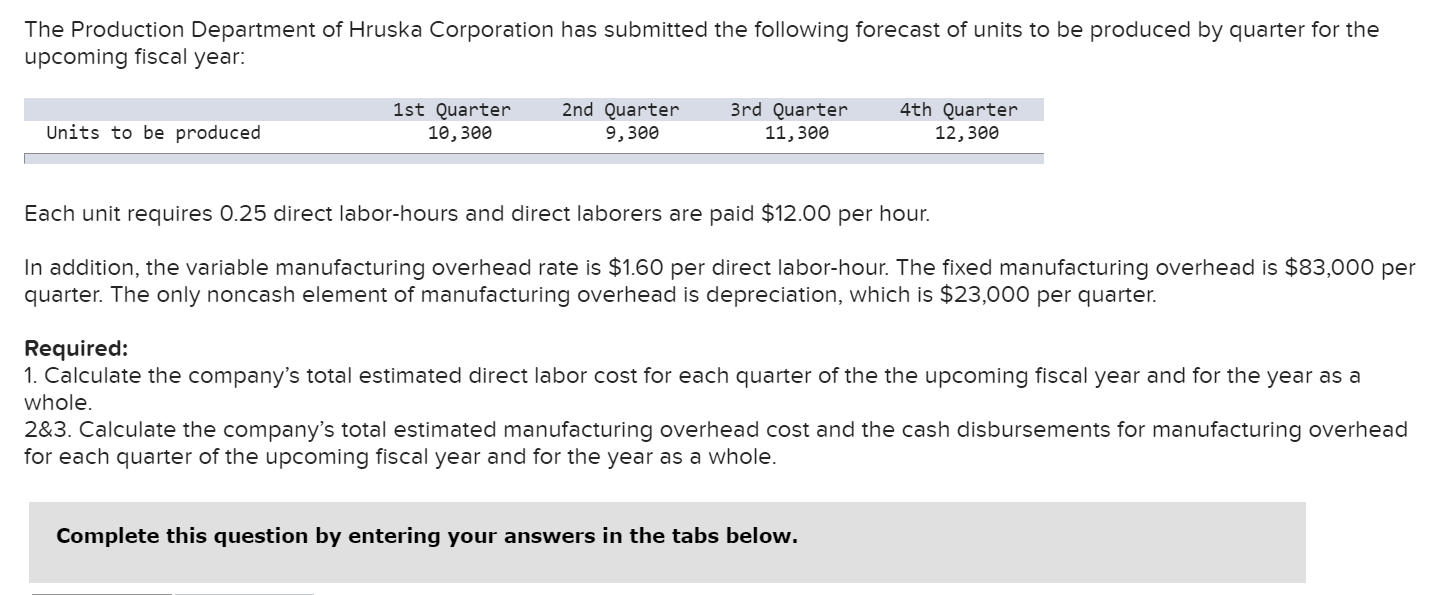

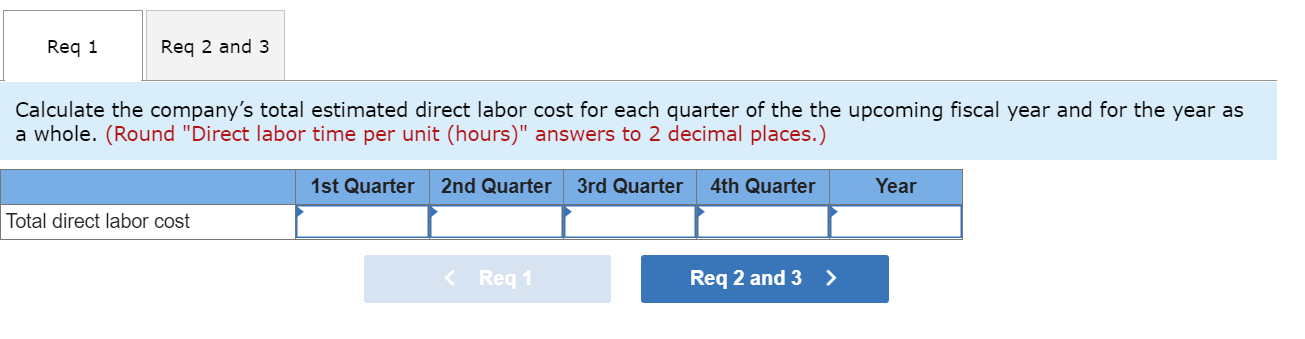

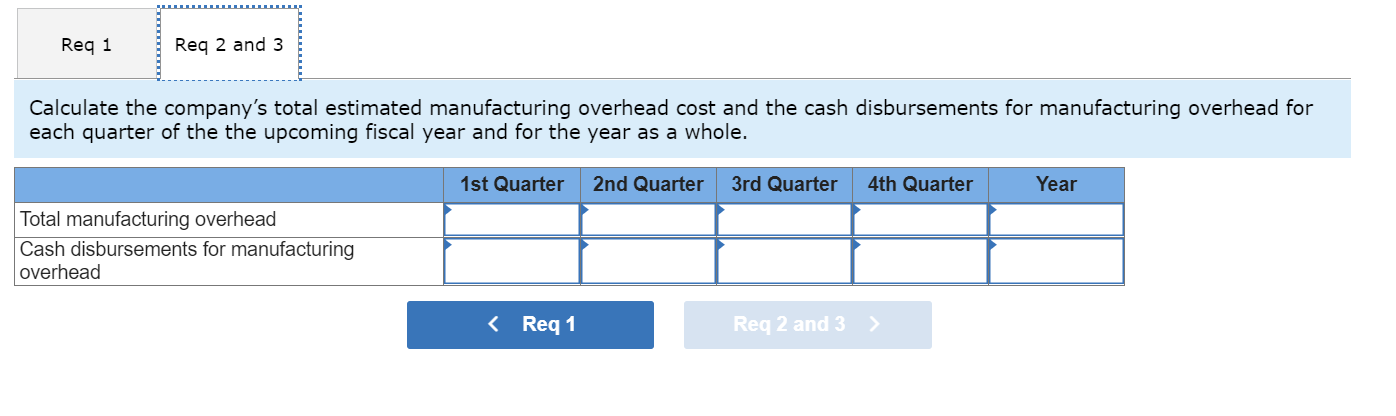

The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Units to be produced 1st Quarter 10,300 2nd Quarter 9,300 3rd Quarter 11,300 4th Quarter 12,300 Each unit requires 0.25 direct labor-hours and direct laborers are paid $12.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $83,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $23,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. 2&3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Calculate the company's total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total direct labor cost Req 1 Req 2 and 3 Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the the upcoming fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total manufacturing overhead Cash disbursements for manufacturing overheadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started