Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello please i have already solved part A i need help to solve part B which has 2 part A and B. B.A and B.b

hello please i have already solved part A i need help to solve part B which has 2 part A and B.

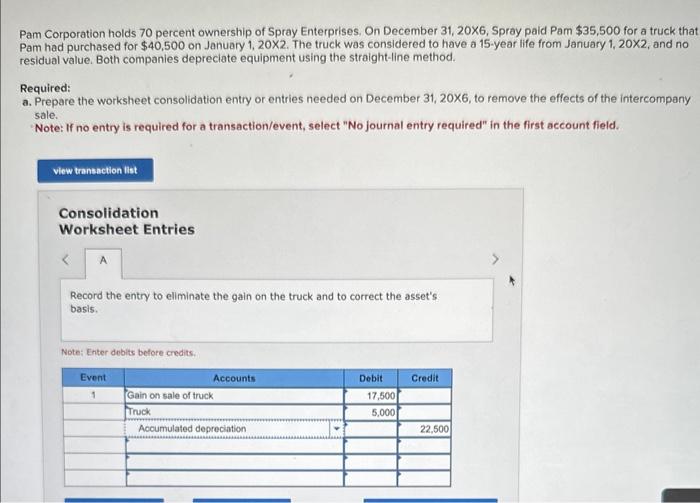

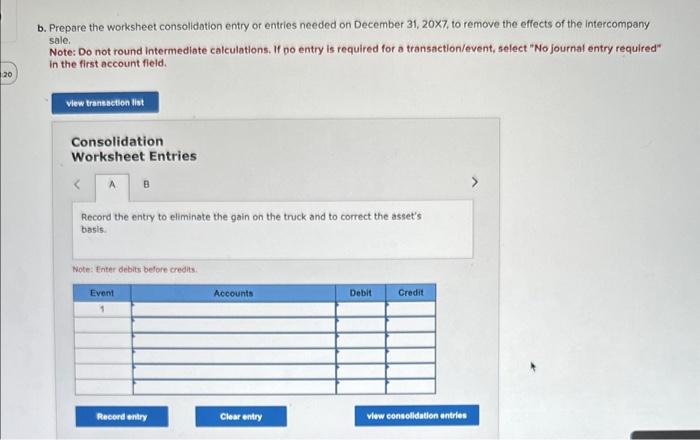

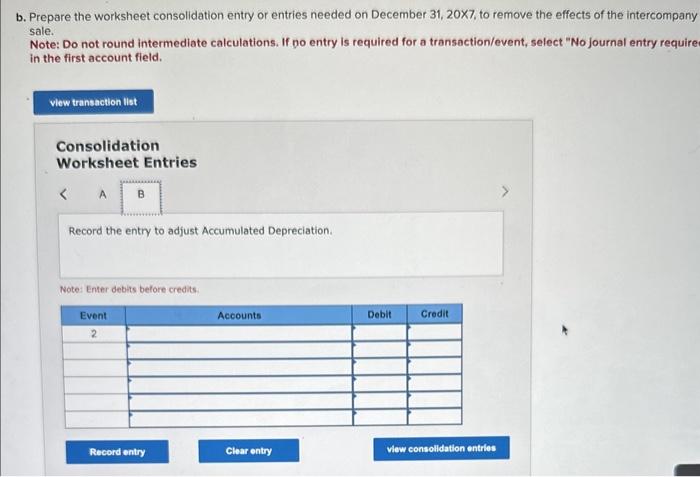

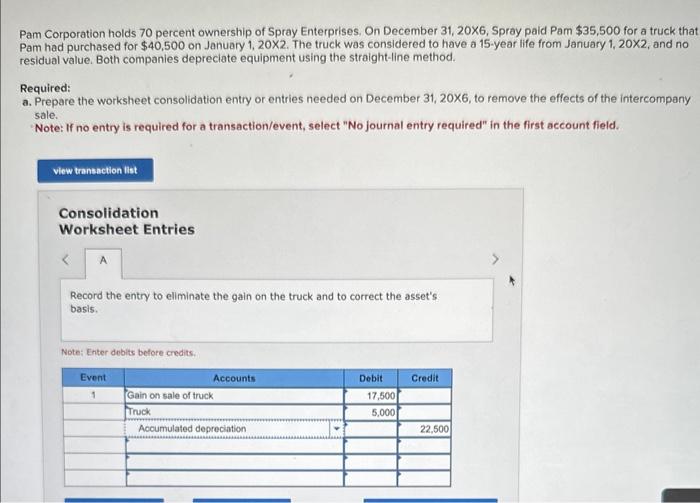

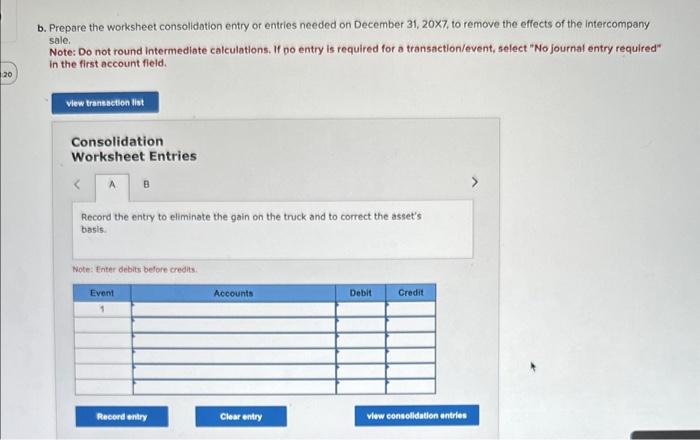

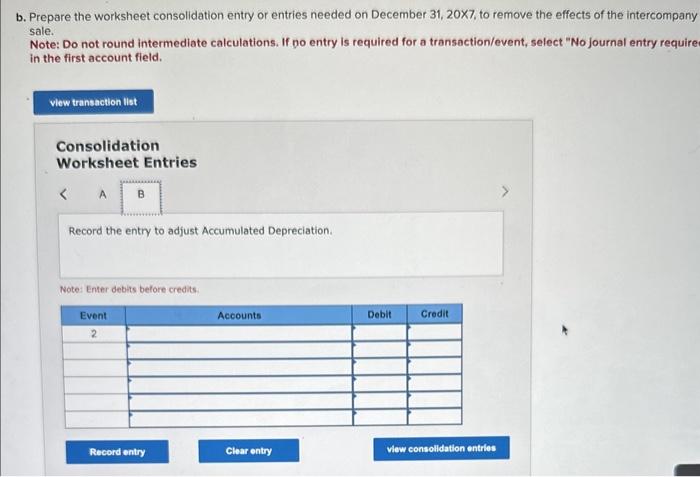

Pam Corporation holds 70 percent ownership of Spray Enterprises, On December 31, 20X6, Spray paid Pam \$35,500 for a truck that Pam had purchased for $40,500 on January 1, 20X2. The truck was considered to have a 15 -year life from January 1, 20X2, and no residual value. Both companies depreciate equipment using the straight-line method. Required: a. Prepare the worksheet consolidation entry or entries needed on December 31,206, to remove the effects of the intercompany sale. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Consolidation Worksheet Entries Record the entry to ellminate the gain on the truck and to correct the asset's basis. Note: Enter deblts before credits. b. Prepare the worksheet consolidation entry of entries needed on December 31, 20x7, to remove the effects of the intercompany sale, Note: Do not round intermediate calculations. If po entry is required for a transaction/event, select "No journal entry required" in the first account fleld. Consolidation Worksheet Entries Record the entry to eliminate the gain on the truck and to correct the asset's basis. Note: Enter deblis before credits. b. Prepare the worksheet consolidation entry or entries needed on December 31,207, to remove the effects of the intercompany sale. Note: Do not round intermediate calculations. If po entry is required for a transaction/event, select "No journal entry require in the first account field. Consolidation Worksheet Entries Record the entry to adjust Accumulated Depreciation. Notes Enter debits before credits B.A and B.b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started