Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello please I need help. Need to turn it in before 11:59 pm. Pearl Corporation bought a new machine and agreed to pay for it

Hello please I need help. Need to turn it in before 11:59 pm.

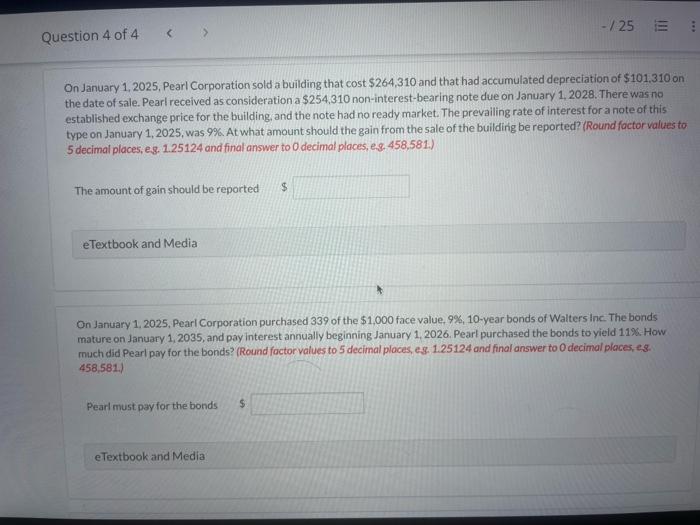

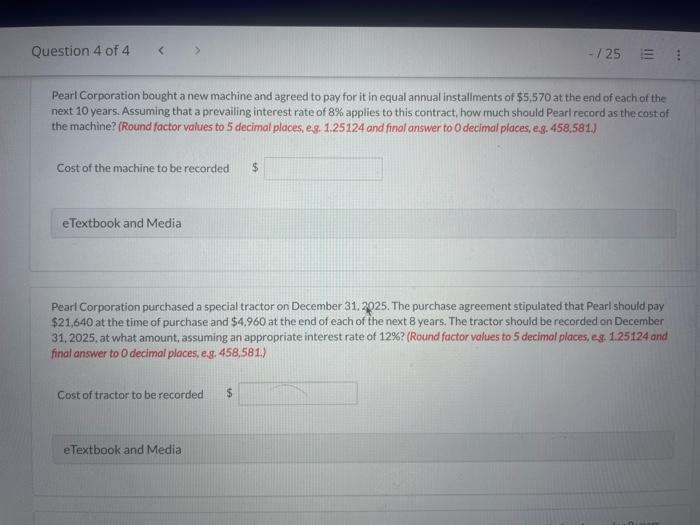

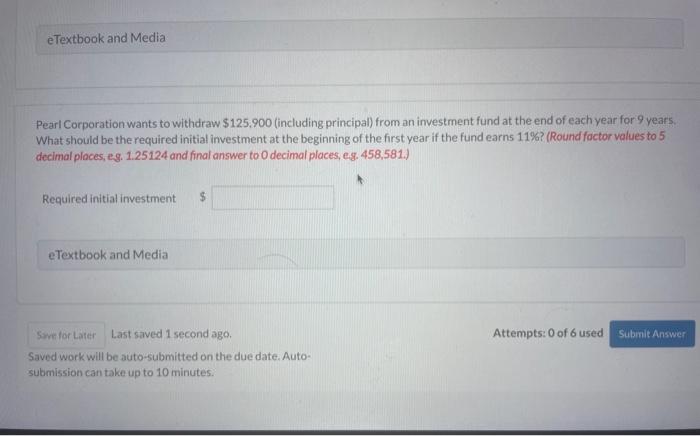

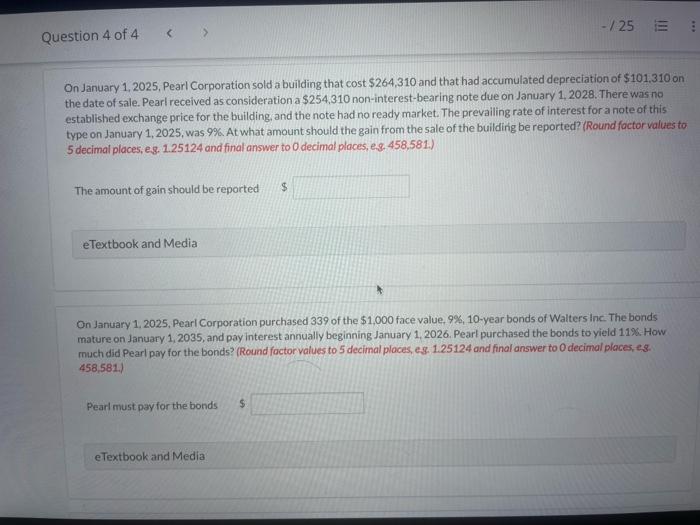

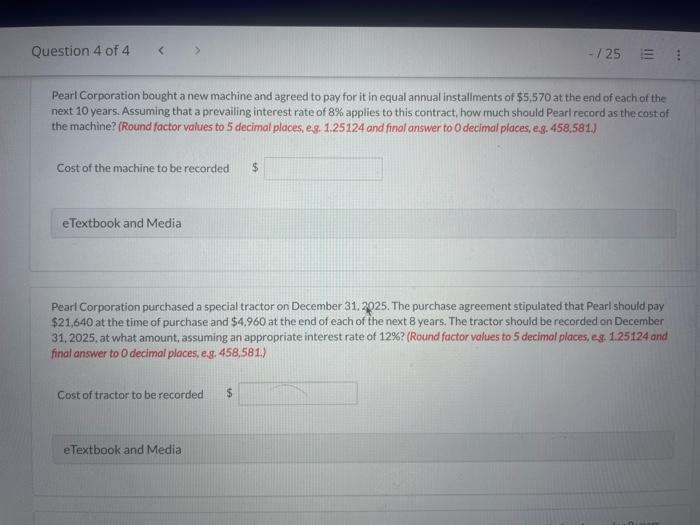

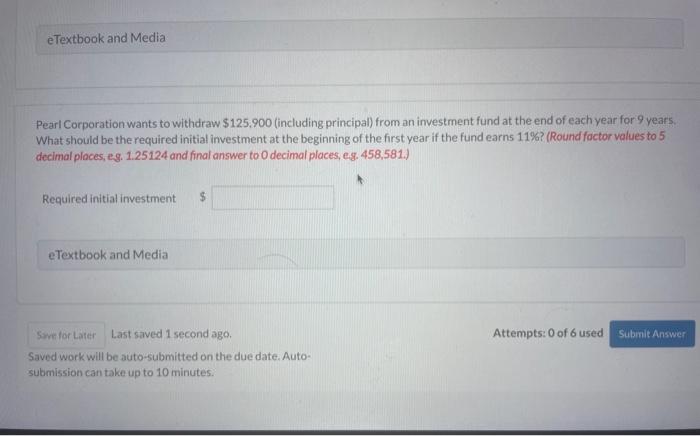

Pearl Corporation bought a new machine and agreed to pay for it in equal annual installments of $5,570 at the end of each of the next 10 years. Assuming that a prevailing interest rate of 8% applies to this contract, how much should Pearl record as the cost of the machine? (Round factor values to 5 decimal places, es. 1.25124 and final answer to 0 decimal places, e.3.458.581.) Cost of the machine to be recorded $ Pearl Corporation purchased a special tractor on December 31,2025 . The purchase agreement stipulated that Pearl should pay $21,640 at the time of purchase and $4,960 at the end of each of the next 8 years. The tractor should be recorded on December 31, 2025, at what amount, assuming an appropriate interest rate of 12% ? (Round factor values to 5 decimal places, es, 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Cost of tractor to be recorded Pearl Corporation wants to withdraw $125,900 (including principal) from an investment fund at the end of each year for 9 years. What should be the required initial investment at the beginning of the first year if the fund earns 11% ? (Round factor values to 5 . decimal places, eg. 1.25124 and final answer to 0 decimal places, eg. 458,581.) Required initial investment eTextbook and Media Last saved 1 second ago. Attempts: 0 of 6 used Saved work vill be auto-submitted on the due date. Autosubmission can take up to 10 minutes. On January 1,2025, Pearl Corporation sold a building that cost $264,310 and that had accumulated depreciation of $101.310 on the date of sale. Pearl received as consideration a $254,310 non-interest-bearing note due on January 1,2028. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1,2025, was 9%. At what amount should the gain from the sale of the buildinig be reported? (Round foctor values to 5 decimal places, e.8. 1.25124 and final answer to 0 decimal places, e. 8.458,581.) The amount of gain should be reported eTextbook and Media On January 1, 2025, Pearl Corporation purchased 339 of the $1,000 face value, 9%,10-year bonds of Walters inc. The bonds mature on January 1,2035, and pay interest annually beginning January 1,2026. Pearl purchased the bonds to yield 11%. How much did Pearl pay for the bonds? (Round factor values to 5 decimal ploces, es. 1.25124 and final answer to 0 decimal places, es. 458,581.) Pearl must pay for the bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started