Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello there need help with these budgeting exercises please ! just need exercise 2 please ! budgeting i knew it wow Exercise-2 The computation of

hello there need help with these budgeting exercises please !

just need exercise 2 please ! budgeting

i knew it wow

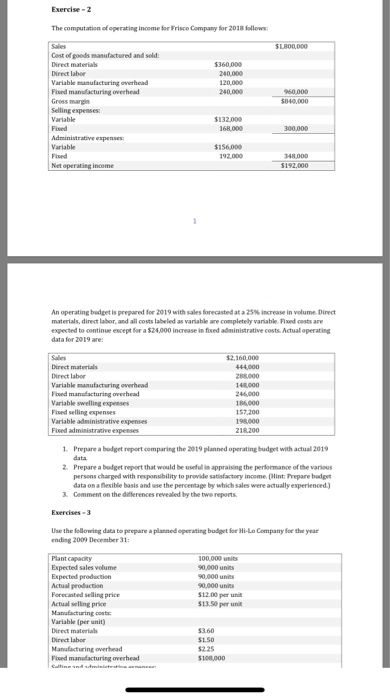

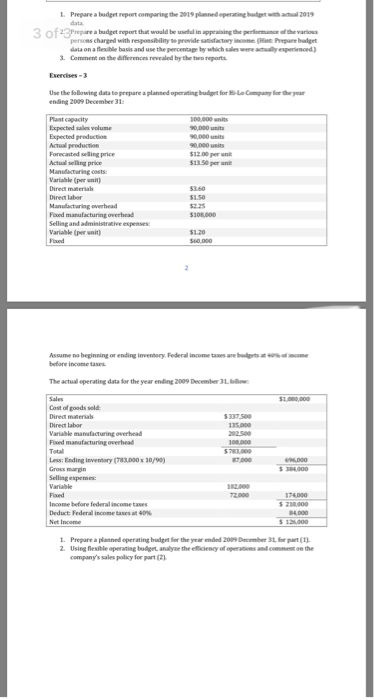

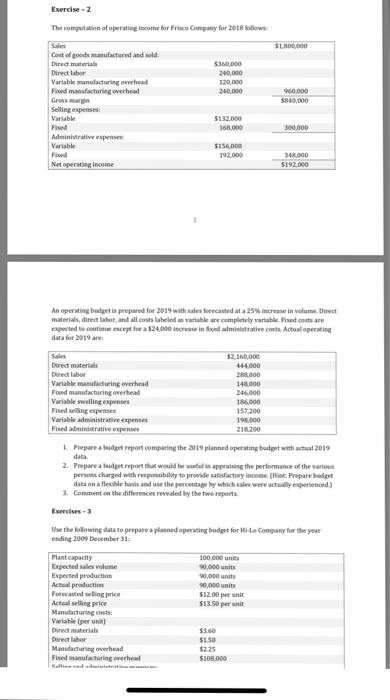

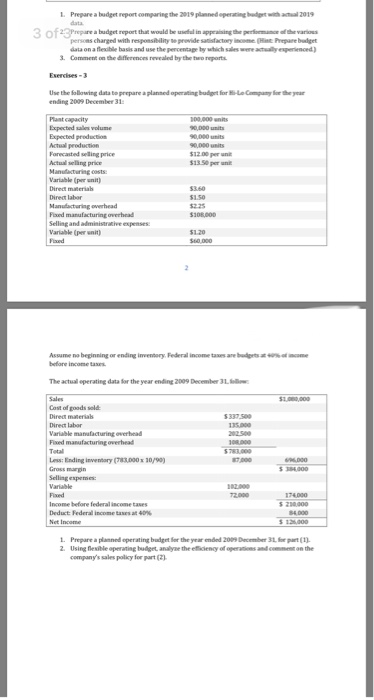

Exercise-2 The computation of operating income for Frisco Company for 2018 follows Cest of goods masufactured and seld Direct materias 240,000 Variable manufacturing overhead 240,000 Selling expenses $156.000 148,000 An operating budget is prepared for 2019 with sales forecasted at a 25% increase in volume Direct materials, direct labor, and all costs labeled as variable are completely variable. Fixed costs are expected to continue except for a $24,000 increase in fixed administrative costs. Actual operating a for 2019 are $2,160.000 Direct materials Direct labor Variable manufacturing overheard Fixed manufacturing overhead Variable swelling expesses Fixed selling espenses 244,000 186,000 57.200 Fised administrative 1. Prepare a budget report comparing the 2019 planned operating budget with actual 2019 2 Prepare a budget report that would be usefull in appraising the performance of the various persons charged with responsibility to provide satisfactory income lint Prepare budgt data on a lesible basis and use the percentage by which sales were actually experienced 3. Comment on the delerences revealed by the twe reports Use the fellowing data to prepare a planned operating budget for Hi-Lo Company for the year ending 2009 December 31 Plant capacty Expected sales volume Forecanted selling price Actual selling price Manufacturing costs Variable (per unit) Direct materiah Direct labor Manufacturing overhead $12.00 per unt 13.50 per unit $225 Exercise-2 The computation of operating income for Frisco Company for 2018 follow Cost of goods manufactured and sold Direct labor 120,000 Selling expenses: $132000 $156.000 An operating budget is prepared for 2019 with sale forecasted at a 25% increase in volume. Direct materials, direct labor, and all costs labeled as variable are completely variable. Fixed costs are expected to continue except for$24,000 increase in fixed administrative costs. Actual operating data for 2019 are 14000 Fised manufacturing overhead Variable swelling expenses Fised selling expenses 186,000 57.200 Fised adminstrative expenses 218200 1 Prepare a budget report comparing the 2019 planned operating bedget with actual 2019 2. Prepare a budget report that would be weful in appraising the performance of the various persons charged with respossibility to provide satisfactory income. (Hist Prepare budget data on a fleible hasis and use the percentage by which sales were actually experienced) 3Comment on the differences revealed by the twe repoets Use the following data to prepare a planned operating budget for i-Le Company for the year ending 2009 December 31 Plant capacity 0,000 units Forecasted seling price Actual selling price Manufacturing costs Variable (per unit) Direct materials $1200 13 50 per unit $3.60 5225 Fised manufacturing overhead L. Prepare a budget report comparing the 2019 planned operating bedgt with atual 2019 persons charged with Comment on the ifferences revealed by the tro reports Use the following data to prepare a planned operating badget for Hi-Le Company fior the year ending 2009 December 31 Plast capacity Expected sales volume Forecasted selling price Actual seling price Manfacturing costs Variable (per unit) 12.00 per une 13 50 per unt Direct labor Selling and administrative expenses Varlable (per unit) before income taxrs The actual eperating data for the year ending 2009 December 31. Cost of goods sold: 337 500 Variable manvufacturing overhead Fixed manufacturing overhead Lesw: Ending inventory(783.000 Gross marpn Selling expemes: 30/90 12000 230000 | Deduct Federal income taxes at 40% L. Prepare a planned operating budget for the year ended 2009 December 3.1 for part(1). company's sales policy for part (2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started