Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, This is for a Principles of cost engineering class, any help would be HUGELY appreciated. Please use the compound interest tables for 8% and

Hello, This is for a Principles of cost engineering class, any help would be HUGELY appreciated.

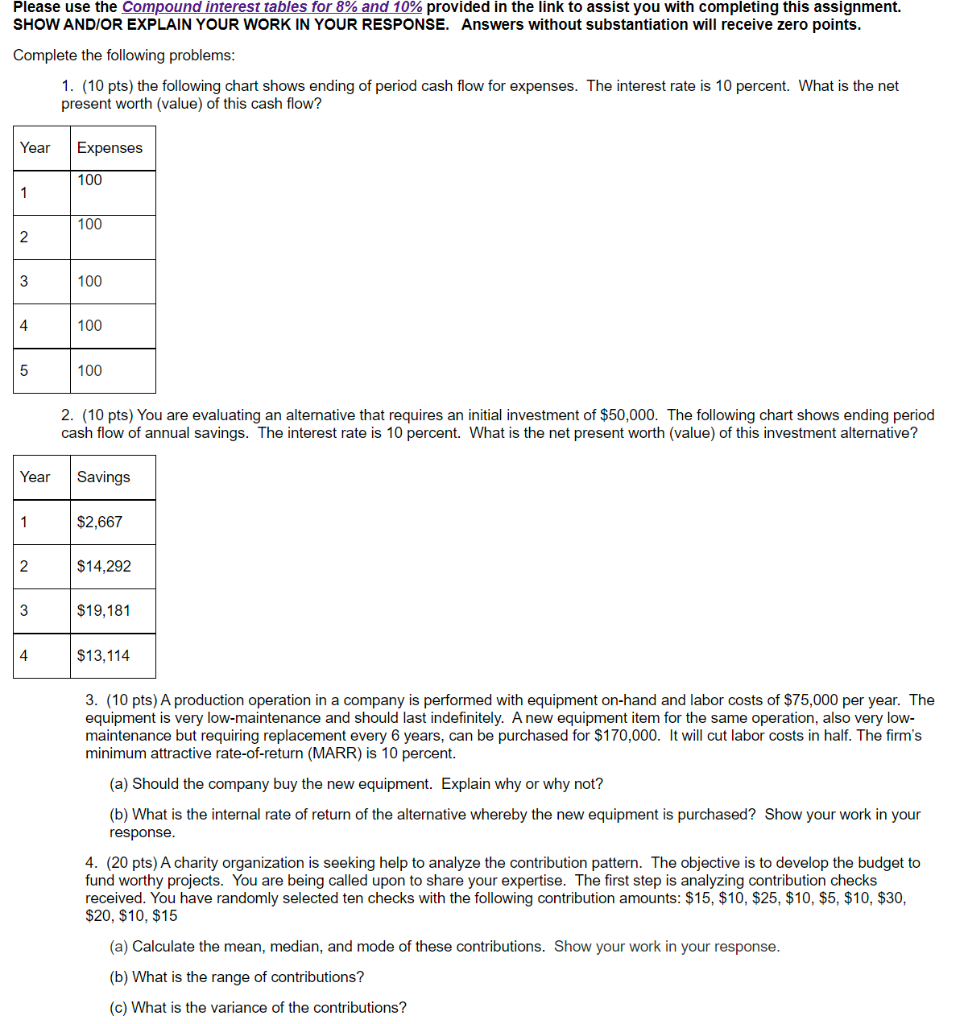

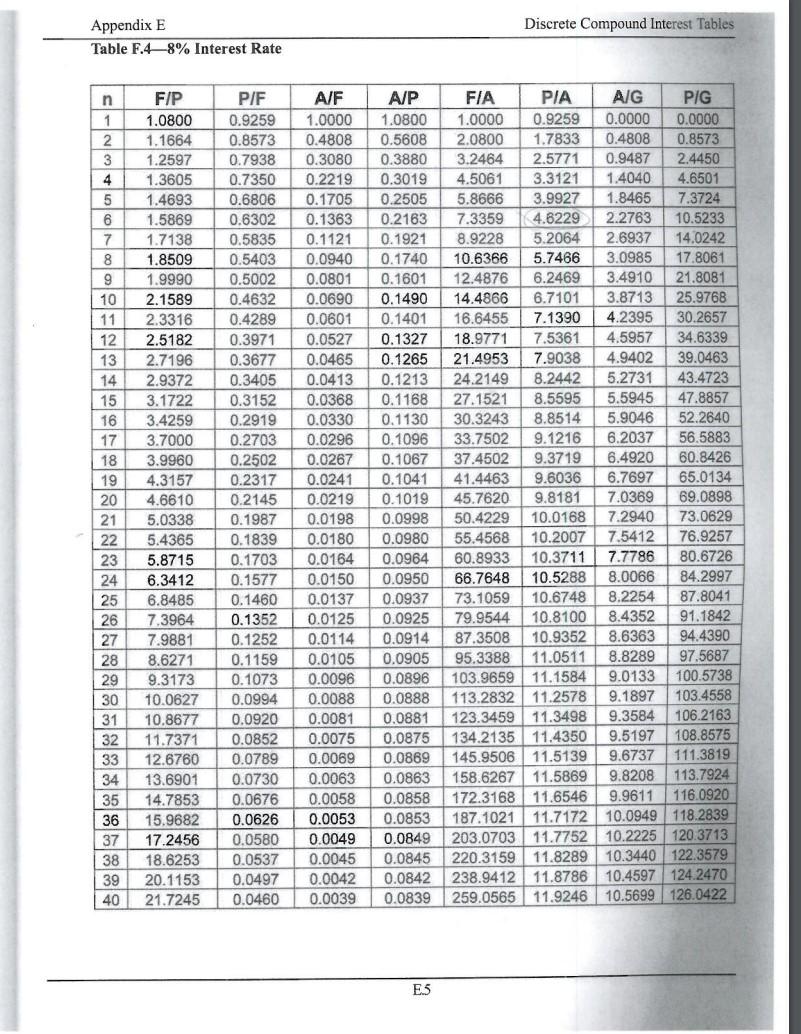

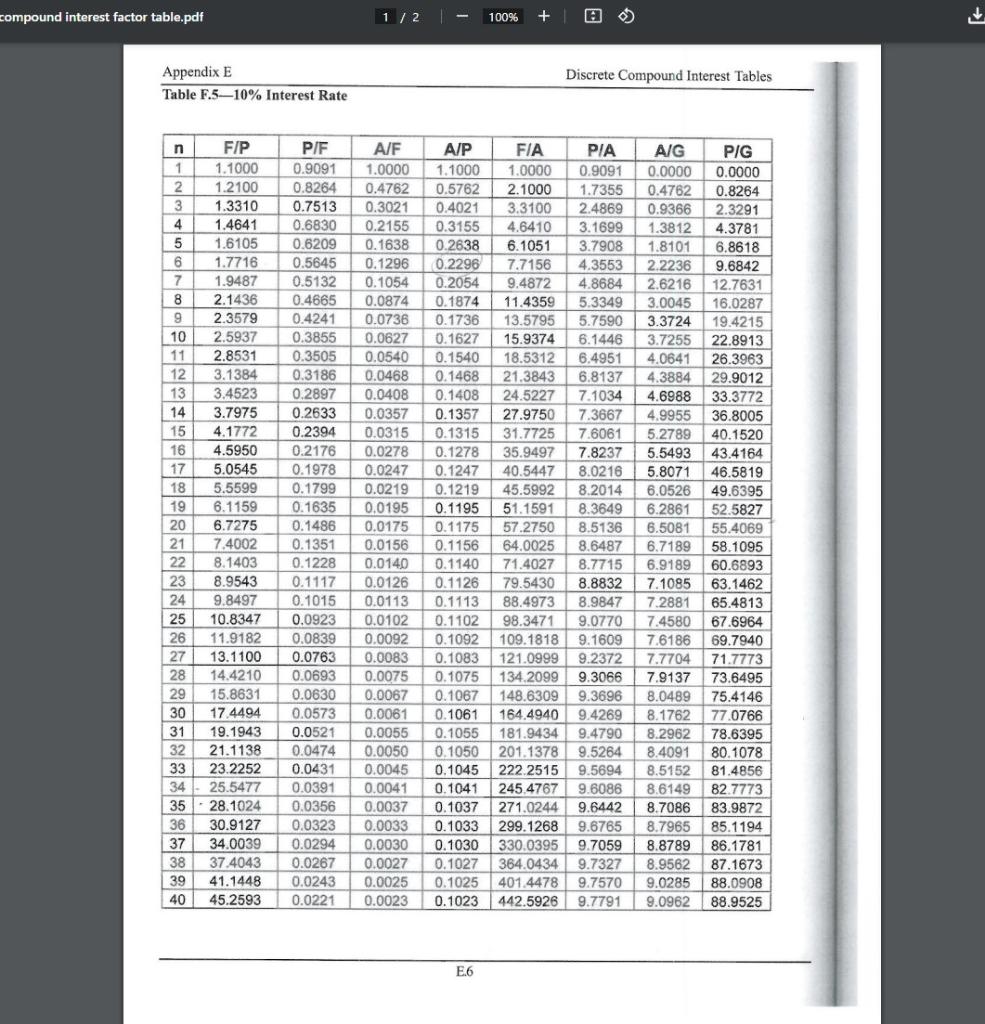

Please use the compound interest tables for 8% and 10% provided in the link to assist you with completing this assignment. SHOW AND/OR EXPLAIN YOUR WORK IN YOUR RESPONSE. Answers without substantiation will receive zero points. Complete the following problems: 1. (10 pts) the following chart shows ending of period cash flow for expenses. The interest rate is 10 percent. What is the net present worth (value) of this cash flow? Year Expenses 100 1 100 2 3 100 4 100 5 100 2. (10 pts) You are evaluating an alternative that requires an initial investment of $50,000. The following chart shows ending period cash flow of annual savings. The interest rate is 10 percent. What is the net present worth (value) of this investment alternative? Year Savings 1 $2,667 2 $14,292 3 $19,181 4 $13,114 3. (10 pts) A production operation in a company is performed with equipment on-hand and labor costs of $75,000 per year. The equipment is very low-maintenance and should last indefinitely. A new equipment item for the same operation, also very low- maintenance but requiring replacement every 6 years, can be purchased for $170,000. It will cut labor costs in half. The firm's minimum attractive rate-of-return (MARR) is 10 percent. (a) Should the company buy the new equipment. Explain why or why not? (b) What is the internal rate of return of the alternative whereby the new equipment is purchased? Show your work in your response. 4. (20 pts) A charity organization is seeking help to analyze the contribution pattern. The objective is to develop the budget to fund worthy projects. You are being called upon to share your expertise. The first step is analyzing contribution checks received. You have randomly selected ten checks with the following contribution amounts: $15, $10, $25, $10, $5, $10, $30, $20, $10, $15 (a) Calculate the mean, median, and mode of these contributions. Show your work in your response. (b) What is the range of contributions? (c) What is the variance of the contributions? Discrete Compound Interest Tables Appendix E Table F.48% Interest Rate n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 F/P 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 2.3316 2.5182 2.7196 2.9372 3.1722 3.4259 3.7000 3.9960 4.3157 4.6610 5.0338 5.4365 5.8715 6.3412 6.8485 7.3964 7.9881 8.6271 9.3173 10.0627 10.8677 11.7371 12.6760 13.6901 14.7853 15.9682 17.2456 18.6253 20.1153 21.7245 P/F 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.2919 0.2703 0.2502 0.2317 0.2145 0.1987 0.1839 0.1703 0.1577 0.1460 0.1352 0.1252 0.1159 0.1073 0.0994 0.0920 0.0852 0.0789 0.0730 0.0676 0.0626 0.0580 0.0537 0.0497 0.0460 A/F 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 0.0601 0.0527 0.0465 0.0413 0.0368 0.0330 0.0296 0.0267 0.0241 0.0219 0.0198 0.0180 0.0164 0.0150 0.0137 0.0125 0.0114 0.0105 0.0096 0.0088 0.0081 0.0075 0.0069 0.0063 0.0058 0.0053 0.0049 0.0045 0.0042 0.0039 A/P 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 0.1401 0.1327 0.1265 0.1213 0.1168 0.1130 0.1096 0.1067 0.1041 0.1019 0.0998 0.0980 0.0964 0.0950 0.0937 0.0925 0.0914 0.0905 0.0896 0.0888 0.0881 0.0875 0.0869 0.0863 0.0858 0.0853 0.0849 0.0845 0.0842 0.0839 FIA PIA AIG PIG 1.0000 0.9259 0.0000 0.0000 2.0800 1.7833 0.4808 0.8573 3.2464 2.5771 0.9487 2.4450 4.5061 3.3121 1.4040 4.6501 5.8666 3.9927 1.8465 7.3724 7.3359 4.8229 2.2763 10.5233 8.9228 5.2064 2.6937 14.0242 10.6366 5.7466 3.0985 17.8061 12.4876 6.2469 3.4910 21.8081 14.4866 6.7101 3.8713 25.9768 16.6455 7.1390 4.2395 30.2657 18.9771 7.5361 4.5957 34.6339 21.4953 7.9038 4.9402 39.0463 24.2149 8.2442 5.2731 43.4723 27.1521 8.5595 5.5945 47.8857 30.3243 8.8514 5.9046 52.2640 33.7502 9.1216 6.2037 56.5883 37.4502 9.3719 6.4920 60.8426 41.4463 9.6036 6.7697 65.0134 45.7620 9.8181 7.0369 69.0898 50.4229 10.0168 7.2940 73.0629 55.4568 10.2007 7.5412 76.9257 60.8933 10.3711 7.7786 80.6726 66.7648 10.5288 8.0066 84.2997 73.1059 10.6748 8.2254 87.8041 79.9544 10.8100 8.4352 91.1842 87.3508 10.9352 8.6363 94.4390 95.3388 11.0511 8.8289 97.5687 103.9659 11.1584 9.0133 100.5738 113.2832 11.2578 9.1897 103.4558 123.3459 11.3498 9.3584 106.2163 134.213511.4350 9.5197 108.8575 145.9506 11.5139 9.6737 111.3819 158.6267 11.5869 9.8208 113.7924 172.3168 11.6546 9.9611 116.0920 187.102111.7172 10.0949 118.2839 203.0703 11.7752 10.2225 120.3713 220.3159 11.8289 10.3440 122.3579 238.9412 11.8786 10.4597 124.2470 259.0565 11.9246 10.5699 126.0422 E5 compound interest factor table.pdf 1 / 2 100% + Appendix E Table F.5-10% Interest Rate Discrete Compound Interest Tables n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 FIP 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 7.4002 8.1403 8.9543 9.8497 10.8347 11.9182 13.1100 14.4210 15.8631 17.4494 19.1943 21.1138 23.2252 25.5477 28.1024 30.9127 34.0039 37.4043 41.1448 45.2593 P/F 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2533 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.1351 0.1228 0.1117 0.1015 0.0923 0.0839 0.0763 0.0693 0.0630 0.0573 0.0521 0.0474 0.0431 0.0391 0.0356 0.0323 0.0294 0.0267 0.0243 0.0221 A/F 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 0.0156 0.0140 0.0126 0.0113 0.0102 0.0092 0.0083 0.0075 0.0067 0.0061 0.0055 0.0050 0.0045 0.0041 0.0037 0.0033 0.0030 0.0027 0.0025 0.0023 AIP FIA PIA 1.1000 1.0000 0.9091 0.5762 2.1000 1.7355 0.4021 3.3100 2.4869 0.3155 4.6410 3.1699 0.2638 6.1051 3.7908 0.2296 7.7156 4.3553 0.2054 9.4872 4.8684 0.1874 11.4359 5.3349 0.1736 13.5795 5.7590 0.1627 15.9374 6.1446 0.1540 18.5312 6.4951 0.1468 21.3843 6.8137 0.1408 24.5227 7.1034 0.1357 27.9750 7.3667 0.1315 31.7725 7.6061 0.1278 35.9497 7.8237 0.1247 40.5447 8.0216 0.1219 45.5992 8.2014 0.1195 51.1591 8.3649 0.1175 57.2750 8.5136 0.1156 64.0025 8.6487 0.1140 71.4027 8.7715 0.1126 79.5430 8.8832 0.1113 88.4973 8.9847 0.1102 98.3471 9.0770 0.1092 109.1818 9.1609 0.1083 121.0999 9.2372 0.1075 134.2099 9.3066 0.1067 148.6309 9.3696 0.1061 164.4940 9.4269 0.1055 181.9434 9.4790 0.1050 201.1378 9.5264 0.1045 222.2515 9.5694 0.1041 245.4767 9.6086 0.1037 271.0244 9.6442 0.1033 299.1268 9.6765 0.1030 330.0395 9.7059 0.1027 364.0434 9.7327 0.1025 401.4478 9.7570 0.1023 442.5926 9.7791 AIG 0.0000 0.4762 0.9366 1.3812 1.8101 2.2236 2.6216 3.0045 3.3724 3.7255 4.0641 4.3884 4.6988 4.9955 5.2789 5.5493 5.8071 6.0526 6.2861 6.5081 6.7189 6.9189 7.1085 7.2881 7.4580 7.6186 7.7704 7.9137 8.0489 8.1762 PIG 0.0000 0.8264 2.3291 4.3781 6.8618 9.6842 12.7631 16.0287 19.4215 22.8913 26.3963 29.9012 33.3772 36.8005 40.1520 43.4164 46.5819 49.6395 52.5827 55.4069 58.1095 60.6893 63.1462 65.4813 67.6964 69.7940 71.7773 73.6495 75.4146 77.0766 78.6395 80.1078 81.4856 82.7773 83.9872 85.1194 86.1781 87.1673 88.0908 88.9525 8.2962 8,4091 8.5152 8.6149 8.7086 8.7965 8.8789 8.9562 9.0285 9.0962 E6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started