Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello. this is my accounting assessment for 75 marks. please do it carefully and all the information is provided. I will upvote your answer. Three

hello. this is my accounting assessment for 75 marks. please do it carefully and all the information is provided. I will upvote your answer.

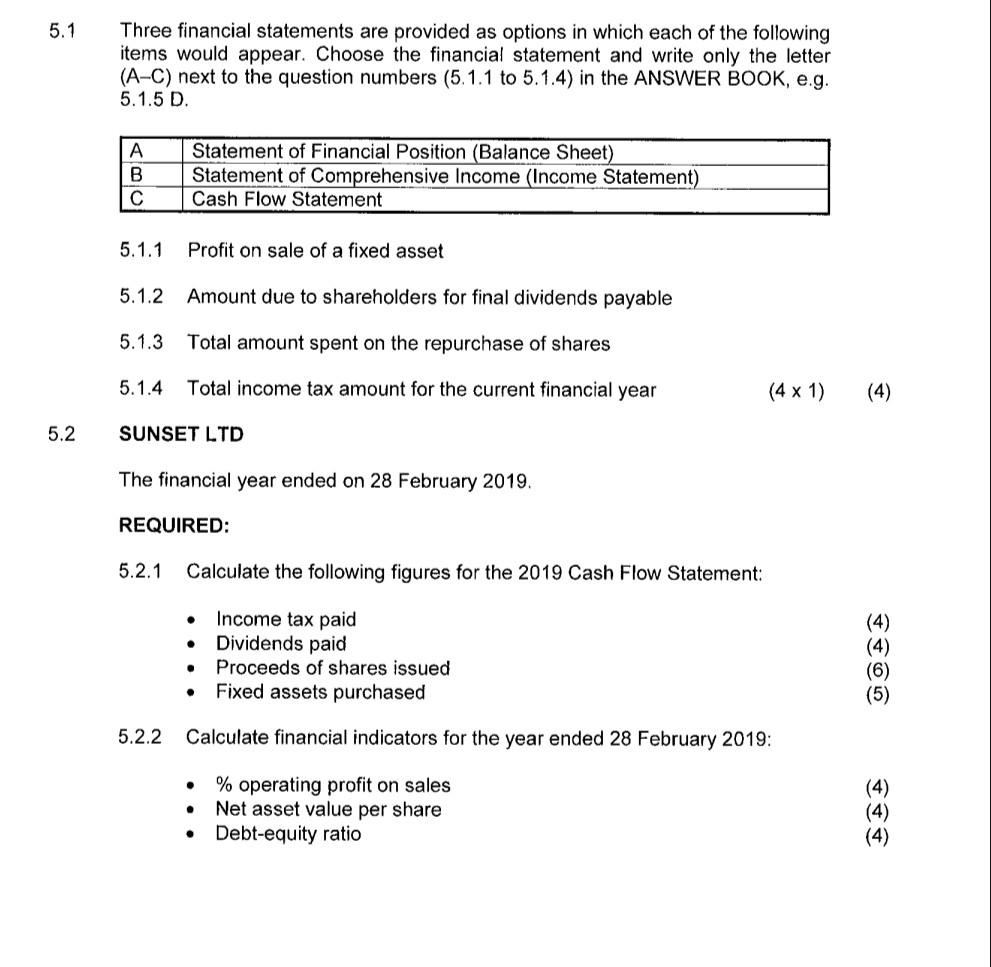

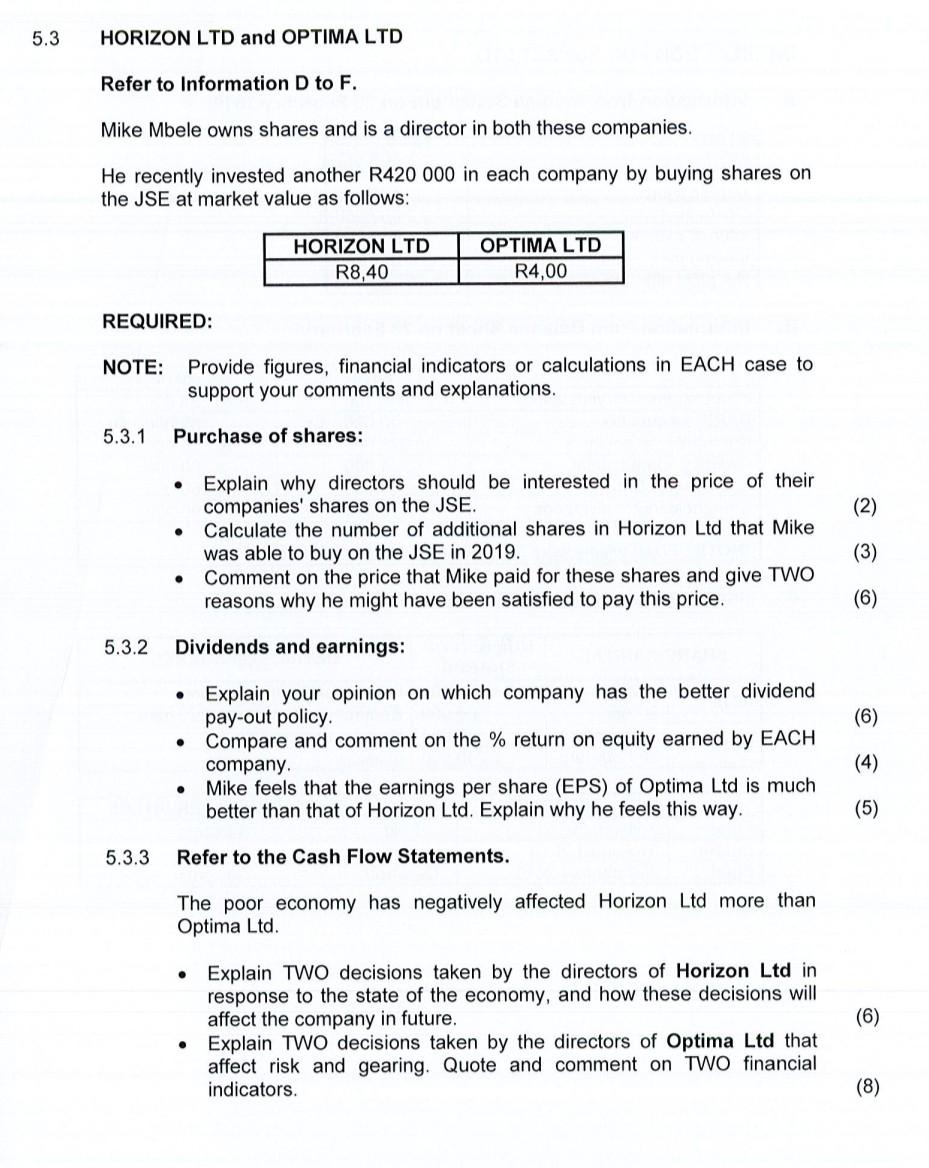

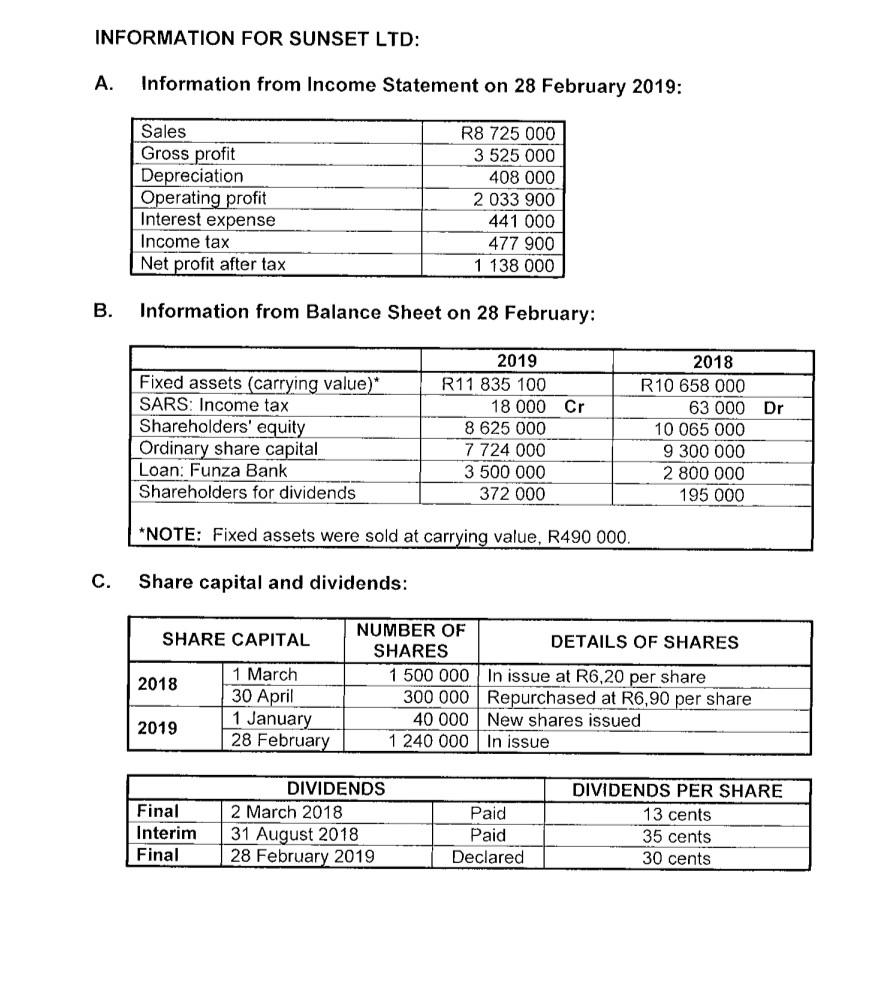

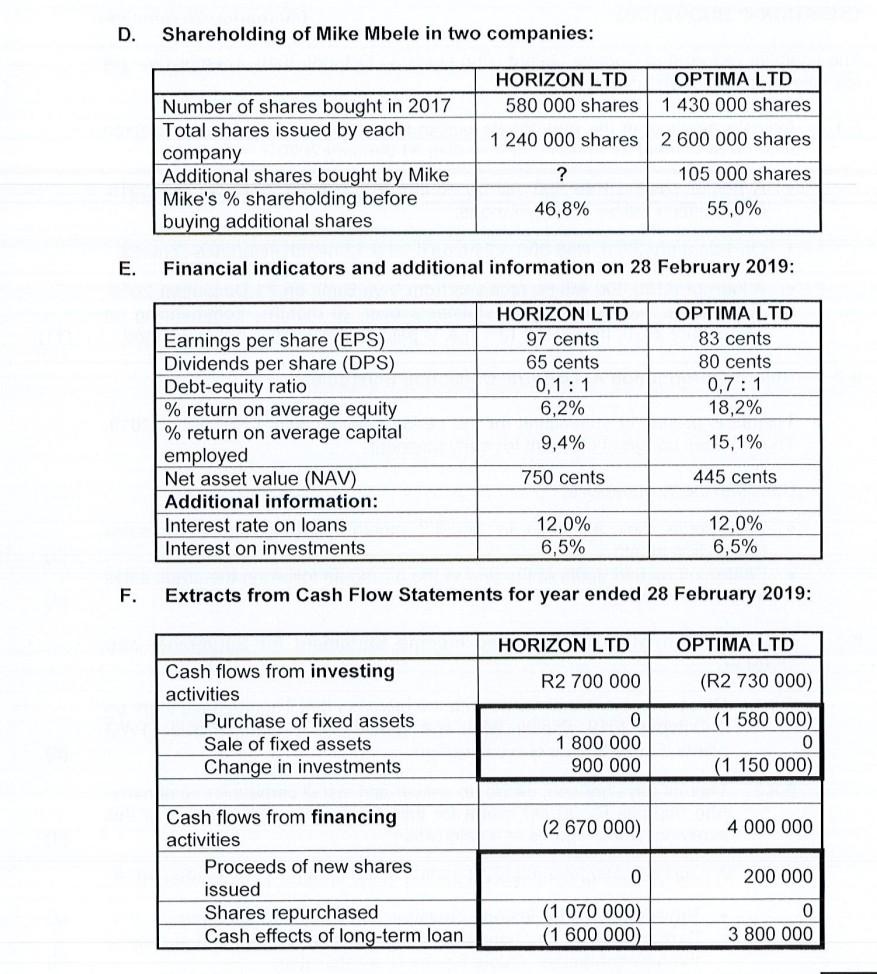

Three financial statements are provided as options in which each of the following items would appear. Choose the financial statement and write only the letter (AC) next to the question numbers (5.1.1 to 5.1 .4) in the ANSWER BOOK, e.g. 5.1.5 D. 5.1.1 Profit on sale of a fixed asset 5.1.2 Amount due to shareholders for final dividends payable 5.1.3 Total amount spent on the repurchase of shares 5.1.4 Total income tax amount for the current financial year (41) (4) SUNSET LTD The financial year ended on 28 February 2019. REQUIRED: 5.2.1 Calculate the following figures for the 2019 Cash Flow Statement: - Income tax paid (4) - Dividends paid (4) - Proceeds of shares issued (6) - Fixed assets purchased (5) 5.2.2 Calculate financial indicators for the year ended 28 February 2019: - % operating profit on sales (4) - Net asset value per share (4) - Debt-equity ratio (4) 3 HORIZON LTD and OPTIMA LTD Refer to Information D to F. Mike Mbele owns shares and is a director in both these companies. He recently invested another R420 000 in each company by buying shares on the JSE at market value as follows: REQUIRED: NOTE: Provide figures, financial indicators or calculations in EACH case to support your comments and explanations. 5.3.1 Purchase of shares: - Explain why directors should be interested in the price of their companies' shares on the JSE. - Calculate the number of additional shares in Horizon Ltd that Mike was able to buy on the JSE in 2019. - Comment on the price that Mike paid for these shares and give TWO reasons why he might have been satisfied to pay this price. 5.3.2 Dividends and earnings: - Explain your opinion on which company has the better dividend pay-out policy. (6) - Compare and comment on the \% return on equity earned by EACH company. - Mike feels that the earnings per share (EPS) of Optima Ltd is much better than that of Horizon Ltd. Explain why he feels this way. (5) 5.3.3 Refer to the Cash Flow Statements. The poor economy has negatively affected Horizon Ltd more than Optima Ltd. - Explain TWO decisions taken by the directors of Horizon Ltd in response to the state of the economy, and how these decisions will affect the company in future. (6) - Explain TWO decisions taken by the directors of Optima Ltd that affect risk and gearing. Quote and comment on TWO financial indicators. (8) A. Information from Income Statement on 28 February 2019: B. Information from Balance Sheet on 28 February: C. Share capital and dividends: D. Shareholding of Mike Mbele in two companies: E. Financial indicators and additional information on 28 February 2019: F. Extracts from Cash Flow Statements for year ended 28 February 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started