Answered step by step

Verified Expert Solution

Question

1 Approved Answer

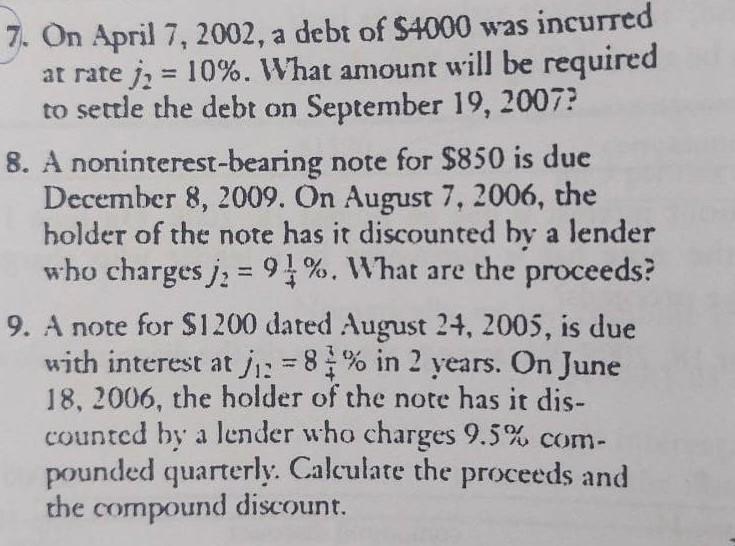

Hello, This is my homework from (Mathematics of Finance Course) In this question i only need solutions for Number 7 and 9. In this question

Hello, This is my homework from (Mathematics of Finance Course)

In this question i only need solutions for Number 7 and 9.

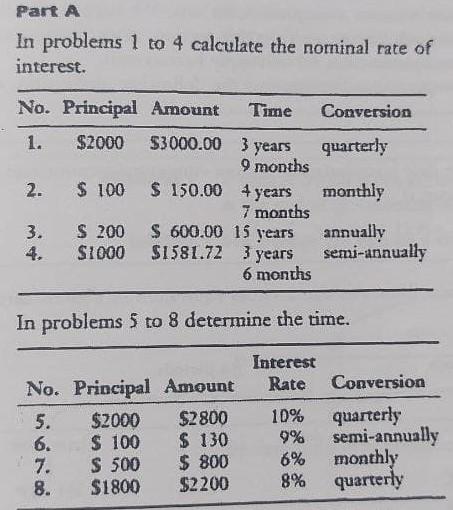

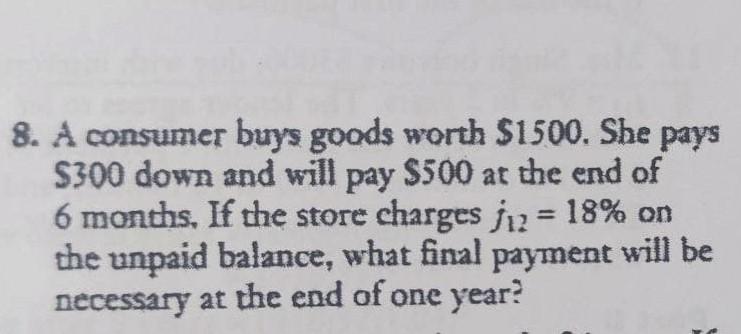

In this question i need solutions for for problems number 2 and 8

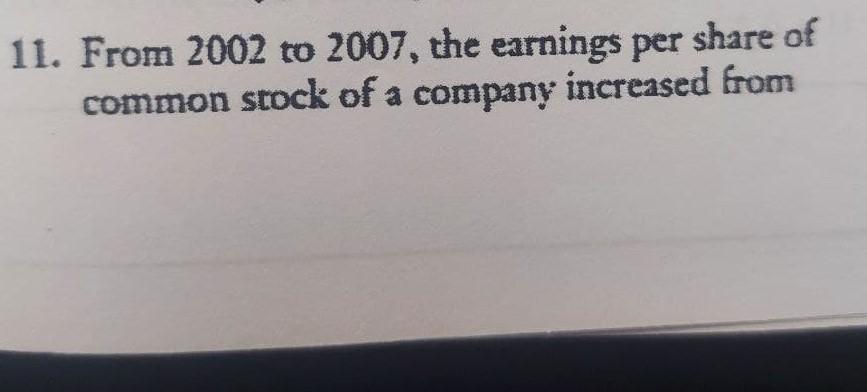

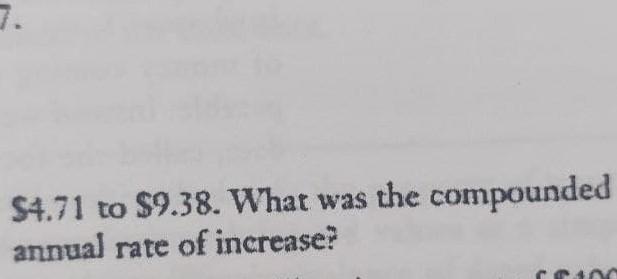

This question only number 11

This question only number 8

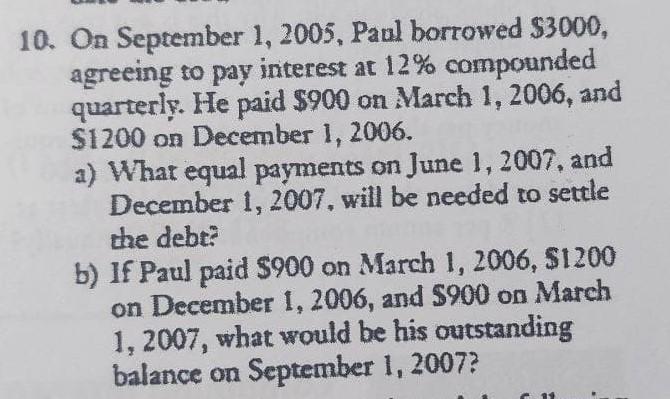

This question solve all of it with A,B

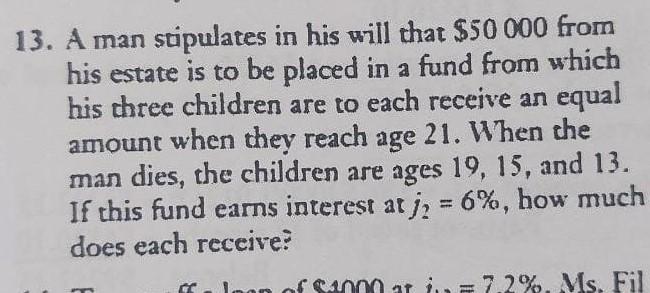

The last question is number 13. Thank you very much.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started