Hello,

was wondering if someone could help me out, if I could get the answers and formals that would be great!

Thanks!

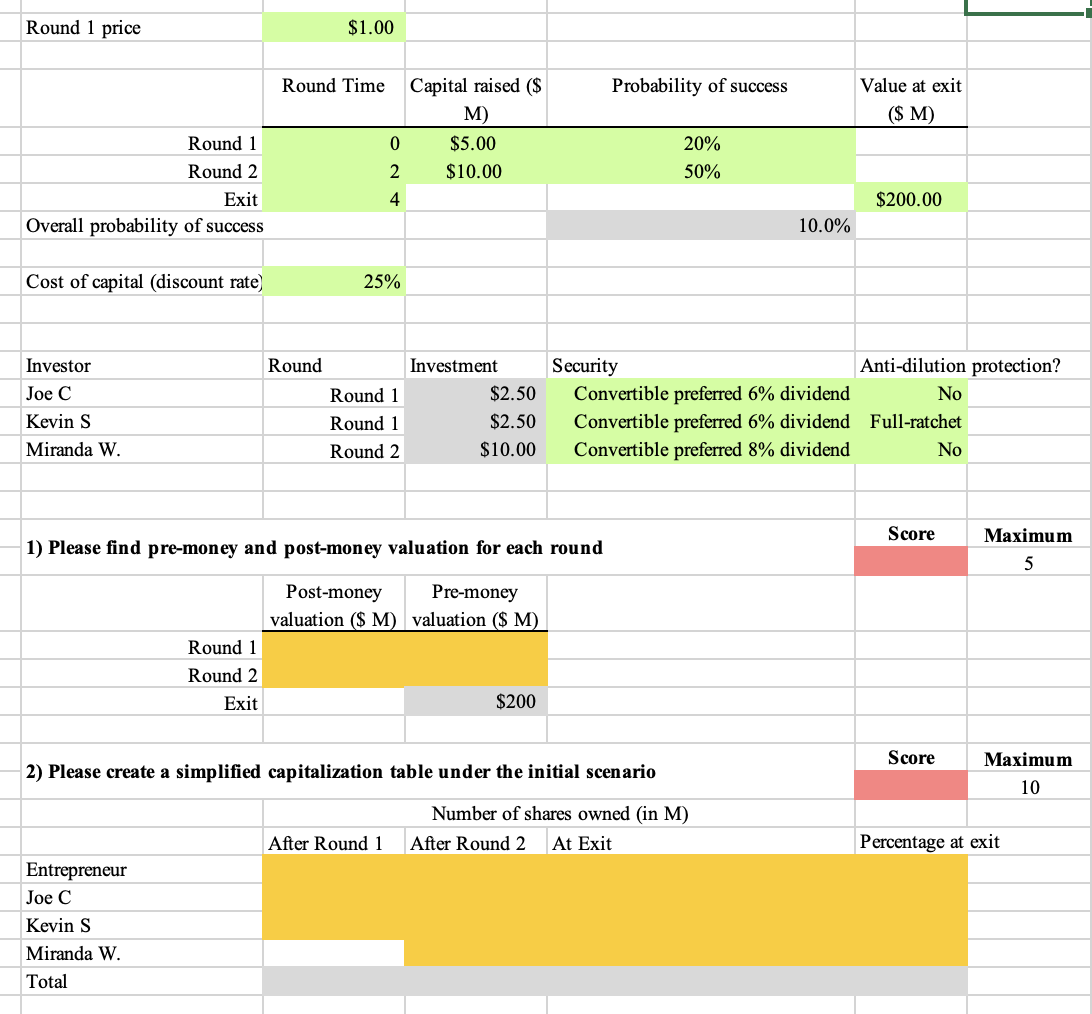

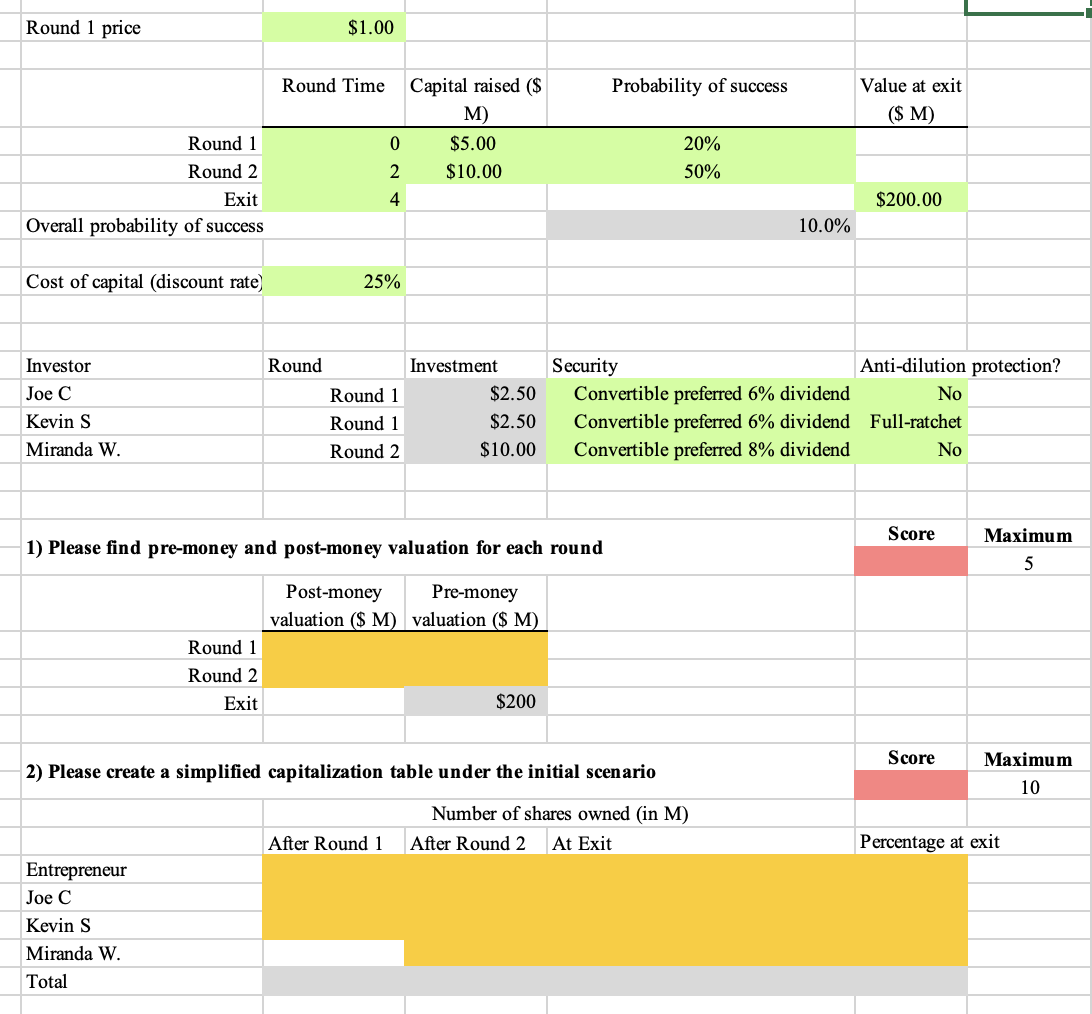

Beam startup is planning to use staged financing to raise capital for its venture. Information about the venture, investors, securities they used and investment amount is given below.

1) Please find pre-mone and post-money valuation for each round

2) Please create a simplified capitalization table.

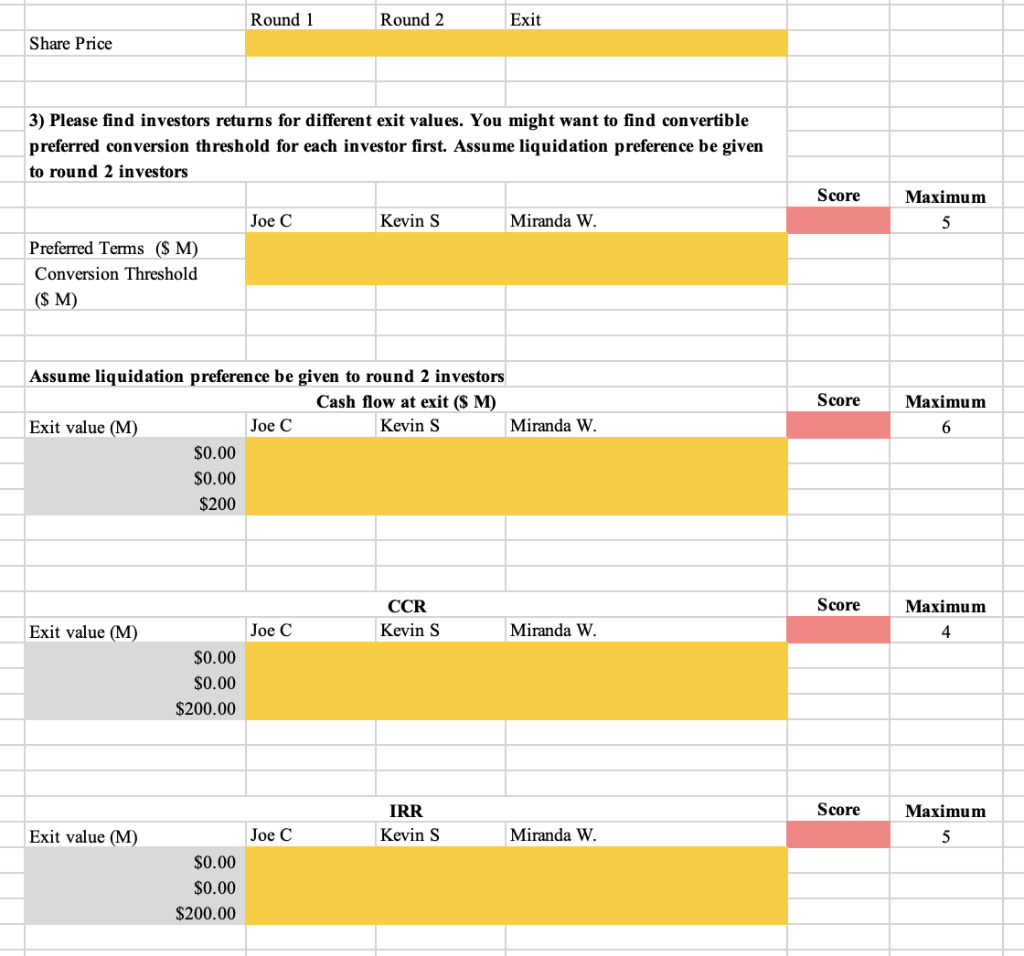

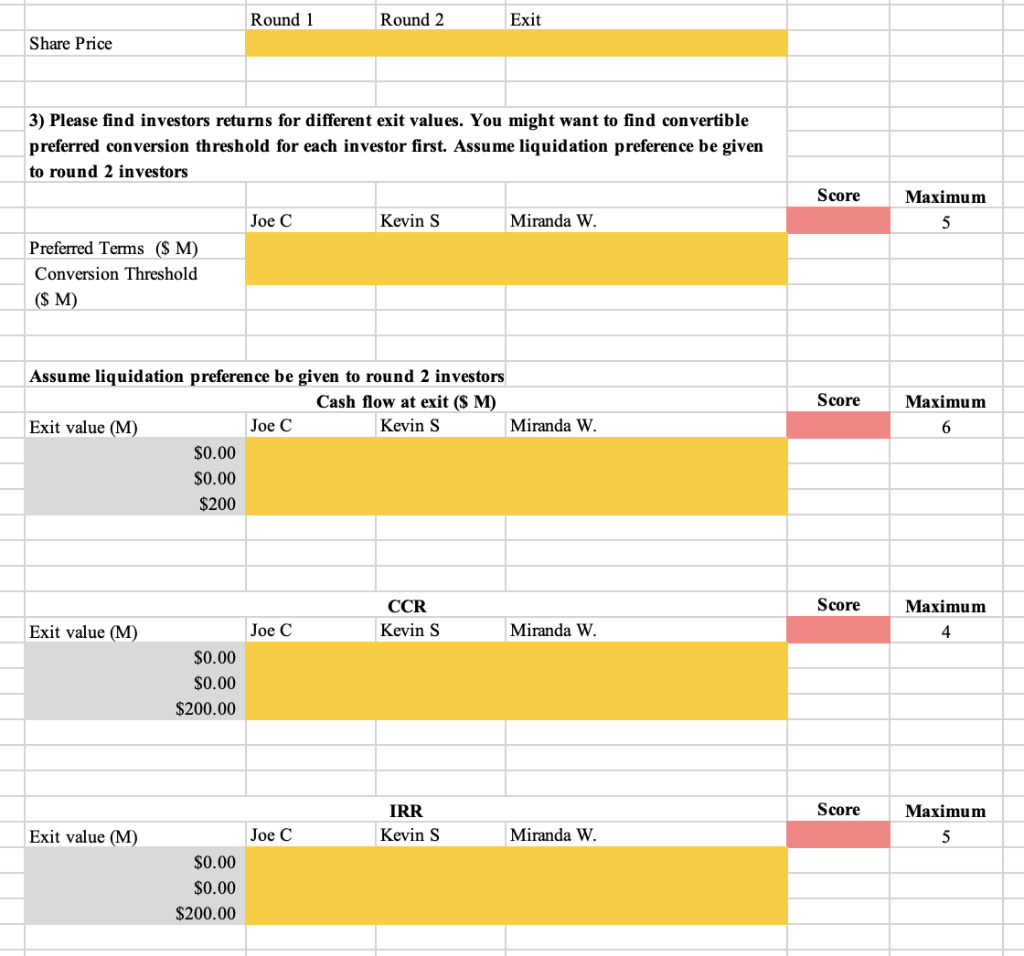

3) Please find investors returns for different exit values. You might want to find convertible preferred conversion threshold for each investor first. Assume liquidation preference be given to round 2 investors

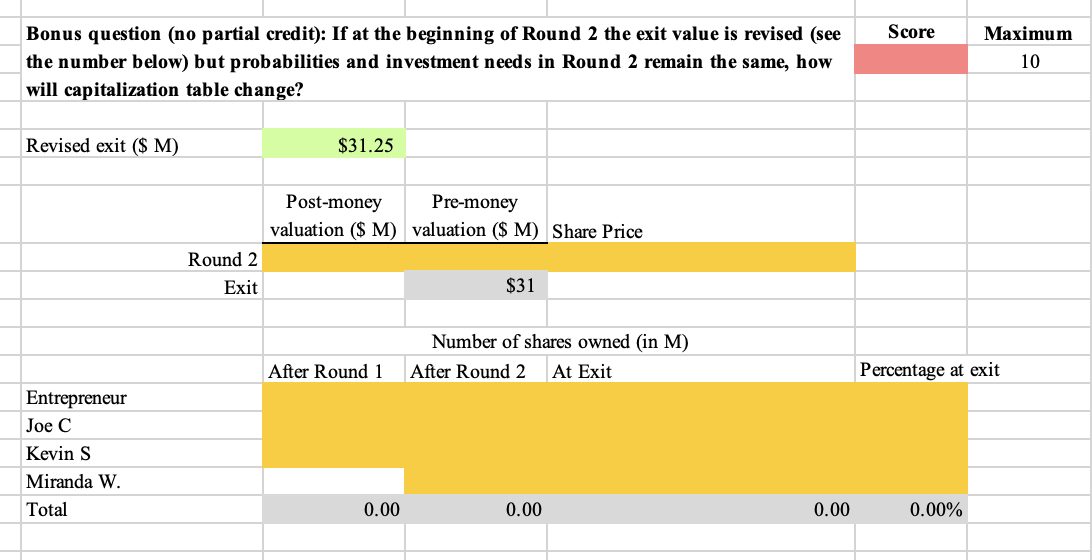

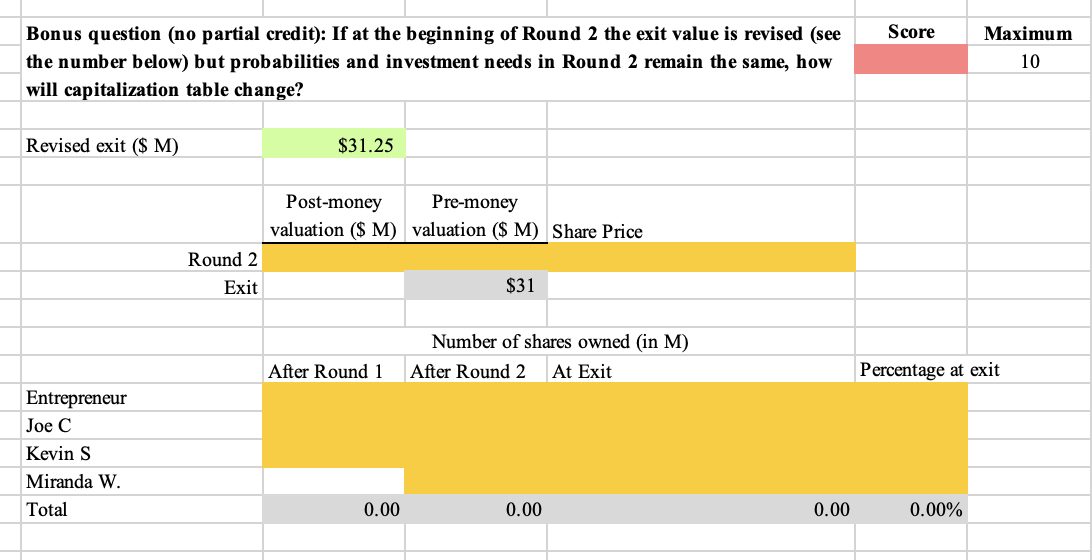

Bonus question (no partial credit): If at the beginning of Round 2 the exit value is revised (see the number below) but probabilities and investment needs in Round 2 remain the same, how will capitalization table change?

Round 1 price Round 1 Round 2 Exit Overall probability of success Cost of capital (discount rate) Investor Joe C Round 1 $2.50 Kevin S Round 1 $2.50 Miranda W. Round 2 $10.00 1) Please find pre-money and post-money valuation for each round Post-money Pre-money valuation ($M) valuation ($ M) Round 1 Round 2 Exit $200 2) Please create a simplified capitalization table under the initial scenario Number of shares owned (in M) After Round 1 After Round 2 At Exit Entrepreneur Joe C Kevin S Miranda W. Total $1.00 Round Time Round 0 2 4 25% Capital raised ($ M) $5.00 $10.00 Investment Probability of success 20% 50% 10.0% Security Convertible preferred 6% dividend Convertible preferred 6% dividend Convertible preferred 8% dividend Value at exit ($ M) $200.00 Anti-dilution protection? No Full-ratchet No Score Maximum 5 Score Maximum 10 Percentage at exit Round 1 Round 2 Exit Share Price 3) Please find investors returns for different exit values. You might want to find convertible preferred conversion threshold for each investor first. Assume liquidation preference be given to round 2 investors Score Maximum 5 Joe C Kevin S Miranda W. Preferred Terms ($M) Conversion Threshold ($ M) Score Maximum 6 Assume liquidation preference be given to round 2 investors Cash flow at exit (SM) Exit value (M) Joe C Kevin S Miranda W. $0.00 $0.00 $200 Score CCR Kevin S Maximum 4. Exit value (M) Joe C Miranda W. $0.00 $0.00 $200.00 Score IRR Kevin S Maximum 5 Exit value (M) Joe C Miranda W. $0.00 $0.00 $200.00 Bonus question (no partial credit): If at the beginning of Round 2 the exit value is revised (see the number below) but probabilities and investment needs in Round 2 remain the same, how will capitalization table change? Revised exit ($ M) $31.25 Post-money Pre-money valuation ($ M) valuation ($ M) Share Price $31 Number of shares owned (in M) After Round 1 After Round 2 At Exit Entrepreneur Joe C Kevin S Miranda W. Total Round 2 Exit 0.00 0.00 0.00 Score Maximum 10 Percentage at exit 0.00% Round 1 price Round 1 Round 2 Exit Overall probability of success Cost of capital (discount rate) Investor Joe C Round 1 $2.50 Kevin S Round 1 $2.50 Miranda W. Round 2 $10.00 1) Please find pre-money and post-money valuation for each round Post-money Pre-money valuation ($M) valuation ($ M) Round 1 Round 2 Exit $200 2) Please create a simplified capitalization table under the initial scenario Number of shares owned (in M) After Round 1 After Round 2 At Exit Entrepreneur Joe C Kevin S Miranda W. Total $1.00 Round Time Round 0 2 4 25% Capital raised ($ M) $5.00 $10.00 Investment Probability of success 20% 50% 10.0% Security Convertible preferred 6% dividend Convertible preferred 6% dividend Convertible preferred 8% dividend Value at exit ($ M) $200.00 Anti-dilution protection? No Full-ratchet No Score Maximum 5 Score Maximum 10 Percentage at exit Round 1 Round 2 Exit Share Price 3) Please find investors returns for different exit values. You might want to find convertible preferred conversion threshold for each investor first. Assume liquidation preference be given to round 2 investors Score Maximum 5 Joe C Kevin S Miranda W. Preferred Terms ($M) Conversion Threshold ($ M) Score Maximum 6 Assume liquidation preference be given to round 2 investors Cash flow at exit (SM) Exit value (M) Joe C Kevin S Miranda W. $0.00 $0.00 $200 Score CCR Kevin S Maximum 4. Exit value (M) Joe C Miranda W. $0.00 $0.00 $200.00 Score IRR Kevin S Maximum 5 Exit value (M) Joe C Miranda W. $0.00 $0.00 $200.00 Bonus question (no partial credit): If at the beginning of Round 2 the exit value is revised (see the number below) but probabilities and investment needs in Round 2 remain the same, how will capitalization table change? Revised exit ($ M) $31.25 Post-money Pre-money valuation ($ M) valuation ($ M) Share Price $31 Number of shares owned (in M) After Round 1 After Round 2 At Exit Entrepreneur Joe C Kevin S Miranda W. Total Round 2 Exit 0.00 0.00 0.00 Score Maximum 10 Percentage at exit 0.00%