hello, we have done the rolls royce corporation case in classe, and we have classified the company's stakegolders knowledges area regarding the power, interest, knowledge, influence, but I did not understand clearly how they did this and on which terms they have based the answers can you please gove me a clear explanation and thank you professor.

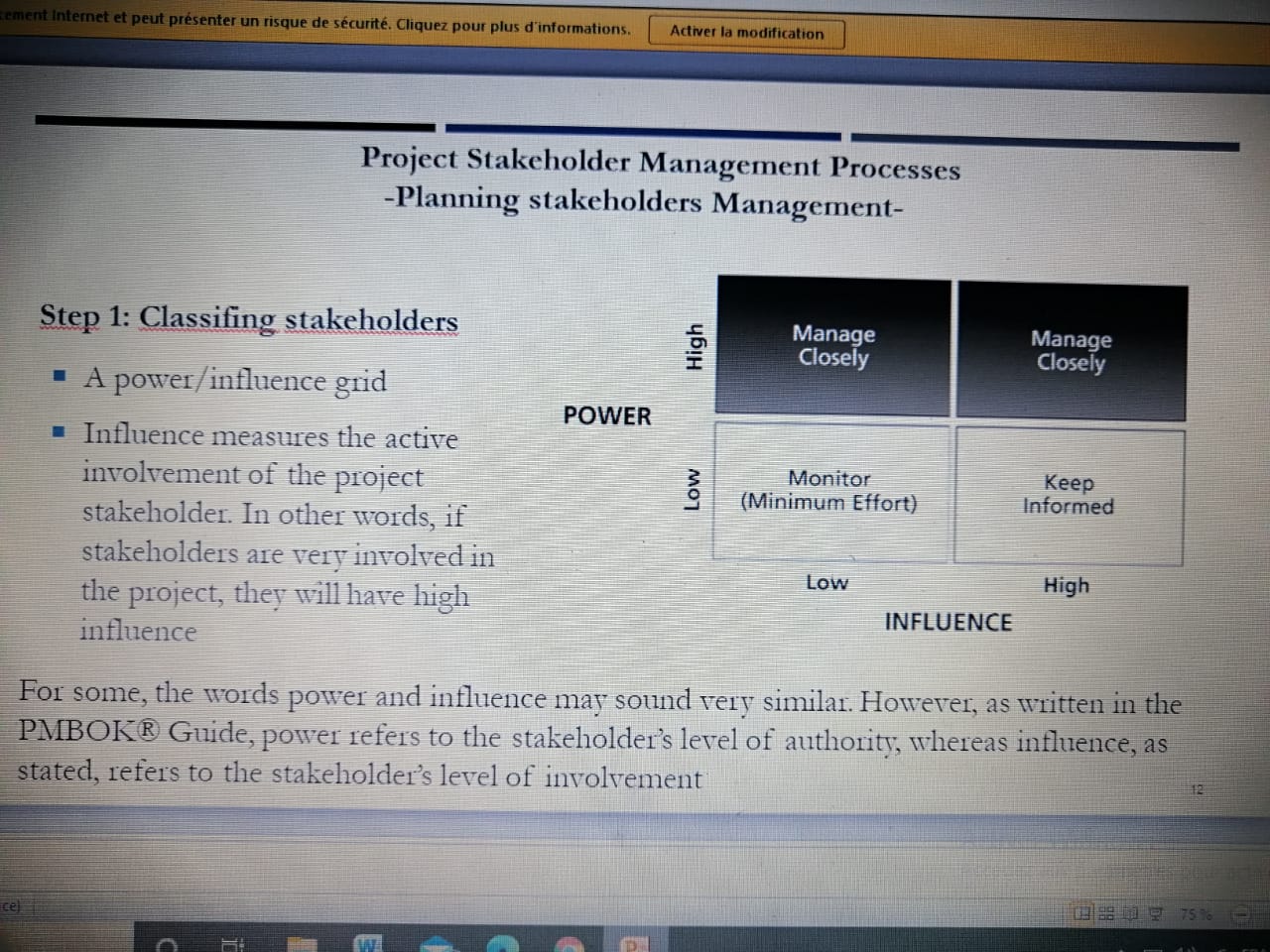

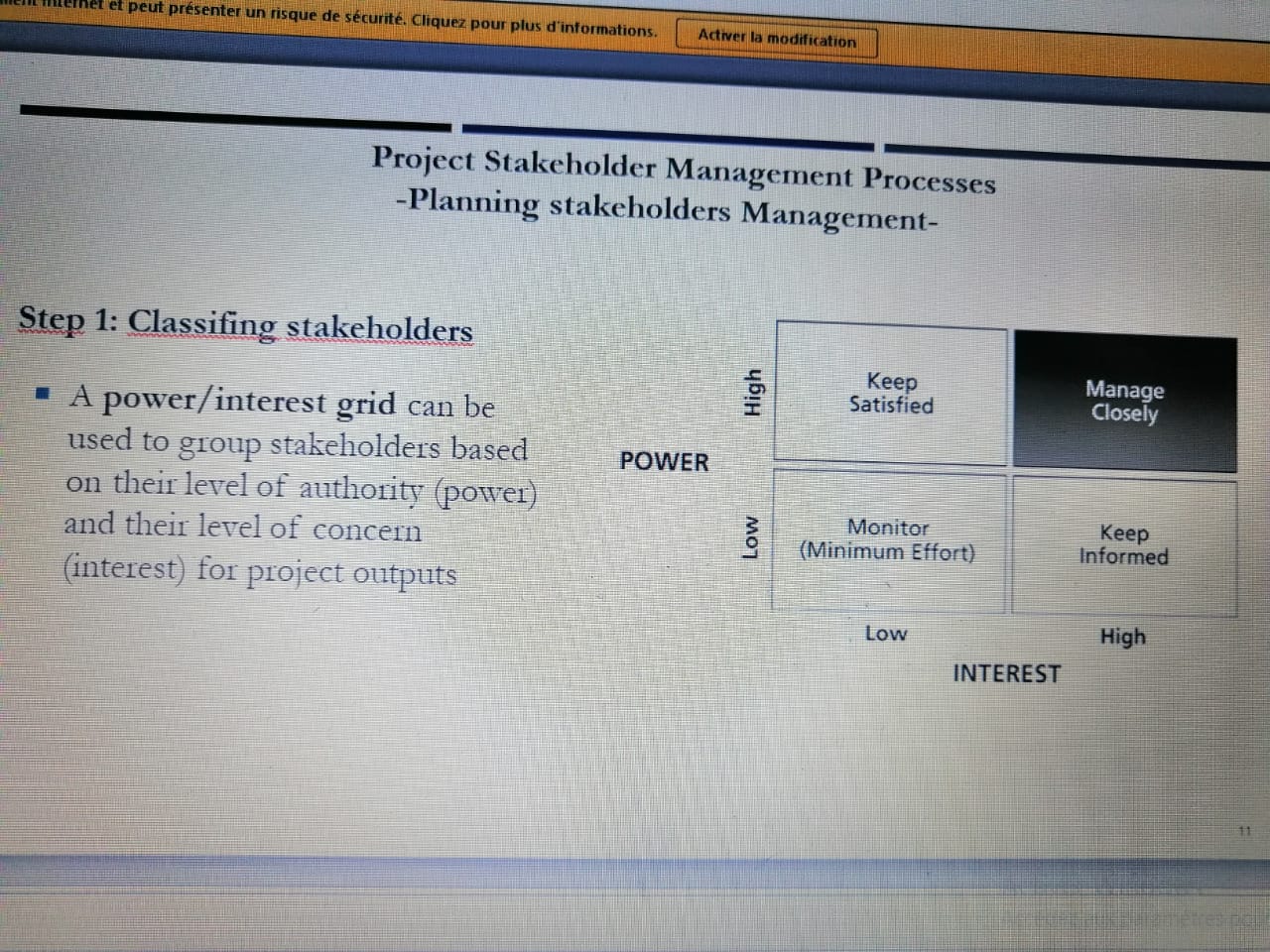

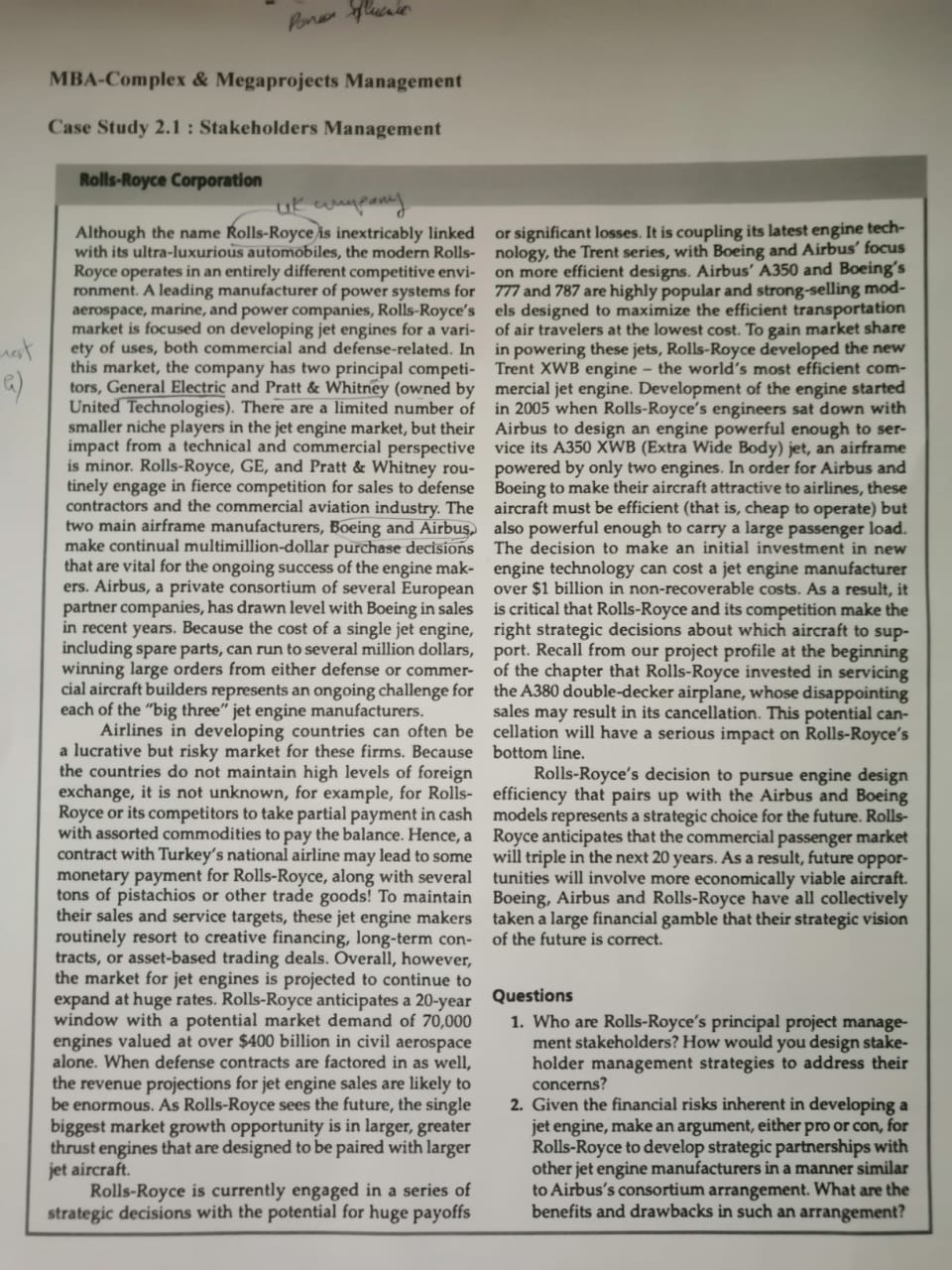

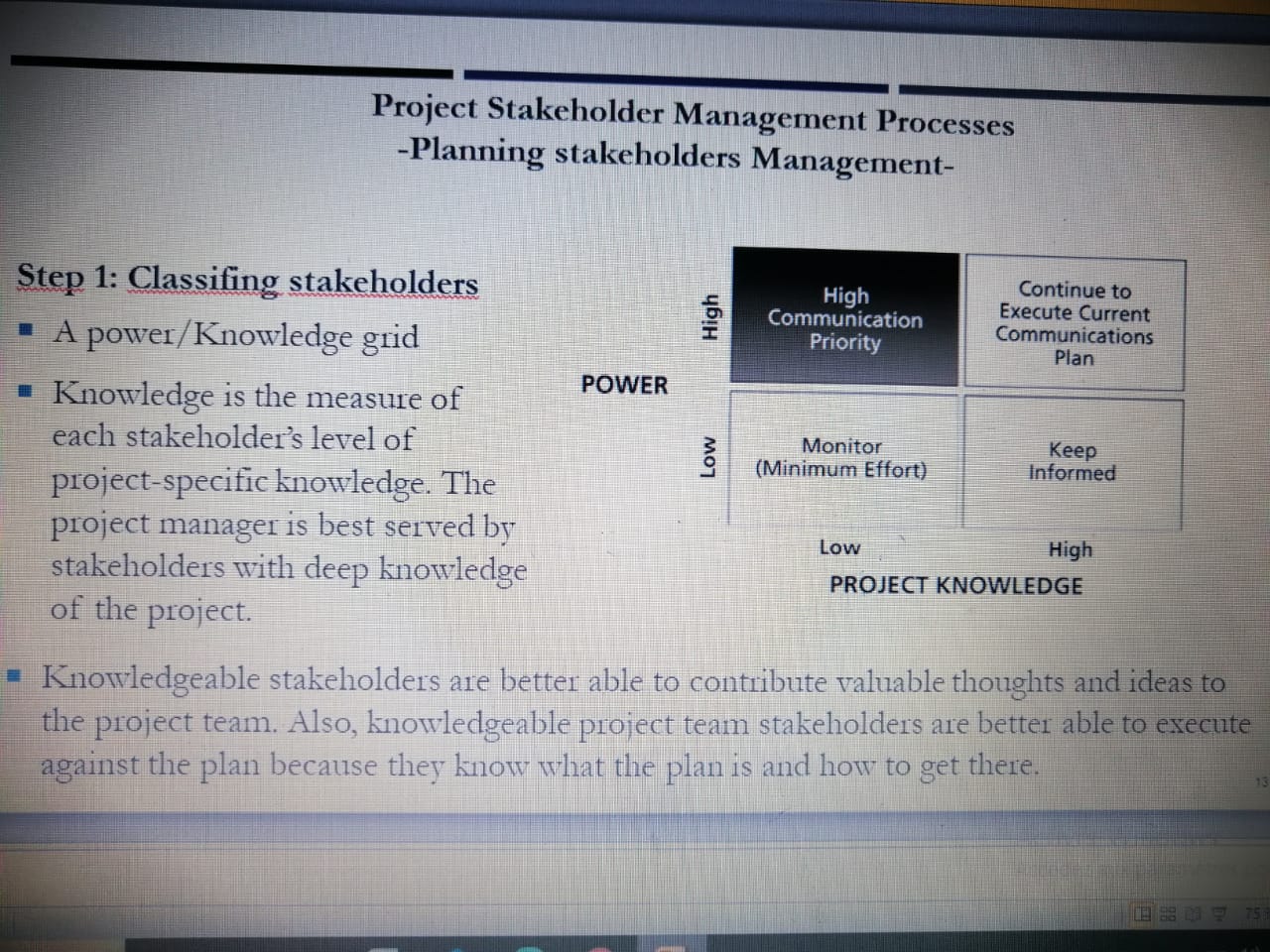

ement Internet et peut presenter un risque de securite. Cliquez pour plus d'informations. Activer la modification Project Stakeholder Management Processes -Planning stakeholders Management- Step 1: Classifing stakeholders Manage Manage High Closely Closely " A power/ influence grid POWER Influence measures the active involvement of the project Monitor Keep Low (Minimum Effort) Informed stakeholder. In other words, if stakeholders are very involved in Low High the project, they will have high INFLUENCE influence For some, the words power and influence may sound very similar. However, as written in the PMBOKR Guide, power refers to the stakeholder's level of authority, whereas influence, as stated, refers to the stakeholder's level of involvement celnet et peut presenter un risque de securite. Cliquez pour plus d'informations. Activer la modification Project Stakeholder Management Processes -Planning stakeholders Management- Step 1: Classifing stakeholders Keep Manage High A power/interest grid can be Satisfied Closely used to group stakeholders based POWER on their level of authority (power) Monitor Keep and their level of concern Low (Minimum Effort) Informed (interest) for project outputs Low High INTERESTMBA-Complex & Megaprojects Management Case Study 2.1 : Stakeholders Management Rolls-Royce Corporation Although the name Rolls-Royce is inextricably linked or significant losses. It is coupling its latest engine tech- with its ultra-luxurious automobiles, the modern Rolls- nology, the Trent series, with Boeing and Airbus' focus Royce operates in an entirely different competitive envi- on more efficient designs. Airbus' A350 and Boeing's ronment. A leading manufacturer of power systems for 777 and 787 are highly popular and strong-selling mod- aerospace, marine, and power companies, Rolls-Royce's els designed to maximize the efficient transportation market is focused on developing jet engines for a vari- of air travelers at the lowest cost. To gain market share ety of uses, both commercial and defense-related. In in powering these jets, Rolls-Royce developed the new (ex ) this market, the company has two principal competi- Trent XWB engine - the world's most efficient com- tors, General Electric and Pratt & Whitney (owned by mercial jet engine. Development of the engine started United Technologies). There are a limited number of in 2005 when Rolls-Royce's engineers sat down with smaller niche players in the jet engine market, but their Airbus to design an engine powerful enough to ser- impact from a technical and commercial perspective vice its A350 XWB (Extra Wide Body) jet, an airframe is minor. Rolls-Royce, GE, and Pratt & Whitney rou- powered by only two engines. In order for Airbus and tinely engage in fierce competition for sales to defense Boeing to make their aircraft attractive to airlines, these contractors and the commercial aviation industry. The aircraft must be efficient (that is, cheap to operate) but ain airframe manufacturers, Boeing and Airbus, also powerful enough to carry a large passenger load. make continual multimillion-dollar purchase decisions The decision to make an initial investment in new that are vital for the ongoing success of the engine mak- engine technology can cost a jet engine manufacturer ers. Airbus, a private consortium of several European over $1 billion in non-recoverable costs. As a result, it partner companies, has drawn level with Boeing in sales is critical that Rolls-Royce and its competition make the in recent years. Because the cost of a single jet engine, right strategic decisions about which aircraft to sup- including spare parts, can run to several million dollars, port. Recall from our project profile at the beginning winning large orders from either defense or commer- of the chapter that Rolls-Royce invested in servicing cial aircraft builders represents an ongoing challenge for the A380 double-decker airplane, whose disappointing each of the "big three" jet engine manufacturers, sales may result in its cancellation. This potential can- Airlines in developing countries can often be cellation will have a serious impact on Rolls-Royce's a lucrative but risky market for these firms. Because bottom line. the countries do not maintain high levels of foreign Rolls-Royce's decision to pursue engine design exchange, it is not unknown, for example, for Rolls- efficiency that pairs up with the Airbus and Boeing Royce or its competitors to take partial payment in cash models represents a strategic choice for the future. Rolls- with assorted commodities to pay the balance. Hence, a Royce anticipates that the commercial passenger market contract with Turkey's national airline may lead to some will triple in the next 20 years. As a result, future oppor- monetary payment for Rolls-Royce, along with several tunities will involve more economically viable aircraft. tons of pistachios or other trade goods! To maintain Boeing, Airbus and Rolls-Royce have all collectively their sales and service targets, these jet engine makers taken a large financial gamble that their strategic vision routinely resort to creative financing, long-term con- of the future is correct. tracts, or asset-based trading deals. Overall, however, the market for jet engines is projected to continue to expand at huge rates. Rolls-Royce anticipates a 20-year Questions window with a potential market demand of 70,000 1. Who are Rolls-Royce's principal project manage- engines valued at over $400 billion in civil aerospace ment stakeholders? How would you design stake- alone. When defense contracts are factored in as well, holder management strategies to address their the revenue projections for jet engine sales are likely to concerns? be enormous. As Rolls-Royce sees the future, the single 2. Given the financial risks inherent in developing a biggest market growth opportunity is in larger, greater jet engine, make an argument, either pro or con, for thrust engines that are designed to be paired with larger Rolls-Royce to develop strategic partnerships with jet aircraft. other jet engine manufacturers in a manner similar Rolls-Royce is currently engaged in a series of to Airbus's consortium arrangement. What are the strategic decisions with the potential for huge payoffs benefits and drawbacks in such an arrangement?Project Stakeholder Management Processes -Planning stakeholders Management- Step 1: Classifing stakeholders High Continue to Execute Current High Communication A power/ Knowledge grid Priority Communications Plan Knowledge is the measure of POWER each stakeholder's level of Monitor Keep Low (Minimum Effort) Informed project-specific knowledge. The project manager is best served by Low High stakeholders with deep knowledge PROJECT KNOWLEDGE of the project. Knowledgeable stakeholders are better able to contribute valuable thoughts and ideas to the project team. Also, knowledgeable project team stakeholders are better able to execute against the plan because they know what the plan is and how to get there. 75