Hello,can it be done on a sheet of paper and the workings should be done properly in margin in accounting formats.please note that the answer should be right

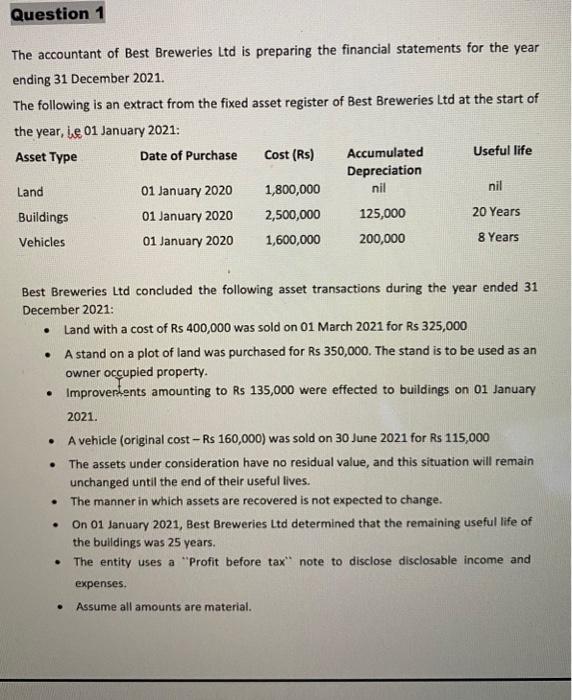

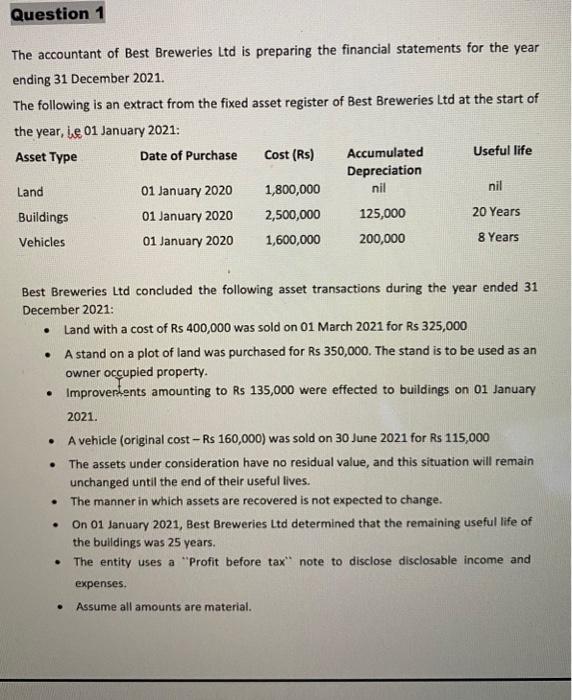

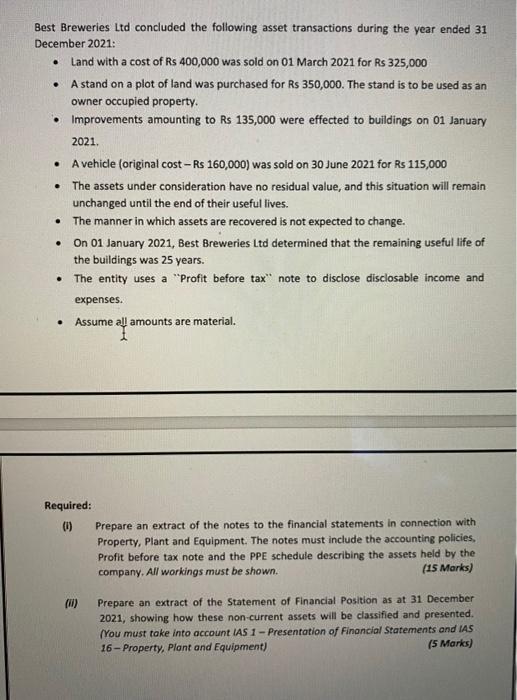

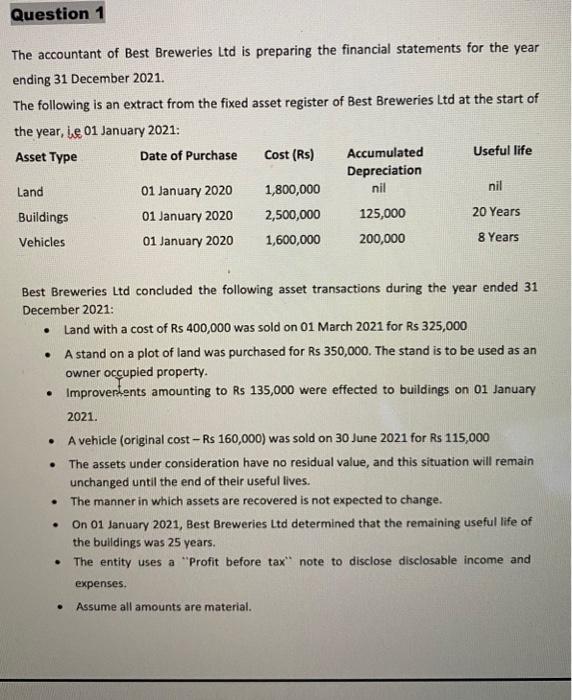

The accountant of Best Breweries Ltd is preparing the financial statements for the year ending 31 December 2021. The following is an extract from the fixed asset register of Best Breweries Ltd at the start of the year, i.e 01 January 2021 : Best Breweries Ltd concluded the following asset transactions during the year ended 31 December 2021: - Land with a cost of Rs 400,000 was sold on 01 March 2021 for Rs 325,000 - A stand on a plot of land was purchased for Rs 350,000. The stand is to be used as an owner occupied property. - Improverfents amounting to Rs 135,000 were effected to buildings on 01 January 2021. - A vehicle (original cost - Rs 160,000) was sold on 30 June 2021 for Rs 115,000 - The assets under consideration have no residual value, and this situation will remain unchanged until the end of their useful lives. - The manner in which assets are recovered is not expected to change. - On 01 January 2021, Best Breweries Ltd determined that the remaining useful life of the bulldings was 25 years. - The entity uses a "Profit before tax" note to disclose disclosable income and expenses. - Assume all amounts are material. Best Breweries Ltd concluded the following asset transactions during the year ended 31 December 2021: - Land with a cost of Rs 400,000 was sold on 01 March 2021 for Rs 325,000 - A stand on a plot of land was purchased for Rs 350,000. The stand is to be used as an owner occupied property. - Improvements amounting to Rs 135,000 were effected to buildings on 01 January 2021. - A vehicle (original cost - Rs 160,000 ) was sold on 30 June 2021 for Rs 115,000 - The assets under consideration have no residual value, and this situation will remain unchanged until the end of their useful lives. - The manner in which assets are recovered is not expected to change. - On 01 January 2021, Best Breweries Ltd determined that the remaining useful life of the buildings was 25 years. - The entity uses a "Profit before tax" note to disclose disclosable income and expenses. - Assume all amounts are material. Required: (i) Prepare an extract of the notes to the financial statements in connection with Property, Plant and Equipment. The notes must include the accounting policies, Profit before tax note and the PPE schedule describing the assets held by the company. All workings must be shown. (15 Marks) (ii) Prepare an extract of the Statement of Financial Position as at 31 December 2021 , showing how these non-current assets will be classified and presented. (You must take into account lAS 1 - Presentation of Financial Statements and IAS 16 - Property, Plant and Equipment)