Answered step by step

Verified Expert Solution

Question

1 Approved Answer

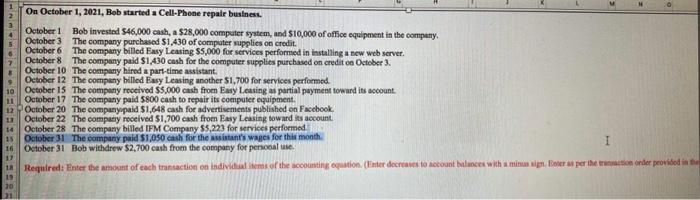

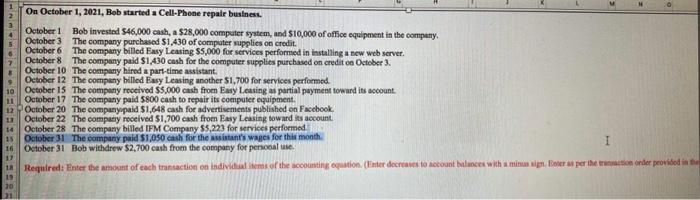

help! 1 . 6 7 9 On October 1, 2021, Bob started a Cell Phone repair business. October 1 Bob invested $46,000 cash, a $28.000

help!

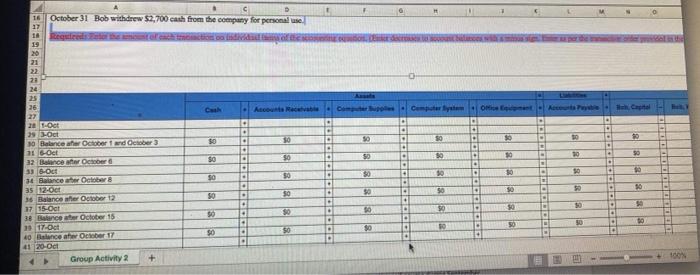

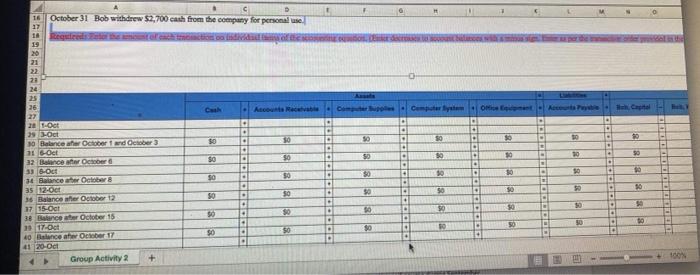

1 . 6 7 9 On October 1, 2021, Bob started a Cell Phone repair business. October 1 Bob invested $46,000 cash, a $28.000 computer system, and $10,000 of office equipment in the company October 3 The company purchased $1,430 of computer supplies on credit. October 6 The company billed Easy Leasing $5,000 for services performed in installing a new web server October 8 The company paid $1,430 cash for the computer supplies purchased on credit on October 3. October 10 The company hired a part-time assistant October 12 The company billed Easy Leasing another $1,700 for services performed 10 October 15 The company received $5,000 cash from Easy Leasing as partial payment toward its account LI October 17 The company paid 5800 cash to repair its computer equipment 12 October 20 The company paid $1.648 cash for advertisements published on Facebook 11 October 22 The company received $1,700 cash from Easy Leasing toward its account October 28 The company billed IFM Company $5,223 for services performed 15 October 31 The company paid $1,050 cash for the Asistant's wages for this month 16 October 31 Bob withdrew $2,700 cash from the company for personal use. in Required: Enter the amount of each transaction on individual tons of the accounting equation. (Toner deres to account balances with a missiers per the order provided in the 17 19 20 C October 31 Bob withdrew $2,700 cash from the company for personal use. Requiremento di 16 17 18 19 20 21 22 ca Accounts Recomme Acest . 1. . . . . . 50 So 50 9 30 30 10 1 SO . 10 SO $0 50 10 30 . . 24 25 26 27 20 1-Oct 29 Oct 10 Balancer October 1 and October 3 1 S-Oet 12 Balance for October 33 6-Oct 34 Bauncher October 35 12-OCT 35 Balance sher October 12 17 15-Oct 38 Encer October 15 38 17-Oct 40 cea October 17 41 20 Oct Group Activity 2 $0 $0 10 30 1 SO . . $0 SO 50 50 50 30 SO 50 . . . 30 50 SO . . . . . 50 50 $0 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started