Help 1 and 2 thanks

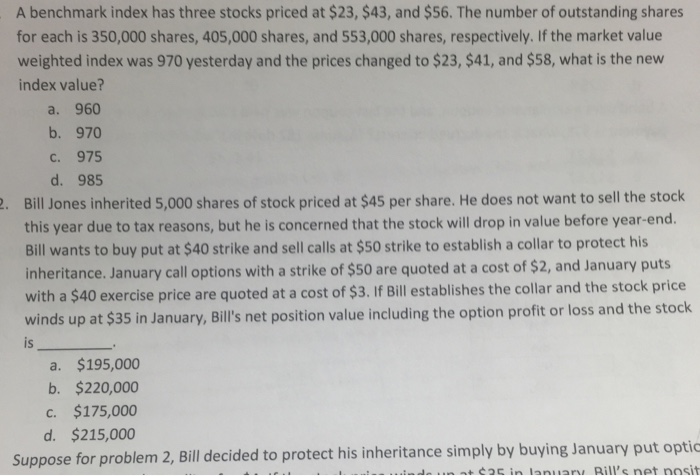

A benchmark index has three stocks priced at $23, $43, and $56. The number of outstanding shares for each is 350, 000 shares, 405,000 shares, and 553,000 shares, respectively. If the market value weighted index was 970 yesterday and the prices changed to $23, $41, and $58, what is the new index value? 960 970 975 985 Bill Jones inherited 5,000 shares of stock priced at $45 per share. He does not want to sell the stock this year due to tax reasons, but he is concerned that the stock will drop in value before year-end. Bill wants to buy put at $40 strike and sell calls at $50 strike to establish a collar to protect his inheritance. January call options with a strike of $50 are quoted at a cost of $2, and January puts with a $40 exercise price are quoted at a cost of $3. If Bill establishes the collar and the stock price winds up at $35 in January, Bill's net position value including the option profit or loss and the stock is_____. $195,000 $220, 000 $175,000 $215,000 Suppose for problem 2, Bill decided to protect his inheritance simply by buying January put optic A benchmark index has three stocks priced at $23, $43, and $56. The number of outstanding shares for each is 350, 000 shares, 405,000 shares, and 553,000 shares, respectively. If the market value weighted index was 970 yesterday and the prices changed to $23, $41, and $58, what is the new index value? 960 970 975 985 Bill Jones inherited 5,000 shares of stock priced at $45 per share. He does not want to sell the stock this year due to tax reasons, but he is concerned that the stock will drop in value before year-end. Bill wants to buy put at $40 strike and sell calls at $50 strike to establish a collar to protect his inheritance. January call options with a strike of $50 are quoted at a cost of $2, and January puts with a $40 exercise price are quoted at a cost of $3. If Bill establishes the collar and the stock price winds up at $35 in January, Bill's net position value including the option profit or loss and the stock is_____. $195,000 $220, 000 $175,000 $215,000 Suppose for problem 2, Bill decided to protect his inheritance simply by buying January put optic