Answered step by step

Verified Expert Solution

Question

1 Approved Answer

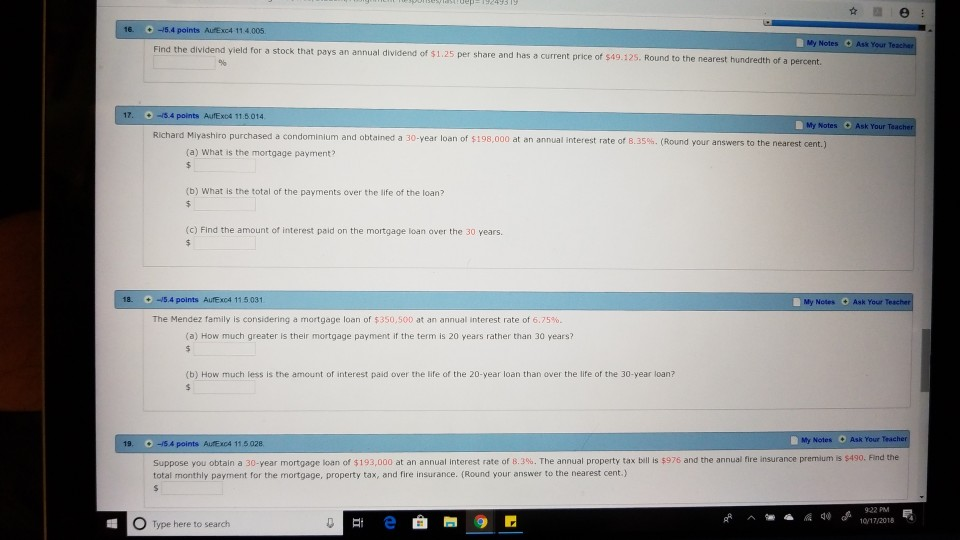

help 16.-15.4 points AufExC4 114.005 My Notes Ask Your Find the dividend yield for a stock that pays an annual dividend of $1.25 per share

help

16.-15.4 points AufExC4 114.005 My Notes Ask Your Find the dividend yield for a stock that pays an annual dividend of $1.25 per share and h as a current price of $49.125. Round to the nearest hundredth of a percent. --3.4 points AutEx04 11.6014 My Notes Ask Your Richard Miyashiro purchased a condominium and obtained a 30-year loan of $198,000 at an annual interest rate of 8.35%. (Round your answers to the nearest cent.) (a) What is the mortgage payment? (b) What is the total of the payments over the life of the loan? (c) Find the amount of interest paid on the mortgage loan over the 30 years. 18.-5.4 points AufExC4 11.5.031 My Notes Ask Your The Mendez family is considering a mortgage loan of $350,500 at an annual interest rate of 6.75% (a) How much greater is their mortgage payment if the term is 20 years rather than 30 years? (b) How much less is the amount of interest paid over the life of the 20-year loan than over the life of the 30-year loan? My Notes Ask Your 19. -45 4 points AutexCA 11 5028 suppose you obtain a 30-year mortgage loan of $193 000 at an annual interest rate of B 3% The annual property tax bil i.976 and the ann arie insurance a total monthly payment for the mortgage, property tax, and fire insurance. (Round your answer to the nearest cent.) mums t400 i 922 PM O Type here to search 1017/2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started