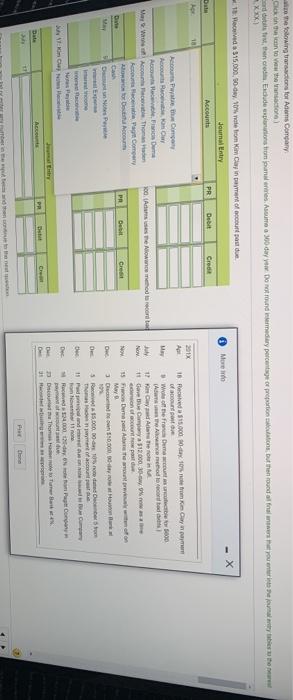

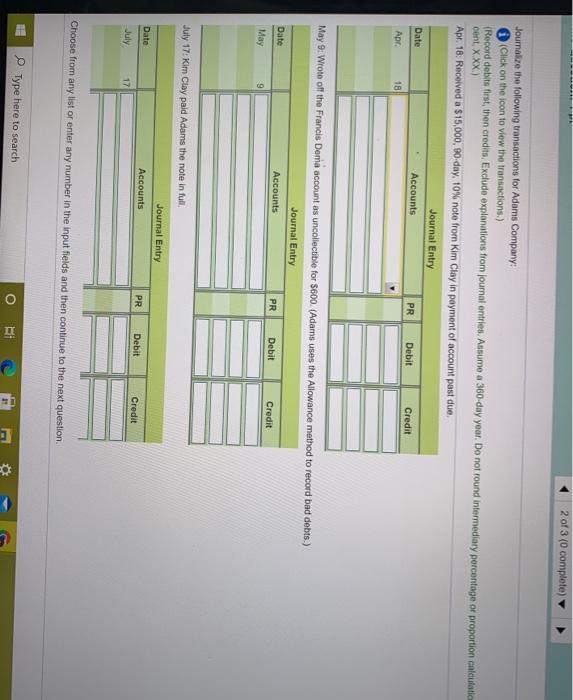

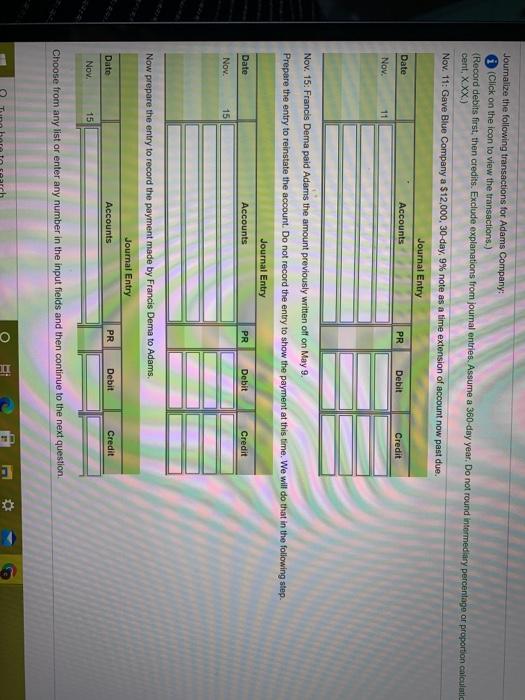

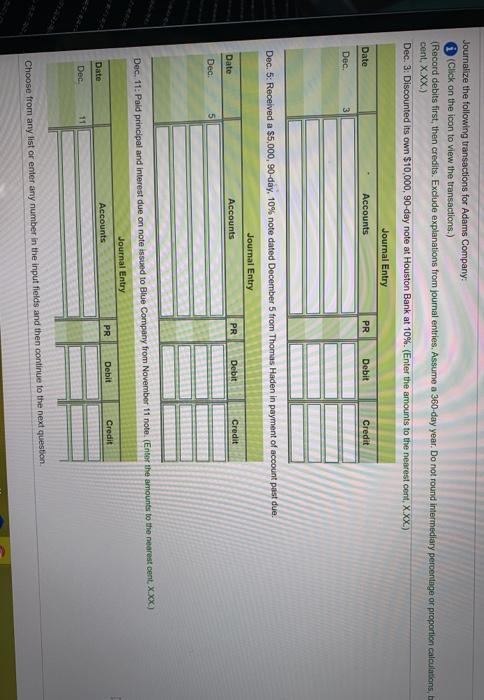

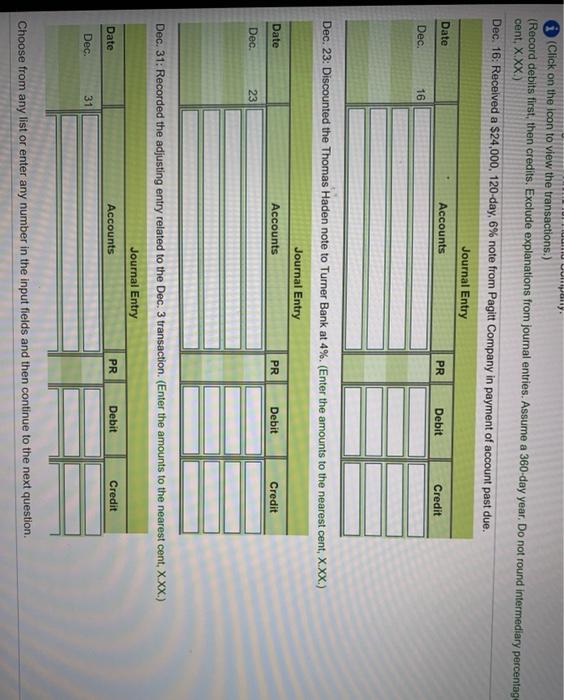

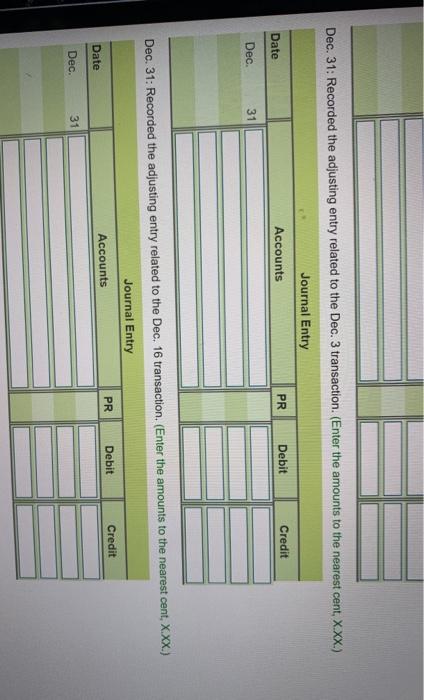

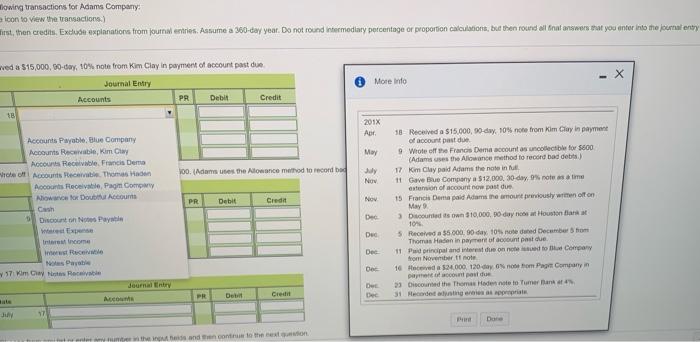

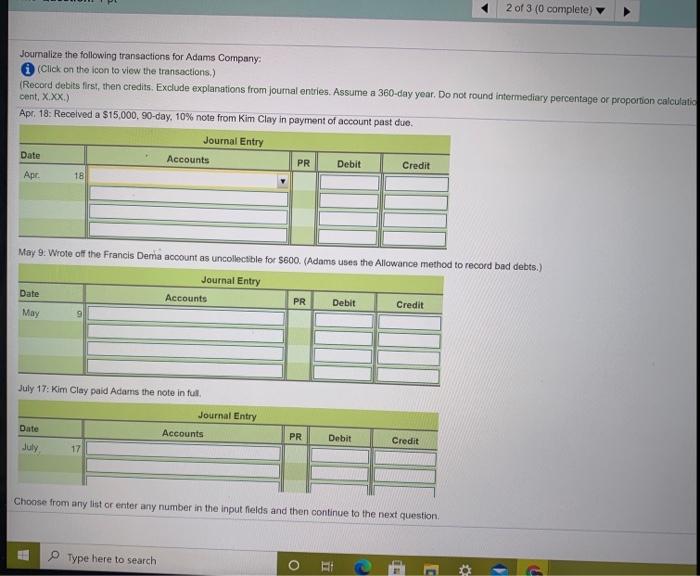

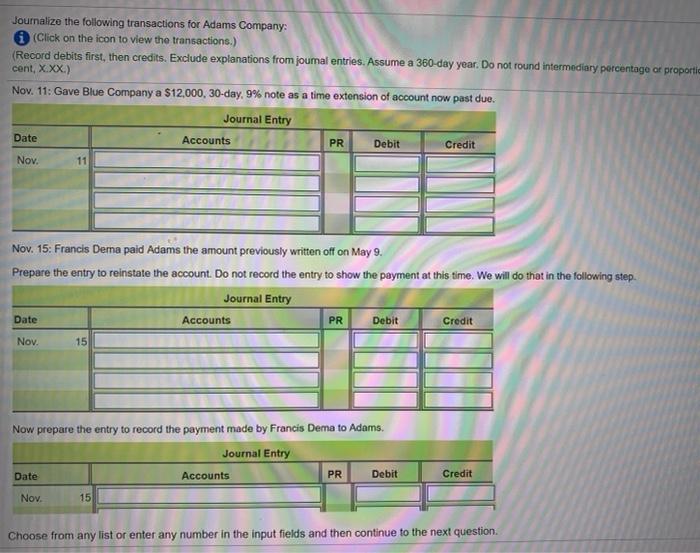

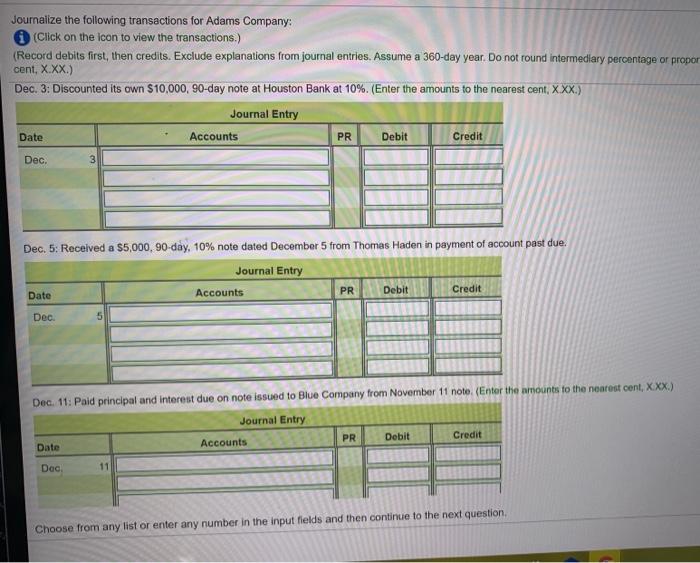

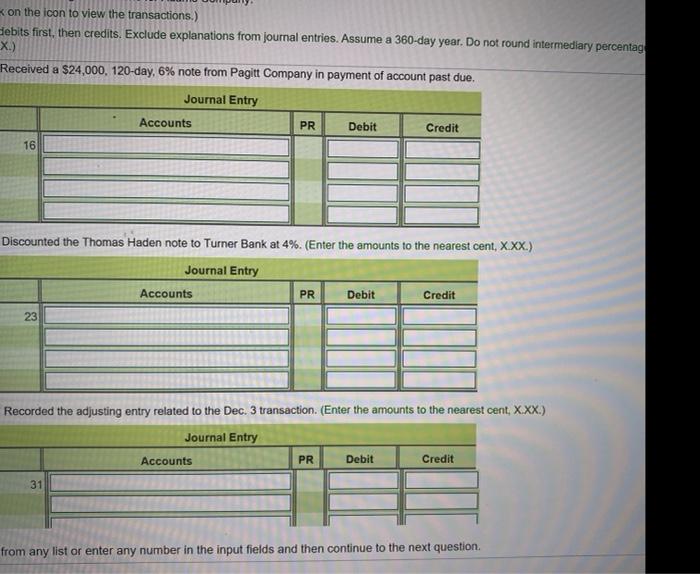

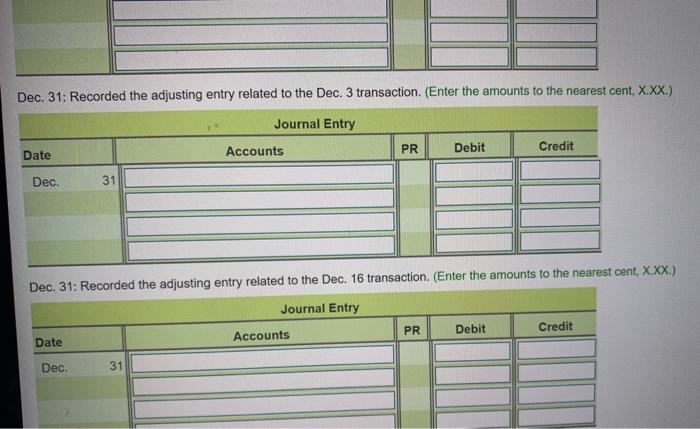

owing transactions for com Company Click on the section Bordit trance Excude postupan Asuma 100 day. Do not found immediary percentage of produtthanda na wewe unath XXX) More Receives 315.000, sodytom Kim Clay in tamen account pour de Journal Entry Account PR Debit Croce 10 201X A Pathwimpon Ay Acous Acc Thomas Recent Porn Company 10. Accetta 18 Received 15.000 - 10 trom Kaya of Wote frem 000 Autocad 1 Adet 11 Gemanya 312.000, 30-may concept Der Autor May PR Det Cre Now Die Cash DNP O 129 13 10 5 R15.000.000 metro Thomas Hentau 11 Pund om 11 24.000 de oro pour 3D Thule ww om CN De Acco PP wanne 2 of 3 (0 complete) Journalize the following transactions for Adams Company: (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not round intermediary percentage or proportion calculation cent. X.XX) Apr. 18: Receved a $15,000, 90-day, 10% note from Kim Clay in payment of account past due Journal Entry Date Accounts PR Debit Credit Apr 18 May 9: Wrote of the Francis Dema account as uncollectible for $600. (Adams uses the Allowance method to record bad debts.) Journal Entry Accounts Date PR Debit Credit May 9 July 17: Kim Clay pald Adams the note in full Journal Entry Date Accounts July 17 PR Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Type here to search O - E Journalize the following transactions for Adams Company: (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360 day year. Do not round intermediary percentage or proportion calculati cent, X.XX.) Nov. 11: Gave Blue Company a $12,000, 30-day, 9% note as a time extension of account now past due. Journal Entry Date Accounts PR Debit Credit Nov. 11 Nov. 15: Francis Dema paid Adams the amount previously written off on May 9. Prepare the entry to reinstate the account. Do not record the entry to show the payment at this time. We will do that in the following step. Journal Entry Date Accounts PR Debit Credit Nov. 15 Now prepare the entry to record the payment made by Francis Dema to Adams Journal Entry Date Accounts PR Debit Credit Nov. 15 Choose from any list or enter any number in the input fields and then continue to the next question o E - T Journalize the following transactions for Adams Company: (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not found intermediary percentage or proportion calculations, cent, X.XX.) Dec. 3: Discounted its own $10,000, 90-day note at Houston Bank at 10%. (Enter the amounts to the nearest cont, X.XX.) Journal Entry Date Accounts PR Debit Credit Dec. 3 Dec. 5: Received a $5,000, 90-day, 10% note dated December 5 from Thomas Haden in payment of account past due. Journal Entry Accounts Date PR Debit Credit Dec Dec, 11: Pald principal and interest due on note issued to Blue Company from November 11 note. (Enter the amounts to the nearest cent XXX) Journal Entry Date Accounts PR Debit Credit Dec 11 Choose from any list or enter any number in the input fields and then continue to the next question ully. (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not round intermediary percentage cent, X.XX) Dec 16: Received a $24,000, 120-day, 6% note from Pagitt Company in payment of account past due. Journal Entry Date Accounts PR Debit Credit Dec. 16 Dec. 23: Discounted the Thomas Haden note to Turner Bank at 4%. (Enter the amounts to the nearest cent, X.XX.) Journal Entry Date Accounts PR Debit Credit Dec. 23 Dec. 31: Recorded the adjusting entry related to the Dec. 3 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry Date Accounts PR Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Dec. 31: Recorded the adjusting entry related to the Dec. 3 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry PR Accounts Debit Credit Date Dec. 31 Dec. 31: Recorded the adjusting entry related to the Dec. 16 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry PR Debit Credit Date Accounts Dec. 31 liowing transactions for Adams Company: icon to view the transactions) first, then credits. Ex explanations from ournal entries. Assume a 360-day year. Do not found intermediary percentage or proportion calculations, but the round all natawwers that you enter into the journal entry ved a $15,000, 30-day, 10% note from Kim Clay in payment of account past du Journal Entry Accounts PR Debit Credit More Info B 201% Adr May Accounts Payable, Blue Company Accounts Recebi, Kim Clay Accounts Receivable Francis Dema de of Accounts receive Thomas Haden Accounts Receivable Page Company Ahow for Dout Account 100. (Adams uses the Allowance method to record bad July NUN PR Debit Credit Nov 18 Received a $15.000, 90 day, 10% note from Kim Clay in payment of account past du 9 Wrote offre Francis Dema account as uncollectible for $800 (Adams uses the Allowance method to record bad debit) 17 km Clay paid Adams the note in 11 Gave Blue Company a $12,000, 30 day, 9% not as a time camion of count now past du 15 France Depaid Adams the amount outly we off on May > Decorados own $10,000,0 day at Houston 10 Received a $5,000 day 10% ned December from Thomas Hadinin payment of account paste 11 Pd principal and interest on need to be company from November tot 10 Hoceva 522000 120 day on om Page Company in popote 23 Discounted the Thomas Hodeto Tumor Dan 4 Discount on N Payti Dec De Dee Income Recen N Payat 37 Kim Clay Roca De Journal Entry PR Credit Acco De JU 97 Done them and the best 2 of 3 (0 complete Journalize the following transactions for Adams Company (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not found intermediary percentage or proportion calculatic cent, X.XX Apr. 18: Received a $15,000, 90-day, 10% note from Kim Clay in payment of account past due. Journal Entry Date Accounts PR Debit Credit Apr 18 May 9. Wrote of the Francis Dema account as uncollectible for $600. (Adams uses the Allowance method to record bad debts.) Journal Entry Date Accounts PR Debit Credit May 9 July 17: Kim Clay paid Adams the note in full Journal Entry Date Accounts PR Debit Credit July 17 Choose from any list or enter any number in the input fields and then continue to the next question Type here to search o P C Journalize the following transactions for Adams Company: (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from joumal entries. Assume a 360 day year. Do not found intermediary percentage ar proporti cent, X.XX.) Nov. 11: Gave Blue Company a $12,000, 30-day, 9% note as a time extension of account now past due. Journal Entry Accounts PR Credit Date Debit Nov. 11 Nov. 15: Francis Dema paid Adams the amount previously written off on May 9. Prepare the entry to reinstate the account. Do not record the entry to show the payment at this time. We will do that in the following step. Journal Entry PR Debit Date Accounts Credit Nov. 15 Now prepare the entry to record the payment made by Francis Dema to Adams, Journal Entry Date Accounts PR Debit Credit Nov. 15 Choose from any list or enter any number in the input fields and then continue to the next question. Journalize the following transactions for Adams Company: (Click on the icon to view the transactions.) (Record debits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not round intermediary percentage or propor cent, X.XX.) Dec 3: Discounted its own $10,000, 90-day note at Houston Bank at 10%. (Enter the amounts to the nearest cent, XXX.) Journal Entry Accounts Debit Credit Date PR Dec. 3 Dec. 5: Received a $5,000, 90-day, 10% note dated December 5 from Thomas Haden in payment of account past due. Journal Entry Accounts PR Date Debit Credit Dec Dec. 11: Pald principal and interest due on note issued to Blue Company from November 11 note. (Enter the amounts to the nearest cent, XXX.) Journal Entry Date Accounts PR Debit Credit Dec Choose from any list or enter any number in the input fields and then continue to the next question on the icon to view the transactions.) Bebits first, then credits. Exclude explanations from journal entries. Assume a 360-day year. Do not found intermediary percentag x.) Received a $24,000, 120-day, 6% note from Pagitt Company in payment of account past due. Journal Entry Accounts PR Debit Credit 16 Discounted the Thomas Haden note to Turner Bank at 4%. (Enter the amounts to the nearest cent, X.XX.) Journal Entry Accounts PR Debit Credit 23 Recorded the adjusting entry related to the Dec. 3 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry Accounts PR Debit Credit 31 from any list or enter any number in the input fields and then continue to the next question Dec. 31: Recorded the adjusting entry related to the Dec. 3 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry Accounts PR Debit Date Credit Dec. 31 Dec. 31: Recorded the adjusting entry related to the Dec. 16 transaction. (Enter the amounts to the nearest cent, X.XX.) Journal Entry PR Debit Credit Date Accounts Dec. 31