Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help 27.) Peter operates a sole proprietorship using the cash method. Peter made the following expenditures: $480 to Truist Bank for 12 months of interest

Help

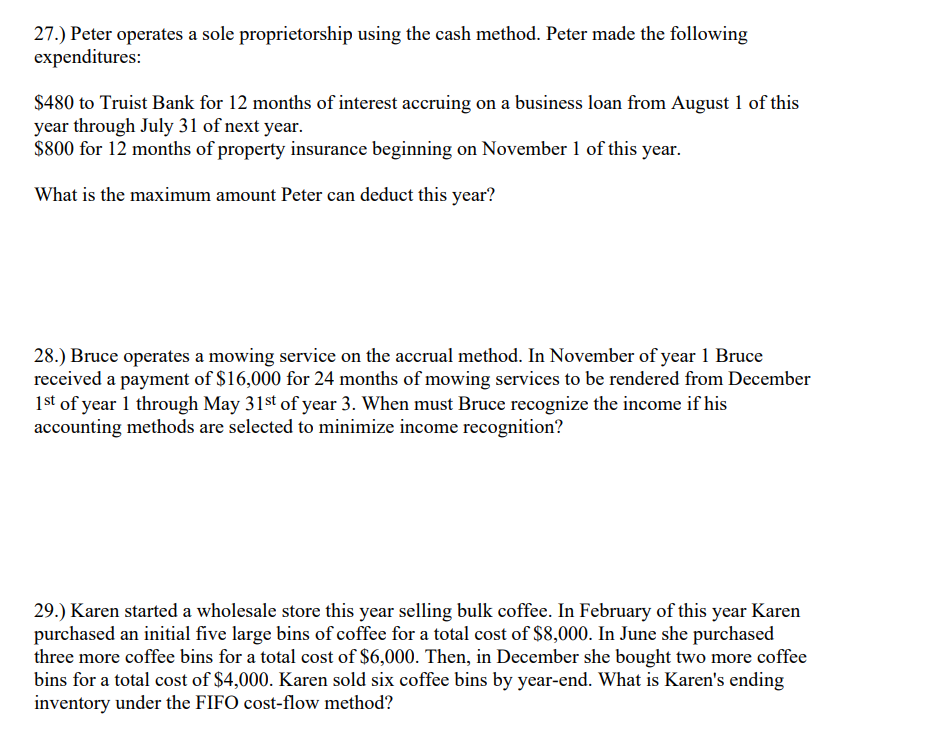

27.) Peter operates a sole proprietorship using the cash method. Peter made the following expenditures: $480 to Truist Bank for 12 months of interest accruing on a business loan from August 1 of this year through July 31 of next year. $800 for 12 months of property insurance beginning on November 1 of this year. What is the maximum amount Peter can deduct this year? 28.) Bruce operates a mowing service on the accrual method. In November of year 1 Bruce received a payment of $16,000 for 24 months of mowing services to be rendered from December 1st of year 1 through May 31st of year 3 . When must Bruce recognize the income if his accounting methods are selected to minimize income recognition? 29.) Karen started a wholesale store this year selling bulk coffee. In February of this year Karen purchased an initial five large bins of coffee for a total cost of $8,000. In June she purchased three more coffee bins for a total cost of $6,000. Then, in December she bought two more coffee bins for a total cost of $4,000. Karen sold six coffee bins by year-end. What is Karen's ending inventory under the FIFO cost-flow method

27.) Peter operates a sole proprietorship using the cash method. Peter made the following expenditures: $480 to Truist Bank for 12 months of interest accruing on a business loan from August 1 of this year through July 31 of next year. $800 for 12 months of property insurance beginning on November 1 of this year. What is the maximum amount Peter can deduct this year? 28.) Bruce operates a mowing service on the accrual method. In November of year 1 Bruce received a payment of $16,000 for 24 months of mowing services to be rendered from December 1st of year 1 through May 31st of year 3 . When must Bruce recognize the income if his accounting methods are selected to minimize income recognition? 29.) Karen started a wholesale store this year selling bulk coffee. In February of this year Karen purchased an initial five large bins of coffee for a total cost of $8,000. In June she purchased three more coffee bins for a total cost of $6,000. Then, in December she bought two more coffee bins for a total cost of $4,000. Karen sold six coffee bins by year-end. What is Karen's ending inventory under the FIFO cost-flow method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started