Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help #32 Exercise 11-3A (Algo) Effect of accounting events on the financial statements of a partnership LO 11-1 Falth Busby and Jeremy Beatty started the

help #32

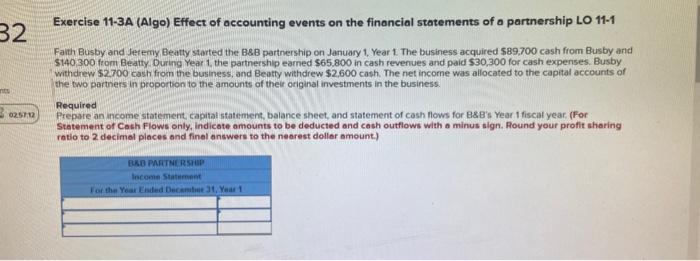

Exercise 11-3A (Algo) Effect of accounting events on the financial statements of a partnership LO 11-1 Falth Busby and Jeremy Beatty started the B8B partnership on January 1, Year 1 The business acquired $89,700 cash from Busby and $140,300 from Beatty During Year 1 the partnership earned $65.800 in cash revenues and paid $30,300 for cash expenses. Busby withdrew $2700 cash from the business, and Beatty withdrew $2,600 cash. The net income was allocated to the capital accounts of the two partners in proportion to the amounts of their original investments in the business. Required Prepare an income statement, capitat statement, balance sheet, and statement of cash flows for B8B's Year 11 iscal year. (For Statement of Cash Flows only, indicate amounts to be deducted and cash outflows with a minus sign. Pound your profit sharing ratio to 2 decimal places and finel answers to the nearest doller amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started