Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help A new firm is developing its business plan. It will require $750,000 of assets, and it projects $501,800 of sales and $421,800 of operating

help

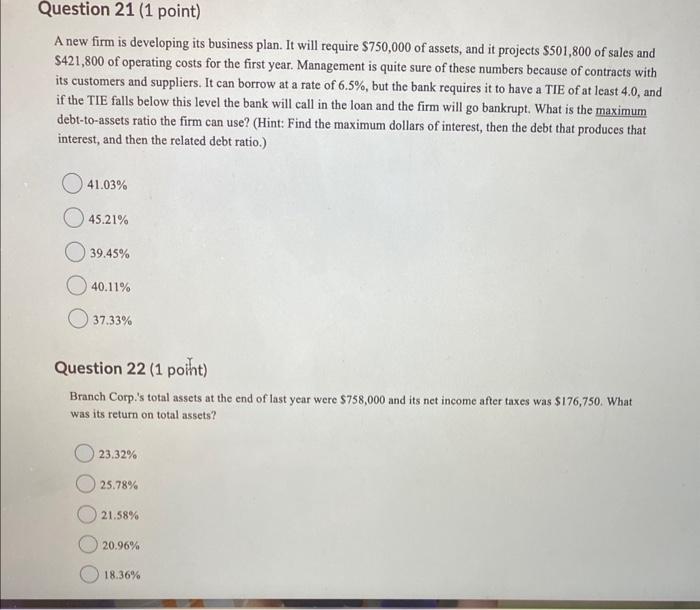

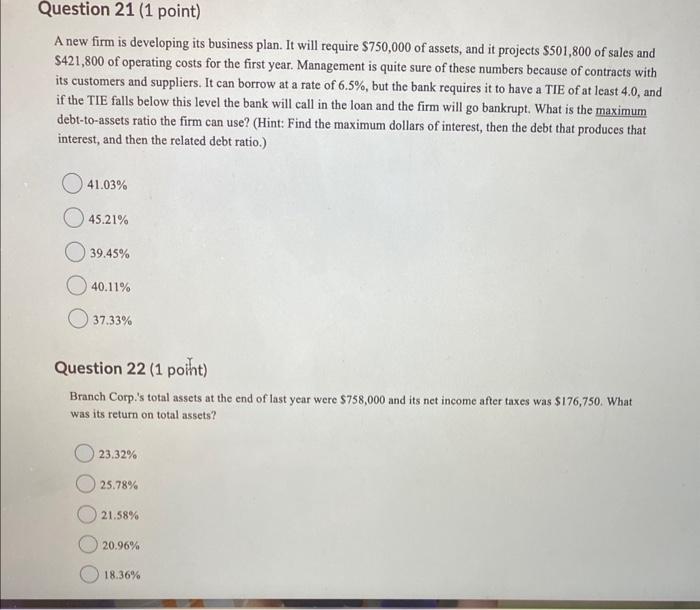

A new firm is developing its business plan. It will require $750,000 of assets, and it projects $501,800 of sales and $421,800 of operating costs for the first year. Management is quite sure of these numbers because of contracts with its customers and suppliers. It can borrow at a rate of 6.5%, but the bank requires it to have a TIE of at least 4.0, and if the TIE falls below this level the bank will call in the loan and the firm will go bankrupt. What is the maximum debt-to-assets ratio the firm can use? (Hint: Find the maximum dollars of interest, then the debt that produces that interest, and then the related debt ratio.) 41.03% 45.21% 39.45% 40.11% 37.33% Question 22 (1 poiht) Branch Corp.'s total assets at the end of last year were $758,000 and its net income after taxes was $176,750. What was its return on total assets? 23.32% 25.78% 21.58% 20.96% 18.36%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started