Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed

Help

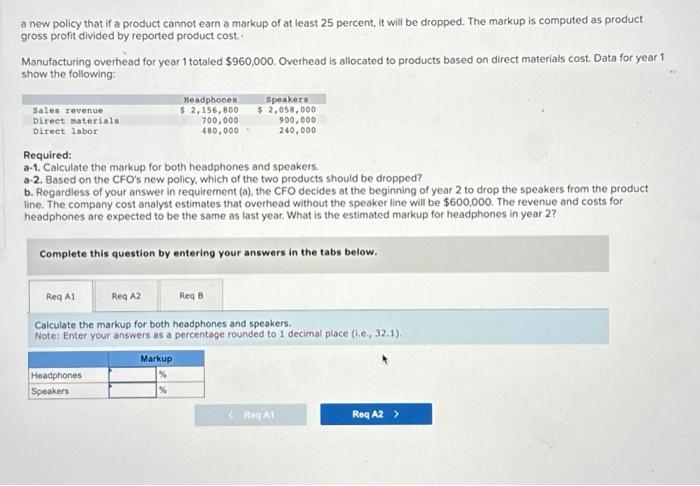

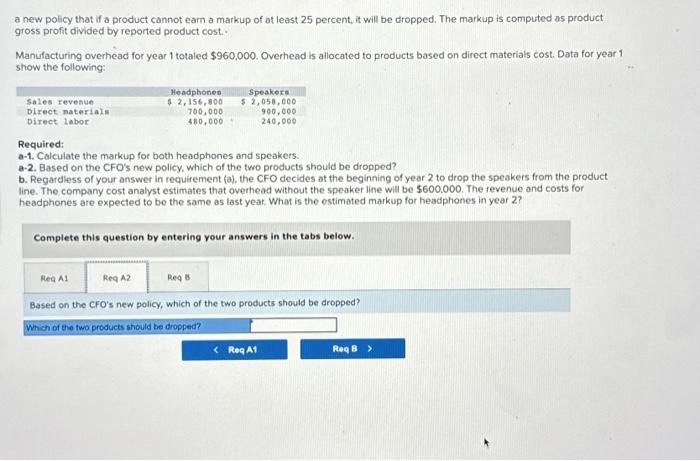

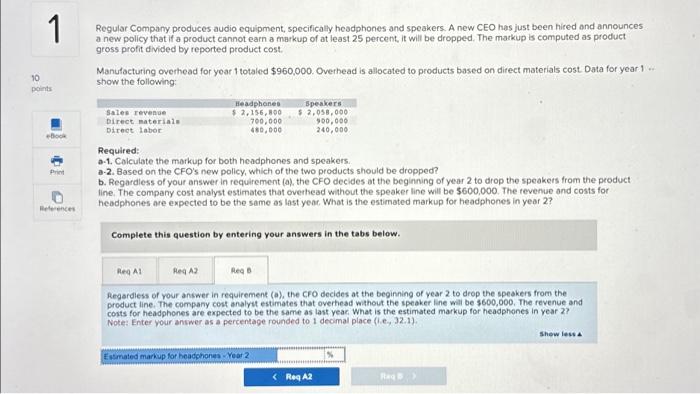

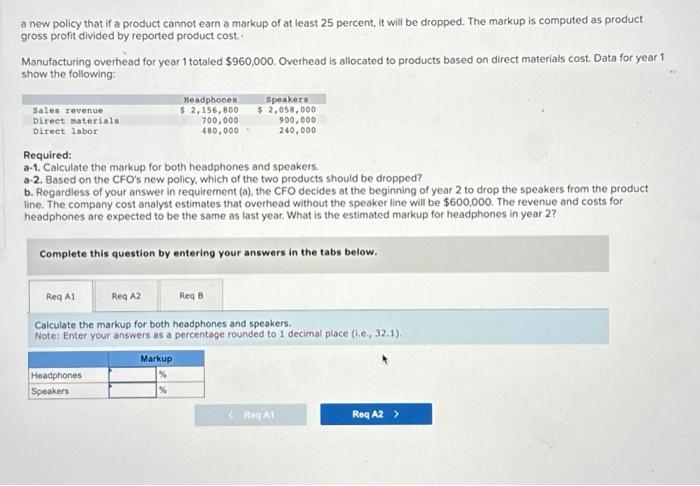

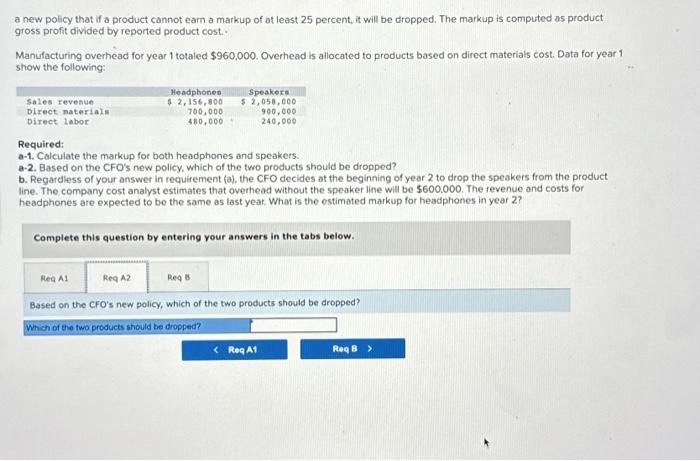

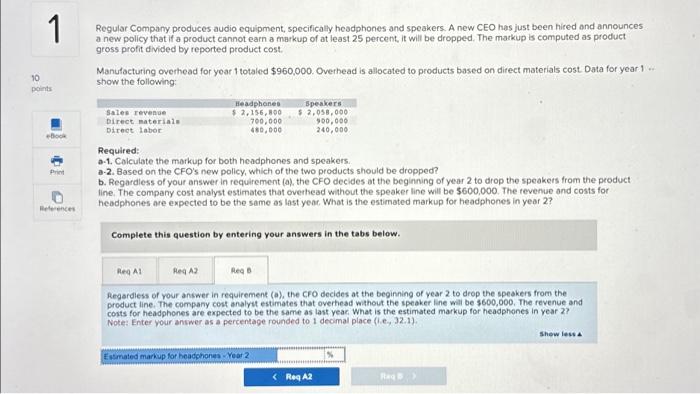

a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product gross profit divided by reported product cost. Manufacturing overhead for year 1 totaled $960,000, Overhead is allocated to products based on direct materials cost. Data for year 1 show the following: Required: a-1. Calculate the markup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst estimates that overhead without the speaker line will be $600,000. The revenue and costs for headphones are expected to be the same as last year, What is the estimated markup for headphones in year 2 ? Complete this question by entering your answers in the tabs below. Calculate the markup for both headphones and speakers. Note: Enter your answers as a percentage rounded to 1 decimal place (1.e., 32.1). Regular Company produces audio equipment, specifically headphones and speakers. A new CEO has just been hired and announces a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product gross profit divided by reported product cost. Manufacturing overhead for yoar 1 totaled $960,000. Overhead is allocated to products based on direct materials cost Data for year 1 .. show the following: Required: a-1. Colculate the morkup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst estimates that overhead without the speaker line will be $600,000. The revenue and costs for headphones are expected to be the same as last yeac. What is the estimated markup for headphones in year 2 ? Complete this question by entering your answers in the tabs below. Regardless of your answer in requirement (a), the cro decides at the beginning of year 2 to drop the speakers from the product line. The company cost andyut estimates that overhead without the speaker line will be $600,000, The revenue and costs for headphones are expected to be the same as last year. What is the estimated markup for headphones in year 2 ? Note: Enter your answer as a percentage rounded to 1 decimal place (1.e,32.1). a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product gross profit divided by reported product cost. Manufacturing overhead for year 1 totaled $960,000. Overhead is allocated to products based on direct materials cost. Data for year 1 show the following: Required: a-1. Calculate the markup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardiess of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product line. The company cost analyst estimates that overhead without the speaker line will be $600,000. The revenue and costs for headphones are expected to be the same as last year. What is the estimated markup for headphones in year 2 ? Complete this question by entering your answers in the tabs below. Based on the CFO's new policy, which of the two products should be dropped

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started