Answered step by step

Verified Expert Solution

Question

1 Approved Answer

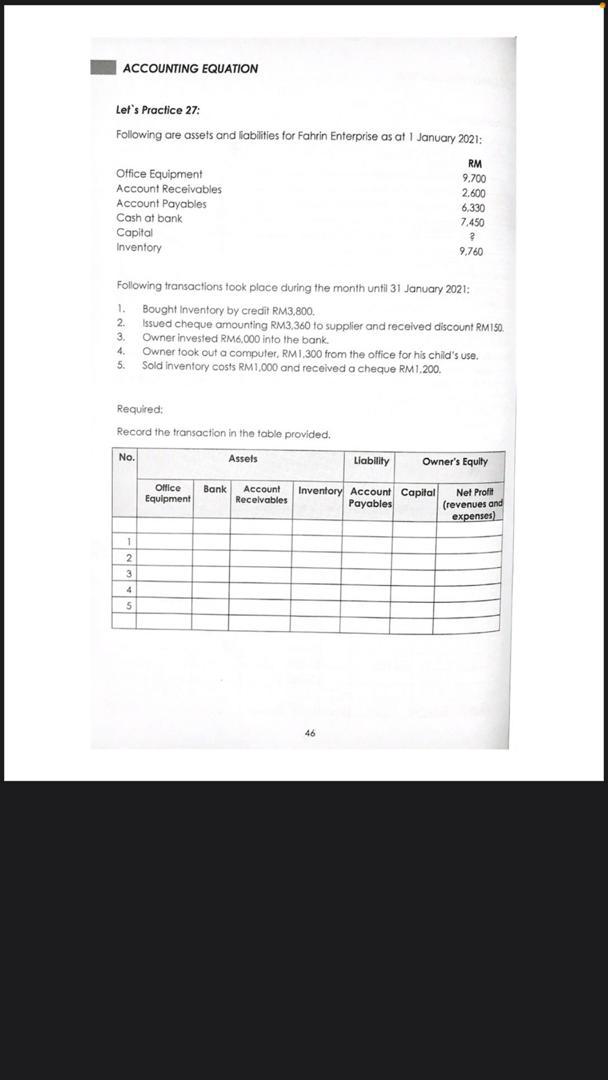

HELP!! ACCOUNTING EQUATION Let's Practice 27: Following are assets and liabilities for Fahrin Enterprise as at 1 January 2021: Office Equipment Account Receivables Account Payables

HELP!!

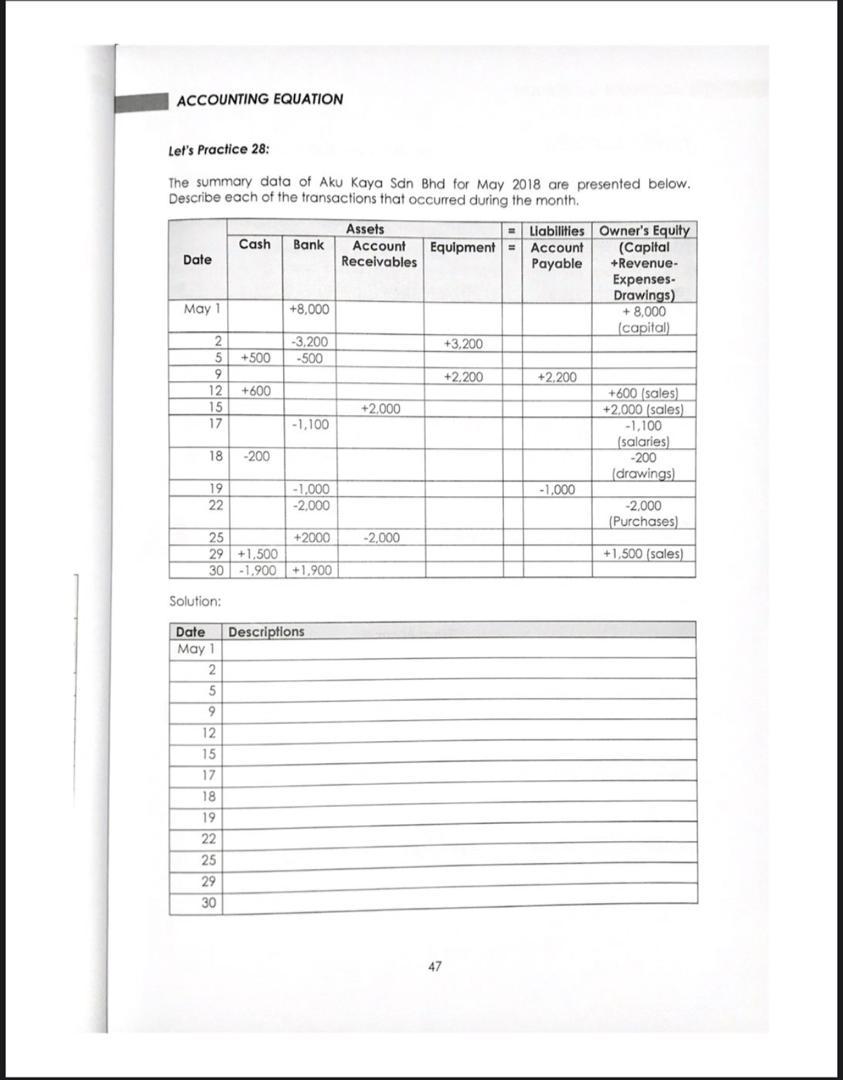

ACCOUNTING EQUATION Let's Practice 27: Following are assets and liabilities for Fahrin Enterprise as at 1 January 2021: Office Equipment Account Receivables Account Payables Cash at bank Capital Inventory RM 9,700 2.600 6.330 7,450 2 9,760 Following transactions took place during the month until 31 January 2021: 1. Bought Inventory by Credit RM3.800 2 Issued cheque amounting RM3,360 to supplier and received discount RM150 3 Owner invested RM6,000 into the bank. 4 Owner took out a computer, RM1.300 from the office for his child's use. 5. Sold inventory costs RM1,000 and received a cheque RM1.200 Required: Record the transaction in the table provided. No. Assets Liability Owner's Equity Office Equipment Bank Account Recolvables Inventory Account Capital Net Profil Payables (revenues and expenses) 1 2] 3 4 ACCOUNTING EQUATION Let's Practice 28: +3,200 The summary data of Aku Kaya Sdn Bhd for May 2018 are presented below, Describe each of the transactions that occurred during the month. Assets = Liabilities Owner's Equity Cash Bank Account Equipment = Account (Capital Date Receivables Payable +Revenue- Expenses- Drawings) May +8,000 +8,000 (capital) 2 -3,200 5 +500 -500 9 +2.200 +2.200 12 +600 +600 sales) 15 +2.000 +2.000 (sales) 17 -1.100 -1.100 salaries) 18 -200 -200 drawings) 19 - 1,000 -1.000 22 -2.000 2.000 (Purchases) 25 +2000 -2,000 29 +1.500 +1.500 (sales) 30 -1.900 +1.900 Solution: Descriptions Date May 1 2 5 9 12 15 17 18 19 22 25 29 30 47Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started