help

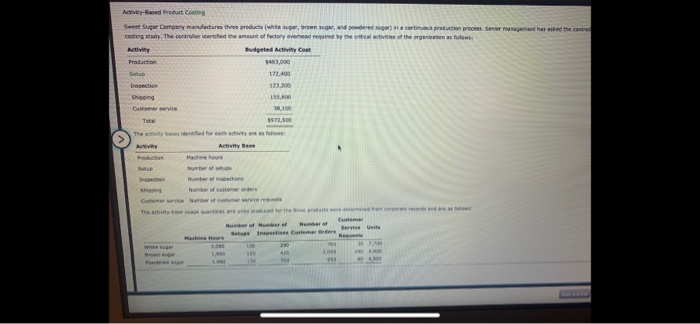

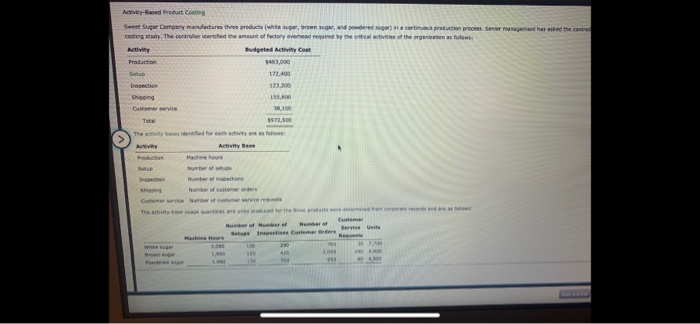

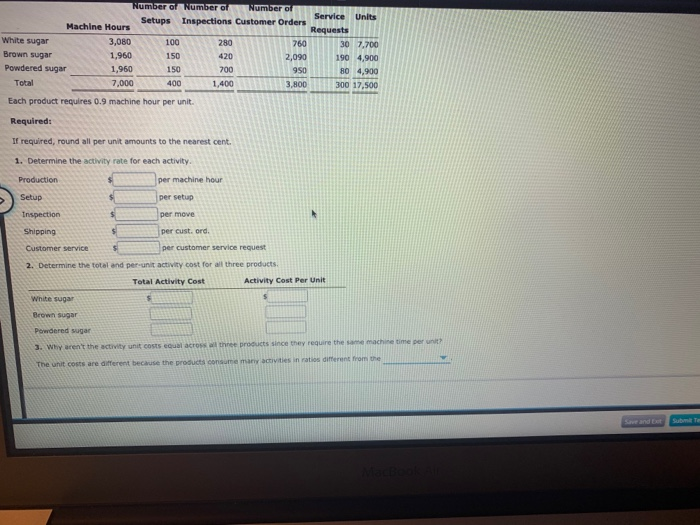

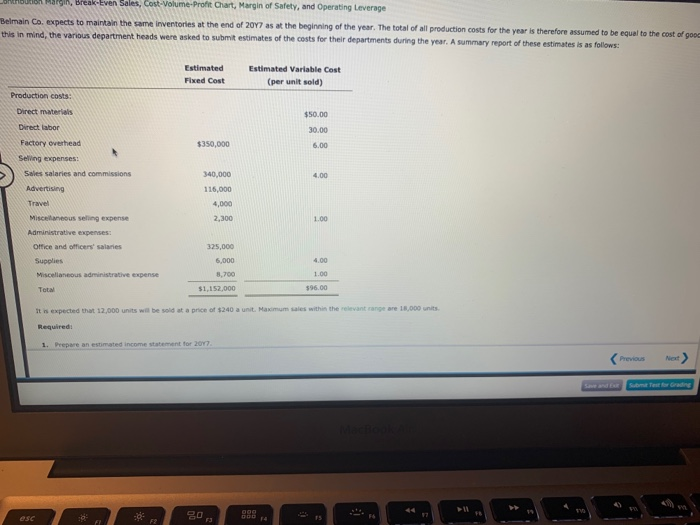

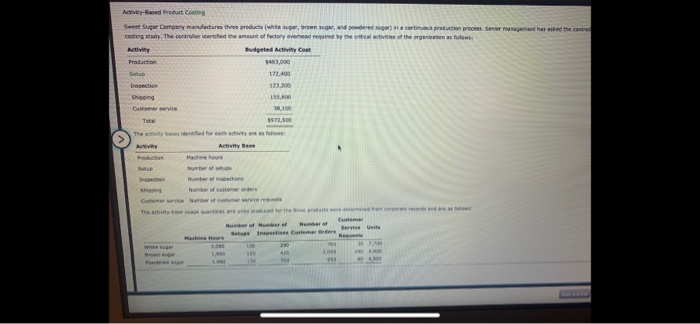

Activity-Based Product Coating Sweet Sugar Coromandres the products (white sugar, brown sugar and powered in a cortinuous production processene Costing study. The controllerted the amount of factory over the lives of the organ as follows Activity dote Active Cast hered the contra 123200 Shipping The inte ressos 100 Number of Number of Number of Machine Hours Setups Inspections Customer Orders Service Requests White sugar 3,080 280 Brown sugar 1,960 420 2,090 190 4,900 Powdered sugar 1,950 150 700 4,900 Total 7.000 1,400 3,800 300 17,500 Each product requires 0.9 machine hour per unit 150 400 Required: If required, round all per unit amounts to the nearest cent. 1. Determine the activity rate for each activity Production per machine hour Setup per setup Inspection per move Shipping Customer service per cust. ord. per customer service request 2. Determine the total and per-unit activity cost for all three products, Total Activity Cost Activity Cost Per Unit White sugar Brown sugar Powdered sugar 3. Why aren't the activity unit cost equal across the products since they require the same machine time per unit The unit costs are different because the products consume many activities in ratio different from the See and Sub a m argo, rex Even Sales, Cost-Volume-Profit Chart, Margin of Safety, and Operating Leverage emain Co. expects to maintain the same inventories at the end of 2077 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of good is in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Fixed Cost Estimated Variable Cost (per unit sold) Production costs: Direct materials Direct labor $50.00 30.00 Factory Overhead $350,000 Seving expenses Sales salaries and commissions 340.000 Advertising 116,000 4,000 Travel 2,300 325.000 Miscellaneous selling expense Administrative expenses: Office and officers' sales Supplies Miscellaneous administrative expense Total It is expected that 12.000 units will be sold at a price of $240 a unit. Maximum sales within th Required