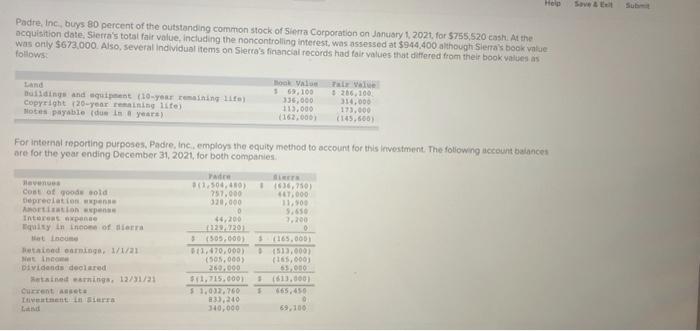

Help ame Padre, Inc., buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2021 for $755 520 cash. At the acquisition date, Sierra's total fair value, including the noncontrolling Interest, was assessed at $944,400 although Sierra's book value was only $673,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values is follows: dings and equipment 10-year remaining life Copyright 20-year retning life) Notes payable idee in a year) Hook View 16.100 206,100 335,000 314,000 113.000 173,000 (145,600) For internal reporting purposes, Pedie, Inc. employs the equity method to account for this investment. The following account balances ore for the year ending December 31, 2021, for both companies 261.500, 410) 757.000 320.000 1636,750 11,90 3.650 5 avenues Cost of wood sold Depreciation Artition pense Interesante Equity in income of a Hot Locume Betained, 1/1/21 Metin Dividends declared tine sings, 12/31/21 Current Assets Tennis 44,200 12.1201 (505,000) 01.070,000) (505.000 200.000 $11.715.000) $ 1,032,760 83),240 340,000 (165.000 153,000 (165,000 55.000 (613,000 65.650 . Help ame Padre, Inc., buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2021 for $755 520 cash. At the acquisition date, Sierra's total fair value, including the noncontrolling Interest, was assessed at $944,400 although Sierra's book value was only $673,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values is follows: dings and equipment 10-year remaining life Copyright 20-year retning life) Notes payable idee in a year) Hook View 16.100 206,100 335,000 314,000 113.000 173,000 (145,600) For internal reporting purposes, Pedie, Inc. employs the equity method to account for this investment. The following account balances ore for the year ending December 31, 2021, for both companies 261.500, 410) 757.000 320.000 1636,750 11,90 3.650 5 avenues Cost of wood sold Depreciation Artition pense Interesante Equity in income of a Hot Locume Betained, 1/1/21 Metin Dividends declared tine sings, 12/31/21 Current Assets Tennis 44,200 12.1201 (505,000) 01.070,000) (505.000 200.000 $11.715.000) $ 1,032,760 83),240 340,000 (165.000 153,000 (165,000 55.000 (613,000 65.650