Answered step by step

Verified Expert Solution

Question

1 Approved Answer

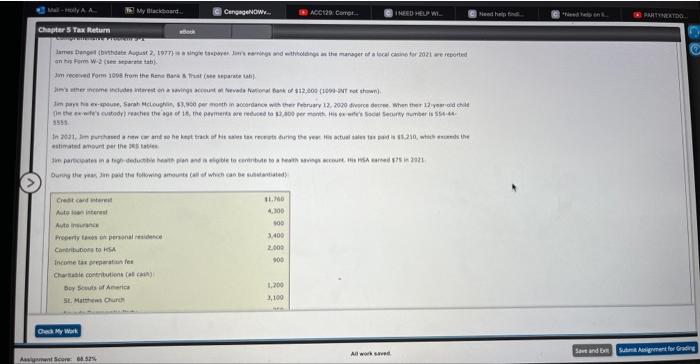

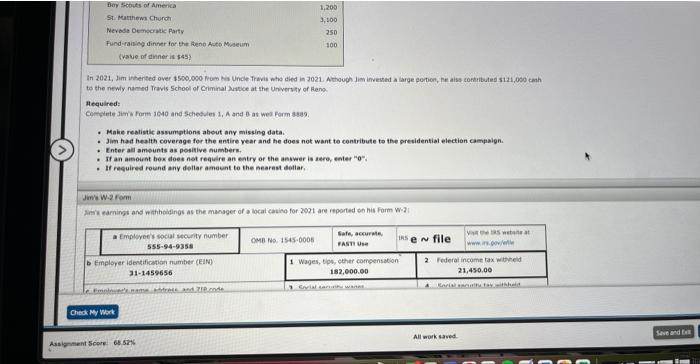

Help answer 12a 16,11, 9 an tis firm W2 (sentseburate 4ab). 3 roceved form 100 frum the Aenat bick s thint (cee separate lah). to

Help answer 12a 16,11, 9

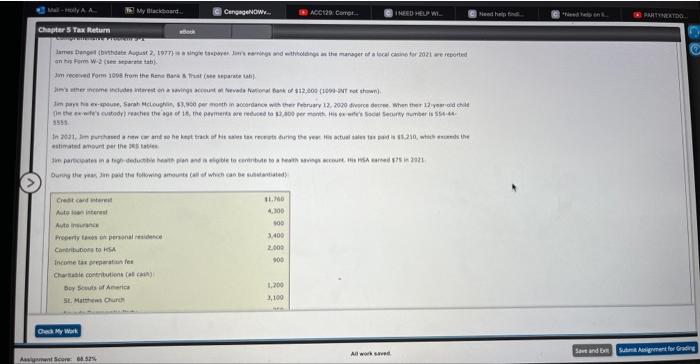

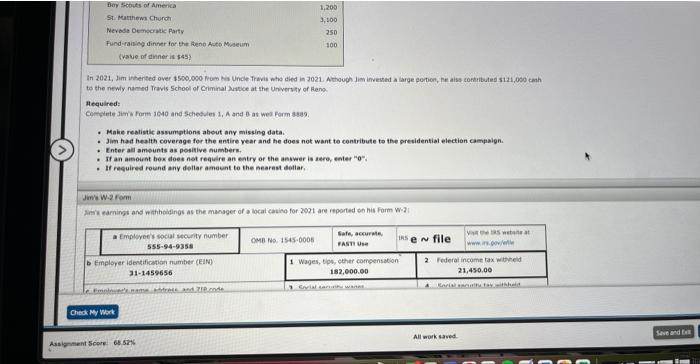

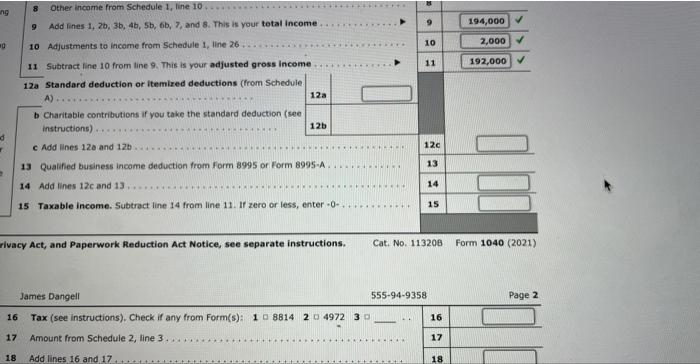

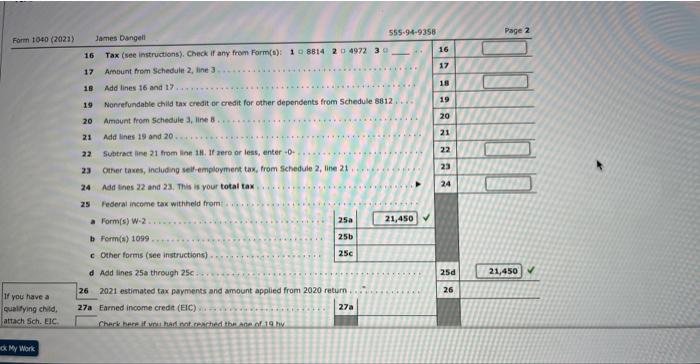

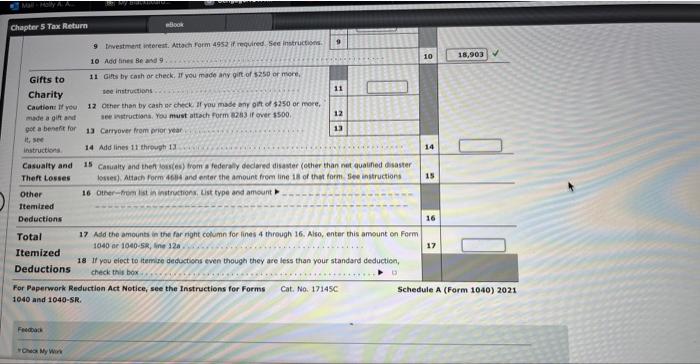

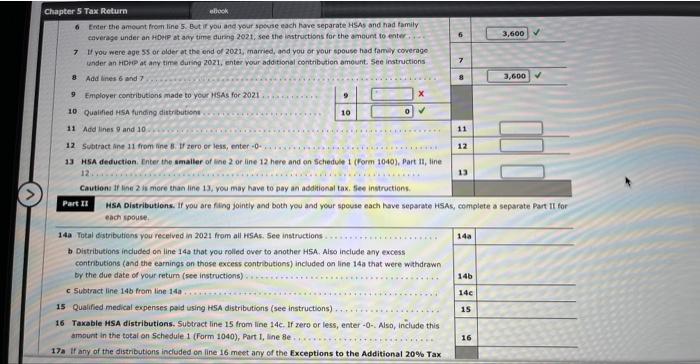

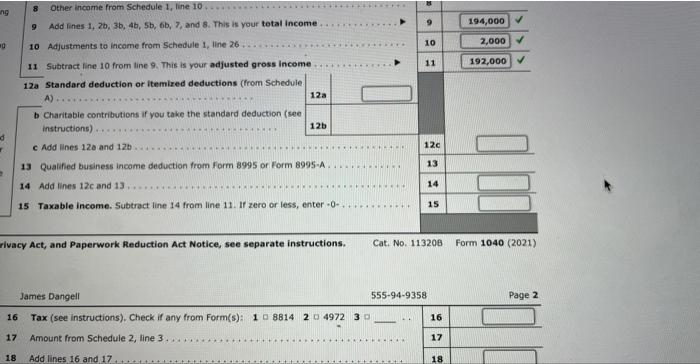

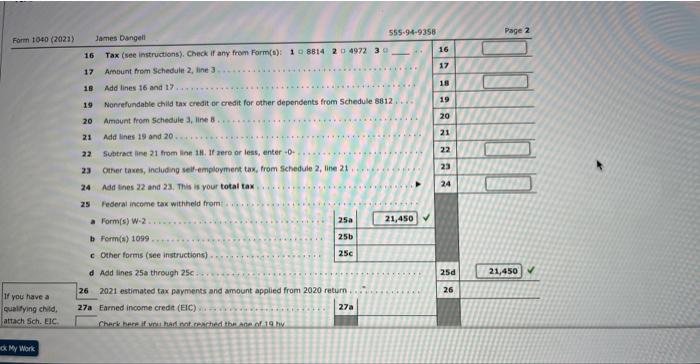

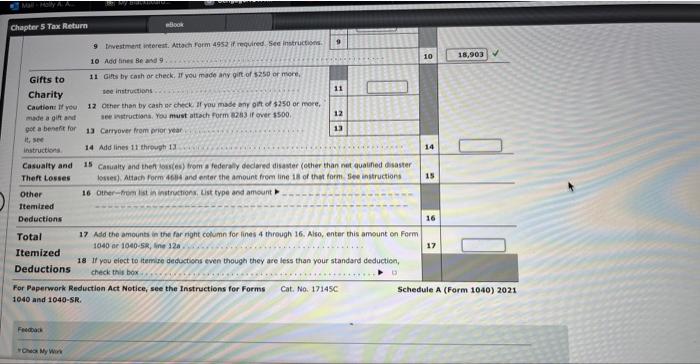

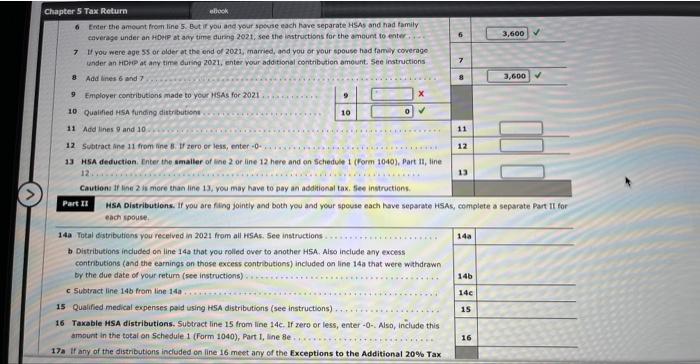

an tis firm W2 (sentseburate 4ab). 3 roceved form 100 frum the Aenat bick s thint (cee separate lah). to the newly named Travis School of Criminal lutitice at the Unversty of Eleno. Aedulred: Cowquete 1 tim worts 1040 and Schecules. 1 , A and 8 at wed Form 3.439. - Make realistic assumytions about any missing data. - Jim had health coverage for the entire year and he does not want to contribute to the preaidential election campalgh. - Inter all amounts as positive numberm. * if an ainount bos does not reauire an entry or the anwwer is aero, enter " 0. * If required round any deliar ameant to the hearest dediar. Jimin W.2 form 8 Other income from Schedule 1, line 10 9 Add lines 1,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26. 11 Subtract line 10 from line 9. This is your adjusted gross income \begin{tabular}{|r|r|} \hline 8 & \\ \hline 9 & 194,000 \\ \hline 10 & 2,000 \\ \hline 11 & 192,000 \\ \hline \end{tabular} 12a Standard deduction or itemired deductions (from Schedule A) b Charitabie contributions if you take the standard deduction (see instructions) c Add lines 120 and 12b. 12c 13 Qualified business income deduction from form 8995 or Form 8995A....... 14 Add lines 12c and 13 15 Taxable income. Subtract line 14 from line 11 . If zero or less, enter 0.... \begin{tabular}{|l|} \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline \end{tabular} rivacy Act, and Paperwork Reduction Act Notice, see separate instructions, Cat, No. 113208 Form 1040 (2021) James Dangell Page 2 18 Add lines 16 and 17 Form tota (2021) James Dungeii 16 Tax (see instructions), Check if any from Form(t): 1 o 8814249723 17 Ambunt fram Scheduiet 2 , line 3 18. Add lines 16 and 17 19 Nonrefundable child tax credit or credit for other depenidents from Schedule 8812. 20 Amant from schedule 3, line b. 21 Add lies 19 and 20 22. Subtract ires 21 from line 14. If aere or less, anter -0 . 23 Other taxes, including self-employment tax, from schedule 2 , line 21 24. Add tines 22 and 23. This is your total tax \begin{tabular}{|l|l|} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline \end{tabular} 25 Federal income tax withheld from a Form(s)W2. b Forth(s) 1099 . c Other forms (see instructions) \begin{tabular}{|l|r|} \hline 25a & 21,450 \\ \hline 25b & \\ \hline 25c & \\ \hline \end{tabular} d Add lines 25 a through 25c. If you have pualfying attach Sich. 26 2021 estimaked tax payments and amount applied from 2020 return + . . . . . . ... . . Cherk here if vioit had nat rmpiched the ane of 19 by 10 Mdd tines 8e asd 9 . 10 18,903 Gifts to 11 Gits by cash or check, If you made any gift of s2s0 or more. Charity see instructions Caitione if you, 12 other than by cash ec check if you made any oit of 5250 or more. got a benefi for 13 Carivover trom prioc year. it, see instructions 14 Add lines 11 throwgh 13 Casuaity and 15 Casuaity and then ious(es) from a federally dedared disaster (other than net quauned disaster Theft Losses iossei), Aitach form 4614 and priter the amount from line is of thet torm. geve instructions 15 Other 16 Other-frem lat in instructions, kist type and amount 1temised Deductions 16 Total 17 Ald the amounts in the far right column for lines 4 through 16. Aiso, enter chis ampunt on Form Itemired 1040 ar 10405k, line 12a 18 If you eloct to itemise deductions even though they are less than your standand deducticn, Deductions check this box For Paperwork Reduction Act Notice, see the Instructions for Forms Cat. No. 17145C 1040 and 10405R. Fectowis Tasriods coea an tis firm W2 (sentseburate 4ab). 3 roceved form 100 frum the Aenat bick s thint (cee separate lah). to the newly named Travis School of Criminal lutitice at the Unversty of Eleno. Aedulred: Cowquete 1 tim worts 1040 and Schecules. 1 , A and 8 at wed Form 3.439. - Make realistic assumytions about any missing data. - Jim had health coverage for the entire year and he does not want to contribute to the preaidential election campalgh. - Inter all amounts as positive numberm. * if an ainount bos does not reauire an entry or the anwwer is aero, enter " 0. * If required round any deliar ameant to the hearest dediar. Jimin W.2 form 8 Other income from Schedule 1, line 10 9 Add lines 1,2b,3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income from Schedule 1, line 26. 11 Subtract line 10 from line 9. This is your adjusted gross income \begin{tabular}{|r|r|} \hline 8 & \\ \hline 9 & 194,000 \\ \hline 10 & 2,000 \\ \hline 11 & 192,000 \\ \hline \end{tabular} 12a Standard deduction or itemired deductions (from Schedule A) b Charitabie contributions if you take the standard deduction (see instructions) c Add lines 120 and 12b. 12c 13 Qualified business income deduction from form 8995 or Form 8995A....... 14 Add lines 12c and 13 15 Taxable income. Subtract line 14 from line 11 . If zero or less, enter 0.... \begin{tabular}{|l|} \hline 13 \\ \hline 14 \\ \hline 15 \\ \hline \end{tabular} rivacy Act, and Paperwork Reduction Act Notice, see separate instructions, Cat, No. 113208 Form 1040 (2021) James Dangell Page 2 18 Add lines 16 and 17 Form tota (2021) James Dungeii 16 Tax (see instructions), Check if any from Form(t): 1 o 8814249723 17 Ambunt fram Scheduiet 2 , line 3 18. Add lines 16 and 17 19 Nonrefundable child tax credit or credit for other depenidents from Schedule 8812. 20 Amant from schedule 3, line b. 21 Add lies 19 and 20 22. Subtract ires 21 from line 14. If aere or less, anter -0 . 23 Other taxes, including self-employment tax, from schedule 2 , line 21 24. Add tines 22 and 23. This is your total tax \begin{tabular}{|l|l|} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline \end{tabular} 25 Federal income tax withheld from a Form(s)W2. b Forth(s) 1099 . c Other forms (see instructions) \begin{tabular}{|l|r|} \hline 25a & 21,450 \\ \hline 25b & \\ \hline 25c & \\ \hline \end{tabular} d Add lines 25 a through 25c. If you have pualfying attach Sich. 26 2021 estimaked tax payments and amount applied from 2020 return + . . . . . . ... . . Cherk here if vioit had nat rmpiched the ane of 19 by 10 Mdd tines 8e asd 9 . 10 18,903 Gifts to 11 Gits by cash or check, If you made any gift of s2s0 or more. Charity see instructions Caitione if you, 12 other than by cash ec check if you made any oit of 5250 or more. got a benefi for 13 Carivover trom prioc year. it, see instructions 14 Add lines 11 throwgh 13 Casuaity and 15 Casuaity and then ious(es) from a federally dedared disaster (other than net quauned disaster Theft Losses iossei), Aitach form 4614 and priter the amount from line is of thet torm. geve instructions 15 Other 16 Other-frem lat in instructions, kist type and amount 1temised Deductions 16 Total 17 Ald the amounts in the far right column for lines 4 through 16. Aiso, enter chis ampunt on Form Itemired 1040 ar 10405k, line 12a 18 If you eloct to itemise deductions even though they are less than your standand deducticn, Deductions check this box For Paperwork Reduction Act Notice, see the Instructions for Forms Cat. No. 17145C 1040 and 10405R. Fectowis Tasriods coea

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started