Help answering these questions using the information in the picture below please! 1. What is Sweeten Companys cost of goods sold for the year? 2.

Help answering these questions using the information in the picture below please!

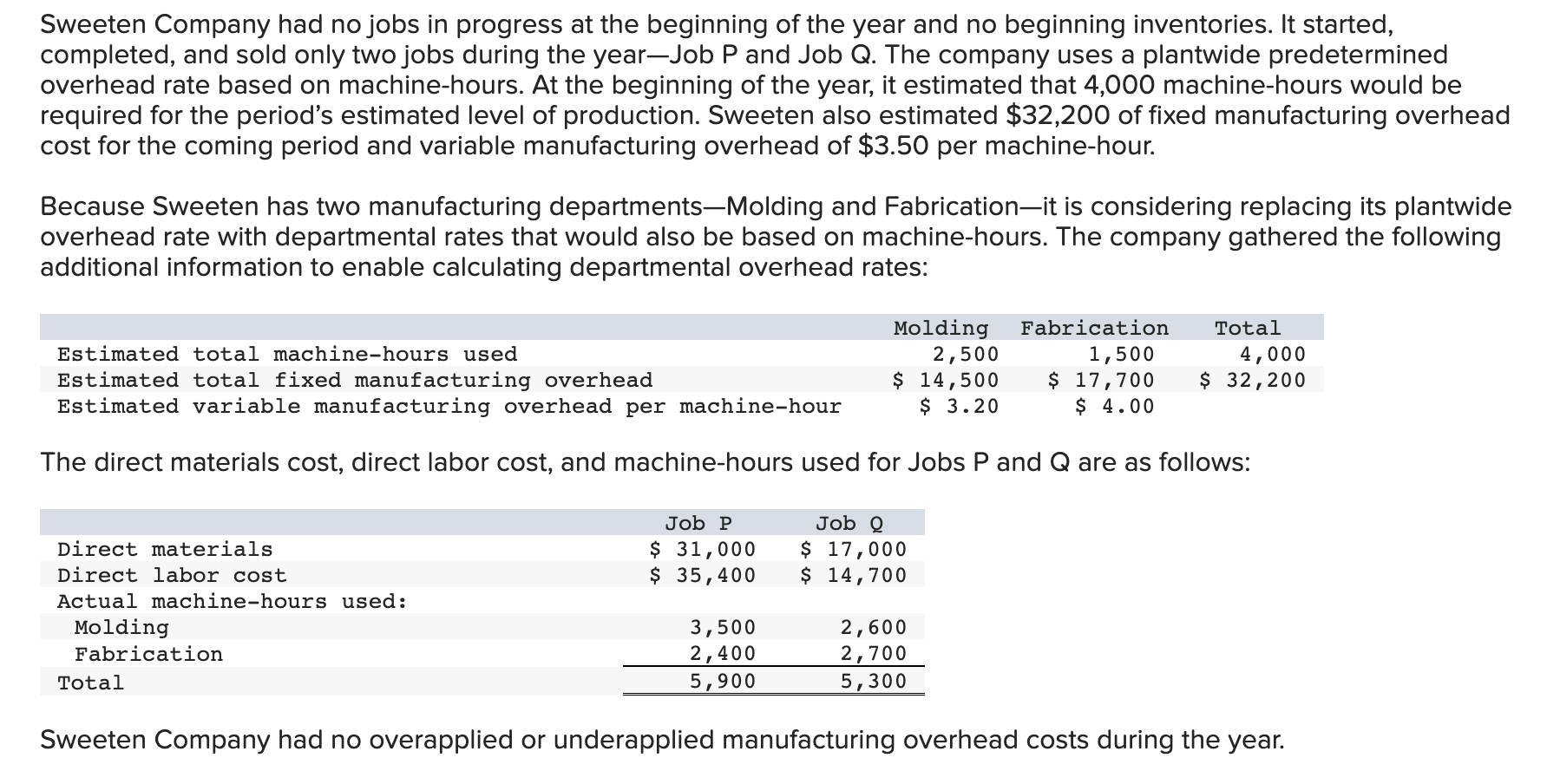

1. What is Sweeten Companys cost of goods sold for the year?

2. What are the companys predetermined overhead rates in the Molding Department and the Fabrication Department? (Round your answers to 2 decimal places.)

3. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.)

4. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.)

5. If Job P includes 20 units, what is its unit product cost? (Do not round intermediate calculations.)

6. If Job Q includes 30 units, what is its unit product cost? (Do not round intermediate calculations. Round your final answer to nearest whole dollar.)

7. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? (Do not round intermediate calculations. Round your final answers to nearest whole dollar.)

8. What is Sweeten Companys cost of goods sold for the year? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards