Answered step by step

Verified Expert Solution

Question

1 Approved Answer

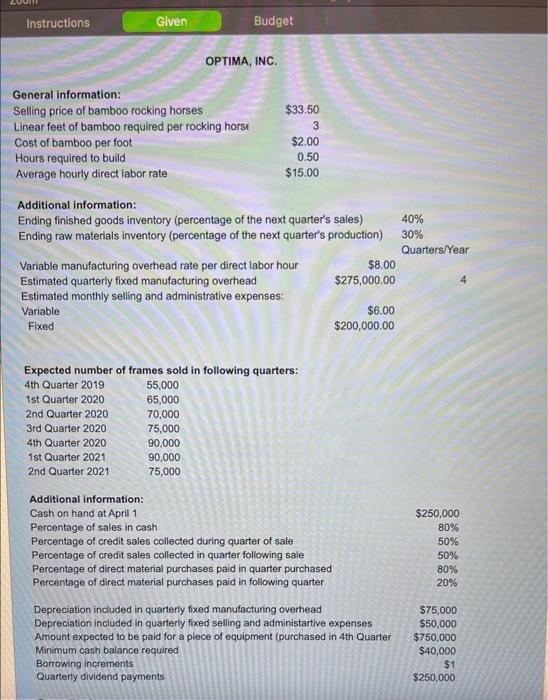

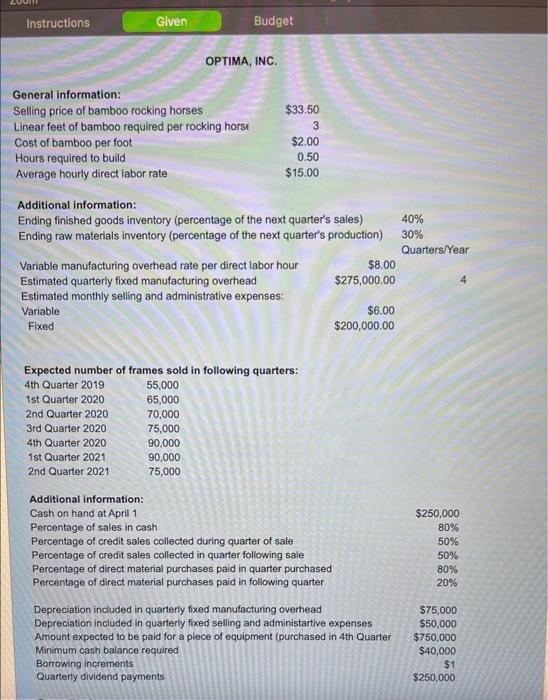

Help! Any help I can get, thank you! OPTIMA, INC. Additional information: Ending finished goods inventory (percentage of the next quarter's sales) 40% Endinn raw

Help! Any help I can get, thank you!

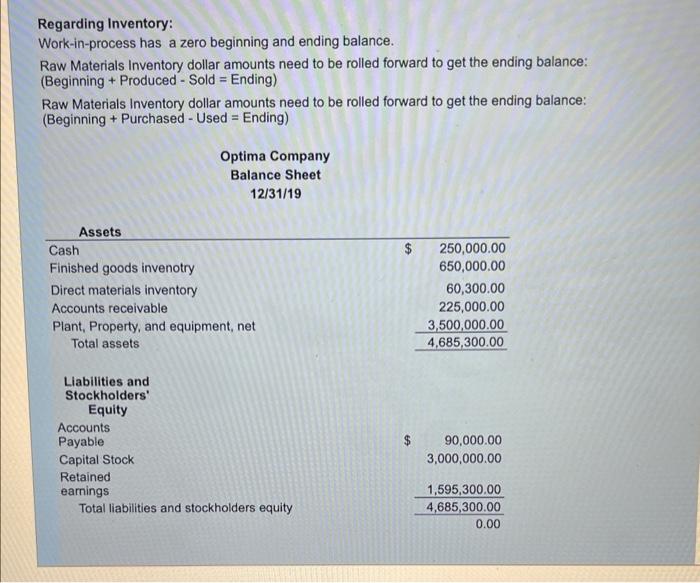

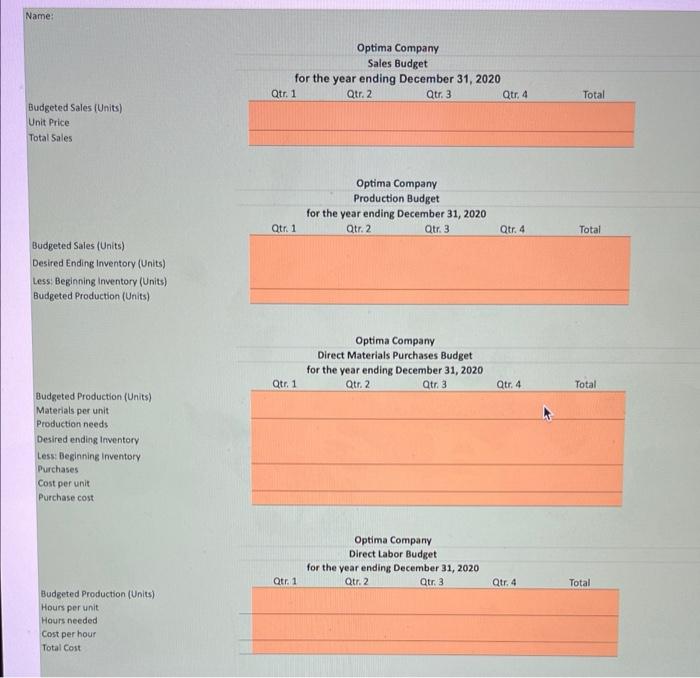

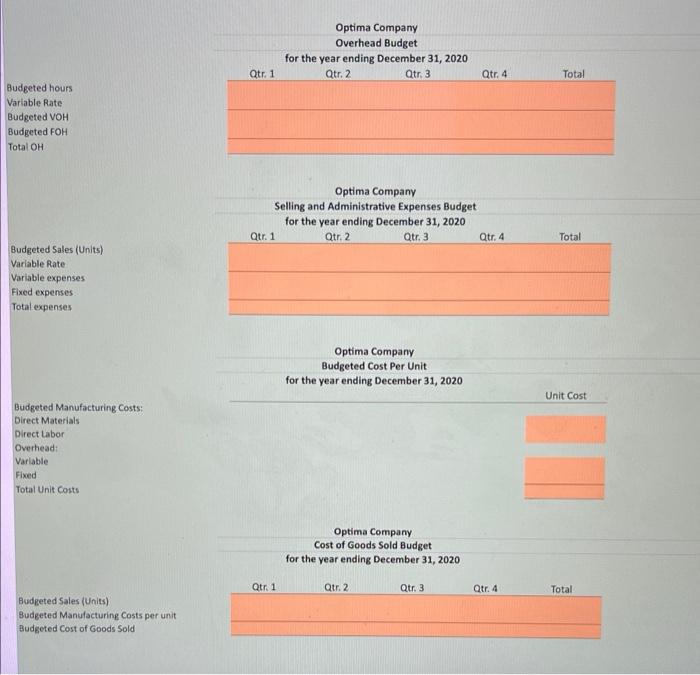

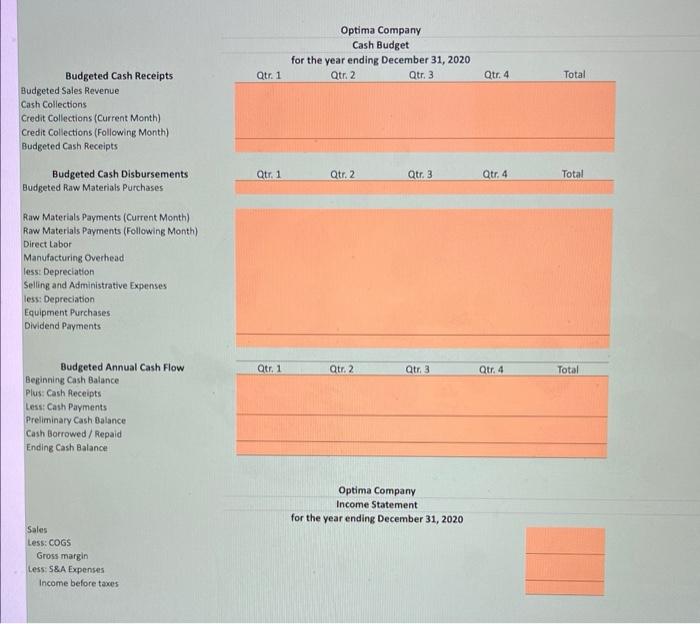

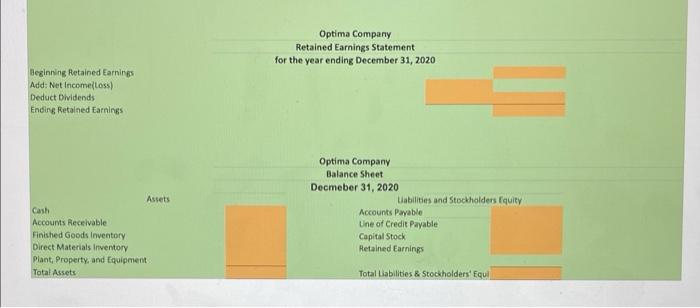

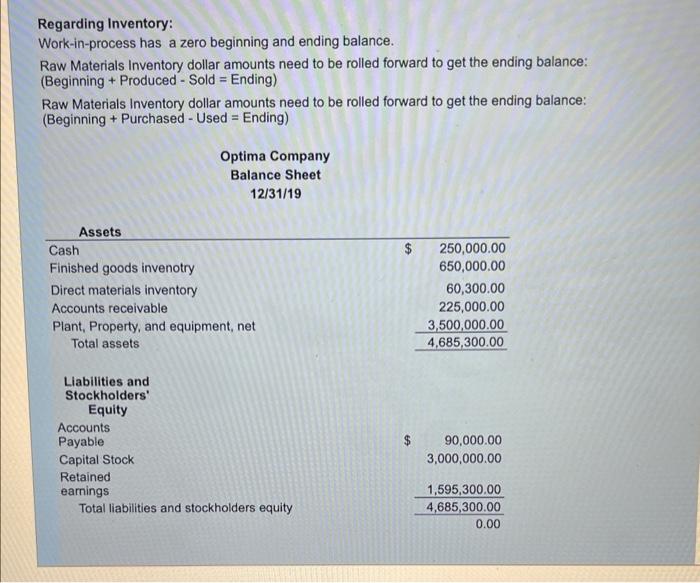

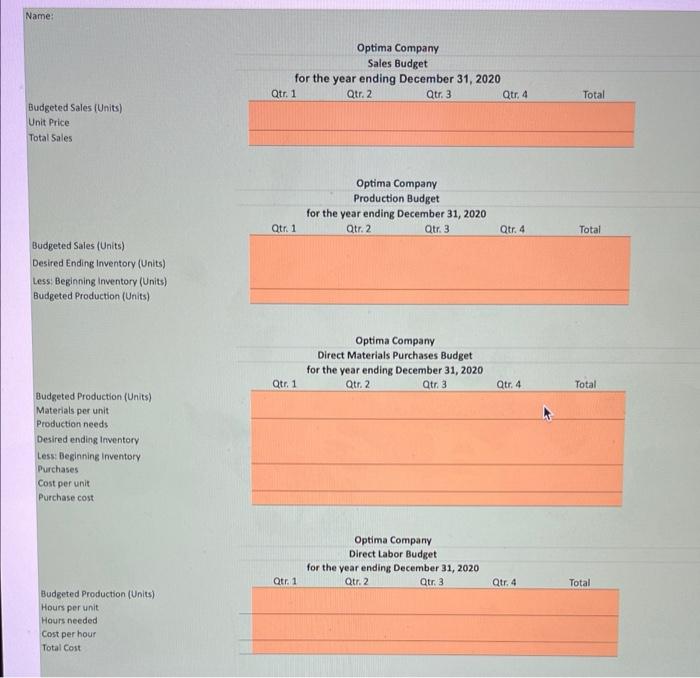

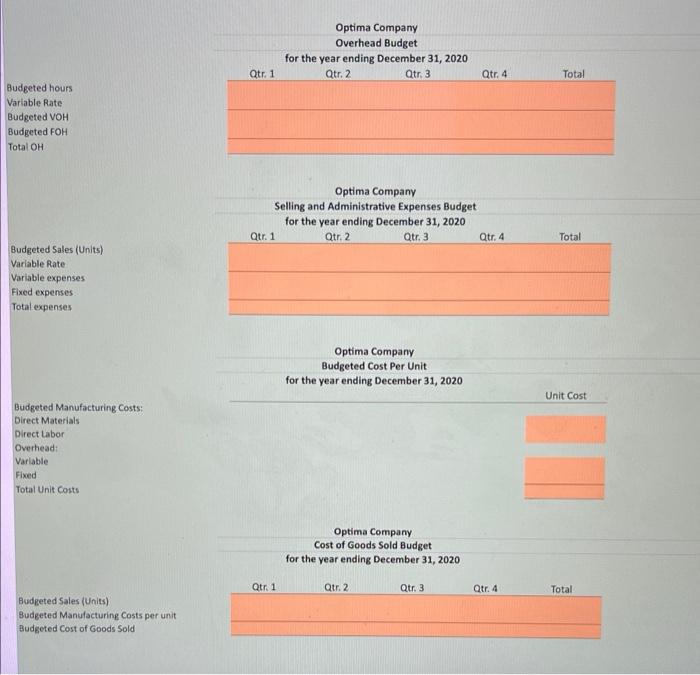

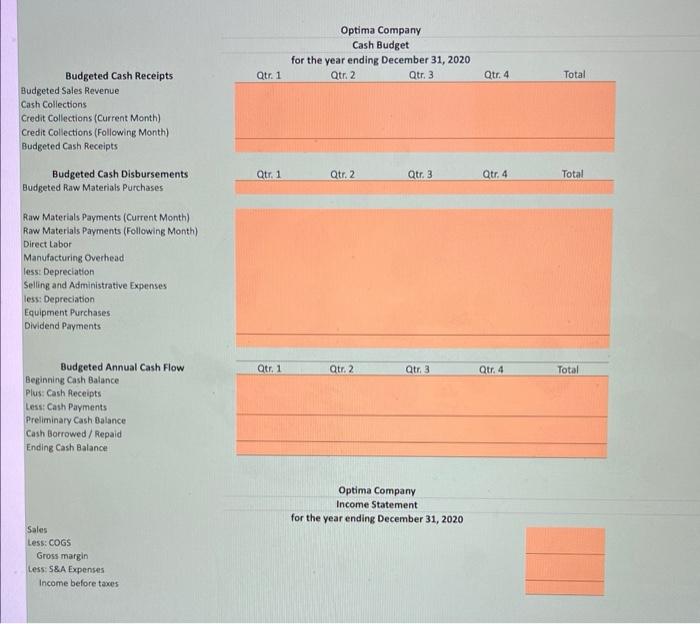

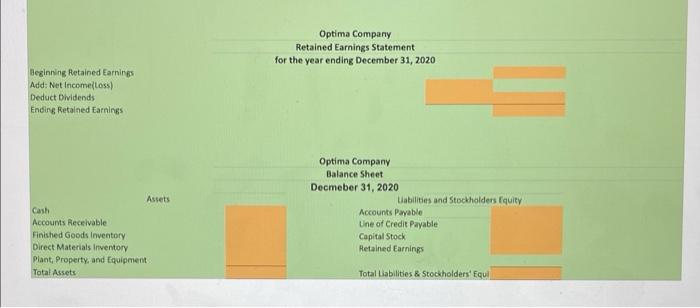

OPTIMA, INC. Additional information: Ending finished goods inventory (percentage of the next quarter's sales) 40% Endinn raw matariale inuontonu inerrantane of the nayt nuartar's nonduetion) 30% Expected number of frames sold in following quarters: Regarding Inventory: Work-in-process has a zero beginning and ending balance. Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Produced - Sold = Ending) Raw Materials Inventory dollar amounts need to be rolled forward to get the ending balance: (Beginning + Purchased - Used = Ending) Name: Optima Company Sales Budget for the year ending December 31, 2020 Budgeted Sales (Units) Qtr. 1 Qtr. 2 Qtr.3 Qtr, 4 Total Unit Price Total5ales Optima Company Production Budget for the year ending December 31,2020 Budgeted Sales (Units) Qtr.1Qtr.2Qtr.3Qtr.4Total Desired Ending Inventory (Units) Less: Beginning inventory (Units) Budigeted Production (Units) Optima Company Direct Materials Purchases Budget for the year ending December 31,2020 Budgeted Production (Units) Materials per unit Production needs. Desired ending Ifwentory Less: Beginning Inventory Purchases Cost per unit Purchase cost Optima Company Direct Labor Budget for the year ending December 31, 2020 Budgeted Production (Units) Hours per unit Hours needed Cost per hour Total Cost Optima Company Overhead Budget Optima Company Selling and Administrative Expen for the vear andine naramhar tudgeted Sales (Units) ariable Rate tariable expenses Fxed expenses fotal expenses Optima Company Cost of Goods Sold Budge for the year ending December 3 Budgeted Sales (Units) Budgeted Manufacturing Costs per unit Budgeted Cost of Goods Sold Optima Company Cash Budget for the year ending December 31,2020 Budgeted Cash Receipts Qti. 1 Qtr. 3 Qtr. 4 Total Budgeted Sales Revenue Cash Collections Credit Collections (Current Month) Credit Collections (Following Month) Budgeted Cash Receipts Budgeted Cash Disbursements Qtr.1Qtr.2Qtr.3Qtr.4Total Budgeted Raw Materials Purchases Raw Materials Payments (Current Month) Raw Materials Payments (Following Month) Direct Labor Manufacturing Overhead less: Depreciation Selling and Administrative Expenses iess: Depreciation Equipment Purchases Dividend Payments \begin{tabular}{l} \multicolumn{1}{c}{ Budgeted Annual Cash Flow } \\ Beginning Cash Balance \\ Plus: Cash fleceipts \\ Less: Cash Payments \\ Preliminary Cash Balance \\ Cash Borrowed/ Repaid \\ Ending Cash Balance \end{tabular} Optima Company Income Statement for the year ending December 31,2020 Sales Less: COG5 Gross margin Less: 58A Expenses Income before taxes Optima Company Retained Earnings Statement for the year ending December 31,2020 Heginning Retained Earnin os Add: Net Income(Loss) Deduct Dividends Ending Retained Earnings Optima Company Balance Sheet Decmeber 31, 2020 Astets Liabilities and Stocthalders fquity Accounts heceivable Accounts Payable Finished Goods Inventory Une of Credit Payable Direct Materials inventory Capital Stock Plant, Property, and tquipment Total Assets Hetained Earnings Total Liabilities \& Stockholden' Equal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started