Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap answer all please A company should accrue a gain contingency and report it on the financial statements ONLY if the likelinood that a

help asap answer all please

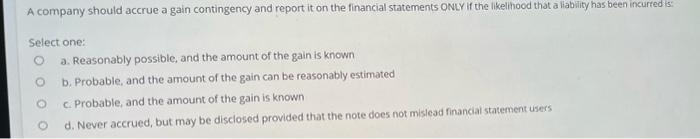

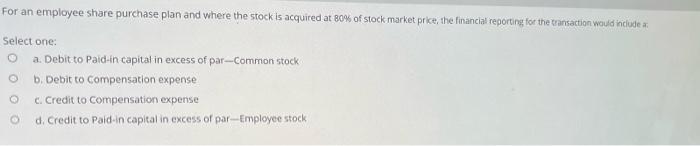

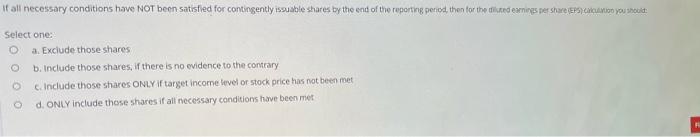

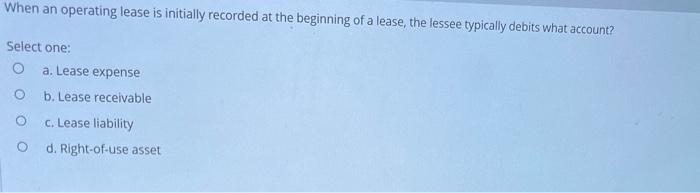

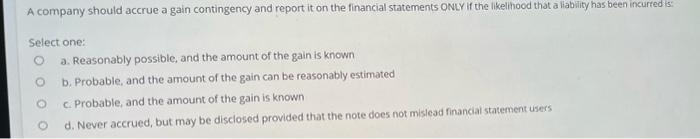

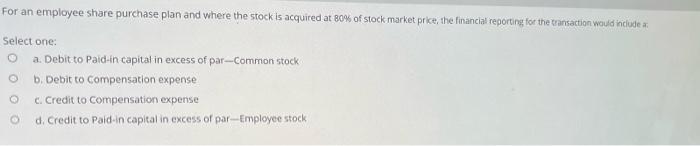

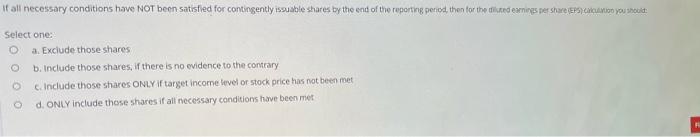

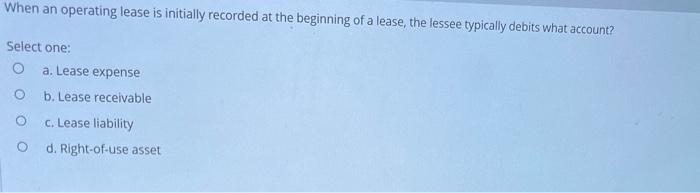

A company should accrue a gain contingency and report it on the financial statements ONLY if the likelinood that a liablity has been incurted ts: Select one: a. Reasonably possibic, and the amount of the gain is known b. Probable, and the amount of the gain can be reasonably estimated c. Probable, and the amount of the gain is known d. Never accrued, but may be disclosed provided that the note does not mislead financial statement users For an employee share purchase plan and where the stock is acquired at 80% of stockmarket prike, the financlal reporting for the tansaction would indiode a. Select one: a. Debit to Paid-in capital in excess of par-Common stock b. Debit to Compensation expense c. Credit to Compensation expense d. Credit to Paid-in capital in excess of par-Employee stock If all necessary conditions have NOT been satisfled for cantingently issusble shares by the end of the reporting period, then for the disked exniggs per share If Select one: a. Exciude those shares b. Include those shares, if there is no evidence to the contrary c. Include those shares ONLY if target incorne fevel or stock price has not been met d. ONLY include those shares if all necessary conditions have been met When an operating lease is initially recorded at the beginning of a lease, the lessee typically debits what account? Select one: a. Lease expense b. Lease receivable c. Lease liability d. Right-of-use asset A company should accrue a gain contingency and report it on the financial statements ONLY if the likelinood that a liablity has been incurted ts: Select one: a. Reasonably possibic, and the amount of the gain is known b. Probable, and the amount of the gain can be reasonably estimated c. Probable, and the amount of the gain is known d. Never accrued, but may be disclosed provided that the note does not mislead financial statement users For an employee share purchase plan and where the stock is acquired at 80% of stockmarket prike, the financlal reporting for the tansaction would indiode a. Select one: a. Debit to Paid-in capital in excess of par-Common stock b. Debit to Compensation expense c. Credit to Compensation expense d. Credit to Paid-in capital in excess of par-Employee stock If all necessary conditions have NOT been satisfled for cantingently issusble shares by the end of the reporting period, then for the disked exniggs per share If Select one: a. Exciude those shares b. Include those shares, if there is no evidence to the contrary c. Include those shares ONLY if target incorne fevel or stock price has not been met d. ONLY include those shares if all necessary conditions have been met When an operating lease is initially recorded at the beginning of a lease, the lessee typically debits what account? Select one: a. Lease expense b. Lease receivable c. Lease liability d. Right-of-use asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started