Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap Assume that on January 1, year 1, ABC Incorporated issved 7,250 stock options with an estimated value of $13 per option. Each option

help asap

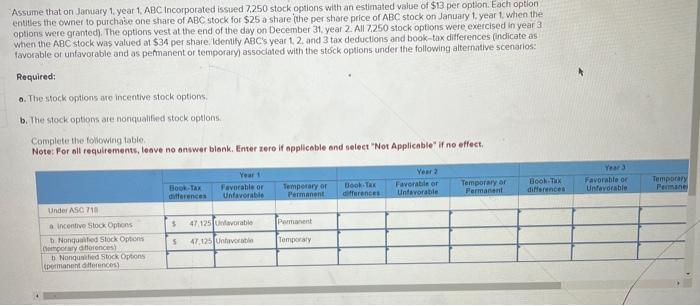

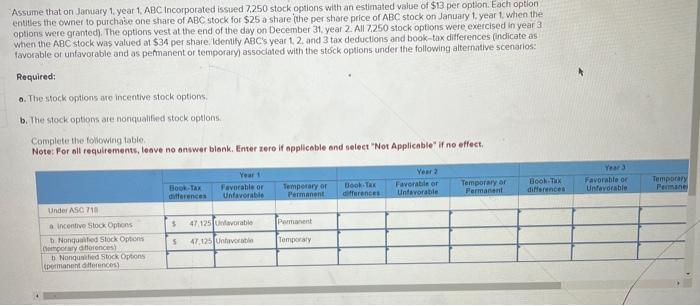

Assume that on January 1, year 1, ABC Incorporated issved 7,250 stock options with an estimated value of \$13 per option. Each option entitles the owner to purchase one share of ABC stock for $25 a share (the per share price or ABC stock on January 1. year 1 , when the options were granted). The options vest at the end of the day on December 31 , year 2 . All 7,250 stock options were, exercised in year 3. when the ABC stock was valued at $34 per share. ldenlify ABC's year 1,2 , and 3 tax deductions and book-tax ditferences (indicate as favorable or unfavorable and as pefmanent of temporary) assoclated with the stock options under the following altemative scenarios: Required: 0. Thes stock options are incentive stock options. b. The stock options are nonqualifind stock optlons. Complete the tollowing table. Note: For oll requirements, leave no onwwer biank. Enter zero if npplicable ond seleet "Not Applicnble" if no effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started