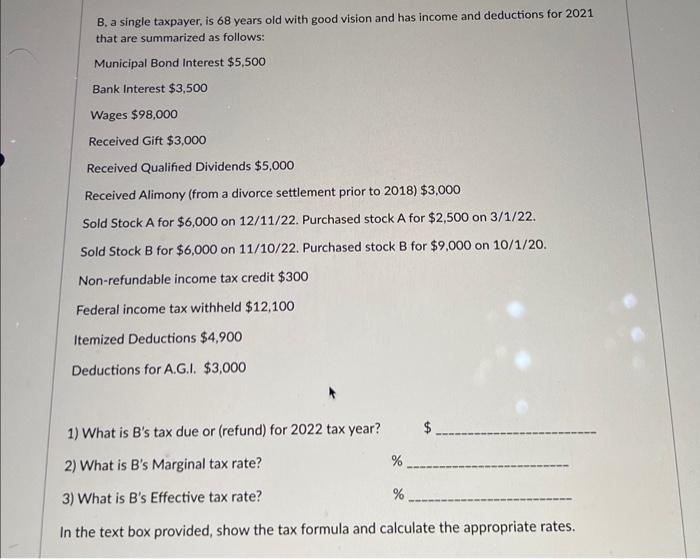

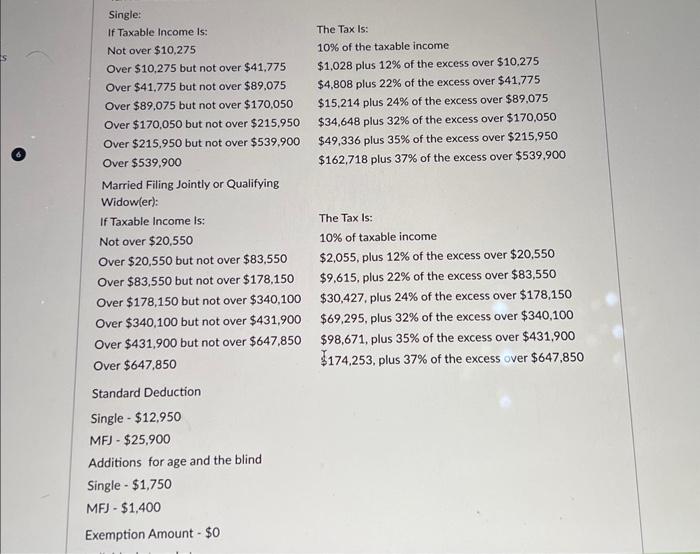

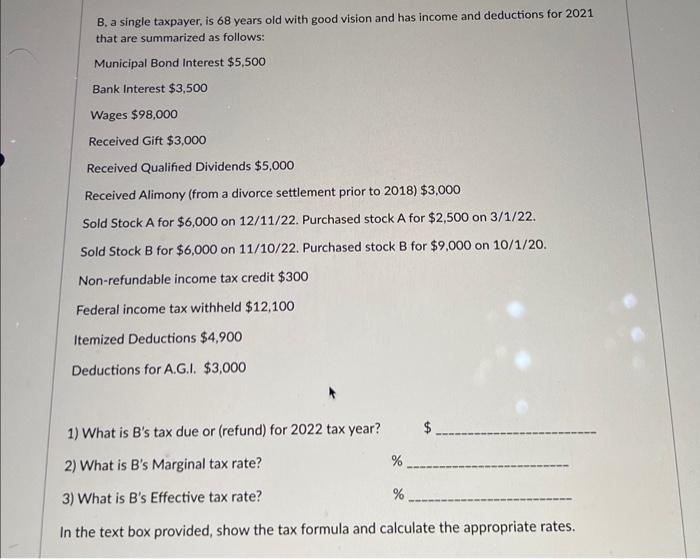

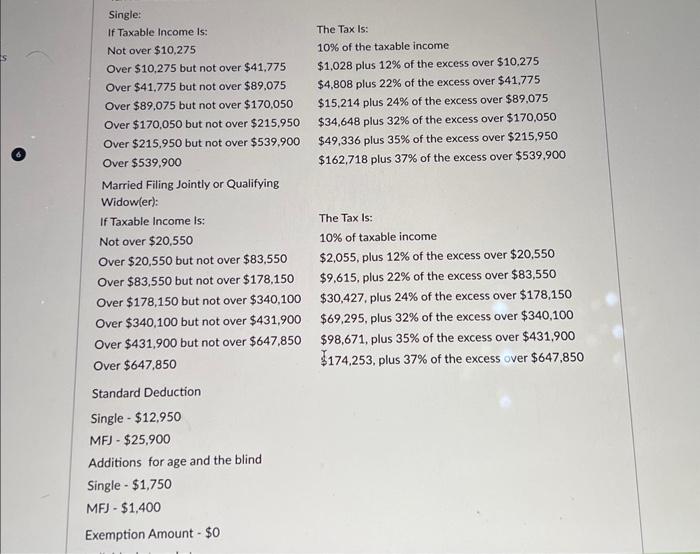

B, a single taxpayer, is 68 years old with good vision and has income and deductions for 2021 that are summarized as follows: Municipal Bond Interest $5,500 Bank Interest $3,500 Wages $98,000 Received Gift $3,000 Received Qualified Dividends $5,000 Received Alimony (from a divorce settlement prior to 2018) $3,000 Sold Stock A for $6,000 on 12/11/22. Purchased stock A for $2,500 on 3/1/22. Sold Stock B for $6,000 on 11/10/22. Purchased stock B for $9,000 on 10/1/20. Non-refundable income tax credit $300 Federal income tax withheld $12,100 Itemized Deductions $4,900 Deductions for A.G.I. $3,000 1) What is B's tax due or (refund) for 2022 tax year? 2) What is B's Marginal tax rate? % 3) What is B's Effective tax rate? % In the text box provided, show the tax formula and calculate the appropriate rates. Single: If Taxable Income is: Not over $10,275 Over $10,275 but not over $41,775 Over $41,775 but not over $89,075 Over $89,075 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 Married Filing Jointly or Qualifying Widow(er): If Taxable Income is: Not over $20,550 Over $20,550 but not over $83,550 Over $83,550 but not over $178,150 Over $178,150 but not over $340,100 Over $340,100 but not over $431,900 Over $431,900 but not over $647,850 Over $647,850 The Tax Is: 10% of the taxable income $1,028 plus 12% of the excess over $10,275 $4,808 plus 22% of the excess over $41,775 $15,214 plus 24% of the excess over $89,075 $34,648 plus 32% of the excess over $170,050 $49,336 plus 35% of the excess over $215,950 $162,718 plus 37% of the excess over $539,900 The Tax Is: 10% of taxable income $2,055, plus 12% of the excess over $20,550 $9,615, plus 22% of the excess over $83,550 $30,427, plus 24% of the excess over $178,150 $69,295, plus 32% of the excess over $340,100 $98,671, plus 35% of the excess over $431,900 $174,253, plus 37% of the excess over $647,850 Standard Deduction Single $12,950 MFJ - $25,900 Additions for age and the blind Single $1,750 MFJ =$1,400 Exemption Amount - $0