help asap!!!

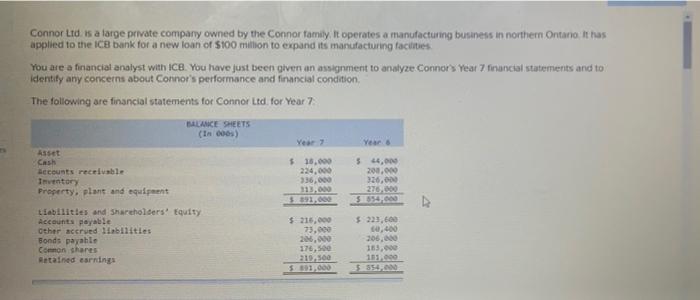

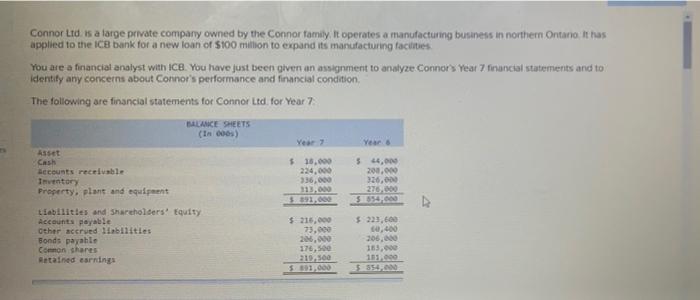

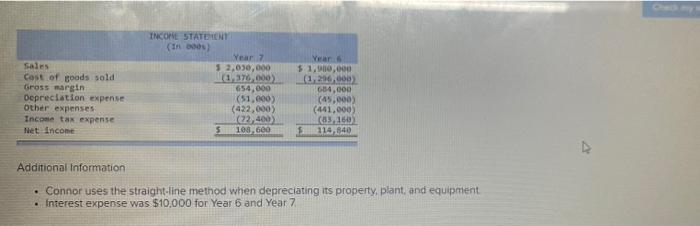

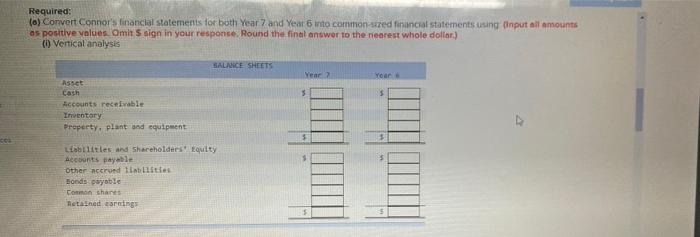

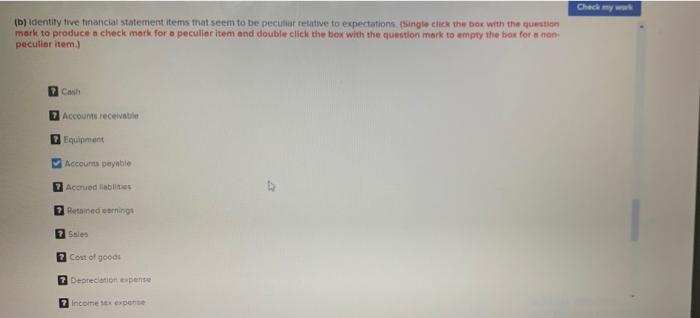

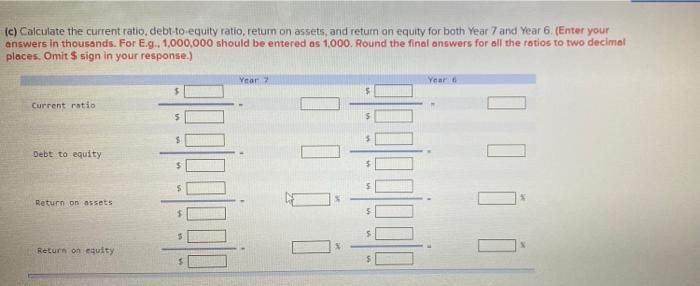

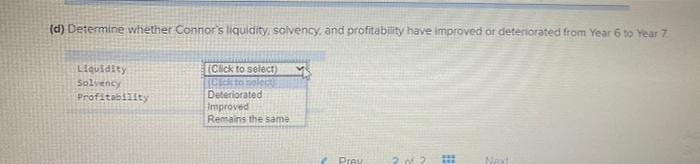

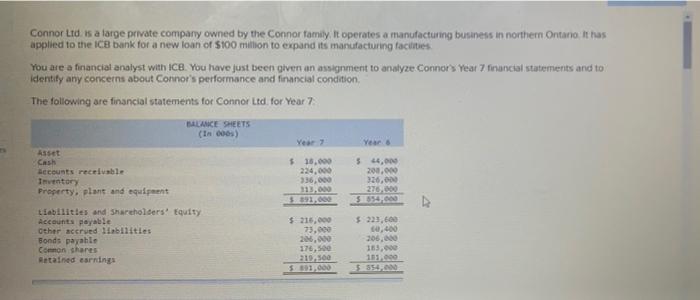

Connor Ltd is a large private company owned by the Connor family. It operates a manufacturing business in northern Ontario It has applied to the ICB bank for a new loan of 5100 million to expand its manufacturing facilities You are a financial analyst with ICE. You have just been given an assignment to analyze Connors Year 7 financial statements and to identity any concerns about Connor's performance and financial condition The following are financial statements for Connor Ltd. for Year 7 BALANCE SHEETS Year 2 Years $ 16.000 224,000 336,000 11,000 5 44.000 200.000 326,000 270.000 5554 st Cash Accounts receivable Thentory Property, plant and equipment Liabilities and Shareholders' Equity Accounts payable Other accrued liabilities Bonds payable Common shares Retained earnings $ 210,000 73,000 2016.000 176,500 210.500 5301.000 $ 223,600 0,400 206,00 165,000 113.00 Sales Cost of goods sold Gross margin Depreciation expense Other expenses Income tax expense Net Income INCOME STATEMENT ( 10) Year 7 3 2,030,000 1 376,000) 654,000 (51,000) (422,000) 22,400 5 100 600 Year $1,900,000 (1.200.000 654,000 (45,000) (441,000) (83.160 114.840 Additional Information Connor uses the straight-line method when depreciating its property, plant, and equipment . Interest expense was $10,000 for Year 6 and Year 7 Required: (o) Convert Connor's financial statements for both Year 7 and Year 6 into common-sured financial statements using input all amounts as positive values Omin sign in your response. Round the final answer to the nearest whole dollar) Vertical analysis SALICE SHEETS Year ? Yoar 5 5 Asset Cash Accounts receivable Inventory Property, plant and equipment Liabilities and Shareholders Equity Accounts payable Other accrued tablettes Bonds payable Common shares Tetained caring INCOME STATEMENT Year Year 5 Sales Cost of goods sold Gross margin Depreciation expense other expenses Income tax expense Net Income (i) Horizontal analysis BALANCE SHEETS Year 7 Year 6 $ Asset Cash Accounts receivable Inventory Property, plant and equipment Liabilities and Shareholders' Equity Accounts payable Other accrued Habilities Bonds payable Common shares Retained earnings $ INCORE STATEMENT Year 2 5 Year 6 $ Sales Cost of goods sold Gross margin Depreciation expense other expenses Income tax expense Net Incore (b) Identify five financial statement items that seem to be peculiar relative to expectations (Single click the box with the question mark to produce a check mark for a peculiaritem and double click the box with the question mark to empty the box for a non- peculiaritem 2 Cash ? Accounts receivable 2 Equipment 2 Accounts gaysble Check my (b) Identity five financial statement items that seem to be peculiar relative to expectations single click the box with the question mark to producen check mark for a peculiaritem and double click the box with the question mark to empty the box for a non peculiar item) Cash 2 Accounts receivable Equipment Accounts payable 2 Accrued labi 2 Renderings Sie 2 Cout of goods 2 Depreciation expense z income tax expense (c) Calculate the current ratio, debt-to-equity ratio, return on assets and return on equity for both Year 7 and Year 6. (Enter your answers in thousands. For E... 1,000,000 should be entered os 1000. Round the final answers for all the ratios to two decimal places. Omit $ sign in your response.) Year 2 Year Current ratio DO Debt to equity 5 n * Return on assets Return on equity (d) Determine whether Connor's liquidity, solvency, and profitability have improved or deteriorated from Year 6 to Year 7 Liquidity Solvency Profitablety (Click to select Bed to see Deteriorated Improved Remains the same Prev 22 Next