Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help ASAP (Estimated time allowance: 27 minutes)Easy Car Corp. is a grocery store located in the Southwest. It paid an annual dividend of $10.00 last

help ASAP

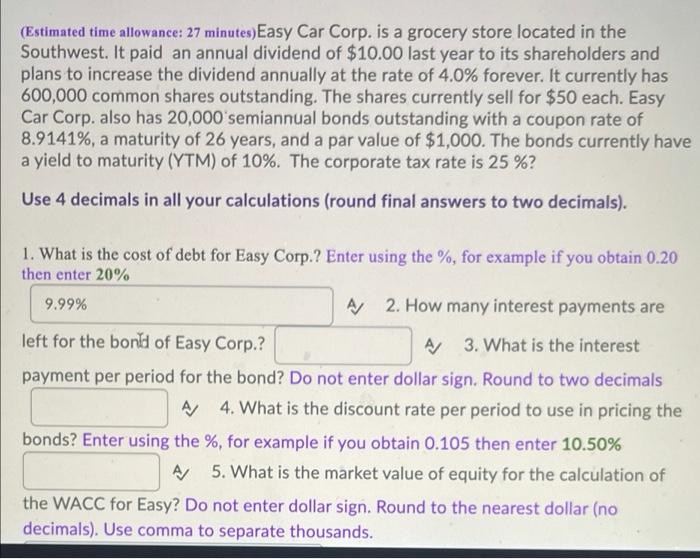

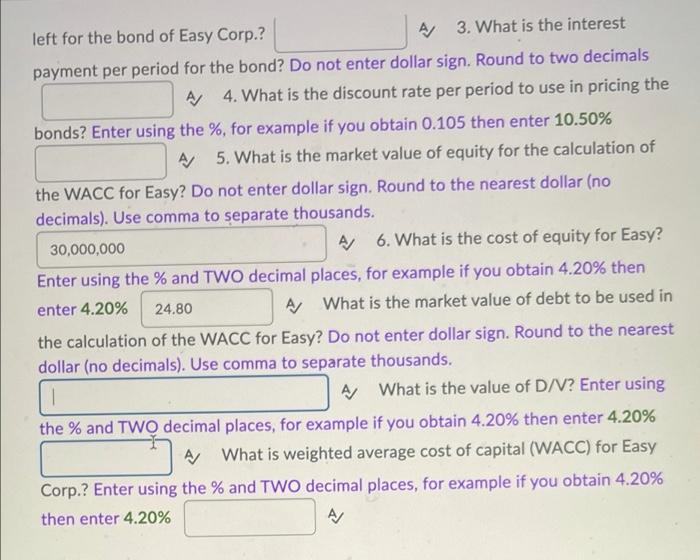

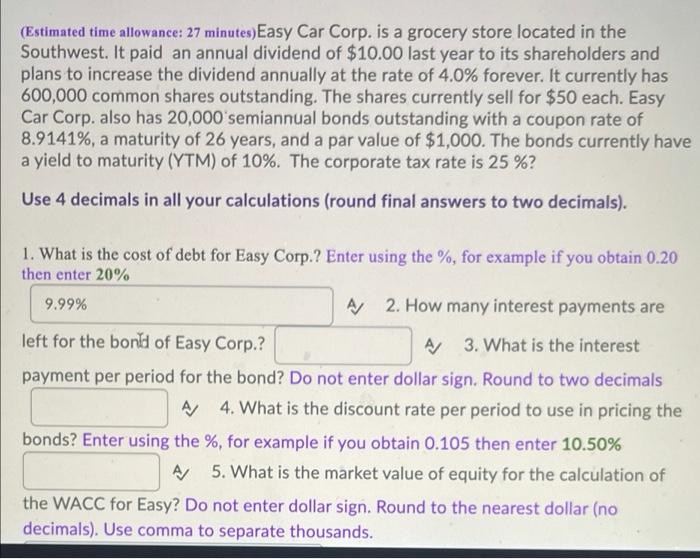

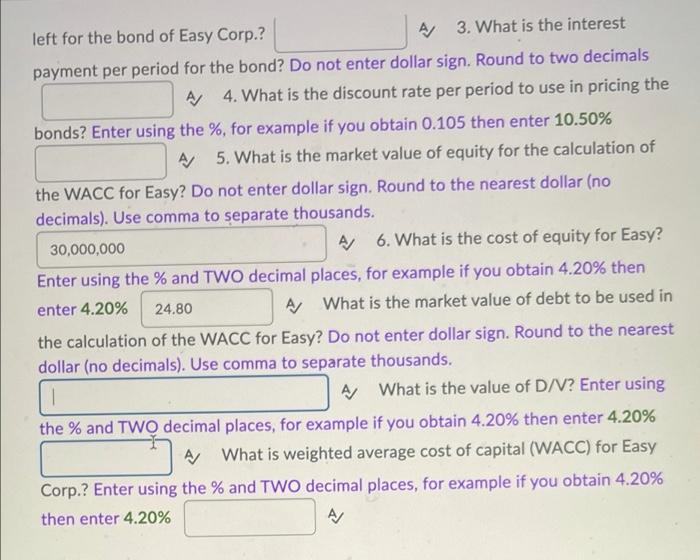

(Estimated time allowance: 27 minutes)Easy Car Corp. is a grocery store located in the Southwest. It paid an annual dividend of $10.00 last year to its shareholders and plans to increase the dividend annually at the rate of 4.0% forever. It currently has 600,000 common shares outstanding. The shares currently sell for $50 each. Easy Car Corp. also has 20,000 semiannual bonds outstanding with a coupon rate of 8.9141%, a maturity of 26 years, and a par value of $1,000. The bonds currently have a yield to maturity (YTM) of 10%. The corporate tax rate is 25 %? Use 4 decimals in all your calculations (round final answers to two decimals). A/ 1. What is the cost of debt for Easy Corp.? Enter using the %, for example if you obtain 0.20 then enter 20% 9.99% A 2. How many interest payments are left for the bond of Easy Corp.? 3. What is the interest payment per period for the bond? Do not enter dollar sign. Round to two decimals A 4. What is the discount rate per period to use in pricing the bonds? Enter using the %, for example if you obtain 0.105 then enter 10.50% A/ 5. What is the market value of equity for the calculation of the WACC for Easy? Do not enter dollar sign. Round to the nearest dollar (no decimals). Use comma to separate thousands. left for the bond of Easy Corp.? A 3. What is the interest payment per period for the bond? Do not enter dollar sign. Round to two decimals A) 4. What is the discount rate per period to use in pricing the bonds? Enter using the %, for example if you obtain 0.105 then enter 10.50% A 5. What is the market value of equity for the calculation of the WACC for Easy? Do not enter dollar sign. Round to the nearest dollar (no decimals). Use comma to separate thousands. 30,000,000 A 6. What is the cost of equity for Easy? Enter using the % and TWO decimal places, for example if you obtain 4.20% then enter 4.20% 24.80 A What is the market value of debt to be used in the calculation of the WACC for Easy? Do not enter dollar sign. Round to the nearest dollar (no decimals). Use comma to separate thousands. 1 A) What is the value of D/V? Enter using the % and TWO decimal places, for example if you obtain 4.20% then enter 4.20% What is weighted average cost of capital (WACC) for Easy Corp.? Enter using the % and TWO decimal places, for example if you obtain 4.20% then enter 4.20% A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started