Answered step by step

Verified Expert Solution

Question

1 Approved Answer

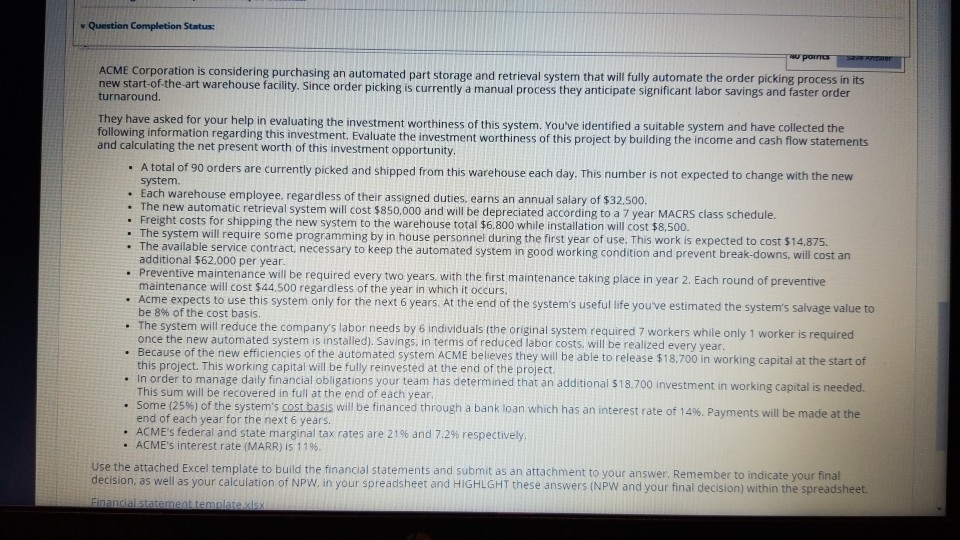

help asap. fill out excel spreadsheet below: Question Completion Status: w poms Saver ACME Corporation is considering purchasing an automated part storage and retrieval system

help asap. fill out excel spreadsheet below:

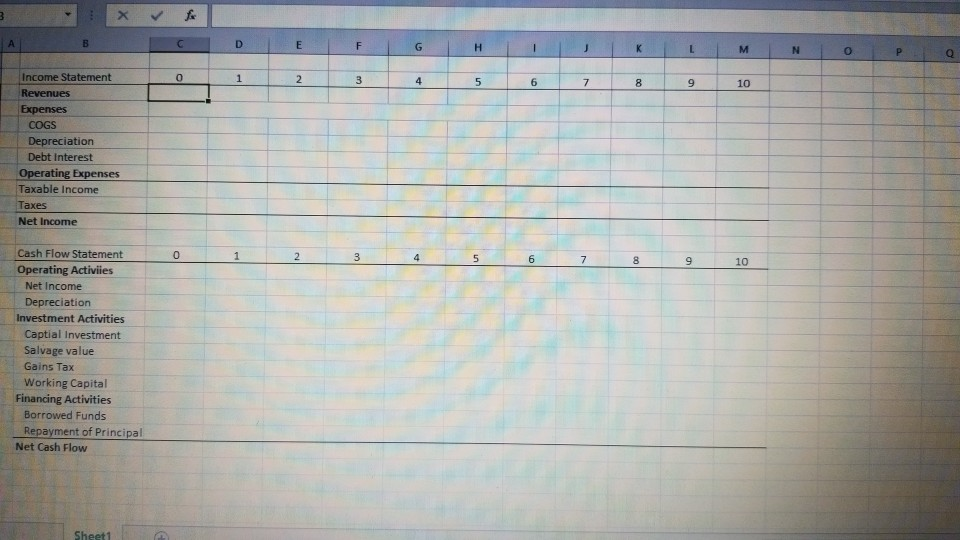

Question Completion Status: w poms Saver ACME Corporation is considering purchasing an automated part storage and retrieval system that will fully automate the order picking process in its new start-of-the-art warehouse facility. Since order picking is currently a manual process they anticipate significant labor savings and faster order turnaround. They have asked for your help in evaluating the investment worthiness of this system. You've identified a suitable system and have collected the following information regarding this investment. Evaluate the investment worthiness of this project by building the income and cash flow statements and calculating the net present worth of this investment opportunity A total of 90 orders are currently picked and shipped from this warehouse each day. This number is not expected to change with the new system. Each warehouse employee, regardless of their assigned duties, earns an annual salary of $32.500. The new automatic retrieval system will cost $850,000 and will be depreciated according to a 7 year MACRS class schedule. Freight costs for shipping the new system to the warehouse total $6,800 while installation will cost $8,500. . The system will require some programming by in house personnel during the first year of use. This work is expected to cost $14,875. The available service contract, necessary to keep the automated system in good working condition and prevent break-downs, will cost an additional $62.000 per year. Preventive maintenance will be required every two years with the first maintenance taking place in year 2. Each round of preventive maintenance will cost $44.500 regardless of the year in which it occurs. Acme expects to use this system only for the next 6 years. At the end of the system's useful life you've estimated the system's salvage value to be 8% of the cost basis. The system will reduce the company's labor needs by 6 individuals (the original system required 7 workers while only 1 worker is required once the new automated system is installed). Savings, in terms of reduced labor costs will be realized every year. Because of the new efficiencies of the automated system ACME believes they will be able to release $18.700 in working capital at the start of this project. This working capital will be fully reinvested at the end of the project. . In order to manage daily financial obligations your team has determined that an additional $18.700 investment in working capital is needed. This sum will be recovered in full at the end of each year, Some (25%) of the system's cost basis will be financed through a bank loan which has an interest rate of 14%. Payments will be made at the end of each year for the next 6 years. ACME's federal and state marginal tax rates are 21% and 7.2% respectively. ACME's interest rate (MARR) IS 119. Use the attached Excel template to build the financial statements and submit as an attachment to your answer. Remember to indicate your final decision, as well as your calculation of NPW, in your spreadsheet and HIGHLGHT these answers (NPW and your final decision) within the spreadsheet. Financial statement template.xlsx 3 fo A D E F G H L M N O P 0 1 2 3 4 5 6 7 8 9 10 Income Statement Revenues Expenses COGS Depreciation Debt interest Operating Expenses Taxable income Taxes Net Income 0 1 2 3 4 5 6 7 8 9 10 Cash Flow Statement Operating Activiies Net Income Depreciation Investment Activities Captial Investment Salvage value Gains Tax Working Capital Financing Activities Borrowed Funds Repayment of Principal Net Cash Flow Sheet1 Question Completion Status: w poms Saver ACME Corporation is considering purchasing an automated part storage and retrieval system that will fully automate the order picking process in its new start-of-the-art warehouse facility. Since order picking is currently a manual process they anticipate significant labor savings and faster order turnaround. They have asked for your help in evaluating the investment worthiness of this system. You've identified a suitable system and have collected the following information regarding this investment. Evaluate the investment worthiness of this project by building the income and cash flow statements and calculating the net present worth of this investment opportunity A total of 90 orders are currently picked and shipped from this warehouse each day. This number is not expected to change with the new system. Each warehouse employee, regardless of their assigned duties, earns an annual salary of $32.500. The new automatic retrieval system will cost $850,000 and will be depreciated according to a 7 year MACRS class schedule. Freight costs for shipping the new system to the warehouse total $6,800 while installation will cost $8,500. . The system will require some programming by in house personnel during the first year of use. This work is expected to cost $14,875. The available service contract, necessary to keep the automated system in good working condition and prevent break-downs, will cost an additional $62.000 per year. Preventive maintenance will be required every two years with the first maintenance taking place in year 2. Each round of preventive maintenance will cost $44.500 regardless of the year in which it occurs. Acme expects to use this system only for the next 6 years. At the end of the system's useful life you've estimated the system's salvage value to be 8% of the cost basis. The system will reduce the company's labor needs by 6 individuals (the original system required 7 workers while only 1 worker is required once the new automated system is installed). Savings, in terms of reduced labor costs will be realized every year. Because of the new efficiencies of the automated system ACME believes they will be able to release $18.700 in working capital at the start of this project. This working capital will be fully reinvested at the end of the project. . In order to manage daily financial obligations your team has determined that an additional $18.700 investment in working capital is needed. This sum will be recovered in full at the end of each year, Some (25%) of the system's cost basis will be financed through a bank loan which has an interest rate of 14%. Payments will be made at the end of each year for the next 6 years. ACME's federal and state marginal tax rates are 21% and 7.2% respectively. ACME's interest rate (MARR) IS 119. Use the attached Excel template to build the financial statements and submit as an attachment to your answer. Remember to indicate your final decision, as well as your calculation of NPW, in your spreadsheet and HIGHLGHT these answers (NPW and your final decision) within the spreadsheet. Financial statement template.xlsx 3 fo A D E F G H L M N O P 0 1 2 3 4 5 6 7 8 9 10 Income Statement Revenues Expenses COGS Depreciation Debt interest Operating Expenses Taxable income Taxes Net Income 0 1 2 3 4 5 6 7 8 9 10 Cash Flow Statement Operating Activiies Net Income Depreciation Investment Activities Captial Investment Salvage value Gains Tax Working Capital Financing Activities Borrowed Funds Repayment of Principal Net Cash Flow Sheet1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started