Answered step by step

Verified Expert Solution

Question

1 Approved Answer

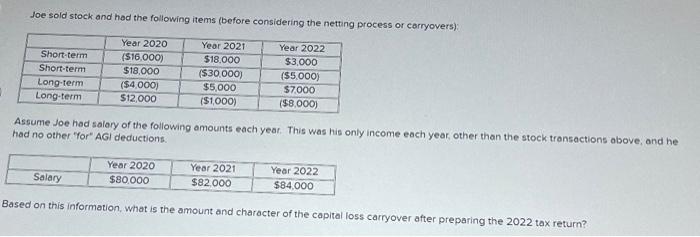

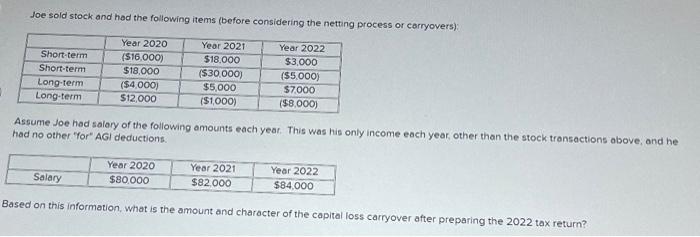

help asap Joe sold stock and had the following items (before considering the netting process or carryovers): Assume Joe had salary of the following amounts

help asap

Joe sold stock and had the following items (before considering the netting process or carryovers): Assume Joe had salary of the following amounts each yeat. This was his only income each year, other than the stock transactions above, and he had no other for' AGl deductions. Based on this information, what is the amount and character of the capital loss carryover after preparing the 2022 tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started